Futures Rebound Lifted By Strong Amazon, Apple Earnings

US equity futures rebound from the Thursday drop, led by Mag 7. As of 8:00am ET, S&P futures are 0.8% higher and Nasdaq futures gain 1.2%, on pace for sixth and seventh straight monthly gains respectively, with all Mag 7 names higher premarket, led by AMZN (+12.7%) and AAPL (+1.9%) after their robust earnings release (AWS sales growth of 19.7%, best since 2022 and AAPL’s revenue guidance) yesterday after-close. Europe's Stoxx 600 fell for a fourth day, putting the gauge on track for its longest losing streak since July; in Japan, the tech-heavy Nikkei 225 closed up and notched its best month since 1990. Bond yields are flat, the USD is higher. Commodities are mostly lower; copper fell -2.4%. Today's calendar slate includes October MNI Chicago PMI at 9:45am (several minutes earlier for subscribers); US government data continue to be postponed by shutdown that began Oct. 1. Fed speaker slate includes Dallas Fed President Logan (9:30am) and Cleveland Fed President Hammack and Atlanta Fed President Bostic (12pm). Both CVX and XOM reporting earnings this morning.

In premarket trading, Mag 7 stocks are all higher: Amazon.com (AMZN) jumps 12% after the company’s cloud unit posted the strongest growth rate in almost three years, reassuring investors who were concerned that the largest seller of rented computing power was losing ground to rivals. Apple Inc. (AAPL) is up 2% after the company predicted a major sales surge during the holiday season after releasing new iPhones, helping assure investors that its flagship product remains a growth engine (Nvidia (NVDA) +2%, Alphabet (GOOGL) +1.2%, Meta Platforms (META) +1.4%, Tesla (TSLA) +1.2%, Microsoft (MSFT) +0.4%)

- Brighthouse Financial (BHF) soars 22% after the Financial Times reports that Aquarian Holdings is in advanced talks to take the US life insurer private.

- Charter Communications (CHTR) falls 5% after posting third-quarter results.

- Cloudflare (NET) rises 8% after the software company forecast revenue for the fourth quarter that beat the average analyst estimate.

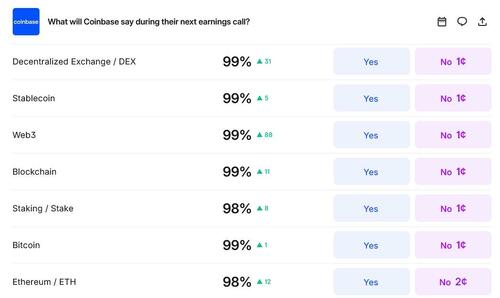

- Coinbase (COIN) advances 4% after the largest US crypto exchanged reported third-quarter revenue that exceeded estimates following an uptick in trading as token prices climbed to record highs.

- Dexcom (DXCM) sinks 12% after the glucose-monitor company cut its adjusted gross margin forecast for the full year.

- Floor & Decor (FND) shares are up 7% after the home products retailer reported adjusted earnings per share for the third quarter that beat the average analyst estimate.

- Illumina (ILMN) gain 6% after the gene-sequencing company boosted its adjusted profit and operating margin for the full year. Analysts note the better-than-expected results for the third quarter should help ease investor concerns.

- Netflix Inc. (NFLX) gained more than 2% in premarket trading. The company approved a 10-for-1 stock split to make its share price more accessible for employees who participate in the company’s stock option program. Separately, Reuters reported the company is exploring a bid for Warner Bros. Discovery’s studio and streaming businesses.

- Pony.ai (PONY) is up 4% after the autonomous vehicle technology company said it’s been granted Shenzhen’s first citywide permit for fully driverless commercial robotaxi operations.

- Reddit (RDDT) gains 10% after the social-media company reported third-quarter results that beat expectations and gave an outlook that is above the analyst consensus.

- Roku (ROKU) shares are down 4% after the streaming-video platform company reported its third-quarter results and gave an outlook. While analysts are broadly positive, they said the results aren’t enough to meet high expectations.

- Western Digital (WDC) rises 9% as the computer-storage company reported better-than-expected 1Q results and its current quarter forecast came in largely ahead of estimates.

In corporate news, Exxon Mobil outperformed Wall Street expectations for a sixth consecutive quarter after beginning operations at its fourth oil-production project in Guyana. Chevron beat earnings estimates as profits from the $53 billion Hess Corp. acquisition were included in the results for the first time, boosting oil production and cash flow. Nvidia CEO Jensen Huang still hopes to sell chips from the company’s Blackwell lineup to customers in China, though he has no current plans to do so, he told reporters Friday. Millennium Management is raising $5 billion in a new fund to invest in private market opportunities.

