"The Yen Collapse Has Become Disorderly": Look For A Final, Sharp Decline Before It Hits A Floor

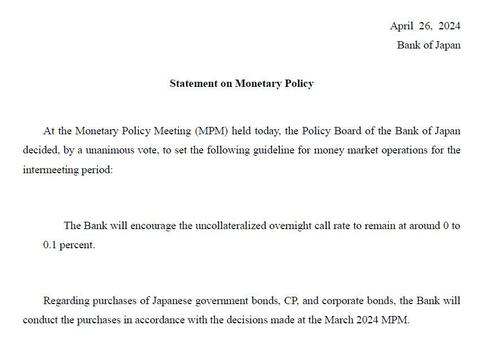

The BOJ came, issued the shortest statement in the history of central banks...

... and left, leaving traders stunned and speechless at the sheer idiocy of the world's most clownish central bank, which has decided to invite currency collapse the same abandon as Zimbabwe, if it means pushing up domestic stonks a little bit more even as hyperinflation is unleashed among Japanese society. And now that the collapse in the yen is making banana republics like Turkey blush, and is making FX managers and traders who are still long the Japanese Dong Lira Yen to the imploding "developed" insolvent, everyone wants to know what happens next?

Below we share to views, one from Deutsche Bank's Geroge Saravelos, and one from SocGen's Kit Juckes.

We start with the DB FX strategist who frames the BOJ's wilful incompetence merely as "benign neglect", to wit:

On the collapse

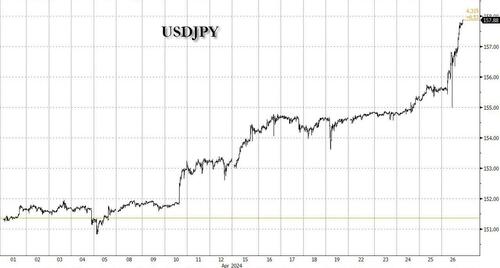

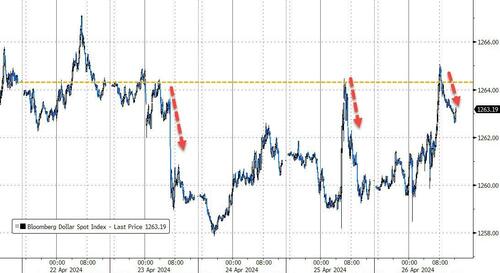

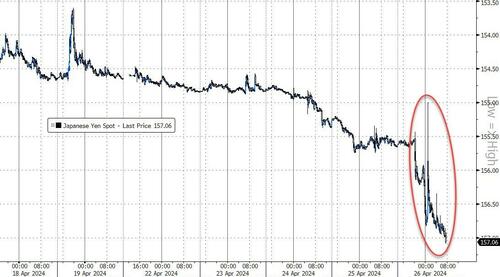

The yen has again collapsed today to fresh record lows following the Bank of Japan meeting. We think this is warranted and that this finally marks the day where the market realizes that Japan is following a policy of benign neglect for the yen. We have long argued that FX intervention is not credible and the toning down of verbal jawboning from the finance minister overnight is on balance a positive from a credibility perspective. The possibility of intervention can't be ruled out if the market turns disorderly, but it is also notable that Governor Ueda played down the importance of the yen in his press conference today as well as signalling no urgency to hike rates. We would frame the ongoing yen collapse around the following points.

