I don't think that the general public realizes how the impending collapse of Fannie and Freddie is a game-changer. Bear Stearns, Enron, IndyMac, those are all small potatoes in comparison to the massive size of the GSE's.

The inevitable failure of these institutions is so epic that when the epitaph of the American Empire is composed it will be Fannie and Freddie that are written large.

However, some people are shouting warnings now.

"If the U.S. government allows Fannie and Freddie to fail and international investors are not compensated adequately, the consequences will be catastrophic," Yu said in e-mailed answers to questions yesterday. "If it is not the end of the world, it is the end of the current international financial system."

"The seriousness of such failures could be beyond the stretch of people's imagination," said Yu, a professor at the Institute of World Economics & Politics at the Chinese Academy of Social Sciences in Beijing.

Believe it or not, this warning is not the one that scares me. It is the warning from Warren Buffett that is truly frightening.

Fannie Mae and Freddie Mac, the two largest mortgage finance companies, "don't have any net worth," billionaire investor Warren Buffett said."The game is over" as independent companies said Buffett, the 77-year-old chairman of Berkshire Hathaway Inc., in an interview on CNBC today...

The two mortgage companies recorded almost $15 billion in combined net losses in the past four quarters as delinquencies rose to record levels, shrinking their capital. The swoon sparked concern they may not be able to weather the worst housing slump since the Great Depression and prompted Paulson to step in with a rescue plan.

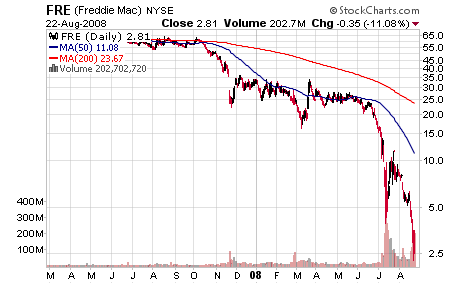

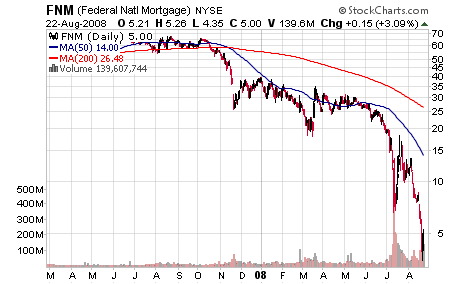

Fannie, down 95 percent in the past year before today, advanced 34 cents to $5.19 at 9:32 a.m. in New York Stock Exchange composite trading. The stock was trading at almost $70 a year ago. Freddie, down 91 percent this year, added 24 cents to $3.40...

Former Federal Reserve Chairman Alan Greenspan and Richmond Federal Reserve Bank President Jeffrey Lacker have called for the companies to be nationalized. William Poole, former head of the St. Louis Fed, said last month Freddie is technically insolvent and Fannie's fair value may be negative next quarter.

And if that wasn't bad enough, Fannie and Freddie have to roll over $223 Billion in questionable debt before the end of September. If Fannie and Freddie were healthy this wouldn't be a big deal. But since terrified foreign investors are running away from them, this is going to be a problem. The bond market just might freeze up.

And just yesterday, Moody's cut the rating of Fannie and Freddie nearly to junk.

Fannie and Freddie account for about half of the $12 Trillion real estate market.

How did we get into this mess?

Like most economic catastrophes of this decade, it started right about the time George Bush came into the White House.

Lies, Cover Ups, and the Making of a Disaster

When the Federal Reserve panicked in 2001 and cut interest rates down to 1%, Wall Street was flooded with cheap money. So what do you think happens when you mix cheap money with Wall Street bankers?

for years, observers have wondered how Fannie could manage its inherently risky portfolio without a whiff of volatility. Now, thanks to Fannie's regulator, we know the answer. The company was cooking the books. Big time.

Lay and Skilling at Enron were amateurs compared to the boyz at Fannie Mae and Freddie Mac.

As part of a scandal that's been running nearly two years, Fannie Mae has "misstated earnings" to the tune of $10.8 billion. That's some tune.

Freddie Mac had their own $5 Billion scandal. The accounting scandal was so large that even Fannie and Freddie didn't know what was in their portfolio. They failed to register with the SEC for at least eight quarters.

Considering the massive size of this scandal, how did Fannie and Freddie manage to avoid being heavily regulated or even nationalized? They spent $170 million lobbying Congress and another $19.3 million in direct campaign contributions. In other words, they legally bribed the people who were supposed to be regulating them.

Now let's fast forward to March 2008.

The housing bubble had burst. The economy was melting down. Real leadership was needed, so the Bush Administration swung into action.