US stock gains offered investors a respite from Thursday’s bruising session, amid lingering doubts over whether heavy AI spending will pay off. The S&P 500’s advance has increasingly relied on a group of tech megacaps - recent record highs were hit on record negative breadth - with warnings over lofty valuations following a blistering rally.

“Volatility has become a feature rather than a bug — day-to-day swings now regularly move major stocks by hundreds of billions of dollars,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “The feedback loop of investor sentiment, speculative positioning, and rapid news-driven reactions amplify these moves.”

On Friday, futures rose as Amazon jumped 13% in premarket trading, a move set to add about $300 billion to its market value after reporting the fastest cloud-unit growth in nearly three years. Apple also climbed on a revenue beat and upbeat holiday forecast. Nvidia meanwhile, unveiled new partnerships with South Korea’s biggest firms, extending a global push to expand artificial intelligence infrastructure. Friday's market gains will seal the index’s longest monthly winning streak since August 2021, capping a rally that has withstood global trade tensions and geopolitical risks.

Earnings season remains top of mind with more than 60% of S&P 500 companies having reported to date, and a further 150 expected today and next week. Contrast of earnings receptions to AI spending has diverged within big tech, as investors seek quantification of how investments are benefiting related businesses. Earnings have also broadly topped forecasts, with about 80% of S&P 500 companies that have reported so far beating expectations.

According to BofA's Michael Hartnett, global equities drew $17.2 billion in inflows in the week to Oct. 29. Hartnett added that AI’s leadership remains firmly in place. Market breadth remains a concern for traders, and divergence notable between US and European equities. Michael Burry, the man who made his name shorting the US housing market, sent what appears to be a cryptic warning to retail investors about market exuberance. Equity performance in 2025 has been characterized by extreme concentration of volatility episodes, according to Barclays strategists.

“The risks are mainly flows. They have been the main driver, much more than EPS growth,” said Karen Georges, an equity fund manager at Ecofi. “If flows begin to halt on risky assets, then there will be a genuine selloff. But it’s like a black swan, you never know when it’s coming.”

On the trade front, Treasury Secretary Scott Bessent said he expects the US to return to the negotiating table with China in a year. That came after Donald Trump and Xi Jinping agreed to a tariff truce, roll back export controls and reduce other trade barriers. Xi also warned against “breaking supply chains” in his first public remarks after meeting with Trump. “A comprehensive deal still looks far away and while trade tensions have eased for the time being, they have the potential to resurface,” said Mohit Kumar, chief economist and strategist at Jefferies International.

In Europe, the Stoxx 600 fell for a fourth day, putting the gauge on track for its longest losing streak since July. Telecoms, insurance and construction stocks are dragging. Treasuries and European bonds relatively steady, with small outperformance at the short-end in gilts. Here are the biggest movers Monday:

- Puig shares rose as much as 9.8% with trading volume almost 10 times the 20-day average after the Spanish group reported better-than-expected 3Q sales and upgraded its guidance for the last three months of the year

- Fuchs shares gain as much as 12%, the most since March 2020, after the chemicals company reported a stronger-than-expected Ebit as North and South American markets improved from previous softness

- Danske Bank gains as much as 2.8%, the most in a month, after the Danish lender reported solid third-quarter numbers, with analysts flagging strong core revenues and a slight beat to net interest income (NII)

- Interpump shares rise as much as 6.8%. Equita analysts upgraded the Italian hydraulics and pumps manufacturer as they expect the stock to outperform thanks to improving margins and organic trends and see M&A opportunities

- Kongsberg shares gain as much as 4.9% after a slew of analysts upgraded the stock following the Norwegian company’s results-driven declines on Thursday, leaving the firm with no sell or equivalent recommendations

- UMG shares rise as much as 1.8% after the world’s largest record label delivered a beat on both revenue and adjusted Ebitda in the third quarter, with growth in the important subscription unit ahead of expectations

- Erste shares rise as much as 4.1% as the Austrian lender raised its net interest income growth and CET1 capital ratio guidance. The bank sees its deal to buy Santander’s Polish unit on track to close around the year-end

- Viridien shares rose as much as 26%, the biggest jump since 2020, after the French group reported operating profits well above expectations

- Scor shares fall as much as 8.2%, the most since July, as analysts grew concerned about the reinsurance company’s solvency ratio and real estate amortization after it reported third-quarter results

