Futures Rise For First Time In 4 Days As Oil Rebounds From 4 Year Low

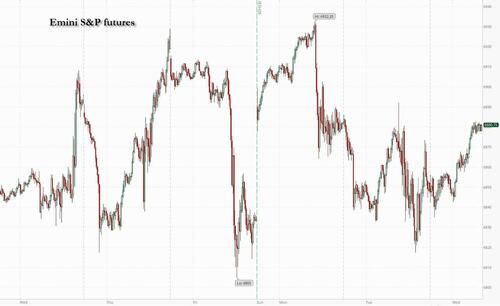

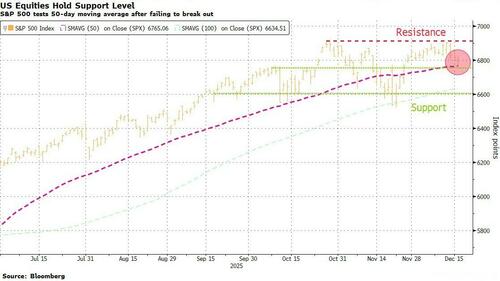

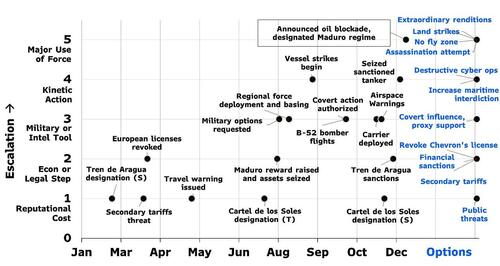

Stock futures are higher but with less than 10 full trading days left in the year, the Santa rally seems increasingly elusive, with traders struggling to find catalysts. The S&P 500 tested a key technical level on Tuesday, coming close to breaking below its 50-DMA. As of 7:15am ET, S&P 500 futures rose 0.3%, pointing to the first increase in four days for the S&P 500 as investor appetite returned after last week’s tech retreat; Nasdaq contracts +0.4%: Netflix rose 1.7% in premarket trading on bets it will prevail in its bid for Warner Bros. Discovery.Amazon rose 2% on report OpenAI is in initial discussions to raise at least $10 billion from Amazon and use its chips. Trading volumes are still relatively high, though will inevitably start to tail off as Christmas approaches. The main action today is in oil, with Brent prices bouncing 2.2% from a four year low back over $60, after Trump ordered a blockade of sanctioned tankers going into and leaving Venezuela, while the US is once again considering sanctions on Russia if Putin rejects the proposed Ukraine peace deal. Gold also jumped. 10Y treasury yields rose 3bps to 4.18% and the dollar index was at session highs. US economic calendar blank for the session. Fed speaker slate includes Waller (8:15am), Williams (9:05am) and Bostic (12:30pm)

In premarket trading, Mag 7 stocks are mostly higher: Amazon +1.9% as OpenAI is in initial discussions to raise at least $10 billion from Amazon and use its chips (Tesla +0.3%, Meta +0.3%, Alphabet +0.3%, Microsoft +0.2%, Apple +0.2%, Nvidia +0.1%)

- Avantor (AVTR) slips 3% after Jefferies cut the life-sciences firm to underperform — a sell equivalent — from hold, citing structural headwinds with “no easy fix.”

- Children’s Place (PLCE) slides 32% after the kids apparel retailer posted third quarter sales that fell 13% from the year-earlier period.

- Frontier Group Holdings (ULCC) climbs 7% as the company is in merger discussions with Bankrupt Spirit Aviation Holdings Inc., according to people familiar with the matter.

- Hut 8 (HUT) surges 21% after the Bitcoin miner and data center operator signed a 15-year, $7 billion lease with Fluidstack for 245 megawatts of IT capacity at its River Bend data center campus in Louisiana with Google backstopping.

- Lennar (LEN) falls 4% after the homebuilder forecast first quarter orders, deliveries and margins all below expectations, signaling strains on the housing market despite a lower interest rate.

- Netflix (NFLX) rises 1.3% as Warner Bros. Discovery plans to reject Paramount Skydance’s takeover bid due to concerns about financing and other terms. Warner Bros. (WBD) shares are down 1.4%, while Paramount (PSKY) drops 1.8%.

- Worthington Enterprises (WOR) falls 8% after the maker of aluminum propane cylinders posted fiscal second-quarter profit that disappointed.

Tuesday’s payrolls signaled a cooling jobs market, but not weak enough to prompt major changes to rate-cut bets in the near term. Hiring was concentrated in education and health care, as well as AI-related construction, but not much else, wrote Bloomberg Economics’ Anna Wong. The CPI data due Thursday will be the last major steer of the year. Still, investors are awaiting that report mostly with a sense of apathy, with options traders betting the S&P 500 will swing just 0.7% in either direction, according to data compiled by Barclays. That’s sharply lower than the 1% average realized move spurred by 12 reports through September. There are also signs that the recent rotation trade is fading, with the Russell 2000 index of small caps down 2.8% over three sessions.