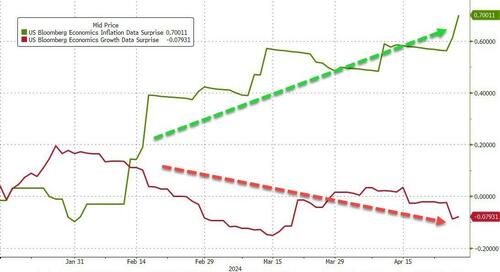

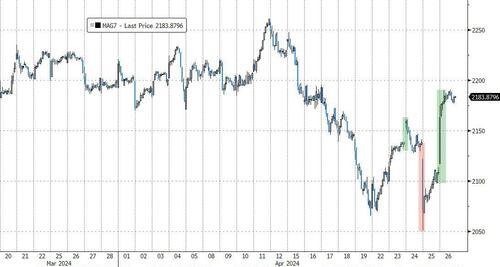

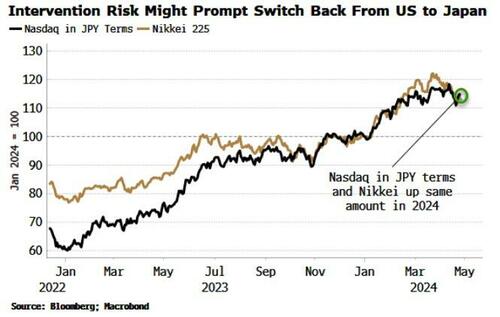

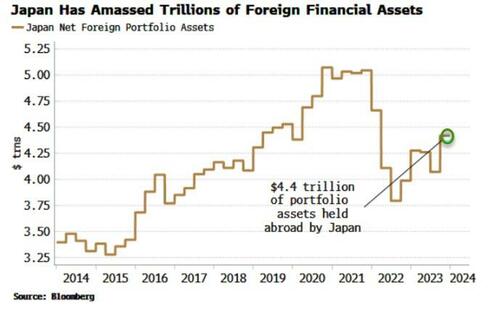

- Yen weakness is simply not that bad for Japan. The tourism sector is booming, profit margins on the Nikkei are soaring and exporter competitiveness is increasing. True, the cost of imported items is going up. But growth is fine, the government is helping offset some of the cost via subsidies and core inflation is not accelerating. Most importantly, the Japanese are huge foreign asset owners via Japan's positive net international investment position. Yen weakness therefore leads to huge capital gains on foreign bonds and equities, most easily summarized in the observation that the government pension fund (GPIF) has roughly made more profits over the last two years than the last twenty years combined.

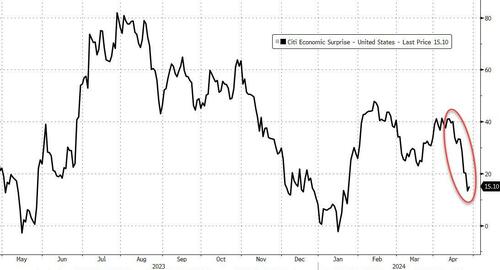

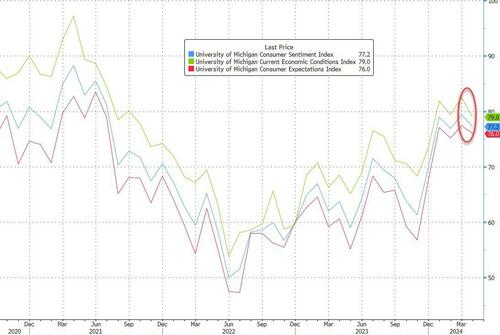

- There simply isn't an inflation problem. Japan's core CPI is around 2% and has been decelerating in recent months. The Tokyo CPI overnight was 1.7% excluding one-off effects. To be sure, inflation may well accelerate again helped by FX weakness and high wage growth. But the starting point of inflation is entirely different to the post-COVID hiking cycles of the Fed and ECB. By extension, the inflation pain is far less and the urgency to hike far less too. No where is this more obvious than the fact that Japanese consumer confidence are close to their cycle highs.

- Negative real rates are great. There is a huge attraction to running negative real rates for the consolidated government balance sheet. As we demonstrated last year, it creates fiscal space via a $20 trillion carry trade while also generating asset gains for Japan's wealthy voting base. This encourages the persistent domestic capital outflows we have been highlighting as a key driver of yen weakness over the last year and that have pushed Japan's broad basic balance to being one of the weakest in the world. It is not speculators that are weakening the yen but the Japanese themselves.

The bottom line is that for the JPY to turn stronger the Japanese need to unwind their carry trade. But for this to make sense the Bank of Japan needs to engineer an expedited hiking cycle similar to the post-COVID experiences of other central banks. Time will tell if the BoJ is moving too slow and generating a policy mistake. A shift in BoJ inflation forecasts to well above 2% over their forecast horizon would be the clearest signal of a shift in reaction function. But this isn't happening now. The Japanese are enjoying the ride

(More in the full note available to pro subs.)