- Spie shares fall as much as 5.9% to the lowest since May as the France-based engineering services company’s third-quarter organic growth came up short

- AXA shares dropped as much as 2.5% after the French insurer reported nine-month results. Jefferies highlighted the Solvency II ratio as the biggest news from the results, while Citi saw the update as uneventful

- Saint-Gobain falls as much as 3.2%, to the lowest since mid-April, after reporting third-quarter like-for-like sales that missed consensus estimates, and expected to trigger small downgrades to consensus numbers

- Acerinox falls as much as 3.4% after the stainless steelmaker said fourth-quarter Ebitda is expected to be lower than in the third quarter. Analysts see potential double-digit downgrades to full-year consensus

- Elis shares fall as much as 1.2% after the French cleaning services group reported growth in Central Europe that missed estimates due to softness in Germany. This morning, the firm also said it will buy Larosé

- Drax shares fall as much as 3.7% after UBS initiated coverage of the chemicals firm with a sell rating, saying too much optimism is priced in for the shares

Earlier in the session, Asia’s benchmark also pared its monthly advance. Stocks in Asia slipped as broad regional losses, led by China and Hong Kong, outweighed gains in Japan and South Korea. The MSCI Asia Pacific Index was down 0.1%, with Alibaba and Tencent among the top laggards, though it’s on track to end the month up 3.6%. The MSCI China Index is on course for its first monthly loss since April, as a liquidity-fueled AI rally gives way to concerns about lingering US-China tensions and economic concerns. In Japan, Hitachi’s better-than-expected earnings and upgraded outlook lifted sentiment. With stocks across major markets trading near record highs, investors are watching for concentration risk and strength of earnings. Results from Amazon and Apple in the US helped lift sentiment around technology names, but BYD’s sales miss raised concerns on the Chinese electric vehicle industry. Stocks also rose in New Zealand and Indonesia, while declining in Vietnam, India and Thailand.

In FX, the Bloomberg Dollar Spot Index is little changed Friday, set to gain 1.5% in October, which would be its second monthly advance this year. USD/JPY fell to 153.65 as inflation in Tokyo rose at a faster pace in October, backing the case for a Bank of Japan rate hike. It has since reversed losses, trading little changed around 154.12. In addition to Tokyo inflation, Japan’s better-than-expected industrial output in September also supported the yen earlier. Spot hit the session low after Finance Minister Satsuki Katayama said the government is monitoring the yen with a strong sense of urgency

In rates, US Treasuries steadied after two sessions of sharply higher yields; most yields were within a basis point of Thursday’s closing levels. US 10-year around 4.105% is just below Thursday’s high; bunds and gilts in the sector keep pace. Curve is slightly steeper, widening 2s10s and 5s30s spreads by less than 1bp on the day. Price action in European bonds is similarly muted following French and euro-area inflation data for October.

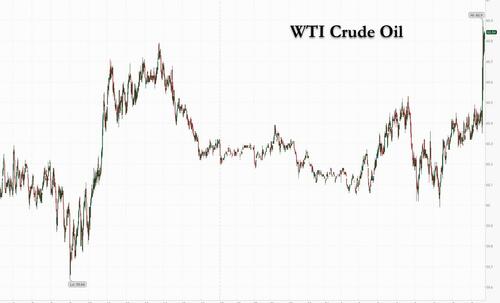

In commodities, gold lower and hovering around $4,000/oz. Oil falling, with Brent short of $65/barrel. Oil set for a third monthly loss.

US economic calendar slate includes October MNI Chicago PMI at 9:45am (several minutes earlier for subscribers); US government data continue to be postponed by shutdown that began Oct. 1. Fed speaker slate includes Dallas Fed President Logan (9:30am) and Cleveland Fed President Hammack and Atlanta Fed President Bostic (12pm)

Market Snapshot

- S&P 500 mini +0.7%

- Nasdaq 100 mini +1.2%

- Russell 2000 mini little changed

- Stoxx Europe 600 -0.3%

- DAX -0.4%

- CAC 40 -0.1%

- 10-year Treasury yield +1 basis point at 4.1%

- VIX -0.8 points at 16.15

- Bloomberg Dollar Index little changed at 1218.88

- euro little changed at $1.157

- WTI crude -0.6% at $60.18/barrel

Top Overnight News

- Trump Urges Republicans to End the Filibuster to Reopen Government. WSJ

- Elon Musk’s SpaceX Set to Win $2 Billion Pentagon Satellite Deal. WSJ

- Private Credit’s Rising Pile of ‘Bad PIK’ Points to Default Woes. BBG

- A narrow Pacific waterway is at the heart of U.S. plans to choke China’s vast navy. RTRS

