"This Alliance Has To Look Different Because The World Looks Different": Rubio Expands On Historic Speech In Munich

Authored by 'sundance' via The Last Refuge,

Marco Rubio appears for an interview with John Micklethwait of Bloomberg News. The interview was pre-scheduled as a follow up to the rather historic speech in Munich at the security conference. Within the interview {video and transcript below} Rubio expands on the baseline of the speech, the ‘why‘ is the U.S-EU alliance important.

Beginning with the end in mind, Rubio reminds the interviewer that an alliance must first accept the purpose of the assembly. There are common values and common social components to the relationship that sit at the core of the decision to be allies.

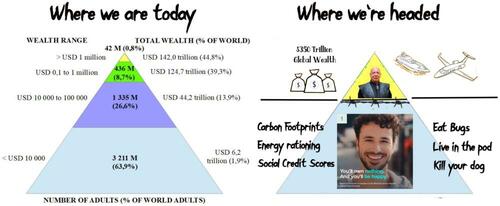

We have a shared civilization based on shared values, and within that central component the Trump administration is staring at the Europeans and saying they have lost focus on these values. Europe is diminishing itself; it is fracturing its culture and has lost its sovereign identity. The United States wants to stay partnered with Europe, but we are not going to be a partner anchored to a collective mindset that has lost its identity.

This culturally Marxist status, a gathering of nations infected with political correctness, pontificating wokeness and apologetic self-flagellation, is the core problem the Europeans are not willing to face. President Trump and Marco Rubio are essentially telling the EU to shake it off, quit being woke, get proud of your heritage, institute political systems that give benefit to the population and regain pride in themselves and their identity.

The process begins with national security, but that is not just about military spending. Their energy industry needs to support economic independence; they cannot outsource component manufacturing; they need to reestablish economic baselines that are not dependent on Russia, China, India or any other risk vector that could be used to manipulate.

Key Quotes:

These quotes capture the core themes of Rubio's remarks: pride in Western civilization, the urgency of a capable alliance, lessons from history, pragmatic diplomacy (including with adversaries), and a push for negotiated resolutions in key conflicts.

On shared Western civilization and the transatlantic alliance

"Ultimately, it’s the fact that we are both heirs to the same civilization. And it’s a great civilization and it’s one we should be proud of. It’s one that’s contributed extraordinarily to the world and it’s one, frankly, upon which America is built, from our language to our system of government to our laws to the food we eat to the name of our cities and towns – all of it deeply linked to this Western civilization and culture that we should be proud of, and it’s worth defending."

"People don’t fight and die for abstract ideas. They are willing to fight and defend who they are and what matters and is important to them."

"When we come off as urgent or even critical about decisions that Europe has failed to make or made, it is because we care. It is because we understand that ultimately, our own fate will be intertwined with what happens with Europe."

On the need for Europe to share the burden and be capable

"We want Europe to survive, we want Europe to prosper, because we’re interconnected in so many different ways and because our alliance is so critical. But it has to be an alliance of allies that are capable and willing to fight for who they are and what’s important."

On the Cold War parallels and lessons for today (vs. China)

"It’s reminding people of what we’ve done together in the past. But it’s also a reminder that at the end of that era, when we won the Cold War, there was this euphoria that led us to make some terrible decisions that have now left us vulnerable – it deindustrialized the West; it left us increasingly dependent on others, including China, for our critical supplies. And that needs to be reversed in order to safeguard us."

"We should never be in a situation where our alliance and our respective countries are vulnerable to extortion or blackmail because someone controls 99 percent of something that’s critical to national life."

On European leaders engaging with China

"Nation-states need to interact with one another. [...] I don’t think visiting Beijing or meeting with the Chinese is – on the contrary, I think it would be irresponsible for great powers not to have relationships and talk through things and, to the extent possible, avoid unnecessary conflict."

On the alliance's evolution and core foundation

"This alliance has to look different because the world looks different. This alliance has to be about different things than it’s been in the past because the challenges of the 21st century are different than the challenges of the 20th."

"The fundamental thing that has to change is we have to remind ourselves of why it is we have an alliance in the first place. [...] This is not just a military arrangement. [...] It is what holds us together in the first place as an alliance is our shared civilizational values, the fact that we are all heirs to a common civilization and one we should be very proud of."

On the Ukraine war

"I think that’s a difficult war to say anyone is winning. The Russians are losing seven to eight thousand soldiers a week – a week. [...] Not wounded – dead."

"In the end, this war will not be solved militarily. It will be – in the end, it will come to a negotiated settlement. We’d like to see that happen as soon as possible."

"I don’t think it’s possible for Russia to even achieve whatever initial objectives they had at the beginning of this war. I think now it’s largely narrowed down to their desire to take 20 percent of Donetsk that they don’t currently possess."

On Cuba and the regime

"Cuba’s fundamental problem is that it has no economy and its economic model is one that has never been tried and has never worked anywhere else in the world."

"They would much rather be in charge of the country than allow it to prosper."

"The people of Cuba – and that’s what this regime has not been willing to give them because they’re afraid that if the people of Cuba can provide for themselves, they lose control over them, they lose power over them."

On Iran

"I think it’s pretty clear that Iran will never be allowed to have a nuclear weapon, that that poses a threat not just to the United States, to Europe, to world security, and to the region."

"The President would always prefer to end problems with a deal. He would always prefer that, so we’re going to give it a chance here again and see if it works."

