Futures Gain With All Time Highs In Sight As Key CPI Report Looms

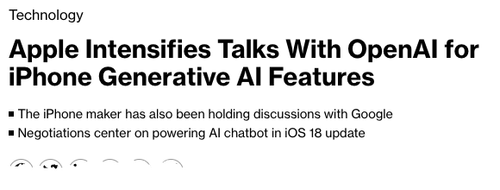

US equity futures extended last week's solid gains when they traded just about 1% below all time highs, as investors awaited key CPI later this week that will shape the Fed's actions in coming months. As of 7:30am, contracts on the S&P 500 rose about 0.2% (but still below Friday's highs), after the index posted a third straight week of gains; meanwhile contracts on the Nasdaq 100 climbed 0.3% even though Alphabet dropped 2% in premarket trading after Bloomberg reported that Apple is closing in on an agreement to use OpenAI’s technology on the iPhone. Treasury yields dipped and the dollar was steady. In addition to the week's inflation data(both PPI and CPI) a handful of Fed speeches will also be in focus this week, including Cleveland Fed President Loretta Mester and Fed vice chair Philip Jefferson, who speak later in the day.

In premarket trading, Alphabet shares fall 2% as Apple is said to be closing in on an agreement to use OpenAI’s technology on the iPhone. Amusingly, GameStop shares soared and on track for the best month since March 2021 after the first (rather cryptic) tweet by Roaring Kitty after 3 years of silence on the platform, has sparked yet another massive short squeeze in the otherwise worthless company, and is allowing Keith Gil to dump stock at a huge gain.

Here are some other notable premarket movers:

- AC Immune shares jump 53% after Takeda signs a worldwide option and license agreement for the biotech’s active immunotherapies targeting amyloid beta, including ACI-24.060 for the treatment of Alzheimer’s disease.

- Cisco Systems shares tick 0.5% higher after losing its only negative analyst rating as BNP Paribas Exane upgrades to neutral from underperform, with limited downside now seen to consensus estimates for the networking equipment maker.

- Incyte climbs 5.5% after announcing that its board approved a share repurchase authorization of $2 billion.

- Intel rises 1.2% after the Wall Street Journal reports that the chipmaker is in advanced talks for a deal in which Apollo Global Management would provide more than $11 billion to help the company build a plant in Ireland, citing people familiar with the matter.

- Penn Entertainment (PENN) drops 2.9% after BofA downgrades the casino and gaming company to neutral following what it describes as disappointing results.

- Squarespace (SQSP) rises 13% after entering into a definitive agreement to go private with Permira in an all-cash transaction valued at approximately $6.9 billion.

- Tencent Music Entertainment’s US-listed shares are up 3.5% after the online music platform reported first-quarter results that beat expectations.

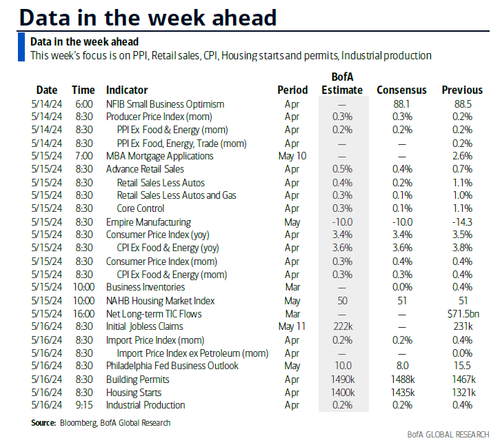

Ahead of Wednesday's all-important CPI report, all eyes will be on US producer prices due Tuesday. Data last week pointed to an economy that is slowing amid stubborn inflation, posing a challenge to the outlook for Fed policy.

“We need a catalyst to break the range on rates or change our view on risky assets,” said Mohit Kumar, Jefferies Europe chief economist. “US CPI data this week could be a potential catalyst. Even though US data has started to show some signs of moderating, inflation remains sticky, creating fears of stagflation.”

In Europe, the Stoxx Europe 600 index was little changed after posting its best weekly return since January (as we previewed just days prior) amid optimism the ECB is poised to ease policy as soon as next month. The autos and health care sectors led gains, while construction and utilities stocks were the biggest laggards. Among individual European movers, AP Moller-Maersk A/S jumped as much as 10% in Copenhagen after analysts at Citigroup Global Markets lifted their earnings estimates on the stock to reflect a recent rise in freight rates. Shell Plc rose to a record in London. Here are the most notable movers:

- Maersk shares jump as much as 10% to touch a three-month high, as the shipping stock catches up after Danish markets were closed for holidays on Thursday and Friday last week. Analysts at Citi lifted their earnings estimates on the stock to reflect the recent rise in freight rates.