“Yesterday’s November US jobs data is more of a confirmation of the prior expected rate path rather than a new catalyst,” said Andrea Gabellone, head of global equities at KBC Global Services.

Investors are increasingly looking for opportunities beyond the US tech giants that have underpinned the S&P 500’s 16% rally so far this year. A growing chorus of Wall Street analysts are making bullish predictions for 2026 after three straight interest-rate cuts from the Federal Reserve and as nations from the US to Germany boost spending.

“I would expect more volatility because investors are differentiating more and they are not just playing one sector,” said Guy Miller, chief strategist at Zurich Insurance. “But the combination of trend-like growth, slightly lower interest rates, fiscal impulse coming through and importantly, a significant capital spending cycle kicking in, will work its way through the economy.”

Trump’s ban on sanctioned oil tankers going into and leaving Venezuela marked a major escalation and follows the seizure of an oil tanker last week by US forces off the country’s coast. Brent crude jumped 2% to $60.11 a barrel, advancing from the lowest level since 2021.

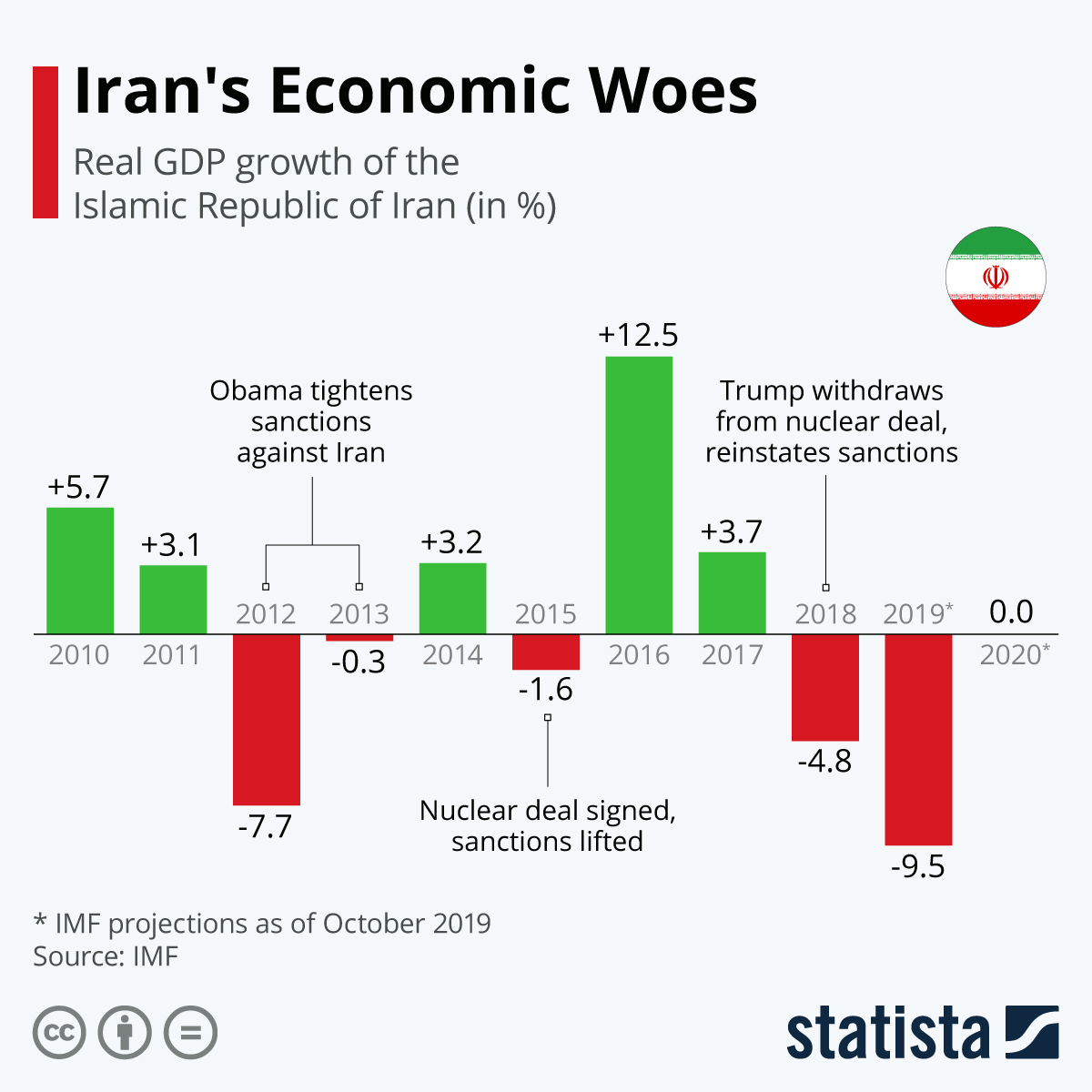

The US is also preparing for a fresh round of sanctions on Russia’s energy sector should President Vladimir Putin reject a peace agreement with Ukraine, according to people familiar with the matter, potentially adding to the uptick in geopolitical tensions.

