The Grid Will Hold - Maybe - But The Bill Will Rise

Authored by Terry L. Headley via RealClearEnergy,

Americans are about to pay a lot more for electricity anyway — not because the grid fails, but because of how we now power it.

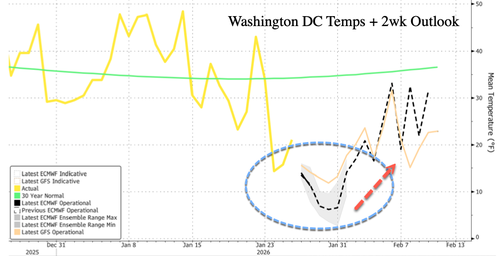

As another deep winter cold snap presses across much of the eastern United States, grid operators are doing what they always do in these moments: watching reserve margins, issuing conservation guidance, leaning on dispatchable generation, and quietly hoping nothing large trips offline at the wrong hour.

If history is a guide, the system will muddle through. It usually does. But survival isn’t the same thing as success. And it’s certainly not the same thing as affordability.

Even if there is no blackout, no emergency load shedding, and no headline-grabbing crisis, this weather event will still deliver a financial shock — one that will show up first in gas markets, then in wholesale power prices, and finally, months later, in the electric bills of households and businesses. That downstream billing impact is not accidental. It is structural. And it tells us far more about the state of the modern grid than any press release ever will.

Yes, the system will probably muddle through through this time. But one day in the not-too-distant future it won’t.

Counting the Cost of High Electric Bills

The modern American electric grid has become adept at avoiding disaster. Operators have more tools than ever: demand response, emergency imports, market signaling, conservation messaging, and sophisticated forecasting. What they do not have — at least not in sufficient quantity — is inexpensive, fuel-secure generation that can run whenever it is needed, regardless of weather.

In winter, the grid’s vulnerability is not generation capacity on paper. It is fuel deliverability in the real world.

Natural gas now sits at the center of that vulnerability. It dominates the marginal price of electricity across large portions of the country, particularly in regions like PJM Interconnection, which spans much of the Mid-Atlantic and Midwest. When gas is abundant and cheap, markets hum along. When it is constrained by cold weather, competing heating demand, pipeline limits, or freeze-offs, prices rise sharply — even if no generator actually fails.

Gas does not have to break to become expensive. It only has to be needed.

That is exactly what happens during prolonged cold snaps. Residential heating takes priority. Storage withdrawals accelerate. Pipelines run near their limits. Power generators bid defensively to secure fuel. The result is predictable: spot gas prices spike at constrained hubs, wholesale electric prices follow, and utilities quietly rack up higher procurement costs.

No blackout. No drama. Just higher bills.

And high electric bills extract a quiet but relentless toll. They are not merely an inconvenience; they function as a regressive tax on households least able to absorb them and a hidden drag on the broader economy.

For families, higher electric bills mean hard tradeoffs. Money spent keeping the lights on is money not spent on groceries, prescriptions, school supplies, or savings. For seniors on fixed incomes, a volatile power bill can force choices between heat and healthcare. For working households, it turns routine weather events into financial stress tests.

For businesses, especially manufacturers and small employers, high electricity costs erode margins, discourage expansion, and quietly kill jobs. Energy-intensive operations either scale back, pass costs along to consumers, or relocate to regions with more stable and affordable power. Over time, this hollowing-out effect weakens local tax bases and strains public services.

For communities, persistently high power costs accelerate decline. Retail districts dim. Investment slows. Population loss follows opportunity. Utility shutoffs rise, charitable assistance is stretched thin, and local governments face growing pressure to subsidize basic services that were once affordable.

And for the grid itself, high bills often signal deeper structural problems—overreliance on volatile fuels, premature retirement of reliable generation, or policy-driven distortions that shift costs from balance sheets to ratepayers. The bill arrives monthly, but the damage accumulates quietly, year after year.

In the end, high electric bills cost more than dollars. They cost stability, competitiveness, and confidence—exactly the things a healthy economy and a secure society require.

The Renewable Mirage in Winter

Renewable advocates often argue that wind and solar will insulate consumers from fossil-fuel volatility. Winter stress events expose the weakness of that claim.

Solar output is minimal during winter peak hours. Wind can help — or not — depending on meteorological luck. Batteries can shave peaks for minutes or a few hours, but they can’t carry a grid through multi-day cold events. When the weather turns hostile, renewables become supplements, not solutions.

That doesn’t mean renewables are useless. It means they are conditional. And conditional resources cannot set the reliability floor of a winter grid.

Yet they increasingly shape the cost structure of the system. Renewable mandates, tax credits, and priority dispatch suppress energy prices when conditions are favorable, discouraging investment in dispatchable generation. But when conditions are unfavorable — when cold sets in and demand spikes — those same policies leave the grid leaning heavily on gas, with fewer alternatives available to keep prices in check.

The irony is hard to ignore: policies sold as a hedge against volatility often amplify it.

The Quiet Role of Coal

This is where coal enters the discussion — not as a political symbol, but as an economic stabilizer.

When coal still dominated the grid, winter pricing behaved differently. Coal plants stored months of fuel on site. They did not compete with residential heating for delivery. They did not depend on pipeline pressure or wellhead performance. When cold arrived, they simply ran.