- OX2 shares gain as much as 44% as private equity firm EQT is offering 16.4 billion kronor ($1.5 billion) for the wind park developer.

- Gulf Keystone shares jump as much as 15% after the oil and gas producer operating in the Kurdistan region of Iraq demonstrated it can be profitable and generate cash from selling its output locally, according to analysts, with a key export pipeline still closed. This is reflected by the $10m share buyback announced this morning.

- Diploma shares rise as much as 11% to touch a record high, the biggest gainer on the FTSE 100 index on Monday. The construction components firm reported solid results and upped its revenue and margin forecasts for the full year, while analysts noted a strong tailwind from M&A.

- Nobia gains as much as 9%, the most in a month, after Nordea reinstated its coverage of the Swedish kitchen-interiors firm with a buy rating, expecting a recovery in construction market and consumer confidence to be a boon for the company.

- NKT gains as much as 9% after Nordea “firmly” reiterated its buy rating for the Copenhagen-listed power-cable manufacturer, predicting that the continued electrification of society will be a huge boon for the firm in the coming years.

- Almirall rises as much as 8.7% as the skin-health focused pharmaceuticals company delivers sales ahead of expectations. The beat was led by the performance of its Ilumetri psoriasis product. Meanwhile, guidance for the full year has been maintained.

- Ceconomy rises as much as 6.2% after the German retailer of consumer electronics gave a better-than-expected profit forecast for the year. Baader Bank and Oddo point to Western/Southern Europe segment as a main driver.

- Victrex shares drop as much as 5.6% after the polymer maker reported a 92% drop in pretax profit for the first half of the year due to high inventory levels and destocking among medical device customers. The firm has “a lot of work” to do in the second half of the year, according to Jefferies, which expects double-digit downgrades to 2024 consensus estimates.

- BAE Systems shares in London fall as much as 2.9% after closing at a record high on Friday. The UK defense company was downgraded to neutral by analysts at BofA Securities, who see limited upside following the stock’s recent re-rating. That comes amid broader pressure on the European defense sector this morning.

The euro-area economy will expand more quickly than previously thought this year as the bloc’s biggest member, Germany, exits more than a year of near-stagnation, a Bloomberg poll of analysts showed. The results capture the improving mood in the region, with first-quarter GDP readings surprising to the upside and inflation is receding toward 2%.

Earlier in the session, Asian stocks were mixed with Chinese technology companies gaining ahead of earnings and the release of eco data this week. Hong Kong’s equity benchmark climbed to the highest since August, and mainland China equities also rose. But shares in South Korea, Japan and Australia fell. The MSCI Asia Pacific Index climbed as much as 0.3%, reversing earlier losses of as much as 0.2%, after reports that China is planning to issue ultra-long bonds to support its economy. TSMC, Alibaba Group and Tencent Holdings were the biggest contributors to the gauge’s gains. Mainland Chinese shares pared declines after initially falling amid concerns over an escalation of US tariffs and weak local credit data. Benchmarks in Hong Kong gained, with a gauge of technology stocks listed in the financial hub headed for its highest close since November. Taiwan shares also rose, while indexes in Japan fell.

News of the China’s plan to sell ultra-long special bonds boosted sentiment after weak data from the country published over the weekend had led to initial Asian stock losses. The specter of further US-China trade tensions also weighed on equities with a report on how much President Biden is set to increase tariffs on Chinese electric vehicles.

“You are looking at a slightly muddied growth outlook” for China, Sonal Desai, chief investment officer at Franklin Templeton, said in an interview on Bloomberg Television. Regardless of who gets elected in the US presidential election in November, we are going to see an escalation of US-China trade tensions, he said.

