Futures Rise As Meta Jumps, Microsoft Plunges; Gold Just Won't Stop

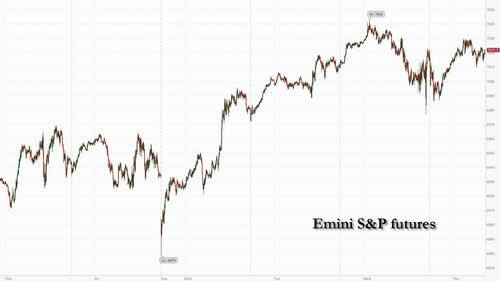

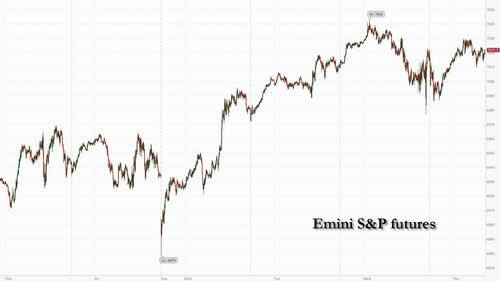

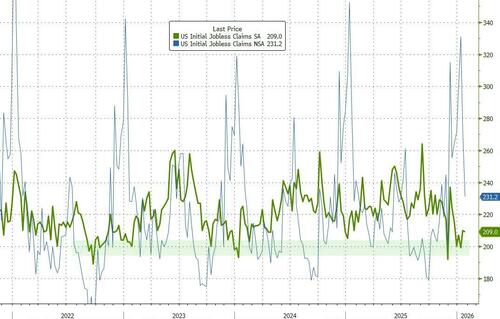

Futures are higher, led by tech, after the first batch of Mag7 earnings with gold breaking new record highs again, rising as high as $5600. As of 8:00am ET, S&P futures are up 0.2% while the Nasdaq if barely in the green; pre-mkt it's a mixed picture with META (+7.9%) rising on higher than expected capex forecast, while MSFT (-6.6%) tumbles on... higher than expected capex forecast; TSLA is also modestly in the green, up +2.8%; AAPL reports today today then AMZN / GOOG next week. Cyclicals are trading higher led by Energy and Industrials and the AI theme also acting well as capex / fundamentals remain supportive of growth. The yield curve is twisting steeper with the USD flat. Commodities remain bid across all 3 complexes with WTI (Iranian supply fears) and precious (fiat incineration trade) the most notable. Today’s macro data focus is on jobless claims though given Powell’s comments yesterday, Friday’s PPI is more important.

In premarket trading, Mag 7 stocks are mixed: Meta (META) rises 8% after the Facebook parent gave a revenue outlook that was much stronger than expected, which helped offset the surge in projected capex; Microsoft (MSFT) falls 6% after the software giant’s report featured an underwhelming read on growth in its Azure cloud-computing business. Analysts also noted higher-than-expected expenses. Tesla (TSLA) gains 2% after the electric-vehicle giant reported adjusted earnings per share for the fourth quarter that topped the average analyst estimate. The company also announced a $2 billion investment in xAI and provided updates on its physical AI ventures (Nvidia (NVDA) -0.2%, Apple (AAPL) +0.5%, Amazon (AMZN) -0.3%, Alphabet (GOOGL) +1.7%)

- Rare earth stocks fall sharply after a report from Reuters said the Trump administration is backing away from plans to guarantee a minimum price for critical minerals projects, citing multiple sources. MP Materials has since refuted the report

- Celestica (CLS) falls 5% after the company reported its fourth-quarter results and gave an outlook. While the results were better than expected, analysts noted higher capex as a potential reason behind the stock’s decline.

- CH Robinson (CHRW) rises 5% after the logistics company reported adjusted earnings per share that beat analyst estimates, despite macroeconomic headwinds from global trade policies.

- Dow Inc. (DOW) slips 2% as the chemical company said it will terminate about 4,500 roles as part of a plan to simplify and streamline its end-to-end processes. It also reported net sales for the fourth quarter that were in-line with the average analyst estimate.

- International Business Machines (IBM) gains 9% after the IT services company reported fourth-quarter results that beat expectations. Analysts highlighted software revenue and free cash flow as positive.

- International Paper Co. (IP) rises 5% on plans to break up and spin off its European packaging operations.

- Las Vegas Sands (LVS) drops 10% after the casino operator’s Macau properties — including The Venetian and Londoner — fell short of Wall Street’s expectations.

- LendingClub (LC) falls 7% after posting fourth quarter results. BI analyst Herman Chan writes that pre-provision profit missed slightly amid higher marketing expenses and guidance looks somewhat lighter than market expectations.

- ServiceNow (NOW) is down 8% after the software company reported its fourth-quarter results and gave an outlook. Analysts are broadly positive, but Bloomberg Intelligence noted that the backdrop remains uncertain.

- Southwest Airlines (LUV) rises 5% after reporting results that topped analyst estimates, signaling the fruits of a turnaround. Shares are climbing 6.2%.

- VSE Corp. (VSEC) rises 1% after agreeing to buy closely held Precision Aviation Group for about $2.025 billion in a cash-and-stock deal.

- Whirlpool (WHR) falls 11% after the appliance maker’s ongoing earnings-per-share forecast for the full year trailed the average analyst estimate. US levies on imports have yet to give the company an edge over foreign rivals, its chief executive said.

Big tech is back in focus, with markets rewarding AI-heavy capex when it’s paired with stronger-than-expected core business growth, as seen at Meta, or punishing it when momentum disappoints, as Microsoft found out the hard way.