That mattered.

Coal-heavy systems were not immune to outages or price swings, but they were insulated from the kind of fuel-driven volatility that now defines winter power markets. Coal did not set the marginal price every hour, but it capped how high that price could go. It acted as ballast — heavy, unglamorous, and stabilizing.

Consider the role played by plants like John E. Amos Power Plant in West Virginia. Facilities like this are not interchangeable widgets. They anchor voltage, reduce transmission stress, and provide firm megawatts precisely when they are most valuable. When they run, they suppress scarcity pricing across wide swaths of the grid. When they retire, that suppression disappears — and consumers pay the difference.

If Coal Still Dominated the Grid, This Cold Snap Would Barely Register

It is worth asking a simple, uncomfortable question: If coal still dominated the electric grid the way it once did, would this cold snap even matter?

From a consumer perspective, the answer is largely no.

In a coal-dominated system, winter cold was an operational issue, not a pricing crisis. Load went up, coal units ran harder, operators adjusted dispatch, and the system absorbed the stress. What did not happen — at least not routinely — were sharp fuel price spikes, emergency conservation messaging, or springtime bill surprises blamed on “market conditions.”

The reason was structural.

Coal plants carried weeks — sometimes months — of fuel on site. That fuel was already purchased, already delivered, and already insulated from real-time weather events. Coal did not compete with residential heating demand. It did not depend on pipeline pressure, compressor stations, or wellhead performance. When the temperature dropped, coal plants did not enter a bidding war with homeowners for survival. They simply ran.

That mattered because coal often sat at or near the margin during winter peaks. And when coal is the marginal fuel, prices behave differently. They move modestly. They reflect cost, not fear. They do not explode because of perceived scarcity three states away.

Contrast that with today’s system. Natural gas now sets the price in much of the country. Gas does not need to fail to become expensive; it only needs to be stressed. Cold weather alone is enough. Add pipeline congestion, freeze-offs, or even the risk of nonperformance, and markets immediately inject a scarcity premium. Wholesale electric prices spike — even if every generator shows up and no emergency is declared.

That volatility then works its way downstream. Utilities absorb higher procurement costs. Fuel adjustment clauses kick in months later. Consumers see higher electric bills long after the weather has passed and are told, vaguely, that it was “because of winter.”

Under a coal-dominated grid, that chain reaction was muted or absent. Gas prices might still rise for home heating, but electricity did not compound the pain. Households were not hit twice — once for gas, and again for gas-driven power prices. Industrial customers did not face the same level of real-time exposure. Regulators were not forced to explain why nothing went wrong yet bills still went up.

None of this means coal eliminated winter stress. It did something more valuable: it absorbed it. Coal acted as ballast — heavy, unfashionable, and quietly stabilizing. By removing that ballast without replacing its function, we did not make the grid more fragile in obvious ways. We made it more expensive in subtle, recurring ones.

That is why today’s cold snap will show up on electric bills even if the grid performs flawlessly. And that is why, when coal still dominated, it would have passed with little more than a footnote in an operator’s log.

The lights stayed on then, too.

The difference is that the bill did not quietly grow teeth afterward.

How the Bill Really Shows Up

Consumers rarely connect winter reliability events to their electric bills, because the impact is delayed and obscured.

Here is how it actually works:

- Renewables go MIA.

- Cold weather tightens reserves

- Gas prices spike at regional hubs

- Wholesale power prices rise during peak hours

- Utilities absorb higher procurement costs

- Fuel adjustment clauses catch up months later

By spring, customers open their bills and wonder why rates are higher, even though “nothing happened.” Utilities point to weather. Regulators nod. The underlying structural cause goes largely unexamined.

Industrial customers feel it immediately through real-time pricing and demand charges. Residential customers feel it later, but more painfully, as higher energy bills stack on top of already elevated heating costs.

This is not a one-off phenomenon. It is now a recurring feature of winter.

We Chose This…

None of this is accidental. We made policy choices that traded fuel security for market efficiency, and market efficiency for political aesthetics. We shifted the grid toward just-in-time fuel delivery. We retired on-site fuel without replacing its stabilizing function. We assumed markets would solve problems that are, at their core, physical.

Markets are excellent at pricing scarcity. They are less effective at preventing it.

The result is a grid that survives winter stress events — but at a higher and more volatile cost. We have optimized for avoiding blackouts, not for protecting consumers from price shocks.

The Bottom Line

The grid will likely get through this winter storm. Operators are competent. Procedures are in place. The system will bend, not break.

But bending has a price.

Renewables will be MIA. Gas prices will rise. Wholesale electric prices will spike. Retail bills will follow. And once again, consumers will pay for a system that values politics over reliability.

Coal’s continued presence on the grid does not eliminate these costs — but its absence guarantees they will be higher.

If we want affordable electricity in winter, we must stop designing a grid that depends on perfect conditions to keep prices low.

And the bill always comes due.

Tyler Durden

Tue, 01/27/2026 - 09:15

Photo via KVOA

Photo via KVOA

Photo via soldiersystems.net

Photo via soldiersystems.net Photo via nrawomen.com

Photo via nrawomen.com Via guns.com

Via guns.com Via yours truly

Via yours truly

US Air Force image

US Air Force image

Recent comments