"Yikes": Impeachment 'Whistleblower' Was In The Loop Of Biden-Ukraine Affairs That Trump Wanted Probed

Authored by Paul Sperry via RealClear Wire,

The ‘whistleblower’ who sparked Donald Trump’s first impeachment was deeply involved in the political maneuverings behind Biden-family business schemes in Ukraine that Trump wanted probed, newly obtained emails from former Vice President Joe Biden’s office reveal.

In 2019, then-National Intelligence Council analyst Eric Ciaramella touched off a political firestorm when he anonymously accused Trump of linking military aid for Ukraine to a demand for an investigation into alleged Biden corruption in that country.

But four years earlier, while working as a national security analyst attached to then-Vice President Joe Biden’s office, Ciaramella was a close adviser when Biden threatened to cut off U.S. aid to Ukraine unless it fired its top prosecutor, Viktor Shokin, who was investigating Ukraine-based Burisma Holdings. At the time, the corruption-riddled energy giant was paying Biden’s son Hunter millions of dollars.

Those payments – along with other evidence tying Joe Biden to his family’s business dealings – received little attention in 2019 as Ciaramella accused Trump of a corrupt quid pro quo. Neither did subsequent evidence indicating that Hunter Biden’s associates had identified Shokin as a “key target.” These matters are now part of the House impeachment inquiry into President Biden.

“It now seems there was material evidence that would have been used at the impeachment trial [to exonerate Trump],” said George Washington University law professor Jonathan Turley, who has testified as an expert witness in the ongoing Biden impeachment inquiry. “Trump was alleging there was a conflict of interest with the Bidens, and the evidence could have challenged Biden’s account and established his son’s interest in the Shokin firing.”

Ciaramella’s role – including high-level discussions with top Biden aides and Ukrainian prosecutors – is only now coming to light thanks to the recent release of White House emails and photos from the National Archives.

The emails show Ciaramella expressed shock – “Yikes” is what he wrote – at Biden’s move to withhold the $1 billion in aid from Kyiv, which represented a sudden shift in U.S. policy. They also show he was drawn into White House communications over how to control adverse publicity from Hunter taking a lucrative seat on Burisma’s board.

Yet there is no evidence Ciaramella raised alarms about the questionable Biden business activities he witnessed firsthand, which is in sharp contrast to 2019. In that instance, he was galvanized into action after being told by White House colleague Alexander Vindman of an “improper” phone call between President Trump and Ukrainian President Volodymyr Zelensky. During the call, Trump solicited Zelensky’s help in investigating Burisma and Hunter Biden’s role in the company.

Some former congressional investigators say Ciaramella effectively helped cover up a scandal far worse than what Trump was impeached over. What’s more, he failed to disclose that he had a potential conflict of interest stemming from his connection to the matter Trump asked Zelensky to probe when he lodged his complaint against Trump. RealClearInvestigations was the first to identify the then-33-year-old Ciaramella as the anonymous impeachment “whistleblower,” something major media continue to keep under tight wraps.

Ciaramella worked under CIA Director John Brennan when President Obama made Biden his point man on Ukraine in 2014, the same year Burisma hired Hunter. The next year, the CIA detailed Ciaramella, a longtime advocate for aid to Ukraine, to the White House, where he worked closely with Biden and his staff as a top adviser on key Ukrainian policies. After Biden left office, he stayed on at the GOP White House until mid-2017 even though he’s a Democrat, working as a Ukrainian and Russian analyst on Trump’s National Security Council. Co-workers there accused him of trying to sabotage Trump, including allegedly leaking sensitive information to the press.

RealClearInvestigations has reviewed more than 2,000 pages of newly disclosed archived emails from the former vice president’s office related to Ukraine, of which more than 160 contained references to Ciaramella. They reveal that his role advising Biden’s office potentially intersects with the current impeachment inquiry in several areas. Chiefly, Ciaramella focused on aid to Ukraine and anti-corruption reforms in the country. In that capacity, he:

- Hosted, cleared into the White House, and met face-to-face there with senior Ukrainian prosecutors.

- Gave a “readout” of the meeting to his superiors, who in turn pushed for Shokin’s firing.

- Traveled with Biden to Kyiv during the 2015 trip during which Biden demanded Shokin’s firing.

- Wrote media “talking points” for Ukrainian officials.

- Huddled with the top Biden officials involved in discussions concerning the $1 billion aid package and Shokin, including: Amos Hochstein; Victoria Nuland; Geoffrey Pyatt; Bridget Brink; and Michael Carpenter.