In FX, the Bloomberg Dollar Spot Index edged 0.1% lower. “After the dovish FOMC meeting and the soft April NFP sucked the momentum from the dollar’s upside, the question is whether price data can actively contribute to the dollar’s downside,” FX strategists at ING write in a note, adding that a softer PPI reading could point to a lower core PCE deflator figure, the Fed’s preferred inflation reading, due on May 31. This week’s data follows a US labour report earlier in the month which showed a slowdown in jobs growth and raised speculation that the Fed may start cutting the rate in the coming months

Traders are betting on a 73% possibility that the Fed will start cutting rates in September, little changed from late last week; roughly 40 basis points of cuts are priced in through the end of the year

In rates, treasuries are slightly richer across the curve, following similar gains for bunds and gilts during European morning. US yields richer by 1bp to 2bp across the curve with 10-year around 4.48%, about 1.5bp lower than Friday’s close, slightly underperforming bunds and gilts in the sector. Curve spreads are steeper by less than 1bp. Wednesday’s April CPI report is poised to provide the biggest test yet of the bond rally that started this month, when Jerome Powell swatted away worries that the Fed may raise interest rates; PPI data on Tuesday will also be in focus. Trading ranges narrow ahead of critical PPI and CPI reports Tuesday and Wednesday. A busy corporate new-issue slate is expected, with a weekly total of about $30 billion anticipated. The next scheduled Treasury auction is 20-year bond sale on May 22

In commodities, oil gained on optimism China’s bond plan may boost growth, and traders assessed the willingness of OPEC+ to agree to extend supply curbs at its upcoming policy meeting. Iron ore and copper extended gains

It has been a strong session for Bitcoin, climbing back up over 63k, while Ethereum is looking to reclaim USD 3k.

Looking at today's calendar, the US economic data slate includes April New York Fed 1-year inflation expectations at 11am; retail sales and industrial production are also ahead this week. Fed officials’ scheduled speeches include Mester and Jefferson at 9am; Cook, Powell, Kashkari, Bowman, Barr, Harker, Bostic, Waller, Daly and Kugler appear later in the week

Market Snapshot

- S&P 500 futures little changed at 5,251.00

- STOXX Europe 600 little changed at 520.98

- MXAP up 0.3% to 178.02

- MXAPJ up 0.5% to 556.98

- Nikkei down 0.1% to 38,179.46

- Topix down 0.2% to 2,724.08

- Hang Seng Index up 0.8% to 19,115.06

- Shanghai Composite down 0.2% to 3,148.02

- Sensex little changed at 72,722.04

- Australia S&P/ASX 200 little changed at 7,750.03

- Kospi little changed at 2,727.21

- German 10Y yield little changed at 2.51%

- Euro little changed at $1.0777

- Brent Futures up 0.3% to $83.04/bbl

- Gold spot down 0.7% to $2,343.69

- US Dollar Index little changed at 105.30

Top Overnight News

- China’s CPI rose for a third straight month in April, increasing at a pace of 0.3% compared with a year earlier, according to official data released Saturday, edging up from March’s 0.1% reading and surpassing the 0.2% growth expected by economists. Meanwhile, the PPI fell 2.5% in April from a year earlier for a 19th consecutive month of declines. WSJ

- China’s credit in April shrank for the first time as government bond sales slowed, while loan expansion was worse than expected in a sign of weak demand. Aggregate financing, a broad measure of credit, decreased by almost 200 billion yuan ($27.7 billion) in April from the previous month, according to Bloomberg calculations of data released by the PBOC. That’s the first time the measure has declined since comparable data began in 2017, reflecting a contraction in financing activity. BBG

- Chinese authorities have kicked off plans to sell Rmb1tn ($140bn) of long-dated bonds, as Beijing raises spending to stimulate the economy. FT

- In the past three days, Russian troops, backed by fighter jets, artillery and lethal drones, have poured across Ukraine’s northeastern border and seized at least nine villages and settlements, ¬and more square miles per day than at almost any other point in the war, save the very beginning. In some places, Ukrainian troops are retreating, and Ukrainian commanders are blaming each other for the defeats. NYT

- Iraq’s oil minister on Sat said the country won’t agree to any additional voluntary oil production cuts, although he expressed support for the overall OPEC+ alliance in more conciliatory comments on Sunday. RTRS

- Stubbornly sticky rent is preventing the Fed from winning the “last mile” portion of its war on inflation and commencing policy easing. WSJ