Meta’s stronger-than-expected revenue outlook helped cushion concerns over rising AI-related spending. The social media giant reported fourth-quarter sales of $59.9 billion, beating the $58.4 billion that Wall Street anticipated. t signaled that while spending is up, the core business supporting those investments is also growing faster than expected. If Meta hits the top-end of capex guidance for 2026, it will mean a jump of roughly 87% from 2025.

Microsoft’s record spending and slower cloud growth sent its shares down sharply amid investor concerns that it could take longer than expected for the company’s AI investments to pay off. Capex for fiscal second quarter hit $37.5 billion, up 66% from a year earlier and exceeding analyst estimates for $36.2 billion. The Azure cloud-computing unit posted a 38% revenue gain when adjusting for currency fluctuations, just meeting analyst projections.

“We’re back to the theme that we’re not seeing monolithic growth for all the tech companies,” said Rory McPherson, chief investment officer at Magnus Financial Discretionary Management. “Capex spending has increased across the board. The market is just rewarding the ability to monetize it, while placing question marks on companies that aren’t able to do that.”

Looking at earnings, out of the 119 S&P 500 companies that have reported so far in the earnings season, 77% have managed to beat analyst forecasts, while 16% have missed. Caterpillar, Dow and Honeywell International are among many companies expected to report results before the market opens. Caterpillar’s revenue is set to accelerate in 4Q, largely driven by higher volume across all segments, as momentum continues to build into 2026. Margin pressure is likely to persist in 4Q due to a step-up in tariffs (about a $725 million headwind) and manufacturing costs. Earnings from Apple, KLA and Stryker and follow later in the day.

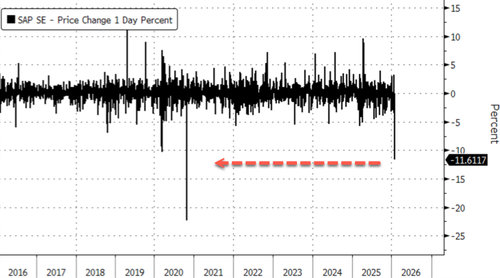

The Stoxx 600 rises 0.4%, with mining, energy and industrial shares leading gains. Technology stocks underperform with Germany’s SAP plunging as much as 13% after reporting a disappointing cloud backlog. Meanwhile, miners outperform. Here are the biggest movers Thursday:

- 3i Group shares rise as much as 15% in London, rebounding from a recent plunge, after the investment firm’s latest results showed a better-than-expected performance for its discount retail business, Action

- ABB rises as much as 9.8% after the Swiss firm predicted higher profitability this year amid a boom in data centers and also announced a $2 billion share buyback. JPMorgan describes orders in the electrical and automation divisions as “blowout”

- STMicro shares rise as much as 5% after the chipmaker gave a better-than-expected 1Q revenue forecast, showing signs of cyclical recovery in demand for analog chips

- EssilorLuxottica shares climb as much as 2.5%, snapping four days of declines. Meta CEO Mark Zuckerberg on an earnings call said it’s “hard to imagine a world in several years where most glasses that people wear aren’t AI glasses”

- European mining shares are the best-performers on the Stoxx 600 benchmark on Thursday after copper posted its biggest one-day gain in years to hit a record above $14,000 a ton

- EasyJet shares rise as much as 3.1% after the airline reported solid first-quarter results and left its outlook for fiscal year 2026 broadly unchanged

- SAP shares drop as much as 13%, the biggest intraday decline in more than five years, after the software firm reported 25% growth in current cloud backlog on constant-currency basis

- H&M shares drop as much as 4.3% after the fashion retailer reported softer current trading than expected, with RBC saying 4Q sales are “a little light” vs. consensus estimates

- Nokia declines as much as 7.4% after the Finnish communications group reported its latest earnings. Analysts say the backwards-looking figures in the report are strong, but 2026 guidance for Network Infrastructure is disappointing

- Givaudan drops as much as 6.7% to the lowest since Oct. 2023 after the Swiss fragrance and flavor maker delivered a weak like-for-like performance in the fourth quarter

- SEB falls as much as 5.7%, the most since April 2025, after the Swedish lender reported its latest earnings, which analysts describe as weak, with a large miss on profits the key disappointment, overshadowing better-than-expected dividends

- Roche shares drop as much as 2.1% after the Swiss drugmaker reported results for the fourth quarter which Intron Health analysts called “soft.” The company also provided guidance for 2026, and analysts see potential for consensus expectations to be cut as a result

- Interroll shares fall as much as 9.6%, the most since last April, after the Swiss industrial-equipment firm’s full-year sales undershot the average analyst estimate. Analysts see some bright spots in the report but highlight headwinds

- Hilton Foods shares drop as much as 9.2%, the most in two months, after the meat producer issued a cautious outlook as inflationary pressures in beef and white fish continue

Earlier in the session, Asian equities edged higher amid mixed trading in heavyweight tech names. Shares in Indonesia pared losses. The MSCI Asia Pacific Index was up 0.2%, after falling as much as 0.7%. SK Hynix and Japan’s Advantest, which surged after its earnings beat, were the biggest boosts to the gauge, while TSMC, Tokyo Electron and Samsung weighed the most. The Indonesian benchmark plunged for a second day, before trimming most of the losses, as investors continue to fret over MSCI’s warning over the market’s investability. The index tumbled as much as 10% before closing 1.1% lower as local regulators said they would double the minimum free-float requirement starting next month.