By reducing the extra cushion of capital the two companies have been required to hold since 2004, the regulator, the Office of Federal Housing Enterprise Oversight, is enabling the companies to invest $200 billion more in home loans. In essence, the companies are being allowed to take billions of dollars that had been used as a reserve against possible further losses and invest that money now in the housing market.

But critics said that if the housing market continued to decline, the move could put the two companies on a less sure footing and ultimately require a huge taxpayer bailout.

“I think it’s very dangerous and it’s a sign that people are very frightened,” said Thomas H. Stanton, an expert on the two companies who teaches a course on credit risk at Johns Hopkins University. “At a time in which finance companies are holding questionable assets and facing losses, regulators typically require more capital, not less.”

"“Additional capital will enable the companies to help more homeowners and will strengthen the underlying fundamentals of the mortgage market.”

- Treasury Secretary Paulson

The Bush Administration had Fannie and Freddie cut their capital reserves to buy assets which were collapsing in price, even while the GSE's were entering a period where they were going to take massive losses.

Freddie Mac and its fellow GSE Fannie Mae are now financing more than 80 percent of all mortgages in the U.S., up from 40 percent a year ago.

"We are nearly the only game in town, and we think we are going to be able to enjoy that position for a number of years," Piszel said.

It was a risky gamble, and it failed. Spectacularly.

That's not to say that Fannie and Freddie are going down without a fight. They fought back with their best weapons - accounting trickery.

Freddie said Wednesday its first-quarter earnings beat Wall Street expectations, but it also reported that the "fair value" of its net assets fell to negative $5.2 billion at the end of March from 12.6 billion dollars at the end of December. That reflected a drop of nearly 32 billion dollars in value for its mortgage assets and credit guarantees that did not affect the company's net income.

With their portfolios in free fall, Fannie and Freddie hemorrhaged money all through the first half of 2008. The Bush Administration stuck to their guns and as late as July 11 assured everyone that there would be no bailout of Fannie and Freddie.

Less than a week later Treasury Secretary Paulson was pushing through a bailout of Fannie and Freddie.

It seems that the thin layer of cash reserves left over after the Bush Administration cut it 6 months earlier, wasn't enough to cover their massive losses. Yet the financial media failed to note that the Bush Administration was partly responsible for this enormous calamity.

But the Bush Administration was going to make it right now. They were going to backstop Fannie and Freddie and calm investors...at least that was the plan.

"If you have a bazooka in your pocket and people know it, you probably won't have to use it."

- Secretary Paulson displaying his ignorance of how the markets work

The powers Paulson won from Congress last month enabling a government rescue of Freddie Mac and Fannie Mae -- authority he likened to a weapon whose mere existence made it unlikely it would have to be fired -- may end up making a bailout more likely, say analysts and investors.They say the threat of government action is creating uncertainty that is raising the companies' borrowing costs and increasing the odds Fannie and Freddie will need taxpayer funding.

The problem with the bailout plan is that Paulson is the implied threat of a de facto nationalization of the two mortgage giants. This would leave existing shareholders with pennies on the dollar.

Thus the bailout plan that Bush and Paulson assured us that they would never have to do, caused stock prices of Fannie and Freddie to crater. This reduced their capital reserves even further, increasing the chances of a taxpayer bailout.

To make matters worse, the taxpayer bailout is likely to cause collateral damage.

"The common shareholders will probably be completely wiped out," Paul Miller, an analyst at FBR Capital Markets, said in a Bloomberg Television interview. "Preferred will also see a lot of pain. But that is up in the air because a lot of banks own the preferred. You put a lot of banks in trouble if you just wipe out the preferred also."

And so, once again, the Bush Administration has lurched from one disaster to another, making each one worse with their every action.

The size of the bailout is anyone's guess, but since the bailout bill came with a mandatory raising of the national debt by $800 Billion, you can bet that it won't be cheap.

CNN called it the trillion-dollar mortgage time bomb.

Where exactly is a nation with a savings rate of zero going to get that kind of cash?

Comments

Roubini & China

Roubini is saying to nationalize the GSEs, which saves a $50B a year anyway to minimize the bailout costs.

Then on your first quote, China I believe is heavily invested in the GSEs.

Roubini:

This is from his site which requires a registration to view it. It's worth it, the article is long and has a lot of info I for one had not seen previously.

I saw the Buffett quote and put it in Instapopulist also. That was really damning and maybe Dr. Doom is right...again.

Bush is not the culprit

Fannie Mae and Freddie Mac are both banking institutions that originally started by an act of Congress when big government was conceived to be the ultimate answer to our economic ills. Although owned by private stockholders, Fannie and Freddie remain very different from private sector companies.

These banking institutions played a dominant role in the housing market by buying up mortgages and reselling them to investors. With approximately 5 trillion dollars of investment portfolios, Freddie and Fannie owned or guaranteed about 50% of the U.S. mortgage market - these banks have simply become too large to fail.