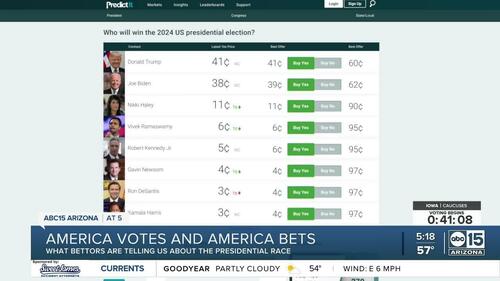

- Biden’s campaign considers Haley voters as a core part of its coalition in Nov, and has been heartened by the fact she continues to perform so well in GOP primaries despite being out of the race for weeks (Trump meanwhile has made little effort to court Haley or her supporters). Politico

- McDonald’s is looking to launch a $5 meal plan in the US, a sign the company is becoming more aggressive on price to recapture market/mindshare as consumers dial back spending. BBG

- Apple has closed in on an agreement with OpenAI to use the startup’s technology on the iPhone, part of a broader push to bring artificial intelligence features to its devices, according to people familiar with the matter. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly cautious after mixed inflation and soft financing data from China over the weekend, although Chinese markets found some solace from China's plans to issue ultra-long treasury bonds. ASX 200 was led lower by underperformance in the energy sector and amid a tepid NAB Business survey. Nikkei 225 lacked firm direction with price action choppy amid a slew of earnings releases. Hang Seng & Shanghai Comp were initially pressured after mixed inflation data and disappointing financing data which showed a rare contraction in Aggregate Financing, while expectations of increased US tariffs on Chinese EVs also provided early headwinds. However, the Hong Kong benchmark then recovered and climbed above the 19,000 level amid tech strength, while the mainland pared the majority of its losses as the attention turned to China's plans to issue ultra-long treasury bonds on May 17th.

Top Asian News

- Chinese authorities kicked off plans to sell USD 140bln of long-dated bonds, according to the FT. It was later reported that China's Finance Ministry is to issue ultra-long treasury bonds on May 17th in which it plans to issue 20yr, 30-year and 50-year treasuries worth CNY 300bln, CNY 600bln and CNY 100bln, respectively, while it plans to complete the issuance of long-term treasury bonds by end-November.

- Country Garden (2007 HK) said it repaid onshore coupons within the grace period, according to Reuters.

- BoJ offered to buy JPY 375bln in 1-3yr JGBs, JPY 425bln in 5-10yr JGBs and JPY 150bln in 10-25yr JGBs (reduced 5yr-10yr purchases from a previous JPY 475bln).

- Australia’s government cut its 2024/2025 real GDP growth forecast to 2% from 2.25% and cut its 2025/2026 growth forecast to 2.25% from 2.50%, while it said inflation could slow to the RBA’s 2%-3% target range by year-end which is sooner than previously expected, according to Reuters.

- Tencent Music Entertainment Group (TME) Q1 2024 (USD): EPS 0.13 (exp. 0.14), Revenue 0.94bln (exp. .91bln).

European bourses, Stoxx600 (U/C) are mixed and trading on either side of the unchanged mark, in what has been a very quiet European morning. European sectors are mixed; Autos tops the pile, with optimism potentially deriving from Chinese CPI as well as new long-dated bond sales, which will help to provide liquidity for the Chinese markets. US Equity Futures (ES +0.1%, NQ +0.1%, RTY +0.3%) are very modestly in the green, following the tentative price action also seen in Europe.

Top European News

- UK PM Sunak is set to declare the UK stands 'at a crossroads' as he readies the Tories ahead of an election, according to FT.

- Socialists were ahead in the Catalan regional election with 41 seats out of the 135-seat chamber and separatists Junts were second with 36 seats after 91% of votes were counted, according to Reuters.

- S&P affirmed Poland at A-; Outlook Stable.

FX

- Dollar is modestly softer, having spent much of the European morning flat, with recent EUR strength pushing the index lower, albeit marginally so. Currently, the DXY is towards the bottom end of today's 105.36-20 range.

- EUR is incrementally firmer vs the USD, catching a slight bid in recent trade though with specifics light. Currently holding around its 50DMA at 1.0786.

- GBP is flat vs USD, with very modest early morning weakness petering out. Focus this week will be March’s job data, as well as potential commentary from BoE Chief Economist Pill.

- USD/JPY is incrementally firmer, having wobbled very briefly after the BoJ said it reduced its purchases of 5yr-10yr JGBs. The announcement led USD/JPY to as low as 155.57, before quickly paring the move. As it stands, the pair holds above its 20DMA, with the high for today at 155.95.