In FX, the Bloomberg Dollar Spot Index is little changed having erased an earlier fall. The greenback has struggled this year as investors bet on its long-term decline, with unpredictable policymaking and ballooning deficits adding to its woes. The dollar hasn’t acted like a haven for some time as investors increasingly favor tangible alternatives such as precious metals, DoubleLine Capital Chief Executive Officer Jeffrey Gundlach told CNBC.

“The risks of another major leg lower in the dollar remain elevated, even if our bias is for a short-term recovery, given the overall supporting macro and rates picture,” wrote strategists at ING Groep NV including Francesco Pesole.

In rates, treasuries are steady, with US 10-year yields near flat at 4.25%. European government bonds are also little changed.

In commodities, Brent crude futures hit $70 a barrel for the first time since September after US President Trump warned Iran to make a nuclear deal with the US or face military strikes far worse than the attack he ordered last June.

Copper surged by the most in more than 16 years, surging about 6% and earlier hitting a record above $14,000 a ton as metals extended a dramatic start to the year, fueled by a wave of intense speculative trading in China. Spot gold also crossed $5,500/oz for the first while silver briefly surpassed $120/oz, extending its year-to-date advance to around 63%.

“We still have some exposure to gold but at these prices I wouldn’t be that long on it,” said Dan Boardman-Weston, chief investment officer at BRI Wealth Management. “You need it for diversification and it’s been wonderful over the past two years, but now I’m minding my exposure to it.”

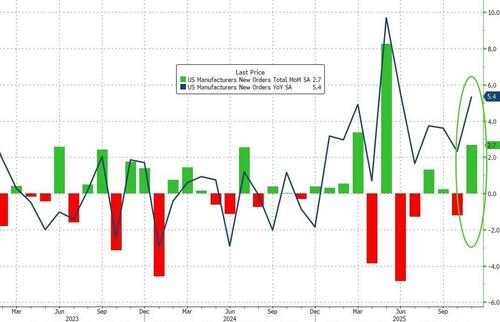

The US economic calendar includes 3Q final nonfarm productivity and unit labor costs, weekly jobless claims and November trade balance (8:30am), November factory orders and wholesale trade sales (10am)

Market Snapshot

- S&P 500 mini +0.2%

- Nasdaq 100 mini +0.3%

- Russell 2000 mini +0.2%

- Stoxx Europe 600 +0.4%

- DAX -1%

- CAC 40 +0.6%

- 10-year Treasury yield +1 basis point at 4.25%

- VIX +0.1 points at 16.45

- Bloomberg Dollar Index little changed at 1178.44

- euro little changed at $1.1955

- WTI crude +2.1% at $64.53/barrel

Top Overnight News

- Talks between top Senate Democrats and the Trump administration to avert a government shutdown have moved closer to Democrats’ demands, though no deal has been reached yet, a person familiar said. Talks included restrictions on ICE agents. BBG

- US Senate Majority Leader Thune sees a possibility to avoid a shutdown by week’s end after Senate Minority Leader Schumer lays out Democrats' demands on ICE: CNN

- President Trump is weighing options against Iran that include targeted strikes on security forces and leaders to inspire protesters, multiple sources said, even as Israeli and Arab officials said air power alone would not topple the clerical rulers. RTRS

- Nvidia, Microsoft and Amazon may invest up to $60 billion in OpenAI’s new funding round. The Information

- Nvidia Corp. hasn’t yet received any orders from Chinese customers for its H200 AI chips as Beijing is still deciding whether to allow imports of the US firm’s components, according to Jensen Huang. BBG

- Cuba only has enough oil to last 15-20 days at current levels of demand and domestic production after its sole supplier Mexico appeared to cancel a shipment while the US blocked deliveries from Venezuela. FT

- Chairman of a US House of Representatives committee said in a letter that NVIDIA (NVDA) helped DeepSeek hone AI models later used in China's military: Reuters.

- Gold and silver hit new records, lifting commodities as a weaker dollar and geopolitical tensions fueled demand. Copper surged on speculative trading in China. Brent hit $70 a barrel after Donald Trump renewed threats against Iran. BBG

- Shares in Chinese property developers surge on news that China has done away with borrowing limits on property developers known as its "three red lines" policy, an apparent end to rules that triggered a debt crisis which continues to weigh on the world's second-largest economy. RTRS

- Indonesia’s stock market suffered its worst two-day rout since 1998, triggered by MSCI’s warning of a possible market downgrade due to transparency concerns. Regulators stepped in and announced plans to double the minimum free-float requirements. BBG

- Sweden’s central bank held its key rate at a three-year low of 1.75%, as expected, and stuck with its forecast for no change until next year. BBG

- Regional banks are on track to outperform the S&P 500 for a third month, the longest streak since 2022. With valuation multiples still below their long-term average and 10% of an S&P gauge set to disclose results in the next two days, the door is open to more gains if profits come in strong.

Notable earnings

- Tesla Inc. (TSLA) Q4 2025 (USD): Adj. EPS 0.50 (exp. 0.45), Revenue 24.9bln (exp. 24.77bln). Gross margin 20.1% (exp. 17.1%). Operating income 1.41bln (exp. 1.32bln). Free cash flow 1.42bln (exp. 1.59bln). In Q1 of this year, we plan to unveil the Gen 3 version of Optimus. Plan to begin megapack 3 and megablock production at megafactory Houston in 2026. On Jan 16, agreed to invest ~2B to acquire shares of Series E Preferred stock of xAI. Shares +3% pre-market

