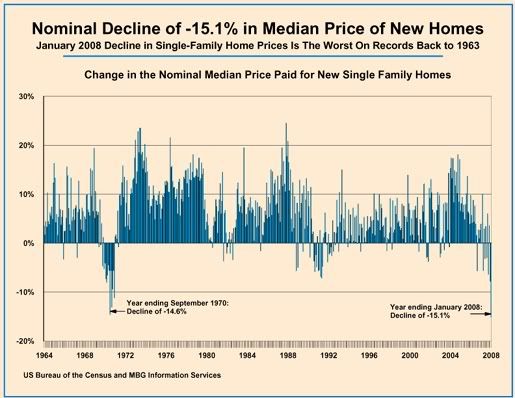

Nominal new home prices plunge record -15.1% yr/yr to January yet sales plunge and inventories soar; durable goods orders also plunged in January.

The key finding in today’s Census Bureau report on new single-family home sales in January is that the median nominal price plunged -15.1% yr/yr, the worst decline on record back to 1963. New home prices were down -7.8% in the year ending December 2007.

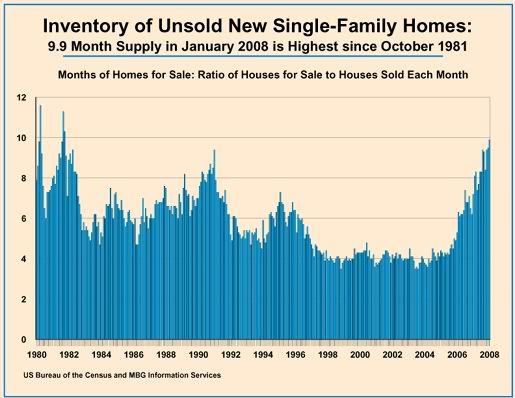

Also very important is that the inventory of unsold new homes soared to a 9.9 month supply in January, the worst glut of empty new homes since October 1981. Unsold inventories represented a 9.5 month supply in December and a 7.2 month supply in January 2007.

Depending on the measure of inflation, January’s nominal price decline is the second worst “real” decline on record. Consumer prices rose 4.3% yr/yr to January implying a “real” plunge of -19.4% in new home prices. This is worse than anything during the famously hyper-inflationary period of 1979-’81 when the “real” decline was -10% to -15% but the year ending July 1970 had the previous record nominal price decline of -14.6% and a rise of 6.0% in consumer prices suggesting a real drop in home prices of -20.6%.

These recent pricing and inventory developments are far more important even than today’s Census report headline that new sales fell another -2.8% from December to January and are now down a remarkable -33.9% yr/yr. The deterioration of the housing market is clearly accelerating and the effects of years of unregulated credit scams and debt-dependence of households are spreading throughout the economy.

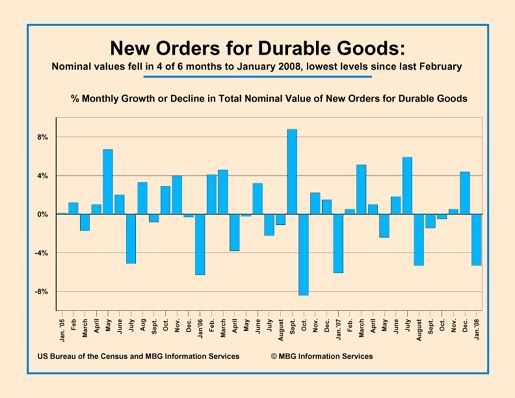

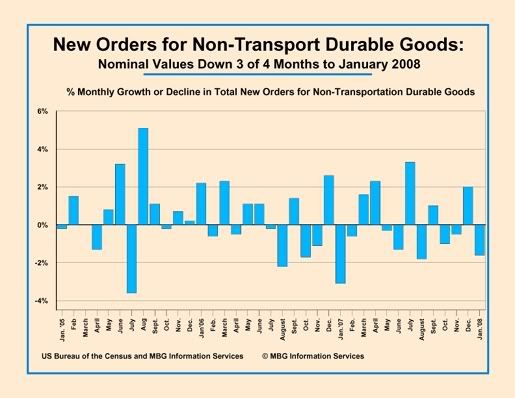

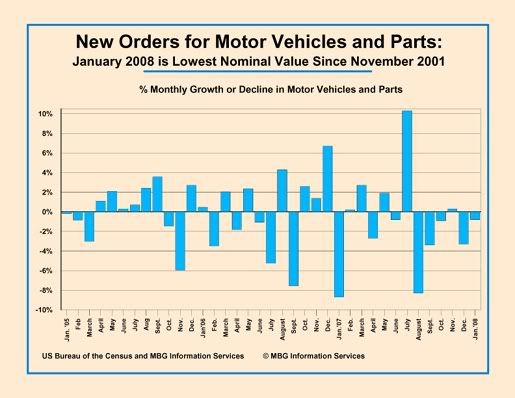

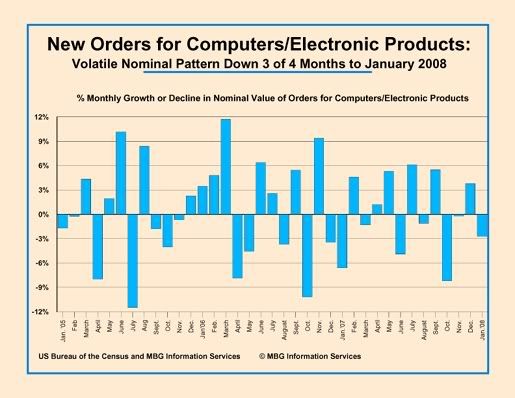

Another important Census report released today shows the nominal value of Durable Manufactured goods orders plunged -5.3% in January, the 4th decline in the last six months bringing the nominal value of orders down to the lowest levels since February 2007. The January decline in orders is broad-based including another decline in orders for Autos and Parts that brings the nominal value of orders in this key, deeply troubled sector back to levels last seen in November 2001 as the last recession was ending.

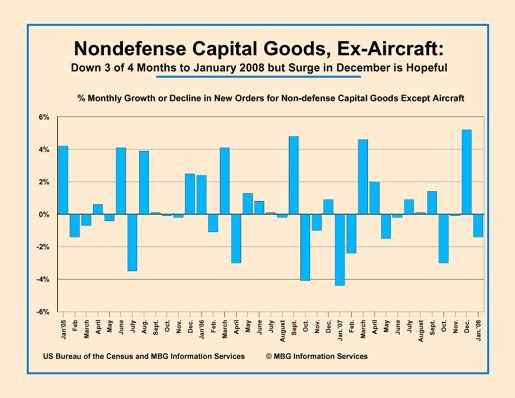

The closely-watched category of “Non-Defense Capital Goods excluding Aircraft” saw a -1.4% drop in the value of orders in January but it also saw an upward revision, to 5.2%, to its strong gains in December – with strong gains in orders for Machinery and Communications Equipment. This is the only slight glimmer of hopeful economic news in either of today’s Census reports, suggesting that business spending may be holding up better than there is any reason to expect.

But the overwhelming evidence points to an economy that is likely already in a recession that could be long and hard.

Recent comments