- Mixed trade for the Antipodeans, initially softened by the cautious risk tone in APAC trade and after the PBoC set a weaker reference rate setting. Weakness in the Kiwi, after inflation expectations, has led NZD/USD as low as 0.60.

- PBoC set USD/CNY mid-point at 7.1030 vs exp. 7.2284 (prev. 7.1011).

Fixed Income

- USTs are a touch firmer but near unchanged overall as the benchmark takes a slight breather from Friday's marked bearish action but remain within a couple of ticks of the 108-21+ trough from Friday with last week's 108-19+ base below.

- Bund price action has been very contained and largely directionless. Drivers thus far have been exceptionally limited and the European docket ahead is very light.

- Gilts in-fitting with the UK docket thin today with the narrative much the same as for EGBs above. Gilts themselves in a thin 20 tick range after a very contained open. Currently around the 97.75 mark above the 97.66 low.

Commodities

- Crude benchmarks are on the front-foot, however action is modest and we remain within around a USD 1/bbl of Friday's base. Focus today has been on commentary from the Iraqi Oil Minister and awaiting updates out of Rafah. Brent July current holding at USD 83/bbl.

- Precious metals are slipping a touch but with the action more of a gentle decline than a pronounced fall thus far. Specifics light and impetus from broader assets limited as overall market action is fairly contained; XAU near session lows around USD 2,240.

- Base metals largely followed the fortunes of China overnight with initial action bearish on the overall soft tone and weak financing data from the region.

- Iraqi Oil Minister said on Saturday that Iraq has made enough voluntary production cuts and will not agree to any future reduction taken by OPEC. However, it was reported on Sunday that the Oil Minister said the voluntary oil output cut is subject to agreement between OPEC countries and any negotiable proposals may be presented at the time, while he added they are part of OPEC and it is necessary to comply with any decisions made by the organisation. The state news agency also reported the Oil Minister said Iraq is committed to voluntary output cuts made by OPEC members and is keen on cooperating with members to achieve more stability in global oil markets.

- Iraqi Oil Ministry launched 29 oil and gas projects within the fifth and sixth licensing rounds.

- Qatar set June marine crude OSP at Oman/Dubai plus USD 1.75/bbl and land crude OSP was set at Oman/Dubai plus USD 0.85/bbl, according to a pricing document.

- QatarEnergy is to acquire two new exploration blocks offshore Egypt in which it signed a farm-in agreement with ExxonMobil (XOM) to acquire a 40% participating interest in the exploration blocks.

- Russian Deputy PM Novak said Russia will be able to increase fuel output in the future, according to TASS.

Geopolitics: Middle East

- Israel’s IDF said it ordered residents of additional east Rafah areas to evacuate and head to the humanitarian zone in Al-Mawasi, according to Reuters.

- Israeli military spokesperson said Hamas has been trying to re-establish military capabilities in Gaza’s Jabalia and Israel is trying to prevent that, while it announced that Israeli forces in Gaza’s Zeitun killed 30 Palestinian militants. It was separately reported that Israel's military opened a new crossing into the Gaza Strip in coordination with the US government for humanitarian aid, according to Reuters.

- US State Department said Secretary of State Blinken stressed to Israeli Defence Minister Gallant the urgent need to protect civilians and aid workers in Gaza and urged to ensure humanitarian access to Gaza, while Blinken reaffirmed to Gallant US opposition to a major ground military operation in Rafah, according to Al Jazeera and Sky News Arabia.

Geopolitics: Other

- Ukrainian President Zelensky said battles are ongoing at seven border villages in Kharkiv and the Donetsk situation is particularly tense, while Ukraine’s military chief said fighting is ongoing and warned of a difficult situation in the Kharkiv region, according to Reuters.

- Ukrainian shelling killed at least 9 people and injured more than a dozen in an apartment block collapse in Russia’s Belgorod, according to Reuters.

- Russian President Putin conducted a surprise reshuffle of top security officials whereby he removed Patrushev as head of the Security Council who will be moved to a new job and proposed that Defence Minister Shoigu become the new head of the Security Council, while he proposed economic adviser Belousov to become the new Defence Minister, according to FT.

- Russian Defence Ministry said its forces have taken five settlements in Ukraine’s Kharkiv region.

