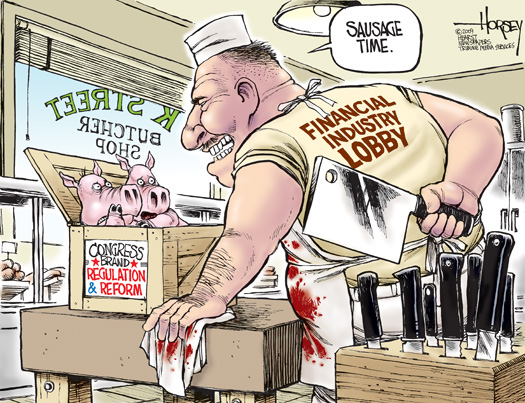

Financial Reform Legislation is D.O.A. according to Simon Johnson, an expert  and watchdog on the Financial crisis. He is not alone in assessing the health of the patient.

and watchdog on the Financial crisis. He is not alone in assessing the health of the patient.

At the end of the day, essentially nothing in the entire legislation will reduce the potential for massive system risk as we head into the next credit cycle.

That's right. What managed to get passed is now being stripped in conference, as we warned about and updated on here.

Now lobbyists are after the very weak version of the Volcker Rule:

To secure the support needed for their bill, Senate negotiators are leaning toward creating a series of exemptions to the Volcker Rule that would allow banks to continue to operate these businesses as investment funds that hold only client money, according to several Congressional aides, industry officials and lawyers.

The three main changes under consideration would be a carve-out to exclude asset management and insurance companies outright, an exemption that would allow banks to continue to invest in hedge funds and private equity firms, and a long delay that would give banks up to seven years to enact the changes.

Who exactly are these supporters? If there was ever a rallying cry among the people, it is financial reform. Yet our government cannot enact a single legislative sentence that isn't given the stamp of approval by Wall Street Lobbyists.

Even Bloomberg is noticing Wall Street Stiffing Overhaul:

One clause in the House bill would be singularly effective in preventing a repeat of the 2008 banking collapse. The other would close a 75-year-old loophole in American corporate governance, forcing boardrooms to, finally, become accountable to shareholders.

Now, both are at risk. Take leverage limits first. Leverage acts like a giant accelerator in the financial system. It heightens the risk of financial crashes, and it magnifies losses when crashes do occur. No wonder that in 2008, as in almost every previous meltdown, excessive financial leverage played a big part.

Other disasters are being issued in press releases from the House Financial Services committee. These press releases are cleverly crafted, so one will miss the fact the Consumer Financial Protection Agency was neutered by putting it under the Federal Reserve. Still lobbyists are not satisfied and are working to weaken it further.

Ridiculous, classic special interest amendments, which have nothing to do with the overall ripoff games against most of America, are being sneaked into the bill. Things like putting civil rights experts on consumer protection boards, as if some color besides green has something to do with mega banks sucking at the middle class jugular.

Many provisions are being stricken and replaced with studies on the issue. Right, studies, as if we don't already know what happened. Things like fees on credit and debit card transactions when weakened, are called a successful compromise.

The deal, struck between Sen. Dick Durbin (D-Ill.) and key House negotiators, leaves out some elements that consumer advocates had been fighting for. It allows fees charged to reloadable, prepaid debit cards -- generally used by the poor -- to remain unregulated. And it allows an exemption for states that use debit cards to dole out benefits. But, for the first time, banks and credit card companies will face restrictions on the fees they can charge merchants for the privilege of accepting credit and debit cards.

Additionally, even more amendments, all designed to weaken any regulation are being introduced. The latest exemption demand is for peddling financial products to old people, annuities in this case, all to grab at their money before they die. Why not just pick at the pockets of the dead and pull out their gold teeth?

Yes, it's yet another lobbyist pig fest.

The only good news is the Fed Audit was expanded from the Senate version:

The Senate had previously approved a provision that would require a government audit of the Federal Reserve’s emergency lending authority, a move that arose in response to the Fed’s actions in the 2008 financial crisis. But the House-Senate conference committee wanted to go further, subjecting the Fed to regular audits of its routine operations.

But is the Fed Audit good news? Not really. The entire House version of auditing the Federal Reserve was dropped in favor of this one time audit, which leaves much in the dark.

The shift by House Democrats was not an unequivocal win for the Fed. Their counteroffer looks to broaden a proposal for a one-time Fed audit contained in the the Senate bill that would focus narrowly on the Fed’s emergency lending during the financial crisis.

House Democrats want to widen the audit to cover regular discount window lending and open market transactions, and require the Fed to publicly disclose details on these operations on an ongoing basis, albeit with a three-year lag.