- Microsoft Corporation (MSFT) Q2 2025 (USD): EPS 5.16 (exp. 3.92), Revenue 81.3bln (exp. 80.28bln). said net gains from OpenAI investments totaled USD 7.6bln, which resulted in an increase in diluted earnings per share of USD 1.02/shr. Operating income 38.3bln (exp. 32.9bln). SEGMENTS:. Q2 Azure and other Cloud services revenue increased 39% (exp. 38.8%). Productivity and Business +16% at USD 34.1bln (exp. 33.5bln). More Personal Computing: USD 14.3bln (exp. 14.33bln). Cloud revenue +26% to USD 51.5bln. Intelligent cloud revenue USD 32.9bln. Commercial RPO +110% to USD 625bln. Shares -6.4% pre-market

- Meta Platforms Inc (META) Q4 2025 (USD) EPS 8.88 (exp. 8.19), Revenue 59.9bln (exp. 58.38bln). Sees Q1 rev. USD 53.5bln-56.5bln (exp. 51.3bln). Sees 2026 capex USD 115bln-135bln (exp. 110.6bln). Shares +7.9% pre-market

- International Business Machines Corporation (IBM) Q4 (USD) Adj. EPS 4.52 (exp. 4.33), Revenue 19.7bln (exp. 19.21bln). Sees FY constant currency rev. growth of over 5%. Sees FY2026 revenue USD 70.14bln (exp. 70.16bln). Sees FY free cash flow to increase by about USD 1bln. Shares +8.2% pre-market

- SAP (SAP GY) Q4 2025 (EUR): Adj. oper. profit 2.83bln (exp. 2.75bln), Revenue 9.68bln (exp. 9.74bln), Cloud Revenue 5.61bln (exp. 5.64bln), Cloud/Software Revenue 8.62bln (exp. 8.68bln); announced up to EUR 10bln buyback, to start Feb 2026. Shares -14%

Trade/Tariffs

- China's MOFCOM spokesperson, when asked about a potential round of US-China trade talks, said China is willing to work with the US side to jointly uphold and implement the important consensus of the two heads of state, Global Times reported.

- Chinese President Xi said they are willing to consider implementing a unilateral visa-free system for British nationals

Central Banks

- Riksbank leaves its policy rate unchanged at 1.75% as expected; reiterates that the policy rate is expected to remain at this level for some time to come, in line with the forecast in December.

- BoK said uncertainty surrounding US monetary policy is likely to persist and it reiterated it will closely monitor financial markets.

- HKMA maintains its base rate at 4.00%, as expected.

- Monetary Authority of Singapore kept the prevailing rate of appreciation of the SGD NEER policy band, as well as made no change to the width and level the band is centred, as expected. said:. Output gap will be positive for the year as a whole. Growth this year is expected to remain resilient. Expects 2026 GDP growth to ease Y/Y.

- Brazilian BCB Policy Announcement 15% vs. Exp. 15.00% (Prev. 15.00%); said it will start cutting rates next meeting.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued with sentiment in the region clouded following a lack of fireworks at the FOMC, where the Fed kept rates unchanged at 3.50%-3.75%, as expected, while top- and bottom-line earnings beats from the likes of Meta, Microsoft and Tesla also failed to spur the broader risk appetite. ASX 200 marginally declined amid underperformance in telecoms and miners, while a surge in exports and import prices added to the inflationary risks and the case for an RBA rate hike next week. Nikkei 225 swung between gains and losses amid currency-related headwinds and earnings results. KOSPI saw two-way price action amid fluctuations in tech heavyweights Samsung Electronics and SK Hynix despite both companies posting stellar earnings results. Hang Seng and Shanghai Comp were mixed with price action relatively flat amid a lack of fresh pertinent macro catalysts for China, although property names were supported after reports that several developers are no longer required to submit the monthly “three red lines” indicators, which are debt metrics introduced in 2021 to curb builders' financial leverage.

Top Asian News

- India's Economic Survey has FY27 growth in a 6.8-7.2% range. Weaker INR causes investors to pause.

- China market liquidity will remain ample in February, according to analysts cited by China Securities Times.

- Google (GOOG) took action against a Chinese company linked to a massive cyber weapon.

European bourses (STOXX 600 +0.4%) are broadly firmer, but with clear underperformance in the DAX 40 (-1.2%), which has been dragged down by post-earnings losses in SAP (-14%). The software giant disappointed on cloud revenue and poor cloud backlog metrics. European sectors are mixed; Basic Resources is the clear outperformer, boosted by continued strength in underlying metals prices and following Glencore (+3%) and Antofagasta (+6%) releasing their FY26 copper production guidance, with both companies indicating strong production throughout the year. Among underperformers, Chemicals has been pressured by Givaudan (-6%) post-earnings, followed closely by Tech, dragged lower by losses in SAP.

Top European News

- Germany's Chancellor Merz said they are now seeing the first signs of recovery in the German economy.

- French Finance Minister Lescure said recent FX moves reflect fundamentals.

- Chinese President Xi said to UK PM Starmer that the UK-China relationship in recent years had seen “twists and turns that did not serve the interests of our countries”. said:. China stands ready to develop with the UK a long-term and consistent strategic partnership . More dialogue between the UK and China was “imperative”.