- Ukrainian drone attack has damaged an oil depot/power substation in Belgorod and Lipestk regions of Russia, via Reuters citing Ukrainian intelligence.

US Event Calendar

- 11:00: April NY Fed 1-Yr Inflation exp; prior 3.00%

Central Bank Speakers

- 09:00: Fed’s Mester, Jefferson Discuss Central Bank Communications

DB's Jim Reid concludes the overnight wrap

After perusing my social media accounts, I think I’m the only person on the planet who couldn’t find the aurora borealis this weekend. All I have to show for my efforts are a few black sky pictures on my iPhone. I had more success in finding a decent song at Eurovision which is saying something.

The main thing that will light up the skies for markets this week will be US inflation data with April’s PPI (Tuesday) and CPI (Wednesday) the highlights. We’ll see if the higher-than-expected US inflation seen in Q1 extends into Q2 or not. Markets will also hear from Powell (tomorrow) and Vice Chair Jefferson (today) as the highlights of a busy Fedspeak calendar that are included in the day-by-day list at the end. The next most important US data release is Retail Sales on Wednesday.

Elsewhere China’s monthly activity numbers (Friday) are important, and staying in Asia, we also have Japanese PPI (tomorrow) and Q1 GDP (Thursday). In Europe tomorrow’s ZEW survey in Germany and UK labour market stats are highlights. Swedish CPI (Wednesday) may get a little extra attention after last week's Riksbank cut, only the second G10 currency to ease this cycle after Switzerland earlier in the year. Earnings season quietens with only 7 S&P 500 companies and 69 Stoxx 600 companies reporting.

Previewing the main events now and let’s start chronologically with regards to US inflation. For PPI tomorrow, the headline (+0.4% DB forecast, +0.3% consensus, vs. +0.2% previously) and core (+0.3% DB, +0.2% consensus vs. +0.2% last month) are always less important than the key components that feed into the core PCE deflator – namely, health care services, portfolio management and domestic airfares. As our economists point out, whilst the March health care services print was relatively soft (+0.1%), the six-month annualised growth rate of 3.5% was still higher than at any point in the decade prior to the pandemic. They also highlight that with respect to portfolio management, the strength in asset market performance leading up to March should result in a strong print for April, given the typical lags.

With regards to CPI, our economists previewed it in full here (see "April CPI preview & webinar registration"), and think that given the 3% rise in seasonally adjusted gas prices, headline CPI (+0.37% forecast vs. +0.38% previously) should grow faster than core (+0.29% vs. +0.36%). This would lead to core YoY CPI falling two-tenths to 3.6%, and headline falling a tenth to 3.4%, both in-line with consensus. The three-month annualised rate under this scenario would fall by four-tenths to 4.1%, but the six-month annualised rate would tick up a tenth to 4.0%. As ever all eyes will be on whether rents finally respond more in keeping to the numerous models that have suggested they should already be well below where they currently are.

For Wednesday's US Retail Sales, DB’s headline (+0.5% vs. +0.7% previously), ex-autos (+0.4% vs. +1.1%) and retail control (+0.3% vs. +1.1%) forecasts suggest some payback from a strong March release. There will be a few extra eyes on initial jobless claims this week given the spike to +231k last week after months of relative stability around the +210k level. Our economists think the spike could have been mostly due to NY school holiday dates having been shifted and would therefore expect much of the spike to reverse. We also have US housing starts and permits on Thursday which include a 2019-2024 seasonal revision which could be of note.

Various regional factory surveys are out which will help fine tune PMI forecasts. Over the weekend Chinese consumer inflation edged higher but producer prices stayed very weak. CPI came in at +0.3% YoY in April from +0.1% YoY in March and a tenth above expectations. PPI however fell -2.5% (-2.3% expected and -2.8% in March). So, deflation still remains intense in manufacturing sectors. Mainland Chinese stocks are lower with the CSI (-0.11%) and the Shanghai Composite (-0.09%) both trading slightly lower on prospects of more US trade tariffs on China across various industries with electric vehicles expected to be a particular target according to Bloomberg.

Elsewhere the KOSPI (-0.28%) and Nikkei (-0.20%) are also edging lower in early trade. Meanwhile, the Hang Seng (+0.38%) is bucking the regional negative trend. S&P 500 (+0.04%) and NASDAQ 100 (+0.07%) futures are trading just above flat with USTs fairly stable as I type.