- China’s factory activity slumped for the longest streak in more than nine years, prompting fresh calls for greater policy support even as the country reached a trade truce with the US. BBG

- Trump's exit is Xi's cue to take centre stage at APEC. RTRS

- More Home Purchases Are Falling Through in an Uncertain Economy. WSJ

- King Charles strips brother Andrew of titles and his mansion. RTRS

- The great AI buildout shows no sign of slowing. RTRS

- Disney Channels Go Dark on YouTube TV. WSJ

- Big Tech Is Spending More Than Ever on AI and It’s Still Not Enough. WSJ

- China signals sharper pivot to consumption as imbalances worsen. RTRS

- The Japanese government is monitoring the yen with a strong sense of urgency, Finance Minister Satsuki Katayama said, sending her first clear warning on currency movements since taking on her role. BBG

- Inflation in Tokyo rose at a faster pace, supporting the case for the Bank of Japan to keep raising interest rates gradually and giving the yen a boost. BBG

- Japan’s new Prime Minister Sanae Takaichi told China’s President Xi Jinping her concerns over his country’s rare earth export restrictions in their first formal meeting, as tensions spanning from trade to security continue to simmer between the two countries. BBG

- US President Trump's administration fired Fannie Mae ethics officials, according to WSJ.

- NVIDIA (NVDA) CEO Huang told reporters that he hopes to sell the Blackwell chip to China, but as it stands there are no plans to do so. Sales were not a topic of discussion during the meeting with China's Council for the Promotion of Trade. Co. has been growing quickly, but in the last six months this has accelerated "quite substantially".

Trade/Tariffs

- Chinese President Xi called for safeguarding multilateral trade at the APEC summit and urged members to practice true multilateralism, while he called on APEC to keep industrial and supply chains smooth and stable. Xi said APEC should promote an open regional economic environment and called for promoting trade and investment liberalisation, as well as urged members to jointly promote the digitalisation and greening of free trade.

- China's top trade negotiator Li Chenggang said they will conduct studies on international standards, economic and trade rules, and continue to meet them in terms of green standards. Li said export volume of photovoltaic products exceeded CNY 200bln for four consecutive years, and that export volume of electric vehicles exceeded 2mln units for the first time last year. Furthermore, he said green vehicles such as locomotives have also maintained strong growth and that China will continue to adapt to the global trend of green and low-carbon development.

- South Korean President Lee said they are at a critical inflection point of change in global order, and global trade uncertainty is deepening.

- EU officials will today be informed about a visit by US Commerce Secretary Lutnick to the EU on November 24th for trade talks, via Politico.

- Japan's PM Takaichi to Chinese President Xi says she would like to confirm basic direction of Japan-China relation, including building constructive and stable ties.

A more detailed look at global markets courtesy of Newqsuawk

APAC stocks traded mixed as the region digested recent earnings releases and a data deluge at month-end. ASX 200 was flat as gains in mining, materials and resources were offset as defensives lagged. Nikkei 225 outperformed and climbed above the 52,000 level to print a fresh all-time high after recent currency weakness and the lack of immediate rate hike signals from the BoJ, while participants digested a slew of data, including a higher Unemployment Rate, hot Tokyo CPI and a rebound in Industrial Production. Hang Seng and Shanghai Comp were amid losses in tech stocks, and after Chinese Manufacturing PMI data missed expectations and showed a faster pace of contraction in factory activity

Top Asian News

- Japanese Finance Minister Katayama said discussions on lowering gasoline prices have progressed, including sources for funding, while she added that the Bank of Japan’s recent decision was extremely reasonable and that monetary policies are up to the BoJ to decide. Katayama also commented that they are recently seeing one-sided and rapid moves, as well noted, it is important for currencies to move in a stable manner reflecting fundamentals and they are closely watching foreign exchange moves with a high sense of urgency.

European bourses (STOXX 600 -0.4%) opened mostly lower and have traded with a negative bias throughout the morning. Pressure which lacks a fresh catalyst, but follows on from a tentative APAC session. European sectors hold a strong negative bias, with only a few sectors managing to hold afloat. Banks buoyed by upside in the likes of Danske Bank (+1.8%) and Caixabank (+1.4%), post-earnings. Construction & Materials is found right at the foot of the pile, pressured by losses in Saint-Gobain (-1.9%), after it missed on its Q3 revenue figure.