FX

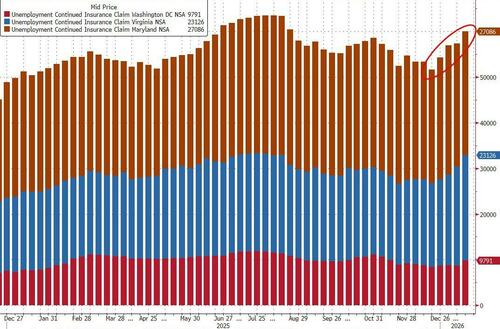

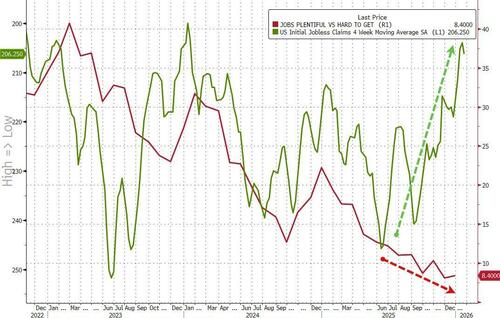

- DXY resides in a current 96.01–96.35 range, well within yesterday’s 95.859–96.787 parameter, with little movement seen following the FOMC decision and press conference yesterday. There was a lack of major surprises or fireworks from the meeting and presser, although Powell noted that rates are at the higher end of the neutral range, and that if the tariff effect on goods pricing is seen to peak this year, it would signal to the Fed that it can loosen policy. Looking ahead stateside, US initial jobless claims for the week of 24 January are expected at 205k (prev. 200k), while continuing claims (week of 17 January, coinciding with the BLS’ traditional survey window for the January jobs report) are seen at 1.86mln (prev. 1.849mln). The Chicago Fed’s Labour Market Indicators are also due today. Final Q3 unit labour costs data are also scheduled, alongside US trade data for November and factory orders for November.

- EUR/USD remains sub-1.2000 after finding some resistance at 1.1996 overnight, while still remaining within yesterday’s 1.1896–1.2045 range. There has been little of note for the EUR as participants gear up for next week’s ECB meeting, with some focus on Governing Council commentary. Aside from that, price action this morning has been largely USD-driven. GBP/USD found resistance near yesterday’s high (1.3846) before waning, with the pair remaining within yesterday’s parameter.

- USD/JPY is softer and back below its 100-DMA (153.71), trading within a 152.76–153.46 band, with price action largely in tandem with the USD in the absence of fresh macro drivers. Traders will be keeping an eye on the geopolitical landscape amid further punchy rhetoric from both Iran and the US. Domestically, a Nikkei poll showed that Japanese PM Takaichi’s party is expected to gain a Lower House majority.

- Antipodeans outperform, with AUD outpacing peers as the commodity-linked currency benefits from the surge in spot gold and copper prices, despite a lack of obvious drivers for the magnitude of gains seen. Data from Australia also showed firmer export and import prices.

Fixed Income

- USTs are, once again, near enough flat, holding off lows in the 111-16+ to 111-26 range. Post-FOMC updates have been light. In brief, the Fed held policy in a decision that saw two dovish dissenters (Miran and Waller), while the statement outlined a more optimistic outlook on the economy and labour market. Overall, the statement and presser left the Fed narrative largely unchanged, although the omission of the line referring to “downside risks to employment” lent a slight hawkish tint to the statement—a point reflected at the time in upside pressure at the short end of the yield curve. This morning, yields are bid across the curve, which is marginally steeper, with the 10yr back above 4.25%, though still shy of last week’s JGB-induced 4.31% YTD peak.

- EGBs were flat this morning, but have gradually edged higher to a peak around the 128.13 area, with gains of up to 10 ticks. Earnings are once again dominating the European newsflow, with the DAX 40 underperforming on account of SAP, though Bunds themselves do not appear to be reacting.

- Gilts gapped lower by just over 10 ticks before slipping to a 90.48 trough, catching up with the modest pressure seen in peers overnight. In the UK, the PM’s meeting with Chinese President Xi generated mixed commentary. A 2028 tender auction attracted strong demand, but had little impact on UK paper.

- Italy sold EUR 6.5bln vs exp. EUR 6-6.5bln 2.85% 2031, 3.45% 2036 BTP & EUR 2.0bln vs exp. EUR 1.5-2.0bln 1.468% 2035 CCTeu.

- UK sold GBP 1.25bln 0.125% 2028 Gilt auction via Tender: b/c 3.77x (prev. 3.84x), average yield 3.443% (prev. 3.783%).

Commodities

- Crude benchmarks have steadily moved higher and reached new four-month highs, with Brent Apr’26 climbing above USD 69/bbl as the probability of a US strike on Iran rises. CNN reported late on Wednesday, citing sources, that US President Trump is considering a new large-scale attack on Iran due to a lack of progress on a nuclear deal. More recently, Kpler’s Bakr reported that Trump is not looking for a war, but instead wants a diplomatic win or an “organic” internal uprising.

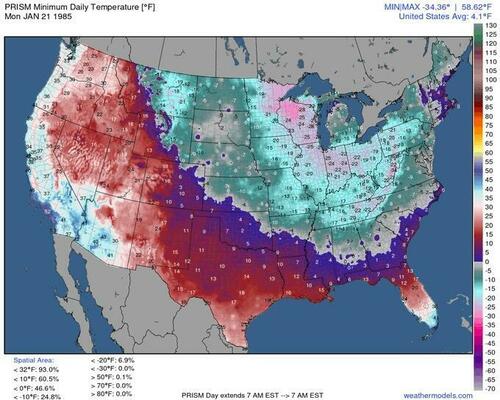

- Worries over oil and gas production due to the Arctic storm have subsided for now, with Henry Hub futures consolidating below USD 4/MMBtu after peaking at USD 7.43/MMBtu earlier in the week.

- Precious metals continue their surge higher, with spot XAU topping out just shy of USD 5,600/oz, aided by a weaker dollar following the FOMC policy announcement. Alongside gold, spot silver also peaked at a new ATH of USD 120.43/oz but is currently underperforming the yellow metal. This runs contrary to recent trends, where spot silver has typically led gains. UBS notes that reduced inflows into ETFs and net speculative futures positioning on the US COMEX exchange hint at a possible end to the rally in XAG.