Europe’s Stoxx 600 Index gained 0.4%, led by the energy sector with BP and Shell rallying more than 2%, tracking gains in oil prices after Bloomberg reported the US is preparing a fresh round of sanctions on Russia’s energy sector. The UK’s FTSE 100 outperforms after inflation fell more than expected, cementing expectations for an interest-rate cut at the Bank of England on Thursday. Here are some of the biggest movers on Wednesday:

- DBV shares soar as much as 47% in Paris, to the highest level since September 2022, after the company’s experimental skin patch met its primary endpoint in a late-stage trial for peanut-allergic children.

- HSBC shares advance as much as 3.6% to a fresh high after KBW upgraded the lender’s shares to outperform from market perform on the strength of its Hong Kong business.

- Serco shares jump as much as 5.6%, touching their highest level in more than 11 years, after the outsourcing services provider boosted its earnings guidance and introduced targets for 2026 that also exceeded expectations.

- IPF shares rise as much as 8.7%, trading at their highest level since 2019, after the company extended the deadline for BasePoint to make a firm takeover offer.

- Ariston shares gain as much as 6% after the Italian white goods and heating firm agreed to buy energy business Riello.

- EnQuest shares rise as much as 6.1% after the oil and gas company said annual production should hit or exceed the top-end of its guidance range.

- Hansa Biopharma shares plummet as much as 28% in Stockholm, the most since 2023, after disappointing results from a trial aimed at improving kidney function in patients with anti-glomerular basement membrane disease.

- Suedzucker shares fall as much as 4.4% to the lowest level since 2008 after the German sugar producer said it expects a slight decrease in FY26/27 revenues as “highly challenging” conditions in the market persist.

- Bunzl shares drop as much as 7.7%, the most since April, after the value-added distributor gave guidance for 2026 including moderate revenue growth and operating margin slightly down year-on-year.

Asian stocks edged higher, buoyed by a rebound in technology shares. Benchmarks rose in South Korea and Hong Kong. The MSCI Asia Pacific Index gained 0.3%, snapping a two-day decline. Samsung Electronics, SK Hynix and Tencent Holdings were among the biggest boosts to the gauge’s climb. Shares also rebounded in mainland China. Sentiment around AI valuations appears to have steadied following a two-day slide that dragged the regional tech gauge down by more than 4% through Tuesday. Investors are once again focused on earnings that may provide further catalyst for shares. Asia is seeing a busy day for stock market listings on Wednesday. Among the debuts, Chinese chipmaker MetaX Integrated Circuits Shanghai Co. soared 693%, while Japan’s SBI Shinsei Bank Ltd. and Indonesia’s digital banking firm PT Super Bank Indonesia also surged. Meanwhile, Hong Kong’s largest licensed cryptocurrency exchange HashKey Holdings Ltd. fell on its first day of trading

In FX, the Bloomberg Dollar Spot index climbs 0.3%. Cable drops 0.7% to $1.3330 with sterling at the bottom of the G-10 FX leaderboard after inflation data came in below expectations. The yen also underperforms, falling 0.5% against the greenback. The Indian rupee jumped 1% after the central bank stepped in to support it after it hit a record low amid the country's aggressive easing policies.

In rates, UK government bonds gapped higher at the open after headline, core and service CPI readings were lower-than-expected in November. Gains have pared but UK 10-year yields are still down 4 bps at 4.48%.

In commodities, WTI crude futures rise 2.4% to $56.60 a barrel while Brent crude jumped 2.2% to $60.24 a barrel, advancing from the lowest level since 2021. Trump's Venezuela move helped send gold above $4,330 an ounce, pushing it close to the record $4,381 set in October. Other precious metals were also gaining, with silver climbing to a record above $66 an ounce and platinum hitting the highest since 2008.

Bitcoin slid 1% to trade around $86,868 as the token headed for the fourth annual decline in its history.