Top European News

- ECB's Rehn says keeping interest rate unchanged is justified due to uncertainty about inflation outlook in the coming years. The impact of tariffs on inflation appears to be disinflationary.

- ECB's Muller says economic situation has gradually improved and current interest rates level is appropriate.

- ECB's Kazaks says ECB will move when needed but shouldn't be 'jumpy', growth is still weak with high uncertainty. Should not overinterpret 2028 inflation outlook.

FX

- DXY is slightly firmer and currently trading at the mid-point of a 99.41-99.66 range. Nothing really behind the mild strength today, but it does comes amid elevated yields in the aftermath of the hawkish Powell presser. Focus for the day will be on the Chicago PMI and commentary from Fed’s Logan and Bostic; Miran and Schmid will also likely explain their recent dissent. As a reminder, Miran voted for a 50bps cut, whilst Schmid opted for U/C.

- EUR is flat vs the USD, trading in a tight 1.1556-1.1577 range. The single-currency was little moved on the ECB decision itself, and President Lagarde lacked surprises at her presser thereafter. Following the announcement, Reuters sources suggested that ECB policymakers are preparing for a December showdown on inflation and rates. Some favour a cut, to prevent undershooting in 2028 whilst others give little weight to longer-term outlooks. Turning to this morning, a few ECB members have provided commentary; Rehn said keeping rates steady was justified due to uncertainty, Muller said current interest rates are appropriate and Kazaks suggested the ECB should not be “jumpy” adding that growth is still weak. On data, little move to the EZ HICP, whereby the headline printed in-line with expectations at 2.1% (prev. 2.2%); core and super-core metrics remained unchanged from the prior, defying the forecast for a slight moderation.

- GBP is a touch softer vs the broadly firmer Dollar; currently trading within a narrow 1.3126-1.3164 range. Really not much by way of fresh in terms of the UK’s Budget, but traders are now weighing up possibilities of a Budget without Chancellor Reeves. In more detail, in the last few days, Reeves reportedly breached renting-related rules, forcing her to apologise for the mistake. There were calls for her to resign, though PM Starmer poured cold water on those suggesting that there is “no need” for further action. GBP did sour a touch in recent sessions, but has since stabilised as PM Starmer backed his Chancellor.

- JPY is a touch lower today and trades within a 153.66 to 154.41 range. Overnight the pair saw modest pressure following a hotter-than-expected Tokyo CPI report, which saw the Y/Y jump to 2.8% (exp. 2.4%, prev. 2.4%). Also in focus for the Yen was some jawboning from the Japanese Finance Minister Katayama who said he has been recently seeing one-sided, rapid moves, adding that, he is closely watching foreign exchange moves with a high sense of urgency.

- Antipodeans are underperforming today, continuing the pressure seen in the APAC session. Downside which follows on from subdued Chinese Manufacturing PMI, and amidst a tentative risk tone in Asia and into the European session.

Fixed Income

- USTs are under modest pressure early doors amid the constructive performance of US equity futures as numbers from Amazon and Apple drive the region, and particularly the NQ, higher. Additionally, the debt space has been hit by Meta announcing USD 30bln of issuance, the largest corporate HG offering this since 2023 and the largest Meta has ever tapped the market for. Newsflow this morning has been light as we await upcoming Fed speakers. Into those, UST are towards the trough of a 112-17+ to 112-23+ band with downside of 5+ ticks at most. The low is just a tick above Thursday’s 112-16 post-Powell base. The Fed docket begins with Logan (2027), Bostic (2027) and Hammack (2026); however, the topics don’t appear to be directly pertinent to current/future monetary policy. Instead, the main focus will likely be on the dissent texts from Miran (voted for a 50bps cut, again) and Schmid (voted for U/C).

- Bunds are weighed on in-fitting with the above. Down to a 129.16 trough into the flash EZ HICP print, posting losses of c. 20 ticks at worst. Little move on the EZ HICP, whereby the headline printed in-line with expectations at 2.1% (prev. 2.2%); core and super-core metrics remained unchanged from the prior, above expectations. Ultimately, the print does not change the narrative for the ECB that inflation remains near target and the outlook is broadly unchanged. As a reminder, post-ECB Reuters sources added to the known narrative around December; that the 2028 inflation forecasts could spark a ‘showdown’ on inflation and by extension interest rates, as the 2028 projection could print in favour of easing.