And next, here is the somewhat more actionable view from SocGen's FX strategist Kit Juckes:

The yen's decline is becoming disorderly, which points to a final, potentially sharp, decline before it finds a floor

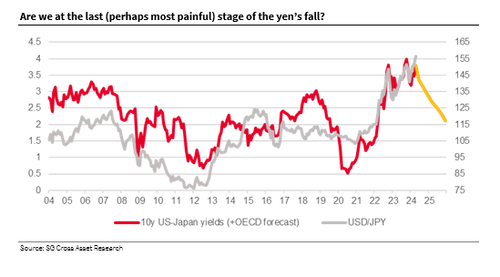

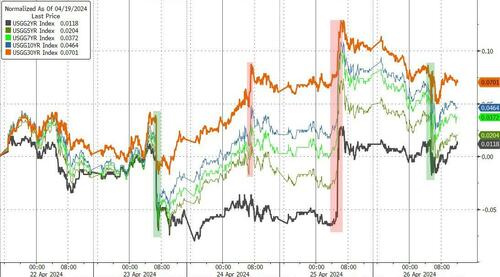

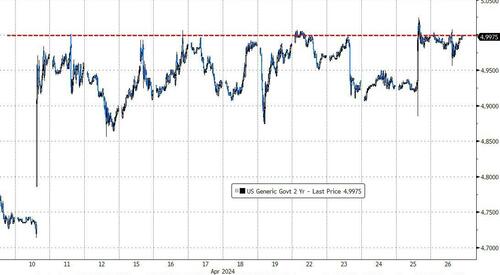

The Bank of Japan, as was universally expected, made no changes to interest rates at today’s policy-setting meeting, though they did edge inflation forecasts higher. Forecasts for the 2025/26 fiscal year look for core inflation (ex-food and energy) at 2.1% and real GDP growth of 1%. In Japan, as in most countries, yields have tended to average more than nominal GDP growth over time, and on that basis the US/Japanese yield differential is set to narrow significantly in the coming quarters. However, for now US yields are rising and Japanese ones are still anchored by very low short-term rates. Those short-term rates give short yen trades their positive carry and have kept the leveraged trading community happy for months.

The chart shows the US-Japanese yield differential and USD/JPY over the last 20 years, with the yield chart extended using the OECD’s forecasts for yields. These are just forecasts but they frame the issue quiet well, particularly bearing in mind how undervalued the yen is now, on any fundamental long-term valuation. If PPP for USD/JPY is now in the mid-90s, fair value adjusted for US exceptionalism and Japanification is still around 110. As long as yield differentials are large and growing, upward pressure on USD/JPY persists and while eventual return to much lower levels is inevitable, the danger here is that unless Japan’s policymakers are much more aggressive (with intervention and monetary policy), this move higher in USD/JPY will end in a final excessive spike higher.

Tyler Durden Fri, 04/26/2024 - 16:40

Hala Rharrit, Arabic language spokesperson for the State Department, has quit in protest. Image: State Dept.

Hala Rharrit, Arabic language spokesperson for the State Department, has quit in protest. Image: State Dept.

(Illustration by The Epoch Times, Shutterstock, Getty Images)

(Illustration by The Epoch Times, Shutterstock, Getty Images) A prison cell block at the El Reno Federal Correctional Institution in El Reno, Okla., on July 16, 2015. (Saul Loeb/AFP via Getty Images)

A prison cell block at the El Reno Federal Correctional Institution in El Reno, Okla., on July 16, 2015. (Saul Loeb/AFP via Getty Images) Texas Gov. Greg Abbott holds a press conference at Shelby Park in Eagle Pass, Texas, on Feb. 4, 2024. (Sergio Flores/AFP via Getty Images)

Texas Gov. Greg Abbott holds a press conference at Shelby Park in Eagle Pass, Texas, on Feb. 4, 2024. (Sergio Flores/AFP via Getty Images) A National Guard soldier looks across the Rio Grande to Mexico on the border in Eagle Pass, Texas, on May 23, 2022. (Allison Dinner/AFP via Getty Images)

A National Guard soldier looks across the Rio Grande to Mexico on the border in Eagle Pass, Texas, on May 23, 2022. (Allison Dinner/AFP via Getty Images) A bus carrying illegal immigrants from Texas arrives at Port Authority Bus Terminal in New York City on Aug. 10, 2022.

A bus carrying illegal immigrants from Texas arrives at Port Authority Bus Terminal in New York City on Aug. 10, 2022. A dairy cow at a dairy farm in Ohio, on December 12, 2014. (Aaron Josefczuk/Reuters)

A dairy cow at a dairy farm in Ohio, on December 12, 2014. (Aaron Josefczuk/Reuters)

Recent comments