US economic calendar blank for the session. Fed speaker slate includes Waller (8:15am), Williams (9:05am) and Bostic (12:30pm)

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.4%

- Russell 2000 mini +0.3%

- Stoxx Europe 600 +0.4%

- DAX +0.1%

- CAC 40 little changed

- 10-year Treasury yield +2 basis points at 4.17%

- VIX -0.3 points at 16.18

- Bloomberg Dollar Index +0.3% at 1208.16

- euro -0.2% at $1.1718

- WTI crude +2.5% at $56.66/barrel

Top Overnight News

- Trump on Tues ordered a “complete blockage” of sanctioned oil tankers from accessing Venezuela and labeled the Maduro gov’t a “terrorist regime.” Brent jumped and rose further on the news of potentially more Russia sanctions. RTRS

- The US is preparing a fresh round of sanctions on Russia’s energy sector should Vladimir Putin reject a peace agreement with Ukraine, according to people familiar. The new measures may be unveiled as soon as this week. BBG

- Trump is expected to sign an executive order as soon as this week that would fast-track reclassification of cannabis, according to NBC News.

- US told China it's ready to defend interests in Indo-Pacific: BBG

- Trump officials privately raise doubts about Hassett for Fed chair, with his critics saying he has not been effective as head of the National Economic Council, playing little part in driving policies: Politico

- Amazon (AMZN +166bps premkt) is in talks to invest more then $10bn in OpenAI and sell it more chips and computing power, in the latest investment deal tying the AI start up to its infrastructure providers. FT

- Jared Kushner’s Affinity Partners is withdrawing from the takeover battle for Warner Bros. Discovery. The studio plans to reject Paramount’s hostile bid, people familiar said, as its board sees the Netflix deal providing greater value. BBG

- Japan’s exports gained 6.1% last month, topping estimates, with shipments to the US rising for the first time since Trump announced baseline tariffs in April. BBG

- India’s central bank stepped in to support the rupee, propelling it to its biggest gain in seven months. BBG

- India’s central bank governor expects the country’s interest rates to remain low for a “long period” as it enjoys robust economic growth that could soon be boosted by trade pacts being thrashed out with the US and Europe. FT

- UK inflation slipped to the lowest level in eight months, with CPI rising 3.2% in November, less than expected. The pound weakened, and traders saw the data as all but sealing a BOE rate cut Thursday. BBG

- European leaders rallying support for Kyiv say they are working to defend a democratic country, safeguard international law and counter Russian aggression. But there is another motivation rooted in self-interest: Europe believes a deal that favors Moscow risks a wider war that could engulf the whole continent. Cash-drained European capitals fear they would have no other choice but to massively increase military spending and defensive preparations, in the hope of preserving their deterrence. WSJ

- Fed's Goolsbee (2025 voter, hawkish dissenter) said job market is cooling at a modest pace. Said: As we go into 2026, optimistic economy will sustain at stabilised rate.

Trade/Tariffs

- The UK Government announces that they are to re-join the EU's Erasmus+ programme in 2027, with the deal including a 30% discount compared to the default terms. The UK and EU set a deadline to agree a food and drink trade deal and carbon markets linkage in 2026. Negotiations on electricity market integration has also been agreed. UK contribution will be about GBP 570mln for 2027.

- UK's EU Relations Minister Thomas-Symonds is expected to announce the UK will rejoin the Erasmus student exchange program at 12:30 GMT, according to POLITICO. The Times said UK was not able to negotiate as large a discount as it wanted from the GBP 120mln/yr that was announced.

- EU diplomats told POLITICO, regarding the Mercosur trade deal, "If a compromise emerges on safeguards, EU ambassadors are expected to vote on the overall deal (Mercosur) on Friday".

- South Korea is to push for service sector FTA with China and CPTPP affiliation for export momentum, according to Yonhap.

- China commerce ministry said the UN convention on cargo documents fully demonstrates China's determination and actions to uphold true multilateralism, and strive to provide public goods globally.

- US and Japan are to consider projects that may tap the USD 550bln fund, according to Bloomberg.

- US President Trump posted "Numbers recently released show that TARIFFS have reduced the Trade Deficit of the United States by more than half. This is larger than anyone, except ME, projected, and will only get stronger in the near future". Full post: "Numbers recently released show that TARIFFS have reduced the Trade Deficit of the United States by more than half. This is larger than anyone, except ME, projected, and will only get stronger in the near future. Everybody should pray that the United States Supreme Court has the Wisdom and Genius to allow Tariffs to GUARD our National Security, and our Financial Freedom! There are Evil, America hating Forces against us. We can not let them prevail. Thank you for your attention to this matter. MAKE AMERICA GREAT AGAIN!".

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were indecisive with the region lacking conviction following the uninspiring lead from Wall Street where price action was choppy as participants digested a deluge of mixed data releases. ASX 200 was subdued in the absence of bullish drivers and as gains in the mining, materials and resources sectors were offset by weakness in energy, defensives and financials. Nikkei 225 swung between gains and losses amid a choppy currency and as participants digested the better-than-expected Japanese machinery orders and exports data, but with upside limited as an anticipated BoJ rate hike looms. Hang Seng and Shanghai Comp initially traded indecisively in a narrow range with little fresh macro catalysts from China, and after the PBoC drained liquidity in its open market operations. The bourses later climbed to session highs.