- Copper prices surged at the start of Asia-Pac trade, with 3M LME copper breaking its prior ATH of USD 13.41k/t to reach a new peak of USD 14.12k/t. Despite the lack of a clear near-term driver, expectations for stronger US growth and increased build-out of AI infrastructure remain key supports for the red metal. This move also comes ahead of China’s Lunar New Year holiday, prompting the usual front-loading of copper and other metals ahead of the festive period.

- US Treasury Secretary Bessent said increased Venezuelan crude oil supply means lower fuel prices and proceeds from the sale of Venezuelan oil will return to Venezuelans.

- US is handing over a seized oil tanker to Venezuela, according to US officials.

Geopolitics: Ukraine

- Russian Kremlin spokesperson Peskov does not comment on reported of a energy infrastructure ceasefire between Russia and Ukraine.

- Russia's Kremlin said they're still waiting for the US response on Putin's offer to extend limits in expiring nuclear treaty.

Geopolitics: Middle East

- Kpler's Bakr, on Iran, writes "What I’m hearing: Trump isn’t looking for war. He wants a diplomatic win, or an “organic” internal uprising that forces change from within.".

- Sources from Arab TV report that disputes are still ongoing between Egypt and Israel regarding the number of people crossing through the Rafah in both direction on a daily basis.

- EU's top diplomat said the EU will likely agree on placing sanctions on Iran's IRGC, AP's Gambrell reported.

- Iran's representative to the UN said Iran informs the Council it faces a clear US threat to use force against it, while the Iranian envoy said Washington will bear responsibility for any uncontrolled consequences resulting from any acts of aggression.

- CNN sources say US President Trump is considering a new large-scale strike on Iran as no progress has been made in nuclear talks, although he has not yet made a final decision on a new major military strike against Iran. Trump's military options include airstrikes and targeting of Iranian leaders and security officials.

- BofA card spending, week to January 24th: +6.6% Y/Y (prev. 4.6% Y/Y). Spending growth grew in groceries and general merchandise, indicative of stockpiling before the Winter storm.

- Turkey said it has foiled an Iranian intelligence plot at US' Incirlik base.

Geopolitics: Others

- Sources from Arab TV report that disputes are still ongoing between Egypt and Israel regarding the number of people crossing through the Rafah in both direction on a daily basis.

- Denmark's Foreign Minister after his meeting in Washington said he's more optimistic on Greenland compared to a week ago. Plan to hold further meetings. Back on track with the US on Greenland.

US Event Calendar

- 8:30 am: United States Jan 24 Initial Jobless Claims, est. 205k, prior 200k

- 8:30 am: United States Jan 17 Continuing Claims, est. 1850k, prior 1849k

- 8:30 am: United States Nov Trade Balance, est. -44b, prior -29.4b

- 10:00 am: United States Nov Factory Orders, est. 1.6%, prior -1.3%

- 10:00 am: United States Nov F Durable Goods Orders, prior 5.3%

- 10:00 am: United States Nov F Durables Ex Transportation, prior 0.5%

- 10:00 am: United States Nov F Wholesale Inventories MoM, est. 0.2%, prior 0.2%

DB's Jim Reid concludes the overnight wrap

Yesterday was a rare occasion when both the latest Fed decision and a slew of Mag-7 results failed to materially move markets, with a pause by the FOMC leaving bonds and equities little changed while mixed results from Microsoft and Meta have left equity futures with marginal gains overnight. Precious metals continued to deliver the most eye-catching moves, with gold (+4.86%) yesterday posting its best day since the early weeks of the Covid pandemic and moving up another 2.41% overnight and above $5,500/oz as I type. Elsewhere Polymarket's probability of a US government shutdown has sunk to 44% in the last couple of hours from a peak of 80% yesterday as the NYT has reported overnight that a deal between Democrats and Republican has been potentially sketched out. We will wait to see how that develops.

Starting with the Fed, and as widely expected the FOMC kept rates on hold at 3.50-3.75%. Governors Miran and Waller dissented in favor of a 25bps cut but there was “broad support” for keeping rates steady according to Chair Powell, who said the Committee was “well positioned” after delivering 75bps of rate cuts in late 2025. The pause came amid a more upbeat tone on the economy, with the statement noting the “solid pace” of economic activity and “some signs of stabilization” in the unemployment rate. Powell emphasised the “clear improvement” in the economic outlook since the last meeting, but any hawkish read-across was offset by a more sanguine tone on inflation. The Chair suggested that services disinflation was continuing, with most of the current inflation overshoot coming due to tariffs, the effect of which is expected to peak around the “middle quarters of the year”.

Powell offered little near-term guidance but suggested the next move is likely to be a cut, noting that “it isn’t anybody’s base case right now the next move will be a rate hike”. Our economists see the Powell-led Fed as having now delivered its last rate cut and, more broadly, they think risks around their expectation of one rate cut this year in September have become more balanced. See their full reaction here. Away from policy, Powell mostly deflected questions on the Lisa Cook hearing and whether he’d stay on as Governor after his term ends in May, while reiterating that he was “strongly committed to (Fed independence) and so are my colleagues”.

Bonds and equities saw muted post-FOMC reactions. Both 2yr (-0.2bps at 3.57%) and 10yr (-0.1bps at 4.24%) Treasury yields were little changed by the close, having been just over a basis point higher pre-FOMC. 10yr and 30yr US yields are +2.4bps and +3.2bps higher this morning though. Fed funds futures continue to price 47bps of easing by December (+0.2bps on the day). The S&P 500 (-0.01%) was also essentially unchanged at 6,978, after reaching the 7,000 level intra-day for the first time earlier in the session. The NASDAQ (+0.02%) and the Mag-7 (+0.04%) were steady as well, while the small cap Russell 2000 (-0.49%) retreated.

