APPLE EMBED

At The Money: Concentrated Portfolios: Andrew Slimmon, Morgan Stanley (May 8, 2024)

Are your expensive active mutual funds and ETFs actually active? Or, as is too often the case, are they only pretending to be active? Do they charge a high active fee but then behave more like an index fund? AndrewToday, we discuss the advantages of concentrated portfolios. If you want to own active funds, then make sure they differ its benchmarks and truly are active.

Full transcript below.

~~~

About this week’s guest:

Andrew Slimmon is Managing Director at Morgan Stanley Investment Management, and leads the Applied Equity Advisors team; he serves as Senior Portfolio Manager for all long equity strategies.

For more info, see:

Personal Bio

Masters in Business recording

LinkedIn

Twitter

~~~

Find all of the previous At the Money episodes here, and in the MiB feed on Apple Podcasts, YouTube, Spotify, and Bloomberg.

SPOTIFY EMBED

TRANSCRIPT

Are your expensive active mutual funds and ETFs actually active? Or, as is too often the case, are they only pretending to be active? Do they charge a high active fee but then behave more like an index fund? If so, you are the victim of closet indexing. We discuss the best ways to avoid the funds that charge high fees but fail to provide the benefits of active management.

Andrew Slimmon is Managing Director at Morgan Stanley Investment Management, and leads the Applied Equity Advisors team; he serves as Senior Portfolio Manager for all long equity strategies.

Barry Ritholtz: How many stocks do you need to own to really be diversified? The number is probably a lot lower than you think. Concentrated portfolios are the opposite of bropad market indexes or funds and ETFs. They only own, A handful of stocks, typically 203-0 names. The goal is to own the best performers without all of the dead weight.

I’m Barry Ritholtz, and on today’s edition of At The Money, we’re going to discuss whether or not you should own a concentrated portfolio.

To help us unpack all of this and what it means for your holdings, let’s bring in Andrew Slimmon. He’s the Managing Director at Morgan Stanley Investment Management, where he leads the Applied Equity Advisors team and serves as Senior Portfolio Manager for all of Morgan Stanley’s long equity strategies. His team manages about 8 billion in client assets. Slimmon’s portfolios have done well against the indexes and his global portfolio has trounced the benchmarks. Let’s start with the basics. What exactly is a concentrated portfolio?

Andrew Slimmon: As I think about a concentrated portfolio, it means two things. As you said, it can be a limited number of positions. So, you know, 10 to 20 stocks is can be concentrated or it can mean a a limited number of what I would call directional position. So if you think about the S&P 500 has lots of different sectors, you could have a lot of stocks, but say you put them all in one or two sectors, you would, you would have a concentrated portfolio simply because it had made a directional, positioning versus a more diversified situation.

Barry Ritholtz: So what are the advantages of having just a few stocks or just a few sectors? How does that generate better returns than the market?

Andrew Slimmon: If you have a limited number of stocks, you’re trying to find the best the best stocks, uh, in that group and eliminate the, you know, the dogs. I think that there is a benefit to that, but what’s important is to make sure that your positions are diversified. What’s perverse about this is I could have 10 stocks and be more diversified then if I owned a hundred stocks, because as long as those 10 stocks don’t zig and zag the other, they, they might be in different sectors; they might be different — some might be growth or value or defensive., I might be more diversified owning 10 stocks than if I owned lots and lots of stocks that, you know, that are highly correlated. So I think, It’s a combination of the number of positions, but whether you diversify, which I’m fully in favor of really depends on what is the correlation, the relationships of the stocks and the portfolios.

Barry Ritholtz: So there’s no magic number where at X number of shares, you’re really diversified. It depends on. the companies themselves, the sectors they are in what various factors and qualities they have. Is that a fair way to describe that?

Andrew Slimmon: That’s exactly right. That’s exactly right. Here’s a great example. We own in our fund NVIDIA, but we also own MasterCard and you’d say, Oh wow, NVIDIA is, you know, a tech company. It’s a semiconductor company. Uh, and MasterCard is a finance, Transactional company. So boy they, that, that’s, those stocks don’t zig and zag together. They’re, they’re not correlated…

Well, actually they are because they’re both large cap growth stocks. And at the end of the day. As we’ve discussed in the past, Barry, stocks move with their, with their factor; Those are both growth stocks. So with growth stocks work, those will work together and growth stocks don’t work. They won’t work together. So understanding the correlations is more than just, well, what sector they, they, they fall into.

Barry Ritholtz: So previously we’ve discussed active share. What does that mean in the world of concentrated portfolios? How much active share do you need to make a concentrated set of holdings look different than the index?

