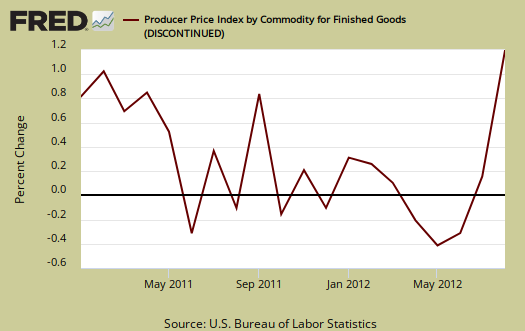

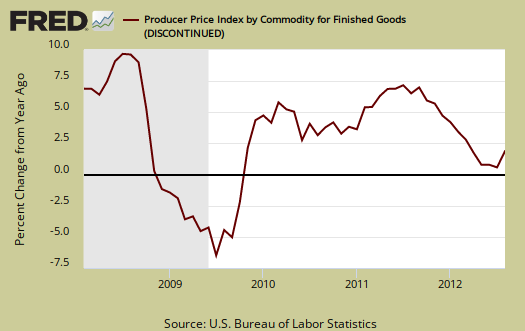

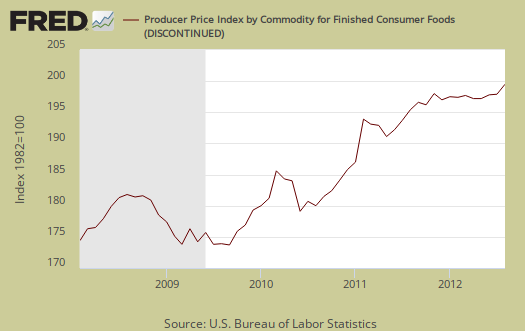

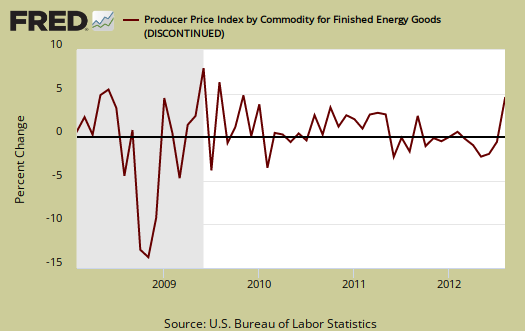

The Producer Price Index, or wholesale inflation, increased 1.7% in August 2012 for finished goods and is the largest monthly increase since June 2009. Energy alone ballooned by 6.4% with gasoline prices surging 13.6% in August. Food also jumped by 0.9%, the highest jump since November 2011. Core PPI, which is finished goods minus food and energy, increased 0.2% although July's core PPI increased by 0.4%. While PPI is wholesale, retail shoppers beware, price increases are usually passed onto consumers. PPI is a Federal Reserve watch number for signs of future inflation.

PPI is reported by stages of processing of materials, finished, intermediate and crude. Finished are commodities ready for final sale, intermediate are partially finished, such as lumber and cotton and crude are products entering the market for the first time, such as raw grain and crude oil.

Unadjusted, finished goods have increased 2.0% for the last 12 months, the highest monthly increase since March. Below is the wholesale finished goods PPI percent change for the year.

The increase in food prices was due to dairy, which increased 3.0% for the month. On the other hand, beef dropped -3.2% so we can only assume more cattle were slaughtered due to the high cost of feed due to the drought earlier this year. Down the line beef and veal should dramatically increase in price. Eggs are always volatile and increased 22.8% in a month. Veggies also increased 7.4% for the month. "Processed" Chickens increased 2.0% and plastic wrapped turkey increased 2.2% in a month.

Core PPI, or finished goods minus food and energy, increased 0.2% for August 2012. The reason for the increase is due to prescription drugs. Pharmaceutical preparations caused 30% of the core PPI increase and by themselves increased 0.5%.

Below is the monthly percentage change of finished energy only, to show the soaring prices. Residential gas increased 1.0%, home heating oil soared 10.8%, electricity, 0.4% and those never ending high wholesale gas prices increased 13.6%.

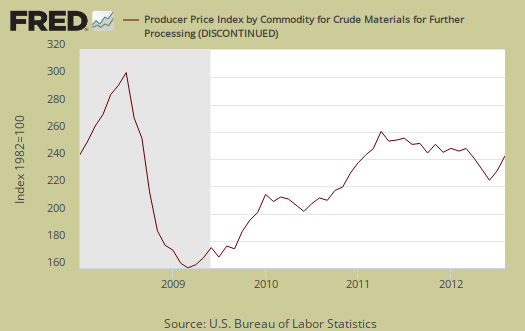

Crude PPI soared 5.8% for August. Crude energy surged 9.7% with crude petroleum increasing 12.8% for the month. Crude core or crude stuff minus food and energy, increased 2.2%.