Top Asian News

- India's Finance Minister said bringing down India's debt to GDP ratio will be a core priority for the government for the next fiscal year, adds high debt to GDP ratio in some Indian states is a cause of worry.

- Japanese PM Takaichi said Japan needs to strengthen its capacity through proactive fiscal policy rather than excessive fiscal tightening. said:. Sustainable fiscal policy and the social welfare system will be achieved by reflating the economy, improving corporate profits and raising household income through wage gains that boost tax revenues. Fiscal spending will be strategic rather than a reckless expansion.

- Australia Treasurer Chalmers said FY27/28 budget deficit seen rising to AUD 32.6bln.

- Former BoJ Deputy Governor Wakatabe said BoJ must raise the neutral interest rate through fiscal policy and growth strategies, adds the neutral interest rate would rise if demand for funds increases. said:. If the neutral rate rises due to fiscal policy and growth strategies, it would be natural for the Bank of Japan to raise interest rates. The Bank of Japan should avoid premature rate hikes and excessive adjustment of monetary support given the level of the neutral rate. Sanaenomics carries over elements of Abenomics, but focuses more on strengthening the supply side of the economy.

- BoK Governor Rhee said will make sure outbound investment to US from a trade deal doesn't hurt Forex stability. said:Need to make MPS hedging strategies more flexible and less transparent to curb herd-like behaviour.

- Bank of Korea said 2026 inflation could exceed forecasts if KRW remains weak against USD.

- Confederation of Japan Automobile Workers’ Union president Kaneko said he’s concerned that a BoJ rate hike on Friday could weigh on companies’ ability to raise wages next fiscal year. said:“If the yen sharply strengthened after Friday’s decision, it could affect corporate sentiment”.

- South Korea forex authority said it resumes currency swap with the Bank of Korea.

European equities are trading mostly firmer. The FTSE 100 (+1.4%) is the outperformer following cooler-than-expected CPI, which increased the odds of a December cut to near 100%. European sectors are mixed. Leading sectors are Basic Resources (+1.1%), Banks (+1.1%) and Energy (+1.1%). Sentiment for Basic Resources has been underpinned by an uptick in metal prices. Energy has been lifted by crude prices nursing the prior day's losses, fuelled by geopolitical tension between the US and Venezuela after US President Trump's announcement of a blockade of sanctioned oil tankers entering and leaving Venezuela. Furthermore, a Bloomberg report on potential Russian energy sanctions lifted crude to highs.

Top European News

- EU Climate Commissioner said they are not exempting any countries from the Carbon levy, though the UK could be exempt but only after UK carbon market linked to EU's.

- EU Commission proposes extending carbon border levy to downstream steel and aluminium-heavy products. Would also apply it to imported washing machines and machinery. Carbon borders levy revenues from 2026-27 for fund to support EU industries. Proposes system to prevent circumvention of carbon border levy, including by applying default country emissions values if companies provide unreliable data.

- French Socialists (PS) have reportedly outlined conditions that would enable them to abstain instead of voting against the Finance Bill, via Politico citing various press; specific demands incl. EUR 10bln in additional spending via new financing streams.

- UK PM Starmer pushes back on delayed defence spending plan and has asked military chiefs to rework aspects of the defence investment plan, according to FT.

- Germany is set to approve EUR 50bln in military purchases, according to FT.

- New South Wales Premier Chris Minns said to recall state parliament to discuss legislation on firearms which will cap number of firearms that can be owned and will reclassify other types of guns, as well as reduce magazine capacity for shotgun.

FX

- The USD is stronger against all G10FX peers following Tuesday's US data deluge, along with broad weakness across other majors, especially GBP and JPY. The session ahead sees comments from Fed second-in-command Williams, Fed Chair candidate Waller, and 2027 voter Bostic. There are no notable data releases until Thursday, November US CPI. DXY trades within a 98.17-98.64 range, with further gains in the greenback capped by its 100DMA at 98.62.

- EUR is a little lower vs the broadly stronger USD. The single currency was little moved following the German Ifo metrics (slightly shy of exp.) and EZ HICP Finals which remained unrevised. Currently within a 1.1704 to 1.1752 range.

- GBP underperforms vs G10 peers. Policymakers on Threadneedle Street this morning will welcome the cooler-than-expected UK inflation print for November, aligning with the BoE's view that inflation had peaked and coming in at 3.2% against the expected 3.5%, lower than October's 3.6% print. GBP, against the EUR and USD has been weakening since the 07:00 data, with further moves likely to encounter resistance at the 0.8795 and 1.33 levels respectively. Following the data, markets have moved to price an additional 10bps of easing in 2026, moving from 58bps (Tuesday) to 66bps. For the BoE confab on Thursday, expectations rose from c. 91% to a fully priced 25bps cut.