After the market close, we then received a mixed set of Mag-7 releases from Microsoft, Meta and Tesla. Microsoft’s shares slumped by around -6% after-hours despite a modest earnings beat, as the software giant only just met elevated cloud revenue growth expectations (at +38%) and saw higher-than-expected quarterly CAPEX outlays ($37.5bn vs $36.2bn est.). By contrast, Meta surged by more than +6% after-hours as it projected stronger ad-driven sales for the current quarter ($53.5-$56.5bn vs $51.3bn est.) and guided for stronger CAPEX in 2026 as a whole ($115-135bn vs $110.6bn est.). Meanwhile, Tesla’s shares gained about +2% in post-market trading after delivering a decent earnings beat and laying out plans to invest $20bn this year to streamline its EV lineup and expand work on robotics and AI. Those results have largely offset each other as far as equity futures are concerned with those tied to the S&P 500 (+0.11%) and NASDAQ 100 (+0.26%) trading slightly higher. We next have Apple reporting after the close today. While we won’t get Nvidia’s earnings until late-February, multiple outlets reported that Beijing had approved purchases of its H200 chips for several Chinese companies including Alibaba. So that helped boost Nvidia’s share price, which rose +1.59%.

Before the Fed decision, the dollar also began to stabilise after Treasury Secretary Scott Bessent reiterated the “strong dollar policy” a day after Trump had seemed more relaxed about its direction. That came in a CNBC appearance, where he said that the US “always has a strong dollar policy, but a strong dollar policy means setting the right fundamentals”. He also commented that the US was “absolutely not” intervening in FX markets, which helped drive a dollar rebound against several other currencies. The dollar did give up some of its rebound later on, in part after Powell said that questions on the recent weakening in the dollar were in the purview of the Treasury not the Fed. Still, the euro was down -0.72% to $1.1954 by the close, with the Japanese yen weakening -0.78% to 153.41 per dollar. Both are back up around a third of a percent higher this morning.

Otherwise, oil prices saw further gains after Trump posted that a “massive Armada” was heading to Iran, and that time was “running out” for Iran to make a deal with the US. Moreover, he said the next US attack would be “far worse” than the strikes last June if Iran did not reach a deal. In response, Iran’s country mission to the UN said that it was ready to correspond with the US, but “if pushed” it would “defend itself and respond like never before.” And yesterday evening, CNN reported that Trump is considering a major strike on Iran but had not yet made a final decision. So fears of tensions escalating between the two countries caused oil prices to rise, with Brent (+1.23%) up to its highest since late-September and trading another +1.62% higher this morning at $69.51/bbl. There were even stronger gains for precious metals, with gold (+4.86%) posting its best day since March 2020 and having now seen its largest 8-day gain since the GFC. Gold is up another +2.41% to $5,550/oz as I type. Meanwhile, silver (+4.12%) also closed at a new high of $116.70/oz and is up just over a percent in Asia.

In Europe, there was a risk off tone yesterday, alongside sovereign bonds rallying as speculation mounted about a potential ECB rate cut this year. That followed comments before the open from the ECB’s Kocher, who said they might have to react if the euro kept appreciating, and overnight index swaps are now pricing in a 26% chance of a rate cut by the September meeting, from 16% before the comments. That helped to push yields lower across the continent, with those on 10yr bunds (-1.7bps), OATs (-0.9bps) and BTPs (-0.4bps) all falling back. Moreover, front-end yields led the declines as investors priced in a growing chance of a rate cut, with the 2yr German yield down -2.2bps.

Elsewhere in Europe, equities largely reversed their gains from the first two days of the week, with the STOXX 600 down -0.75%. Luxury goods were a big underperformer, led by a steep fall in LVMH (-7.89%) after the company’s earnings disappointed the previous evening, which meant the CAC 40 (-1.06%) saw one of the biggest falls.

Finally, the Bank of Canada held its policy rate at 2.25% yesterday, as expected. Governor Macklem kept their options open, saying that “elevated uncertainty makes it difficult to predict the timing or direction of the next change in the policy rate.” But markets are still pricing in a rate hike as most likely by year-end, which is priced in as a 42% probability.

In Asia, the KOSPI (+1.32%) is leading the way again, followed by the Hang Seng (+0.57%) and the Nikkei (+0.31%). Other markets are fairly close to flat.

To the day ahead, data releases include the US November trade balance, factory orders and initial jobless claims, Italy’s November industrial sales, the Euro Area’s January economic confidence. Central bank events include the Riksbank decision, and the ECB’s Cipollone will be speaking today. Finally, Apple, Visa, Mastercard and Blackstone are among those reporting today.