Still, the push points to successful lobbying efforts by both the Fed and the financial sector, which firmly backs the U.S. central bank. Influential industry groups wrote to the Senate Banking Committee in March pleading for the Fed to retain its supervisory responsibilities.

The $150 billion dollar bail out fund, supposedly paid by the large banks is also dropped.

Other minor, symbolic clauses, such as Say on Pay, which was a non-binding shareholder vote on executive compensation, was rendered empty by Chris Dodd with a requirement that shareholders with a 5% equity stake only could vote. There are no shareholders with a 5% or greater equity stake in each company.

While the negotiations, if you care to call it that, are ongoing, overall, Simon Johnson and others are right. The death blow will be in derivatives and the Volcker rule. In spite of putting the entire globe at risk, nothing meaningful will happen to stop too big to fail, increase capitalization requirements, to isolate contagion risk or to firewall systemic risk.

Comments

Where is everyone? No comments for this long?

Is everyone just absolutely so disgusted with all that is going on they are silent?

Myself, considering how you cannot get the right things done on almost every issue am assuredly in that camp, but still, I'm hoping people pipe up.

I have kind of given up.

I have kind of given up. Congress and indeed much, if not all, of govt is so captured, at this point, that nothing of significance is going to be done, and we all know it. It is more important to fund boondoggles to the middle east and provide a nonstop stream of corporate welfare than it is to fix our economic problems here at home.

Synthetic Securities

The true test of financial reform has always been whether Synthetic securities like CDOs and CDS's require meaningful escrow coverage.

This last financial crisis has made the word "security" into an oxymoron as financial institutions have been allowed to issue these securities with nothing backing them up.

In order to estimate the escrow requirements, we need to estimate the correlated risk just as is done routinely by issuers of insurance under regulation of the insurance commissioner.

Fire insurance written on homes sprinkled over the US for example, might require only 5 or 10% of the face value (eg value at risk) to be placed in escrow. Hurricane insurance written on properties in Miami Beach, on the other hand, would require 50% or more of insured value to be placed in escrow.

The financial collapse of 2008 proved that the losses associated with the financial instruments being issued was highly correlated--everything went South at the same time. Therefore meaningful financial reform must include putting at least a third of the value at risk in escrow. I would suggest that it is only fair that this escrow be held in the form of US treasuries as a great amount of them was created to cover the risks previously taken.

agree w/ but think it's worse than that

By the mathematics, these things are not mathematically valid. Then, on top of it, one cannot computationally, prove they are not "stuffed" or biased.

Congress, regulators, politicians just completely ignore this, or any analysis from the scientific or even the structured finance/statistics experts.

How can one build a product, put a price on that, when the model itself is flawed?

So, how anyone can "trade" in structured/securitized CDOs, CDSes and other derivatives that don't even hold up by the mathematics, never mind there is no way to verify their holdings are not "stuffed" or biased (Abacus, etc.), I don't see how they are allowed.

Then, on top of it, I agree, with no escrow, collateral, capitalization, this is just pure folly. It's like a glorified dutch tulip bulb trade.

I read today that Russ Feingold is introducing new legislation, pushing for real reform. But I imagine just like health care, once this bill is passed, it's off the legislative agenda to actually reform anything. There is even debate to make the SEC "self financing", i.e. no funding to hire the right people, fund enforcement, investigations on some of the regulators.

CDS Synthetic Created to Avoid Insurance

The top card in the mortgage house of cards was the Credit Default Swap. There was a thought to have real credit insurance but that lost to the synthetic security. As long as the billions poured in, no questions asked.

Insiders at AIG will tell you that Greenberg personally allowed Cassano (Drexell, Barbarians at the Gate) to set up shop in London with minimal adult supervision, fully aware that law and regulation were both scoffed.

Elizabeth Warren of CBO is warning that AIG will not repay the TARP fully. We will be stuck for $35 billion that AIG attempted to dodge through selling itself to Prudential PLC in Hong Kong. Liz points the finger for the AIG mess at Geitner as NY Fed Chief.

We should be screaming aloud that we are trying to negotiate with criminals. Looks like Joe Lieberman & Co. need the Kill Switch. Lieberman insists that "civil libertarians" reviewed the legislation and there is nothing we should fear. I say, that there is a reason he got that kiss from W at the 2003 State of the Union Speech.

Burton Leed

I would like to see the

I would like to see the rating agencies held to a higher standard. I mean in what world is it feasible that an MBS would get a AAA rating?!?

derivatives today

I'll bet money it will take analysis a while to find out all of the loopholes, but regardless, I imagine derivatives reform will be rendered useless, simply because it was in the House version. More later.

But for now, the Reuters is reporting 110 amendments, that's just today on just derivatives.

House Passes so called reform

The watered down bill that won't stop TBTF or another collapse was passed in the House.