- USD/JPY is lower today. Despite better-than-expected Japanese exports and machinery orders, the stronger USD, firmer energy benchmarks (on the day), and technicals have weighed on the haven in light newsflow. Remarks from Japanese Government panel member Nagahama did little to move the JPY, he said the BoJ's monetary policy appears to be heavily influenced by FX moves. Since the beginning of the European session, and partially coinciding with the aforementioned comments, the pair breached the psychological 155 level, last crossed on Monday. As such, USD/JPY trades within 154.52-155.59 parameters. Levels to be aware of include 21 and 50DMAs, at 155.95 and 154.25, respectively.

Fixed Income

- Gilts are the clear outperformer this morning. Gapped higher by 73 ticks, boosted by a cooler-than-expected November CPI series. A release that cements a December cut with markets now assigning a 99% chance of such a move (vs 91% pre-release). Ahead of the data, sell-side analysts generally viewed a 5-4 vote split as the consensus; the release today could now see the split shift a bit more dovishly. The current hawks are Mann, Pill, Greene and Lombardelli; the latter has been viewed as the most likely candidate to join Bailey in cutting rates in December, with Chief Economist Pill perhaps the other member to watch. Back to price action, Gilts are currently higher by 50 ticks and at the lower end of a 91.38 to 91.78 range.

- USTs are a touch lower this morning, pulling back after ultimately settling in the green on Tuesday. Currently trading towards the lower end of a narrow 112-11 to 112-17+ range. Ahead, US data is lacking (CPI tomorrow); before that, the POTUS will deliver remarks where he could potentially outline new policies for the new year.

- Bunds were essentially unchanged throughout overnight trade, but then caught a bid following the release of the UK’s inflation report (see below). The German benchmark swung from troughs to peaks following the release, but have since scaled back towards the midpoint of a 127.53 to 127.79 range. No real move on the German Ifo data, which was broadly slightly shy of expectations, another disappointing release from the region. From an inflationary standpoint, a recent Bloomberg article suggested that the US is planning new energy sanctions on Russia, if they reject a peace deal with Ukraine. This sparked upside in the crude complex, putting the German benchmark under very slight pressure – albeit within ranges.

Commodities

- Crude benchmarks have completely reversed the losses seen throughout Tuesday’s as the US blocks sanctioned oil tankers going in and out of Venezuela and recent reports, from Bloomberg sources, that the US are preparing new Russian energy sanctions if Russia rejects a Ukraine peace deal. Kremlin recently said that it had not yet seen the report, but highlighted that any sanctions will harm attempts to mend relations. As soon as the Bloomberg reports came out regarding new Russian energy sanctions, WTI lifted from USD 55.95 to a 56.74/bbl session high while Brent rose from USD 59.60 to a 60.40/bbl session high.

- Spot XAU continued to grind higher throughout the APAC session but remains well-contained within Friday’s range of USD 4257-5354/oz. After opening just above USD 4300/oz, XAU gradually traded higher and briefly extended beyond Tuesday’s high of USD 4335/oz, peaking at USD 4342/oz, before falling back into Tuesday’s range. XAG has, in recent sessions, dragged the yellow metal higher as investors look for cheaper alternatives to gold. XAG extended to a new ATH of USD 66.52/oz in the APAC session.

- 3M LME Copper bid higher throughout the Asia-Pac session, trending from USD 11.62k/t to a peak of USD 11.79k/t, in-line with the rest of the metals space. The red metal has slightly pulled back as the European session gets underway, dipping to a trough of USD 11.7k/t, but gains remain mostly in-tact as trade continues.

- Kazakhstan Deputy Energy Minister said Kazakhstan oil production in the first 11 months of 2025 totalled 91.9mln tons and exports were 73.4mln tons.

- Chevron Corp (CVX) spokesperson said operations in Venezuela continue without disruption following Trump's blockade order.

- US Private Inventory Data (bbls): Crude -9.3mln (exp. -1.1mln), Distillate +2.5mln (exp. +1.2mln), Gasoline -4.8mln (exp. +2.1mln), Cushing -0.5mln.

Geopolitics

- Russia's Kremlin said it is not expecting US envoy Witkoff to come to Moscow this week. As soon as the US are ready, they will inform Moscow about their talks with Ukraine.

- US readies new Russian energy sanctions in the scenario that Russia rejects a Ukraine peace deal, according to Bloomberg sources; could potentially be announced as early as this week. Considering options such as targeting vessels in Russia’s "shadow fleet" of tankers used to transport Moscow’s oil. Crude benchmarks saw immediate upside. WTI lifted from USD 55.95 to a 56.68/bbl session high. Brent rose from USD 59.60 to a 60.33/bbl session high.