Tyler Durden

Thu, 01/29/2026 - 08:49

A John Deere excavator piles road salt in preparation for a winter storm at the Boston Public Works Department yard in Boston on Jan. 28, 2022. Scott Eisen/Getty Images

A John Deere excavator piles road salt in preparation for a winter storm at the Boston Public Works Department yard in Boston on Jan. 28, 2022. Scott Eisen/Getty Images Texas Department of Agriculture Commissioner Sid Miller speaks to The Epoch Times in Irving, Texas, on Sept. 22, 2023. Samira Bouaou/The Epoch Times

Texas Department of Agriculture Commissioner Sid Miller speaks to The Epoch Times in Irving, Texas, on Sept. 22, 2023. Samira Bouaou/The Epoch Times

Undated image of Home Secretary Shabana Mahmood speaking in the House of Commons in London, England. UK Parliament/PA

Undated image of Home Secretary Shabana Mahmood speaking in the House of Commons in London, England. UK Parliament/PA An undated image of a police officer viewing a camera feed from inside a live facial recognition vehicle at an undisclosed location in England. Andrew Matthews/PA

An undated image of a police officer viewing a camera feed from inside a live facial recognition vehicle at an undisclosed location in England. Andrew Matthews/PA Illustration by The Epoch Times, Shutterstock

Illustration by The Epoch Times, Shutterstock

Screenshot via The News Movement

Screenshot via The News Movement Screenshot via The News Movement

Screenshot via The News Movement

via Reuters

via Reuters

Michael Jay Kamfolt, pictured in a red sweatshirt and hat, at a No Kings protest on Feb. 17, 2025 in Redding, California. Photo by Annelise Pierce.

Michael Jay Kamfolt, pictured in a red sweatshirt and hat, at a No Kings protest on Feb. 17, 2025 in Redding, California. Photo by Annelise Pierce.

Employees work with aluminum ingots at a factory in Huaibei, Anhui province, China, on Feb. 9, 2022. STR/AFP via Getty Images

Employees work with aluminum ingots at a factory in Huaibei, Anhui province, China, on Feb. 9, 2022. STR/AFP via Getty Images Mary Barra, Chair and CEO of the General Motors Company (GM), speaks during the Milken Institute Global Conference in Beverly Hills, California, on May 2, 2022. Patrick T. Fallon | AFP | Getty Images

Mary Barra, Chair and CEO of the General Motors Company (GM), speaks during the Milken Institute Global Conference in Beverly Hills, California, on May 2, 2022. Patrick T. Fallon | AFP | Getty Images Illustration via insideevs.com

Illustration via insideevs.com Artemis II sits in the Vehicle Assembly Building at Kennedy Space Center in Cape Canaveral, Fla., on Jan. 16, 2026. Jim Watson/AFP via Getty Images,

Artemis II sits in the Vehicle Assembly Building at Kennedy Space Center in Cape Canaveral, Fla., on Jan. 16, 2026. Jim Watson/AFP via Getty Images,  (L–R) The Artemis II crew—mission specialist Jeremy Hansen of the Canadian Space Agency, mission specialist Christina Koch, pilot Victor Glover, and commander Reid Wiseman—rehearse a walkout from the Neil A. Armstrong Operations and Checkout Building at NASA’s Kennedy Space Center in Cape Canaveral, Fla., on Dec. 20, 2025. The astronauts are rehearsing for the scheduled 10-day mission in February, which will take them around the moon and back to Earth. Joe Raedle/Getty Images

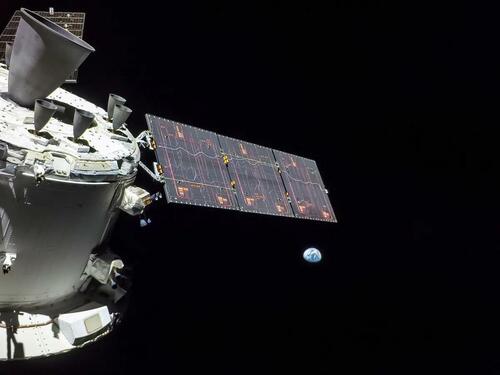

(L–R) The Artemis II crew—mission specialist Jeremy Hansen of the Canadian Space Agency, mission specialist Christina Koch, pilot Victor Glover, and commander Reid Wiseman—rehearse a walkout from the Neil A. Armstrong Operations and Checkout Building at NASA’s Kennedy Space Center in Cape Canaveral, Fla., on Dec. 20, 2025. The astronauts are rehearsing for the scheduled 10-day mission in February, which will take them around the moon and back to Earth. Joe Raedle/Getty Images On flight day 12 of the 25 1/2-day Artemis I mission, a camera on the tip of one of Orion’s solar arrays captures the Earth as Orion travels in distant retrograde orbit around the moon, on Nov. 27, 2022. NASA

On flight day 12 of the 25 1/2-day Artemis I mission, a camera on the tip of one of Orion’s solar arrays captures the Earth as Orion travels in distant retrograde orbit around the moon, on Nov. 27, 2022. NASA The Artemis II rocket core stage of NASA's Space Launch System is offloaded from the Pegasus Barge at Kennedy Space Center in Florida, on July 24, 2024.Chandan Khanna/AFP via Getty Images

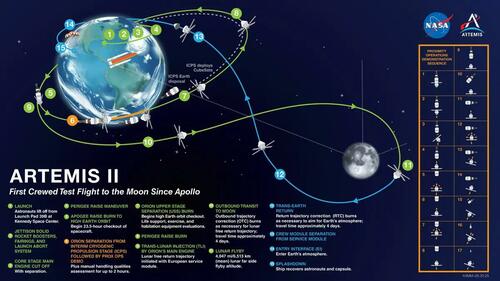

The Artemis II rocket core stage of NASA's Space Launch System is offloaded from the Pegasus Barge at Kennedy Space Center in Florida, on July 24, 2024.Chandan Khanna/AFP via Getty Images A diagram of NASA's Artemis II flight around the moon scheduled for February. Artemis II could launch as early as Feb. 6 or as late as April 6. NASA

A diagram of NASA's Artemis II flight around the moon scheduled for February. Artemis II could launch as early as Feb. 6 or as late as April 6. NASA

Recent comments