Andrew Slimmon: The studies show that you need to have active share of somewhere between 80 and 90 percent, which means 90 percent of your of your portfolio differs from the index.

Now I’m a believer in owning stocks that are in your benchmark, but just not owning many of them. You could have a high active share again by owning stocks that are not in the index. But over time, the higher your active share, the better managers do, because If you only own say 20 stocks, it’s going to become pretty apparent whether you’re good or not, because you’re not kind of moving on a daily basis with the index.

And, so there is survivorship bias, but higher active shares proven to outperform lower active share over time.

Barry Ritholtz: I know you’re a fan of various market factors like value, quality, and momentum. How does that fit into the equation of a concentrated portfolio?

Andrew Slimmon: Just academically, we know that any stock, and I’ll go back to NVIDIA, it is a large cap, technology, growth stock, and over time or Apple, same thing, large cap growth technology stock about two thirds of its return in any one year can be defined by those what I’d call factor exposures. Only a third comes from what’s going on at the company level. So in other words, As a portfolio manager, I need to make sure that I understand what is going to work in the future. Are we in an environment where growth stocks are going to work? Are we environment where value stocks are going to work? Value has a little bit more inflation sensitivity. And so in value stocks have worked recently. Um, so I think understanding those large factors Has to play into it. I can’t just put my blinders on and say, I’m just going to buy 20 stocks that, you know, I love fundamentally, and I’m not going to look at anything else.

I’ve seen so many managers that have made that mistake is they. Don’t focus on the bigger factors as well. And so we play into that. And that’s why I go back to that invader versus Mastercard example, which is, uh, on the surface, two different sectors, but they are both growth stocks and therefore they will move with the growth factor.

So if I have 20 stocks and I don’t want to have just exposure to the growth factor, I better go find another finance stock that’s not correlated to the growth factor, say a bank or whatever.

Barry Ritholtz: Given your concentrated portfolios, 20 internationally, 30 domestically, how much more risk is contained in that small number of stocks versus your benchmarks that in some cases are 500 or 1,600 different names.

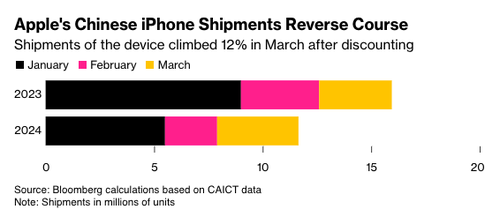

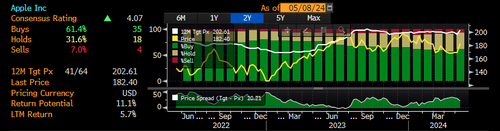

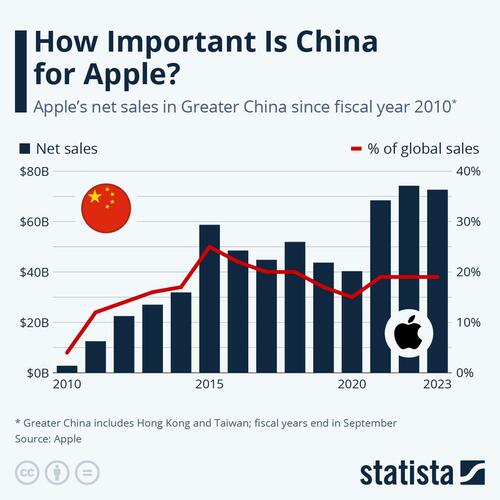

Andrew Slimmon: That is true, but there are very, very large stocks in the index today. And if you in our global country, we don’t own app. Well, Apple had a very tough first quarter. So, that added a lot of relative performance to our portfolio because it’s a big waiting in the index. I think it’s understanding what is the makeup of the index, and identifying stocks you think will work and ones in being underweight, the ones that won’t work.

Barry Ritholtz: And what about different regions? Can you run a concentrated portfolio with a global tilt, very separate from, from the US

Andrew Slimmon: If I said to you, Barry, I want to run a portfolio for you and I want to just be able to buy the best companies I can find that I think I can make the most money for you. And I don’t care where they come from. Just the best opportunities. Would you say yes to that more than I just, I want to buy only European stocks for you; or only emerging markets are only this region or only this style. What would you jump at?

And I just always remember I was at a conferences about 10 years ago and, uh, in London and this international manager says to me, so Andrew, you run a global concert, your global fund, how, you know, what European banks do you invest in? And I said, I don’t have a single European bank. Wow. You can’t do that. It’s in my European benchmark. I don’t like European banks either, but I got to own them.