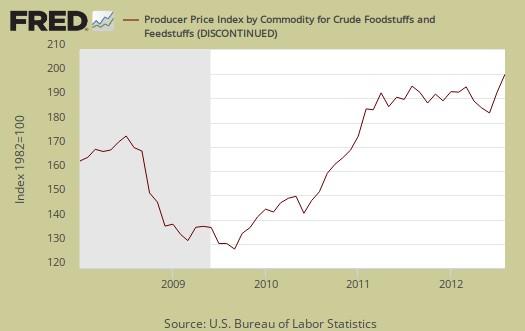

From the report we see the direct impact of the drought for feeds and grains:

The index for crude foodstuffs and feedstuffs moved up 4.6 percent in August. For the 3 months ended in August, prices for crude foods jumped 8.3 percent compared with a 3.0-percent decline from February to May. Forty percent of the monthly advance in the crude foods index can be traced to prices for grains, which rose 6.1 percent. Higher prices for slaughter steers and heifers also contributed to the increase in the crude foods index.

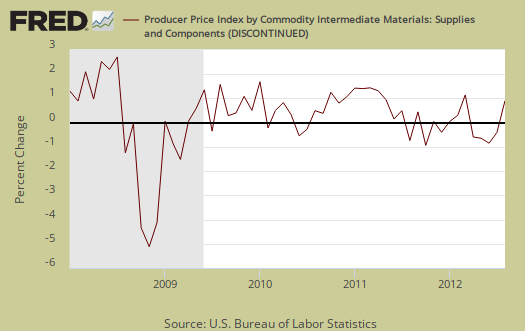

For intermediate wholesale goods we had a 1.1% increase and this is after four months intermediate PPI has declined. Intermediate energy jumped 4.4% with diesel fuel increasing 4.9%.

Intermediate food prices was up by 2.4%, the third monthly consecutive increase and once again drought looks like the culprit. Animal feeds jumped 6.6% are the about 75% of the total intermediate foods prices increase.

Intermediate core actually declined -0.2 for August and this is the 4th consecutive decline. Hot rolled steel sheet and strip is to blame, which dropped -8.3%. Who knew rolled steel and strip was so influential.

alt="" />

alt="" />

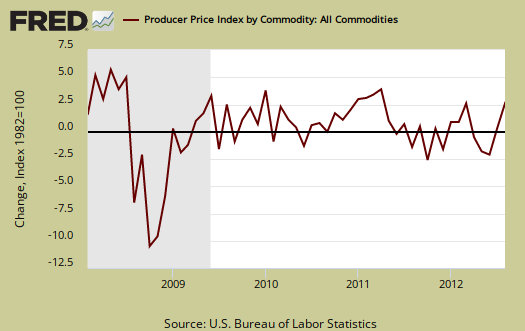

Below is the indexed price change for all commodities. Commodities are not limited to what comes from inside the United States. Commodities should start soaring due to today's quantitative easing announcement. For August overall commodities increased 1.3% with farm products increasing 2.7% and gasoline increasing 7.7%.

PPI also has special indexes which measure services and their margins. From the report it looks like prices just cut into profit margins:

Trade industries: The Producer Price Index for the net output of total trade industries declined 1.3 percent in August, the largest decrease since a 1.4-percent drop in June 2010. (Trade indexes measure changes in margins received by wholesalers and retailers.) Leading the August decline, margins received

by merchant wholesalers of durable goods moved down 1.7 percent. Lower margins received by gasoline stations and department stores also contributed to the decrease in the total trade industries index.Transportation and warehousing industries: The Producer Price Index for the net output of transportation and warehousing industries moved up 0.4 percent in August following a 0.4-percent decline in July. Over half of this advance can be attributed to a 1.3-percent rise in prices received by the scheduled passenger air transportation industry. Higher prices received by the truck transportation industry group and by the general warehousing and storage industry also were factors in the increase in the transportation and warehousing industries index.

Traditional service industries: The Producer Price Index for the net output of total traditional service industries advanced 0.6 percent in August after no change in the prior month. Leading this rise, prices received by the industry group for hospitals climbed 1.6 percent. Higher prices received by the industry groups for depository credit intermediation and for securities, commodity contracts, and related financial investment services also contributed to the increase in the total traditional service industries index.

The Federal Reserve just did another round of quantitative easing and commodities immediately racketed up. The Fed believes their core inflation target rate of 2.0% annual is safe and secure but real people, main street need to eat and drive their cars to work, so we'll see what the effect of QE3 is on future inflation in later reports.

Here is the BLS website for more details on the Producer Price Index. They list individual items and special indexes.

Recent comments