- Ukraine's military strikes Russian oil refinery in Krasnodar region.

- EU ambassadors convene at 08:00 GMT, to talk on frozen Russian assets; a diplomat told POLITICO it was "still quite early". Belgian Prime Minister De Wever is expected to float a legal workaround at Thursday’s summit that would allow joint EU borrowing for Ukraine, according to four diplomats. POLITICO writes that EU joint borrowing was first aired by ECB's Lagarde, and since received support from Italy, though the idea has since been disregarded with officials dismissing it as legally unviable.

- Ukrainian drone attack on Russia's Krasnodar region injures two people and cuts power to parts of the region, according to regional authorities.

- Israeli forces conduct raids in Al Tuffah and Al Zaytoun neighbourhoods east of Gaza City, according to Al Jazeera.

US Event Calendar

- 4:00 am: Sep New Home Sales MoM, est. -10.82%, prior 20.5%

- 4:00 am: Sep New Home Sales, est. 713.5k, prior 800k

- 4:00 am: Sep Housing Starts MoM, est. 1.61%

- 4:00 am: Sep P Building Permits, est. 1350k, prior 1330k

- 4:00 am: Sep Housing Starts, est. 1328k, prior 1307k

- 4:00 am: Sep Construction Spending MoM, est. 0%, prior 0.2%

- 7:00 am: Dec 12 MBA Mortgage Applications, prior 4.8%

Central Banks (All Times ET):

- 8:15 am: Fed’s Waller Speaks on Economic Outlook

- 9:05 am: Fed’s Williams Delivers Opening Remarks

- 12:30 pm: Fed’s Bostic Participates in Moderated Discussion

DB' Jim Reid concludes the overnight wrap

The mood in markets hasn't been very "Christmassy" this week with yesterday seeing the S&P 500 (-0.24%) post a third consecutive decline thanks to a US jobs report that could be interpreted in whichever way your biases were. The report was always expected to be choppy given the DOGE cuts and the government shutdown, but the rise in unemployment was even bigger than expected, reaching a four-year high of 4.6%. So on balance, investors interpreted the report in a dovish light, and Treasuries rallied in a choppy post payroll session, as investors priced in more cuts for 2026. Moreover, that risk-off mood was clear across the board, with US HY spreads (+5bps) reaching their highest in three weeks. And we saw Brent crude oil prices (-2.71%) close beneath $60/bbl for the first time since February 2021, at just $58.92/bbl, though they are +1.21% higher overnight after Trump ordered a blockade of sanctioned oil tankers in Venezuela. The move has taken Treasuries yields back higher too.

In terms of more detail on that jobs report, the main headline was that payrolls were down by -105k in October, before rebounding by +64k in November (vs. +50k expected). That October decline was driven by a collapse in government payrolls of -157k, marking their biggest monthly slump since the pandemic-driven losses in May 2020. But it was hard for markets to take too much optimism from the November recovery, as the unemployment rate ticked up to 4.6% (vs. 4.5% expected), and the broader U6 measure (which adds in the underemployed and those marginally attached to the labour force) hit 8.7%, the highest since August 2021. Diluting some of the concern over higher unemployment was that this was driven by re-entrants to the labour market rather than permanent job losses. Another consolation was the resilience of private payrolls, up by +52k in October and +69k in November, suggesting that things were a bit stronger away from the DOGE cuts and the shutdown. The 3-month moving average for private payrolls is in fact now at a 6-month high.

Ultimately however, the higher unemployment rate confirmed existing fears about a softer labour market, and investors priced in more Fed rate cuts for 2026. Indeed, the number of cuts priced by the December 2026 meeting was up +2.4bps on the day to 59bps. And in turn, Treasuries rallied across the curve, with the 2yr yield (-1.5bps) down to 3.49%, whilst the 10yr yield (-2.8bps) fell to 4.15%. Those moves came amid ongoing headlines surrounding the Fed Chair nomination, with the Wall Street Journal reporting that Trump was going to interview Fed Governor Chris Waller today. The latest standings on Polymarket put NEC Chair Kevin Hasset at around 53%, and comfortably back in the lead, ahead of former Fed Governor Kevin Warsh at 26% and with Waller up to 16% from 7% the previous day.

Nevertheless, equities struggled against this backdrop, with the S&P 500 (-0.24%) having now posted 3 declines since its record high last Thursday. Those moves were broad-based, with around three-quarters of the index losing ground yesterday. Indeed, the losses would’ve been larger were it not for outperformance by the Mag-7 (+0.82%), which were led by Tesla (+3.07%) reaching a new record high for first time since last December. By contrast, the equal-weighted S&P 500 was down -0.71%, with energy stocks (-2.98%) leading the decline given the latest slump in oil prices.