- Corresponded with Biden officials coordinating responses to negative media reports about Hunter’s cushy and controversial Burisma job.

Former Obama-Biden administration officials have confirmed in recent closed-door congressional testimony that Ciaramella was a key part of Biden’s process for making policy in Ukraine. In 2016, for instance, a White House photo shows him taking notes at a White House meeting Biden held with then-Ukrainian Prime Minister Arseniy Yatsenyuk to discuss Ukraine’s anti-corruption reforms and other issues.

Ciaramella also worked directly with top Obama and Biden administration diplomats on Ukraine, including senior State Department official Victoria Nuland. “Eric was regularly the clearing authority to get me into the White House for interagency meetings on Ukraine,” Nuland revealed in a 2020 Senate deposition. Asked if she ever discussed Ukraine policy and Shokin with Ciaramella, Nuland testified: “Of course, I did. He was part of the interagency process. He was also on my negotiating team for the six, seven rounds of negotiations I did with the Russians on [the disputed Ukraine region] Donbas.”

Ciaramella was directly involved in talks concerning the massive U.S. aid package to Ukraine that Biden conditioned on the removal of Shokin, who at the time had seized the assets of the corrupt Burisma oligarch employing Hunter Biden. He also arranged and participated in White House talks with Ukrainian prosecutors visiting from Shokin’s office.

White House visitor logs confirm Ciaramella escorted Shokin’s deputy prosecutor, David Sakvarelidze, into the White House for a January 2016 meeting. A White House agenda for the meeting lists Ciaramella as “point of contact” for the Ukrainian delegation. He also checked in Andriy Telizhenko, the Ukrainian Embassy official who says they discussed Burisma and Hunter Biden during the meeting and struggled to understand why his U.S. counterparts were suddenly hostile to Shokin after praising him in earlier talks.

Emails from the time show Ciaramella appeared surprised to hear about the linkage between the $1 billion loan to Ukraine and the dismissal of Shokin. Though Biden maintains he insisted Kyiv oust Shokin because he was too soft on weeding out fraud in entities that included Burisma, Ciaramella suggested he didn’t share the view that Shokin was corrupt. “We were super impressed with the group,” Ciaramella added, “and we had a two-hour discussion of their priorities and the obstacles they face.”

On Jan. 21, U.S. Ambassador to Ukraine Geoffrey Pyatt emailed Ciaramella and other White House aides an article from the Ukrainian press – “U.S. loan guarantee conditional on Shokin’s dismissal.”

“Yikes. I don’t recall this coming up in our meeting with them,” Ciaramella replied, referring to the White House meeting he hosted with top Ukrainian prosecutors.

But in a closed-door 2020 deposition before the Senate, Pyatt sounded skeptical that Ciaramella was in the dark about the decision. “I think you have to ask Eric what he meant by ‘Yikes,’” Pyatt told Senate investigators. He said that he believed conditioning the loan guarantee on Shokin’s removal “obviously came up in those meetings” hosted by Ciaramella, suggesting that Biden’s aide knew of the quid pro quo before Pyatt circulated the article about it from the Ukrainian press.

The day before he hosted the Ukraine prosecutors, Ciaramella received an agenda from a State Department official that asked him to “note the importance of appointing a new PG [Prosecutor General], reiterating that Shokin is an obstacle to reform,” according to emails. The agenda also called on Ciaramella to “ask the del [Ukrainian delegation] what high-level cases are on the docket for prosecution,” which raises suspicions in some quarters that Biden’s advisers were fishing for information about Shokin’s plans for prosecuting Burisma oligarchs, something Hunter Biden had been asked to find out.

In a Jan. 21 email, Pyatt told Ciaramella to “buckle in” because, as he later explained to Senate investigators, the deal was a “difficult issue” and “there was going to be political controversy around this [news].”

The former ambassador demurred when asked if conditioning the $1 billion on Shokin’s firing was Biden’s idea or came from his office. “It was the – our interagency policy,” he testified, adding, “I don’t remember when the vice president would have weighed in on this.”

However, Pyatt allowed that it was a sudden change in policy. “At the beginning,” he said, “it was not our expectation that Shokin’s removal would be necessary.” Indeed, an Oct. 1, 2015, memo summarizing the recommendation of the Interagency Policy Committee on Ukraine stated, “Ukraine has made sufficient progress on its [anti-corruption] reform agenda to justify a third [loan] guarantee.” Ciaramella was a member of the IPC task force, which monitored Shokin’s office. The next month, moreover, the task force drafted a loan guarantee agreement that did not call for Shokin’s removal. Then, in December, Joe Biden flew to Kyiv to demand his ouster.