- Gilts opened lower by 18 ticks at the benchmark reacted to the overnight pressure from US earnings and Meta issuance. Thereafter, Gilts fell another 10 to a 93.44 trough but still clear of Thursday’s 93.29 base and the WTD low of 93.15 from Monday. Specifics for the UK are relatively light, domestic press remains focussed on the rental blunder by Chancellor Reeves. As it stands, PM Starmer is standing by her but the scandal could ultimately lead to her dismissal; given how close we are to the Autumn Budget, if that occurs before the replacement would likely be a continuity-appointment to essentially deliver Reeves’ budget.

Commodities

- Crude benchmarks are on the backfoot but remain rangebound as the market waits for the OPEC+ meeting at the weekend. Currently, WTI and Brent are oscillating in a tight USD 60.02-60.53/bbl and USD 63.83-64.33/bbl range respectively. On the Gaza ceasefire, it was reported that the US has allowed Israel to enforce the ceasefire and fire at Hamas targets behind the yellow line where the IDF holds in Gaza. Artillery shelling has been reported inside the yellow line east of Gaza city. However, this news has not shifted crude prices.

- Spot XAU followed on from Thursday’s rebound, extending to a peak of USD 4046/oz in the early hours of the APAC session before falling back lower to a trough of USD 3988/oz. XAU remains above USD 4k/oz, currently trading at 4003/oz, as the market digests a week of central bank announcements.

- Base metals continue to fall despite the positive China-US talks held in the early hours of Thursday’s session. Following Thursday’s selloff weighed on by dollar strength, 3M LME Copper rebounded in the latter hours of Thursday’s session and peaked at USD 10.98k/t as the APAC session got underway. The red metal fell to a trough of USD 10.86k/t and oscillated in a tight c. USD 40/oz before extending on the day’s losses. Thus far, 3M LME Copper remains near session lows at USD 10.83k/t.

- Oman December crude OSP at USD 65.06/bbl (prev. USD 70.01 M/M), via GME data.

- China Iron and Steel Association said China’s apparent steel consumption from January to September fell 5.7% Y/Y to 649mln metric tons, while it added that apparent steel consumption in 2025 is expected to fall for a fifth straight year.

Geopolitics

- Palestinian media reports Israeli raids targeted Khan Younis in the southern Gaza Strip, according to Sky News Arabia.

- US reportedly cancelled the Trump-Putin meeting after Moscow sent a memo to Washington, as the Russian Foreign Ministry’s maximalist demands for ending the Ukraine war led to the US scrapping the planned meeting in Budapest, according to FT.

- Russia's Kremlin on FT report that US President Trump and Russia's President Putin meeting is cancelled says "I'd refer you to Russia's Foreign Ministry statement, not newspapers reports".

- US President Trump's administration identified targets in Venezuela that include military facilities used to smuggle drugs, according to WSJ citing US officials familiar with the matter. Furthermore, the officials stated that if Trump decided to move forward with airstrikes, the targets would send a clear message to Venezuelan leader Maduro that it is time to step down.

- US Secretary of Defense Hegseth met with Chinese counterpart Dong Jun, which he said was a good and constructive meeting, while he highlighted the importance of maintaining the balance of power in the Indo-Pacific. Furthermore, he highlighted US concerns about China’s activities in the South China Sea and said the US will continue to stoutly defend its interests.

US Event calendar

- 8:30 am: Sep Personal Income, est. 0.4%, prior 0.4%

- 8:30 am: Sep Personal Spending, est. 0.4%, prior 0.6%

- 8:30 am: Sep Real Personal Spending, est. 0.18%, prior 0.4%

- 8:30 am: Sep PCE Price Index MoM, est. 0.3%, prior 0.3%

- 8:30 am: Sep PCE Price Index YoY, est. 2.8%, prior 2.7%

- 8:30 am: Sep Core PCE Price Index MoM, est. 0.2%, prior 0.2%

- 8:30 am: Sep Core PCE Price Index YoY, est. 2.9%, prior 2.9%

- 8:30 am: 3Q Employment Cost Index, est. 0.9%, prior 0.9%

- 9:45 am: Oct MNI Chicago PMI, est. 42, prior 40.6

DB's Jim Reid concludes the overnight wrap

Happy Halloween to you all. My main skill today will be to persuade my family that although I’m a bit more mobile now, the risks of going trick or treating is just too great so soon after the back operation. I’m not convinced that will fly. I may threaten to show off my two huge operation scars to frighten everyone! The whole family have extravagant outfits delivered yesterday from Amazon with every accessory imaginable. No wonder their results were so good last night.