And it was really at that point, I thought, you know, this is crazy. Let’s just, let’s just find the best ideas we can, you know, around the world and just have a limited number of them.

I just think that that’s, you know, it’s a better approach than presuming that you can allocate to these specific regions or styles because managers then they’re going to buy things that they may not want to own because they’re in the index.

Barry Ritholtz: You are one of the few active managers I am familiar with who seem to also embrace passive indexing. Tell us a little bit about how a concentrated portfolio matches up with a broad index.

Andrew Slimmon: Look, I’ve got no problem with people getting market exposure, but there is a place for active management. And I’m a believer in finding great companies and making sure they’re all, they’re not, um, you know, they’re not highly correlated and sticking with them.

What I’m absolutely not a fan of. Is low active share, mutual funds that own lots and lots of positions. And the number of times I’ve read articles, where someone says, “Oh, I love this stock. It’s my favorite position.” And then, you know, you look up and they have a one and a half or 2 percent position. Well, it’s ridiculous because even the stock doubles, you know, they’re not, they’re not really, they don’t really believe in those companies if they own, you know, the small position. So I, you know, my, the, my enemy is not passive strategies. My enemy is really, uh, it’s the closet, the closet indexers because I think they’re bringing a bad name to, you know, to active managers.

So I embrace passive strategies. I have, you know, I have passive strategies in my personal, uh, portfolio, but I have active managers that I know have done very well over time. And I, I’ve stuck with them and you know, it’s worked.

So there’s a place for both. It’s just the closet indexers is no place for it.

Barry Ritholtz: So to wrap up, if you’re going to go active, well then go active. Own a percentage of your portfolio in a concentrated set of holdings with an active manager with a high active share. That marries up well to an inexpensive passive index and it improves the odds of outperforming The broad indices, it can add a little sizzle to a conservative set of market holdings.