Coming back to China, the government plans to sell the first batch of its 1 trillion yuan ($138 billion) of ultra-long dated bonds on Friday, ramping up its spending to stimulate the economy. The total issuance will include 300 billion yuan 20-year bonds, 600 billion yuan 30-year notes and 100 billion yuan in 50-year tenor and the bonds will be sold from May through November.

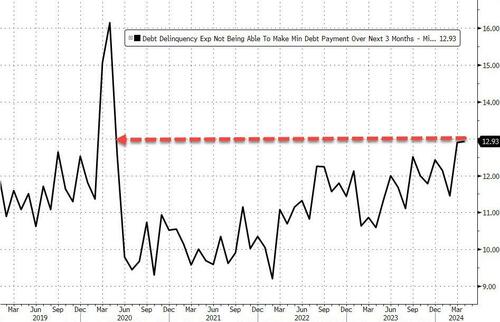

Recapping last week now. On Friday we had a weak reading for the University of Michigan’s preliminary consumer sentiment index for May. The headline sentiment index dropped well below expectations, falling from 77.2 to 67.4 (vs 76.2 expected), the lowest level since November. Respondents’ view of current conditions also deteriorated in May, falling from 79.0 to 68.8 (vs 79.0 expected).

Notably, the year-ahead inflation expectations rose from 3.2% last month to 3.5% (vs 3.2% expected), erasing all the index’s decline earlier this year. The 5-10yr expectation also rose from 3.0% to 3.1% (vs 3.0% expected).

The University of Michigan release helped pare back some of the week’s upbeat tone. The upside in inflation expectations saw the number of Fed rate cuts expected by December decline by -5.1bps on Friday (-4.9bps over the week), erasing mid week optimism that monetary policy was heading to a less restrictive stance. Over in Europe it was a similar story, with the amount of ECB cuts priced by December coming down -3.2bps on Friday (and -5.0bps over the week) to 69bps.

Off the back of this, US Treasuries sold off. The 2yr yield rose +5.1bps on Friday, and +4.9bps on the week. Similarly, 10yr yields rose +4.3bps on Friday, although this failed to fully wipe out the decline in yields earlier in the week, as yields ended the week down -1.3bps at 4.50%. Meanwhile in Europe, yields on 10yr bunds were up +2.2bps (+2.2bps on Friday).

In the equity space, the S&P 500 had traded nearly +0.5% higher early on Friday before the University of Michigan survey but then gave up those gains, finally closing the day +0.16% higher. It finished the week up +1.85% in its third consecutive week of gains, the longest winning streak for the index since February. The NASDAQ followed suit, rising +1.14% last week (-0.03% on Friday).

Moreover, global equities were also on the stronger side, as the STOXX 600 gained +3.01% (and +0.77% on Friday). The UK FTSE 100 hit another record high last week, supported by a strong beat to the UK GDP data for Q1 which rose +0.6% quarter-on-quarter (vs +0.4% expected). This saw the FTSE 100 gain +2.68% (and +0.63% on Friday).

Finally, in commodities, oil prices lost ground on Friday, with Brent crude down -1.30% (-0.20% on the week) to $82.79/bbl, its lowest level in nearly two months. By contrast, gold was up +1.32% on Friday (+2.55% over the week) to $2,361/oz, its highest level in three weeks.

Tyler Durden

Mon, 05/13/2024 - 08:03

Former President Donald Trump, with attorney Todd Blanche (R), speaks to the press as he arrives for his criminal trial for allegedly covering up hush money payments at Manhattan Criminal Court in New York City on May 10, 2024. (Curtis Means-Pool/Getty Images)

Former President Donald Trump, with attorney Todd Blanche (R), speaks to the press as he arrives for his criminal trial for allegedly covering up hush money payments at Manhattan Criminal Court in New York City on May 10, 2024. (Curtis Means-Pool/Getty Images)

Arizona Attorney General Kris Mayes (D)

Arizona Attorney General Kris Mayes (D)

(portumen/Shutterstock)

(portumen/Shutterstock)

California Governor Gavin Newsom unveils revised 2024-25 state budget on Friday, May 10 (photo: AP, Rich Pedroncelli)

California Governor Gavin Newsom unveils revised 2024-25 state budget on Friday, May 10 (photo: AP, Rich Pedroncelli)

Recent comments