Indeed just as the tech mood had soured yesterday, this morning that has mostly turned around following results from Apple and Amazon after the closing bell. Amazon’s shares surged by +13% in post-market trading as its cloud revenue grew +20% y/y, the fastest since 2022. So that boosted sentiment on what has been the weakest performing of the Mag-7 stocks this year, with only a +1.58% YTD gain after yesterday’s -3.23% decline. Meanwhile, Apple saw a +2% after-market gain as it projected 10-12% revenue growth in the current quarter (vs. +6% est.) driven by stronger iPhone sales. US equity futures are erasing much of yesterday’s decline this morning, with those on the S&P 500 up +0.65% and on the NASDAQ up +1.21%.

This renewed momentum has helped sentiment after a more challenging day yesterday despite the positive outcomes from the US-China trade discussions. Investor concerns over AI-related capital expenditure resurfaced, highlighted by Meta’s sharp decline of -11.33% after results after the closing bell on Wednesday night. The company also announced a $30 billion bond issuance - the largest in over two years - to fund its operations. So not all capex is being funded out of cash! Nvidia also fell -2.00% as investors didn’t received any clarity on possible Blackwell chip sales to China. Overnight Trump has actually said that they didn’t talk about Blackwell specifically. These developments curtailed the recent equity rally, with the S&P 500 down -0.99%, the Nasdaq off -1.57%, and the Magnificent 7 sliding -2.73%. We could get a bounce back today.

One of the more fascinating stories yesterday was Meta’s $30 billion bond sale announcement, aimed at supporting its AI growth and infrastructure. US IG was a couple basis points wider yesterday to make room for the deal. A deluge of corporate bond issuance also appeared to push up Treasury yields early in the US session, with 10yr yields closing +2.1bps at 4.10%. Meta’s shares were already falling before the deal was announced due to disappointments in the earnings release the night before. Initially they dropped as much as -13.50% before closing -11.33% lower - its largest fall since the autumn 2022 bear market. This followed Wednesday’s disclosure that Meta expects to spend up to $72 billion on capital expenditures this year, primarily on datacentres and infrastructure, with further increases anticipated in 2026. Investors are increasingly questioning the return on such spending, particularly given Meta’s revenue-to-capex ratio of just 3.02—the lowest among its peers.

Markets are also still digesting the outcome of the meeting between President Trump and President Xi Jinping in South Korea. While most agreements had been priced in beforehand, the two leaders agreed to a one-year trade truce until November 2026. The US will reduce its fentanyl-related tariff from 20% to 10%, and China will remove its 10–15% retaliatory tariffs on various US agricultural products and delay rare earth export controls announced earlier this month. Despite this stabilisation, structural differences persist, and it’s easy for there to be some scepticism of the deal’s scope due to the lack of concrete commitments. The sense that we are seeing more of an extended truce rather than a de-escalation was added to by US Trade Representative Greer confirming last night that the US will continue a recently opened probe into China’s compliance with the limited trade agreement reached during Trump’s first term.

Asian equity markets saw mixed performance this morning, with the Nikkei (+2.03%) and KOSPI (+0.5%) helped by gains in semiconductor and AI-related stocks. The S&P/ASX 200 is flat with China risk lagging on poor PMI data. The CSI (-1.14%), Hang Seng (-0.88%), and the Shanghai Composite (-0.75%) are all lower.

With regards to that data, the official manufacturing PMI for October was reported at 49.0, compared to the expected 49.6, down from 49.8 in September, and the lowest for 6 months. The non-manufacturing PMI increasing to 50.1 in October as anticipated. However, the weakness in manufacturing has caused the composite PMI to decline to 50.0 in October from 50.6.

In Japan, Tokyo’s core CPI increased by 2.8% in October, surpassing expectations (2.6%) and underscoring ongoing inflationary pressures. Ueda yesterday seemed to place more emphasis on monitoring things like progress on the next spring Shinto wage negotiations and how the economy was dealing with tariff uncertainty. So this higher inflation alone won't seemingly change much. Also in Japan, factory output in September rose by 2.2% from the previous month, exceeding market forecasts of a 1.5% increase, while retail sales showed a modest year-on-year rebound of 0.5%, compared to the expected 0.7%, indicating fragile domestic demand. Additionally, Japan’s unemployment rate unexpectedly remained stable at 2.6% in September (expectations at 2.5%).

Turning to Europe, the ECB held rates steady at 2% for the third consecutive meeting, citing mixed signals on growth and inflation. President Christine Lagarde reiterated that policy is “in a good place”, though she emphasised it is “not a fixed place”, and the ECB will act as needed to maintain stability. While there were no material surprises, our economists note that if anything the ECB seemed a little more confident about growth amid all the uncertainties, continuing a trend of increasingly less dovish statements. They continue to see the ECB as having reached the end of its easing cycle (see their reaction here). Market expectations for ECB rate cuts remain muted, with just 11.6bps of cuts priced by next September (-0.7bps on the day).