Brent crude fell -2.71% to $58.92/bbl, its lowest since February 2021, though it is +1.21% higher overnight after President Trump posted last night that he was ordering a “BLOCKADE OF ALL SANCTIONED OIL TANKERS going into, and out of, Venezuela”. This marks the latest move by the US to raise pressure on the Maduro regime. The overnight oil rise is also helping 10yr Treasury yields (+2.5bps) reverse some of yesterday’s decline.

In Europe, markets had followed a very similar pattern yesterday, with a risk-off move that pushed equities and bond yields lower. In part, that was driven by an underwhelming set of flash PMIs for December, with the Euro Area composite reading falling back from its two-year high in November to 51.9 (vs. 52.6 expected). So that added to fears that the economy had lost some momentum into year-end, and the STOXX 600 (-0.47%) fell back, along with yields on 10yr bunds (-0.8bps), OATs (-1.7bps) and BTPs (-2.7bps).

Admittedly, European assets were supported by signs of progress on the Ukraine negotiations, and the impact was clear in assets sensitive to the conflict. In addition to the decline in oil, the 10yr yield on Ukraine’s dollar bond (-28.4bps) fell back to 13.77%, its lowest level since March, whilst the STOXX Aerospace & Defense index (-1.79%) underperformed. Yet despite hopes for a ceasefire in the coming months, that still wasn’t enough to outweigh the broader negativity for European equities from the US jobs report and the weaker PMIs.

One exception to that pattern came in the UK, where gilts struggled after yesterday’s data leant in a hawkish direction. For instance, wage growth was up by +4.7% in the three months to October (vs. +4.4% expected), and the flash composite PMI also moved up to 52.1 in December (vs. 51.5 expected). So collectively, that suggested inflationary pressures might be stronger than thought, and 10yr gilt yields (+2.3bps) moved back up to 4.52%. Remember as well that we’ll get the UK CPI print for November shortly after this goes to press, so the focus will be on whether that continues its downward trajectory. Then the BoE meeting tomorrow.

This morning, Asian equity markets are stabilising, led by the KOSPI, which is up +0.95%. The Hang Seng (+0.22%) and the Nikkei (+0.15%) are also higher. In mainland China, both the CSI (+0.58%) and the Shanghai Composite (+0.18%) are also trading in positive territory, fueled by expectations of additional fiscal stimulus from Beijing, especially in the wake of several weaker-than-expected economic indicators for November. In contrast, the S&P/ASX 200 in Australia is bucking this regional trend, currently down -0.16%. US equity futures are down a tenth.

In Japan, exports in November recorded their fastest growth in nine months this year, increasing by an impressive 6.1% y/y. This significantly surpassed market expectations of a +5.0% rise and was also a marked improvement from the 3.6% increase observed in the preceding month. This strong export performance was underpinned by a +3.6% increase in goods shipped to Western Europe and an +8.8% surge in exports to the United States, Japan's second-largest trading partner. Notably, this marks the first time that exports from Japan to the US have increased since March. Concurrently, imports into Japan rose by +1.3% in November, which was below the anticipated +2.5% increase. As a result, Japan's trade balance for November amounted to a surplus of 322.3 billion yen, far exceeding the projected 72.6 billion yen surplus and representing a significant turnaround from the 226.1 billion yen deficit recorded in the prior month.

Elsewhere yesterday, we had a few other data releases, including the delayed US retail sales for October. They were unchanged (vs. +0.1% expected), but the measure excluding autos and gas stations was up +0.5% (vs. +0.4% expected), and retail control, which feeds into GDP, was up +0.8%, much higher than the +0.4% expected. Meanwhile in Germany, the expectations component of the ZEW survey moved up to a 5-month high of 45.8 (vs. 38.4 expected), although the current situation fell back to a 7-month low of -81.0 (vs. -80.0 expected).

Tyler Durden Wed, 12/17/2025 - 08:11

Trash lines the beaches near the Tijuana River mouth outside of San Diego, Calif., on Sept. 19, 2024. John Fredricks/The Epoch Times

Trash lines the beaches near the Tijuana River mouth outside of San Diego, Calif., on Sept. 19, 2024. John Fredricks/The Epoch Times Trash builds up along the Tijuana River outside of San Diego, Calif., on Sept. 19, 2024. John Fredricks/The Epoch Times

Trash builds up along the Tijuana River outside of San Diego, Calif., on Sept. 19, 2024. John Fredricks/The Epoch Times Water flows along the Tijuana River outside of San Diego, Calif., on Sept. 19, 2024. John Fredricks/The Epoch Times

Water flows along the Tijuana River outside of San Diego, Calif., on Sept. 19, 2024. John Fredricks/The Epoch Times

via European Union

via European Union

Recent comments