For years, financial experts, economists, and regulators warned Congress that both institutions were growing too large and lacked sufficient capital to protect itself against losses. Since 2001, the Bush Administration issued 34 warnings about the need to reform Fannie Mae and Freddie Mac before it caused substantial economic turmoil in the financial markets.

In April of 2001, the Bush Administration first red flagged Fannie and Freddie stating that "financial trouble of a large GSE could cause strong repercussions in financial markets, affecting Federally insured entities and economic activity."

On September 11th of 2003, Treasury Secretary John Snow recommended to the House Financial Services Committee that Congress enact "legislation to create a new Federal agency to regulate and supervise the financial activities of our housing-related government sponsored enterprises" and set prudent and appropriate minimum capital adequacy requirements.

The new agency was a recommendation from the Bush Administration for the serious regulatory overhaul in the housing finance industry. The plan was an acknowledgment of two things. First, more oversight was necessary for both institutions that have managed to accumulate over 1.5 trillion dollars in outstanding debt - averaging a 20% increase in residential debt per year. And second, the supervisory system in place did not have the tools to deal effectively with the size, scope, and complexity of Freddie and Fannie as evidenced by irregularities that went unnoticed by current regulators. The Administration's recommendation was strongly opposed by Congressional Democrats and National Association of Home Builders who thought that tighter regulation Fannie and Freddie would reduce their commitment to financing low-income and affordable housing.

In response to the Bush's regulatory overhaul proposal, Barney Frank, a ranking Democrat on the Financial Services Committee, defended Fannie and Freddie saying, "These two entities -- Fannie Mae and Freddie Mac -- are not facing any kind of financial crisis, the more people exaggerate these problems, the more pressure there is on these companies, the less we will see in terms of affordable housing."

Representative Melvin L. Watt, Democrat of North Carolina, agreed saying, "I don't see much other than a shell game going on here, moving something from one agency to another and in the process weakening the bargaining power of poorer families and their ability to get affordable housing."

In October of 2003, Fannie Mae discloses $1.2 billion accounting error.

In November of 2003, the Bush Administration upgraded their warning to a "systemic risk" that could extend even beyond the housing market. In a July report written by external investigators concluded that Freddie Mac manipulated its accounting to mislead investors, and other critics pointed out that Fannie Mae did not adequately hedge against rising interest rates.

In November of 2003, Council of the Economic Advisers, Chairman Greg Mankiw, argued that "legislation to reform GSE regulation should empower the new regulator with sufficient strength and credibility to reduce systemic risk." And in order to do such, the regulator would have "broad authority to set both risk-based and minimum capital standards" and "receivership powers necessary to wind down the affairs of a troubled GSE."

In February of 2005, President Bush's Budget again emphasizes the risk posed by the explosive growth of the GSEs and their sub-par levels of capital. The Budget called for the creation of a new, world-class regulator: "The Administration has determined that the safety and soundness regulators of the housing GSEs lack sufficient power and stature to meet their responsibilities, and therefore…should be replaced with a new strengthened regulator.

In February of 2005, Alan Greenspan suggested that Congress limit the growth of Fannie and Freddie saying, "Enabling these institutions to increase in size - and they will once the crisis in their judgment passes - we are placing the total financial system of the future at substantial risk."

In April of 2005, Treasury Secretary John Snow called for GSE reform, saying "Events that have transpired since I testified before this Committee in 2003 reinforce concerns over the systemic risks posed by the GSEs and further highlight the need for real GSE reform to ensure that our housing finance system remains a strong and vibrant source of funding for expanding homeownership opportunities in America… Half-measures will only exacerbate the risks to our financial system."

In April of 2005, Chairman Alan Greenspan told the Committee on Banking, Housing, and Urban Affairs, U.S. Senate,

The strong belief of investors in the implicit government backing of the GSEs does not by itself create safety and soundness problems for the GSEs, but it does create systemic risks for the U.S. financial system as the GSEs become very large. Systemic risks are difficult to address through the normal course of financial institution regulation alone and, as I will stipulate shortly, can be effectively handled in the case of the GSEs by limiting their investment portfolios funded by implicitly subsidized debt . . . When these institutions were small, the potential for such risk, if any, was small. Regrettably, that is no longer the case. From now on, limiting the potential for systemic risk will require the significant strengthening of GSE regulation and the GSE regulator . . . The GSEs will have increased facility to continue to grow faster than the overall home-mortgage market; indeed since their portfolios are not constrained, by law, to exclusively home mortgages, GSEs can grow virtually without limit. Without restrictions on the size of GSE balance sheets, we put at risk our ability to preserve safe and sound financial markets in the United States, a key ingredient of support for homeownership.