I’m Barry Ritholtz, and this has been Bloomberg’s At The Money.

~~~

The post At The Money: Concentrated Portfolios appeared first on The Big Picture.

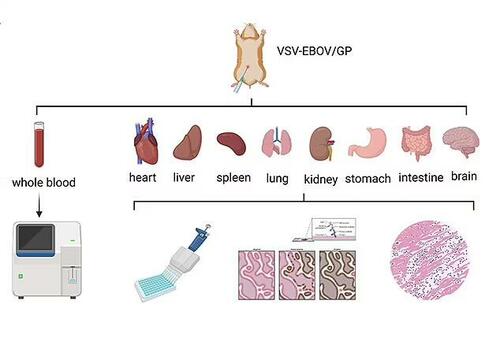

The group of female hamsters also had multi-organ failure

The group of female hamsters also had multi-organ failure

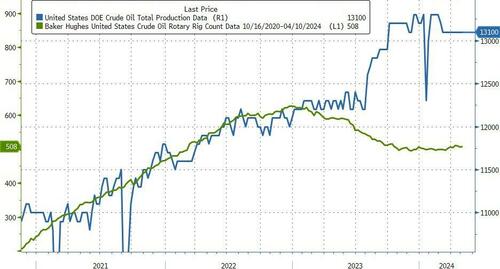

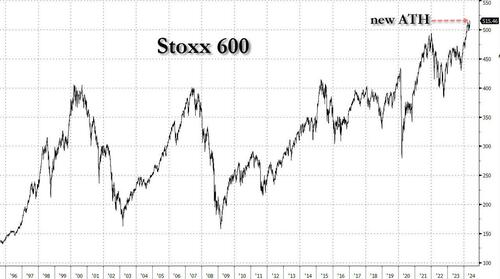

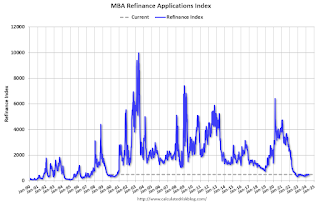

Source: Bloomberg

Source: Bloomberg

via AP

via AP NATO bombing of Yugoslavia

NATO bombing of Yugoslavia

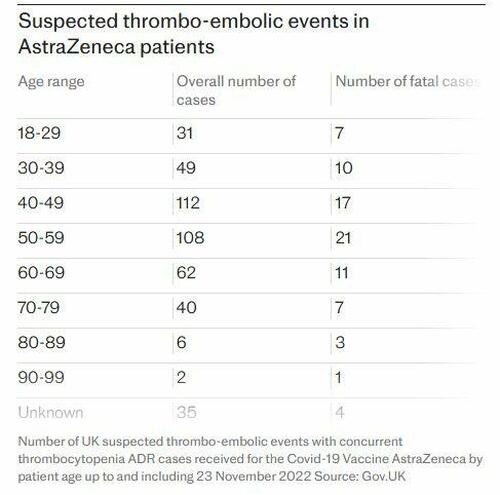

The vaccine has been credited with saving millions of lives Credit: GETTY IMAGES EUROPE/MATTHEW HORWOOD

The vaccine has been credited with saving millions of lives Credit: GETTY IMAGES EUROPE/MATTHEW HORWOOD

Mr Scott, pictured with his wife, wishes the vaccine had been withdrawn much earlier Credit: ANDREW FOX via The Telegraph

Mr Scott, pictured with his wife, wishes the vaccine had been withdrawn much earlier Credit: ANDREW FOX via The Telegraph European Commission President Ursula von der Leyen delivers a speech to the press at the French representation of the European Commission in Paris on May 6, 2024

European Commission President Ursula von der Leyen delivers a speech to the press at the French representation of the European Commission in Paris on May 6, 2024 France's President Emmanuel Macron speaks with European Commission President Ursula von der Leyen as they leave after holding a trilateral meeting, which included the Chinese regime leader Xi Jinping, as part of Xi's two-day state visit, at the Elysee Palace in Paris, on May 6, 2024

France's President Emmanuel Macron speaks with European Commission President Ursula von der Leyen as they leave after holding a trilateral meeting, which included the Chinese regime leader Xi Jinping, as part of Xi's two-day state visit, at the Elysee Palace in Paris, on May 6, 2024 An honor guard stands next to the original copies of the Declaration of Independence, the Constitution, and the Bill of Rights at the National Archives in Washington on July 4, 2001. (Alex Wong/Getty Images)

An honor guard stands next to the original copies of the Declaration of Independence, the Constitution, and the Bill of Rights at the National Archives in Washington on July 4, 2001. (Alex Wong/Getty Images)

Residents cast their ballots during in-person absentee voting at City Hall in Green Bay, Wisconsin, on Nov. 4, 2022. (Scott Olson/Getty Images)

Residents cast their ballots during in-person absentee voting at City Hall in Green Bay, Wisconsin, on Nov. 4, 2022. (Scott Olson/Getty Images) Wisconsin's top election official, Meagan Wolfe, speaks during a virtual press conference on Nov. 4, 2020. (Wisconsin State Handout via Reuters)

Wisconsin's top election official, Meagan Wolfe, speaks during a virtual press conference on Nov. 4, 2020. (Wisconsin State Handout via Reuters)

A policeman covers a camera to stop journalists from recording footage outside the Shanghai Pudong New District People's Court, where Chinese citizen journalist Zhang Zhan is set for trial in Shanghai on Dec. 28, 2020. (Leo Ramirez/AFP via Getty Images)

A policeman covers a camera to stop journalists from recording footage outside the Shanghai Pudong New District People's Court, where Chinese citizen journalist Zhang Zhan is set for trial in Shanghai on Dec. 28, 2020. (Leo Ramirez/AFP via Getty Images) Riot police pepper spray journalists on the 23rd anniversary of the city's handover from Britain to China as protesters gathered for a rally against the new National Security Law in Hong Kong on July 1, 2020. (Dale De La Rey/AFP via Getty Images)

Riot police pepper spray journalists on the 23rd anniversary of the city's handover from Britain to China as protesters gathered for a rally against the new National Security Law in Hong Kong on July 1, 2020. (Dale De La Rey/AFP via Getty Images) A pro-democracy activist holds a placard urging Chinese authorities to release Chinese citizen journalist Zhang Zhan and 12 detained Hongkongers outside the Chinese central government's liaison office, in Hong Kong, on Dec. 28, 2020. (Kin Cheung/AP Photo)

A pro-democracy activist holds a placard urging Chinese authorities to release Chinese citizen journalist Zhang Zhan and 12 detained Hongkongers outside the Chinese central government's liaison office, in Hong Kong, on Dec. 28, 2020. (Kin Cheung/AP Photo) Chinese citizen journalist Fang Bin in a YouTube video posted on Feb. 4, 2020 reporting the deaths in Wuhan during the COVID-19 outbreak. (Screenshot via The Epoch Times)

Chinese citizen journalist Fang Bin in a YouTube video posted on Feb. 4, 2020 reporting the deaths in Wuhan during the COVID-19 outbreak. (Screenshot via The Epoch Times) Picture alliance/dpa

Picture alliance/dpa

Recent comments