If what Ciaramella expressed in his email (which he knew would be part of archived White House records) was a genuine reaction, it appears that Vice President Biden went against the recommendation of one of his top NSC advisers on Ukraine. If Ciaramella were genuinely alarmed, he might have blown the whistle on his boss like he did on Trump, but he stayed mum. If, on the other hand, Ciaramella were a party to the quid-pro-quo discussions, as Pyatt suggests, then he had “a direct conflict,” noted Derek Harvey, the former congressional investigator involved in the first impeachment. Either way, Ciaramella clearly found himself in the middle of a major controversy.

Just weeks prior, White House photos indicate that Ciaramella traveled with Biden on the same December 2015 Air Force Two flight the vice president took to Kyiv to threaten Ukrainian President Petro Poroshenko to ax Shokin. Republicans have accused Biden of pushing Shokin’s ouster to block scrutiny of his son’s actions.

“Biden called an audible and changed U.S. policy toward Ukraine to benefit his son on the plane ride to Ukraine,” House Oversight Committee Chair James Comer said, and “later bragged about withholding a U.S. loan guarantee if Ukraine did not fire the prosecutor [Shokin].”

Biden and his supporters have repeatedly claimed Shokin had to go because he wasn’t cracking down on corruption and that everyone else in the administration, as well as Europe, agreed Shokin should be fired. This remains the prevailing narrative in major U.S. media. But around that time, Shokin had conducted a raid of Burisma oligarch Mykola Zlochevsky’s home, seizing his house, cars, and other assets.

IRS Special Agent Joseph Ziegler, who examined Hunter’s emails as part of his investigation of Hunter for tax evasion, said Shokin was identified as a “key target” in emails exchanged between Hunter and Burisma officials in November 2015 – the month before Biden traveled to Ukraine to demand Shokin’s removal. Just days before Biden arrived in Kyiv in early December 2015 to demand Shokin’s ouster, Hunter allegedly called his father from Dubai following a meeting there with Burisma official Vadym Pozharskyi, who asked him to pressure his father to shut down Shokin’s investigation. Vice President Biden was familiar with Pozharskyi, having met with him in April 2015 during a dinner at the Cafe Milano in D.C. arranged by Hunter.

“The unstated goal was to have the Ukrainian prosecutor removed in an effort to close the criminal case against [Burisma founder] Zlochevsky,” Ziegler said in recent testimony before the House impeachment inquiry. After Shokin was pushed out of office, the Burisma investigation dried up.

Ciaramella tried to marshal a defense for Biden in the whistleblower complaint he sent to Rep. Adam Schiff in August 2019. He listed among Trump’s concerns at the time of the fateful July phone call “that former Vice President Biden had pressured Poroshenko in 2016 to fire Shokin in order to quash a purported criminal probe into Burisma Holdings.” But Ciaramella attempted to pour cold water on the notion by referencing a Bloomberg News article that quoted a “former senior Ukrainian prosecutor” who falsely claimed “that Mr. Shokin in fact was not investigating Burisma at the time of his removal in 2016.”

White House emails reveal that Ciaramella was looped into messages sent by Biden’s communications team, who were concerned that Hunter Biden taking a position on corrupt Burisma’s board created unseemly optics and undercut their boss’ mission to clean up corruption in Ukraine.

In a Dec. 8, 2015, email, for example, Biden’s communications director Kate Bedingfield copied Ciaramella on a link to a New York Times article headlined, “The Knotty Ties Between Joe Biden, His Son and Ukraine.” Bedingfield is quoted in the story, authored by James Risen, denying Hunter had traveled with his father to Ukraine in an attempt to downplay his influence. She also said Ukrainian officials never raised his position on the Burisma board with Biden as an issue of concern. Risen got spun, however, on the issue of compensation for Hunter, reporting that it was “not out of the ordinary.”

At the time, Burisma was paying Hunter, who had no energy sector experience, $1 million a year just for lending his name to its board. It turns out that Hunter never traveled to Ukraine for a single meeting in the five years he sat on Burisma’s board. Republicans suspect Biden got the prosecutor ousted to keep the money flowing from Burisma to the Biden family.

Career State Department officials led by George Kent, who was stationed in Ukraine at the time, tried to get Biden’s aides to raise the issue of potential family conflicts with the vice president. Despite their concerns, Biden never asked his son to step down from the Burisma board, which would have made all questions go away. And despite Kent and other officials identifying Burisma founder Zlochevsky by name as a corrupt actor in Ukraine, Biden himself never publicly called Zlochevsky out as corrupt while Hunter served on his board and pocketed millions in payments from him. For all his talk of fighting corruption in Ukraine, Biden failed to distance himself from one of the most corrupt oligarchs in the country.