In April of 2005, Democrat Senator Chuck Schumer said, “I think Fannie and Freddie have done an incredibly good job and are an intrinsic part of making America the best-housed people in the world…. if you look over the last 20 or whatever years, they’ve done a very, very good job.”

In May of 2005, Senator John McCain stated,

For years I have been concerned about the regulatory structure that governs Fannie Mae and Freddie Mac–known as Government-sponsored entities or GSEs–and the sheer magnitude of these companies and the role they play in the housing market. OFHEO’s report this week does nothing to ease these concerns. In fact, the report does quite the contrary. OFHEO’s report solidifies my view that the GSEs need to be reformed without delay. I join as a cosponsor of the Federal Housing Enterprise Regulatory Reform Act of 2005, S. 190, to underscore my support for quick passage of GSE regulatory reform legislation. If Congress does not act, American taxpayers will continue to be exposed to the enormous risk that Fannie Mae and Freddie Mac pose to the housing market, the overall financial system, and the economy as a whole.

In May of 2005, Senator McCain co-sponsored the legislation for more regulation on Fannie Mae and Freddie Mac, however it was blocked by democrats including Sen. Chris Dodd, Rep. Barney Frank, and Sen. Chuck Schumer. In fact, these three democrats are the same men who are now blaming the free market and the republicans for a lack of federal regulation as the cause of today's economic crisis.

In June of 2005, Deputy Secretary of Treasury Samuel Bodman highlights the risk posed by the increasing GSEs and subsequently called for reform. He said, "We do not have a world-class system of supervision of the housing government sponsored enterprises (GSEs), even though the importance of the housing financial system that the GSEs serve demands the best in supervision to ensure the long-term vitality of that system. Therefore, the Administration has called for a new, first class, regulatory supervisor for the three housing GSEs: Fannie Mae, Freddie Mac, and the Federal Home Loan Banking System."

In August of 2007, President Bush calls upon Congress to push through a reform package for Fannie Mae and Freddie Mac, saying "first things first when it comes to those two institutions. Congress needs to get them reformed, get them streamlined, get them focused, and then I will consider other options."

In December of 2007, President Bush warns Congress to pass legislation reforming GSEs, saying "These institutions provide liquidity in the mortgage market that benefits millions of homeowners, and it is vital they operate safely and operate soundly. So I've called on Congress to pass legislation that strengthens independent regulation of the GSEs – and ensures they focus on their important housing mission. The GSE reform bill passed by the House earlier this year is a good start. But the Senate has not acted. And the United States Senate needs to pass this legislation soon."

In March of 2008, President Bush calls on Congress to "move forward with reforms on Fannie Mae and Freddie Mac. They need to continue to modernize the FHA, as well as allow State housing agencies to issue tax-free bonds to homeowners to refinance their mortgages."

In April of 2008, President Bush urges Congress to "modernize Fannie Mae and Freddie Mac. [There are] constructive things Congress can do that will encourage the housing market to correct quickly by … helping people stay in their homes."

On May 3rd of 2008, Bush pleads with Congress to make legislation before Fanny and Freddie start to collapse. In his radio address, Bush says, "Americans are concerned about making their mortgage payments and keeping their homes. Yet Congress has failed to pass legislation I have repeatedly requested to modernize the Federal Housing Administration that will help more families stay in their homes, reform Fannie Mae and Freddie Mac to ensure they focus on their housing mission, and allow State housing agencies to issue tax-free bonds to refinance sub-prime loans."

On May 19th of 2008, Bush pleads with Congress again with his radio address saying, "The government ought to be helping credit-worthy people stay in their homes. And one way we can do that – and Congress is making progress on this – is the reform of Fannie Mae and Freddie Mac. That reform will come with a strong, independent regulator."

On May 31st of 2008, Bush makes yet another radio address saying, "Congress needs to pass legislation to modernize the Federal Housing Administration, reform Fannie Mae and Freddie Mac to ensure they focus on their housing mission, and allow State housing agencies to issue tax-free bonds to refinance sub-prime loans."

In June of 2008, Bush told Congress, "We need to pass legislation to reform Fannie Mae and Freddie Mac."

In July of 2008, Congress finally passed a reform bill addressing Fannie Mae and Freddie Mac only after it became clear that the institutions were failing.

On September 30th of 2008, Congressman Artur Davis of Alabama (featured in the youtube video defending Fannie and Freddie) issued an apology on Fox News saying,

Like a lot of my Democratic colleagues I was too slow to appreciate the recklessness of Fannie and Freddie. I defended their efforts to encourage affordable homeownership when in retrospect I should have heeded the concerns raised by their regulator in 2004. Frankly, I wish my Democratic colleagues would admit when it comes to Fannie and Freddie, we were wrong.