European sovereign yields moved modestly higher, with the 10yr Bund yield up +2.2bps, OATs +1.7bps, and BTPs +1.7bps. That rise in yields was supported by decent Euro area Q3 GDP data, with quarter-on-quarter growth at +0.2% (vs. +0.1% expected). Germany posted flat growth (0.0% vs. 0.0% expected), while France outperformed at +0.5% (vs. +0.2% expected). You can view our economists’ note here. Positives include strong private sector savings, fiscal policy flexibility (except in France), and a less restrictive monetary outlook. However, US tariffs remain a headwind. Despite the stronger-than-expected growth, the Stoxx 600 (-0.10%) lost ground, with France’s CAC (-0.53%) and Spain’s IBEX (-0.68%) leading the decline.

In commodities, gold rebounded above $4,000/oz, rising +2.40%. Brent crude saw a modest gain, climbing to $65.00/bbl (+0.12%), after President Trump indicated that China will begin importing oil and gas from Alaska.

In other news, liberal Dutch leader Rob Jetten is poised to become the next prime minister in the Netherlands after the D66 party performed better than expected in Wednesday’s parliamentary elections. This marks a shift back to the centre following the 2023 elections, which were won by the far-right Freedom Party, now set to lose 11 seats.

Looking ahead to today, the main release will be inflation data in Europe, with October CPI due for France, Italy and the Euro area. We’ll also hear from Fed officials Logan, Hammack, and Bostic, while key earnings reports are expected from ExxonMobil, AbbVie, and Chevron.

Tyler Durden

Fri, 10/31/2025 - 08:37

via US Navy

via US Navy

Vice President JD Vance takes the stage during a "This Is the Turning Point" campus tour event at the University of Mississippi, in Oxford, Miss., on Oct. 29, 2025. Gerald Herbert/AP Photo

Vice President JD Vance takes the stage during a "This Is the Turning Point" campus tour event at the University of Mississippi, in Oxford, Miss., on Oct. 29, 2025. Gerald Herbert/AP Photo Attendees listen as Vice President JD Vance speaks during a "This Is the Turning Point" campus tour event at the University of Mississippi, in Oxford, Miss., on Oct. 29, 2025. Gerald Herbert/AP Photo

Attendees listen as Vice President JD Vance speaks during a "This Is the Turning Point" campus tour event at the University of Mississippi, in Oxford, Miss., on Oct. 29, 2025. Gerald Herbert/AP Photo Attendees cheer during a "This Is the Turning Point" campus tour event at the University of Mississippi, in Oxford, Miss., on Oct. 29, 2025. Gerald Herbert/AP Photo

Attendees cheer during a "This Is the Turning Point" campus tour event at the University of Mississippi, in Oxford, Miss., on Oct. 29, 2025. Gerald Herbert/AP Photo Source:

Source:  Source:

Source:

People shop for food at a store that accepts food stamps in New York City in a file photograph. Spencer Platt/Getty Images

People shop for food at a store that accepts food stamps in New York City in a file photograph. Spencer Platt/Getty Images

An air traffic control tower at Los Angeles International Airport on Oct. 28, 2025. John Fredricks/The Epoch Times

An air traffic control tower at Los Angeles International Airport on Oct. 28, 2025. John Fredricks/The Epoch Times Transportation Secretary Sean Duffy speaks about how the government shutdown is affecting travel at airports throughout the country during a press conference at LaGuardia Airport in New York City on Oct. 28, 2025. Michael M. Santiago/Getty Images

Transportation Secretary Sean Duffy speaks about how the government shutdown is affecting travel at airports throughout the country during a press conference at LaGuardia Airport in New York City on Oct. 28, 2025. Michael M. Santiago/Getty Images

"Brussels wants to give farmers’ money to Ukraine," says Hungary's defiant Agriculture Minister István Nagy

"Brussels wants to give farmers’ money to Ukraine," says Hungary's defiant Agriculture Minister István Nagy Slovakian Agriculture Minister Richar Takáč said the EU is failing to protect domestic producers

Slovakian Agriculture Minister Richar Takáč said the EU is failing to protect domestic producers  Illustration by The Epoch Times, Shutterstock

Illustration by The Epoch Times, Shutterstock Belgian defense chief Theo Francken. Source: DeMorgen

Belgian defense chief Theo Francken. Source: DeMorgen

Recent comments