Harvey, who served as the staff investigator for the Republican side of the House Intelligence Committee during the 2019 Trump impeachment hearings, said: “The [Biden] impeachment inquiry should compel Ciaramella to testify since we now know he was involved in communications about Biden using the $1 billion in aid to extort Ukraine into firing Shokin.”

Harvey said Ciaramella would make a valuable material witness against Biden in the probe, which centers on whether Biden used his White House clout or political influence on behalf of his son’s foreign paymasters. White House photos indicate Ciaramella took notes during his meetings with Biden, his staff, and Ukrainian officials – materials that lawmakers could subpoena along with his testimony.

Another former staff investigator noted that Ciaramella is no longer protected by federal whistleblower laws. He has left the government and now works as a senior fellow focusing on Ukraine and Russia for the Carnegie Endowment for International Peace in Washington, where he is consulting with White House officials and pushing for billions more in U.S. aid for Ukraine – including “a Marshall Plan for the Ukrainian military.” Through a spokesperson, Ciaramella declined to comment.

“None of the whistleblower protections apply to this particular situation,” said Jason Foster, former chief investigative counsel for the Senate Judiciary Committee and a whistleblower expert. He also noted that the Whistleblower Protection Act doesn’t shield whistleblowers from any other conduct they might have been involved in, including their own conduct. Nor does it give them a legal right to anonymity.

A spokeswoman for the House Oversight Committee, which is leading the Biden impeachment inquiry, declined to say whether Ciaramella is on the witness list. “I don’t have anything for you on this at this time,” said House Oversight Communications Director Jessica Collins. However, Comer has publicly described the “whistleblower” impeachment of Trump as a “cover-up” operation for the alleged Biden blackmail scheme in Ukraine involving U.S. aid and the Burisma corruption probe.

What Ciaramella witnessed and what he documented in notes he took during high-level Biden-Ukraine meetings could now be relevant to the active impeachment inquiry of President Biden. The House may have little choice but to hold the kind of hearings the Democrats blocked during the earlier impeachment by keeping Ciaramella’s identity – and his own potential conflict – secret.

As the catalyst for Trump’s impeachment, Ciaramella could now be a reluctant witness for Biden’s.

Tyler Durden

Thu, 04/18/2024 - 09:25

Former President Donald Trump gestures as he returns from a recess in his trial for allegedly covering up hush money payments linked to extramarital affairs, at Manhattan Criminal Court in New York City on April 18, 2024. (Brendan McDermid/Pool/AFP via Getty Images)

Former President Donald Trump gestures as he returns from a recess in his trial for allegedly covering up hush money payments linked to extramarital affairs, at Manhattan Criminal Court in New York City on April 18, 2024. (Brendan McDermid/Pool/AFP via Getty Images)

The trucking industry is asking, “How much longer is the market going to remain in a recession?” (Photo: Jim Allen/FreightWaves)

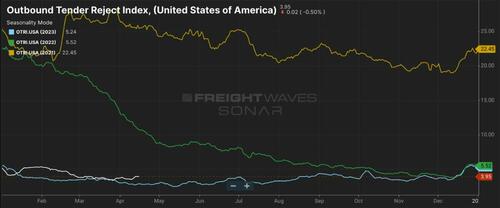

The trucking industry is asking, “How much longer is the market going to remain in a recession?” (Photo: Jim Allen/FreightWaves) The Outbound Tender Rejection Index. To learn more about FreightWaves SONAR, click

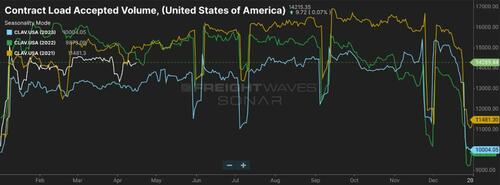

The Outbound Tender Rejection Index. To learn more about FreightWaves SONAR, click  Contract Load Accepted Volume. To learn more about FreightWaves SONAR,

Contract Load Accepted Volume. To learn more about FreightWaves SONAR,  Contract Load Accepted Volume. To learn more about FreightWaves SONAR,

Contract Load Accepted Volume. To learn more about FreightWaves SONAR, To learn more about FreightWaves SONAR,

To learn more about FreightWaves SONAR,

(Benjamin Child/Unsplash.com)

(Benjamin Child/Unsplash.com) Washington Post/Getty Images

Washington Post/Getty Images

Recent comments