Full Transcript:

QUESTION: Marco Rubio, Secretary of State, thank you for talking to Bloomberg. You’ve just made this rather remarkable speech where you talked about the destiny of Europe and America always being intertwined. You talked about the alliance which has stretched all the way, culturally, from Michelangelo to the Rolling Stones – a first, I suspect, for a secretary of state – but a culture that has bled and died together. But the very common theme of your speech was the need to share the burden, the need for Europe and America to do things together, which was slightly different from the Vice President last year. Were you kind of offering a carrot where perhaps he was offering a stick?

SECRETARY RUBIO: I think it’s the same message. I think what the Vice President said last year very clearly was that Europe had made a series of decisions internally that were threatening to the alliance and ultimately to themselves, not because we hate Europe or we don’t like Europeans but because – what is it that we fight for, what is it that binds us together? And ultimately, it’s the fact that we are both heirs to the same civilization. And it’s a great civilization and it’s one we should be proud of. It’s one that’s contributed extraordinarily to the world and it’s one, frankly, upon which America is built, from our language to our system of government to our laws to the food we eat to the name of our cities and towns – all of it deeply linked to this Western civilization and culture that we should be proud of, and it’s worth defending.

And ultimately, that’s the point. The point is that people – people don’t fight and die for abstract ideas. They are willing to fight and defend who they are and what matters and is important to them. And that was the foundation he laid last year in his speech – and we add on into this year – to explain to people that when we come off as urgent or even critical about decisions that Europe has failed to make or made, it is because we care. It is because we understand that ultimately, our own fate will be intertwined with what happens with Europe. We want Europe to survive, we want Europe to prosper, because we’re interconnected in so many different ways and because our alliance is so critical. But it has to be an alliance of allies that are capable and willing to fight for who they are and what’s important.

QUESTION: You see a parallel – you seem to see a parallel between the Cold War, which I think I would argue that the – America beat the Soviet Union because it had a common idea and it had allies on its side. You’re now in a struggle with China. As people say, you’ve often been a hawk on that subject. You’re in a struggle with China. Do you think you absolutely need Europe to be able to win that?

SECRETARY RUBIO: Yeah. I would say two things. First, the mentions of the Cold War are to remind people of everything we’ve achieved together in the past in times when there was doubt. I mean, it’s hard to imagine today, but there were those who believed, in the 60s and 70s, even, that at a minimum, we had reached a stalemate, and worse, that perhaps Soviet expansion was inevitable and that we needed to come to accept it. There were voices that actually argued this.

And so it’s reminding people of what we’ve done together in the past. But it’s also a reminder that at the end of that era, when we won the Cold War, there was this euphoria that led us to make some terrible decisions that have now left us vulnerable – it deindustrialized the West; it left us increasingly dependent on others, including China, for our critical supplies. And that needs to be reversed in order to safeguard us.

And so I do think, yes, it would be ideal to have a Western supply chain that is free from extortion from anyone – leave aside China – anybody else. We should never have to – we should never be in a situation where our alliance and our respective countries are vulnerable to extortion or blackmail because someone controls 99 percent of something that’s critical to national life. So I think we do have a vested interest in that regard.

Today is different than yesterday, but it has parallels, not in that China’s the new Soviet Union but that in our future, collectively we’ll be stronger if we work on these things together.

QUESTION: Do you worry from that perspective the fact that, especially in the recent period, various sort of allies – Mark Carney has just been to Beijing, Starmer has just been to Beijing, Merz is about to go there – do you worry that they’re beginning to drift off too much in that direction?

SECRETARY RUBIO: No. I think nation-states need to interact with one another. Just because you’ve – I mean, remember, I serve under a President that’s willing to meet with anybody.

QUESTION: Yes.

SECRETARY RUBIO: I mean, to be frank, I’m pretty confident in saying that if the ayatollah said tomorrow he wanted to meet with President Trump, the President would meet him, not because he agrees with the ayatollah but because he thinks that’s the way you solve problems in the world, and he doesn’t view meeting someone as a concession. Likewise, the President intends to travel to Beijing and has already met once with President Xi. And in this very forum yesterday, I met with my counterpart, the foreign minister of China.

So we expect nation-states to interact with one another. In the end, we expect nation-states to act in their national interest. I don’t think that is – that in no way runs counter to our desire to work together on things that we share in common or threats we face in common. But I don’t think visiting Beijing or meeting with the Chinese is – on the contrary, I think it would be irresponsible for great powers not to have relationships and talk through things and, to the extent possible, avoid unnecessary conflict.

But there will be areas we’ll never agree on, and those are the areas that I hope we can work together on.

QUESTION: So you think the Russia that many people have spoken about is illusory, that hasn’t happened yet?

SECRETARY RUBIO: Well, there’s no – I mean, even as I speak to you now, there are U.S. troops deployed here on this continent on behalf of NATO. There are still all kinds of cooperation that go on at every level; from intelligence to commercial and economic, the links remain. I think there is a readjustment that’s happening, because I think we have to understand that we want to reinvigorate – this alliance has to look different because the world looks different. This alliance has to be about different things than it’s been in the past because the challenges of the 21st century are different than the challenges of the 20th. The world has changed and the alliance has to change.

But the fundamental thing that has to change is we have to remind ourselves of why it is we have an alliance in the first place. This is not just a military arrangement. This is not just some commercial arrangement. It is what holds us together in the first place as an alliance is our shared civilizational values, the fact that we are all heirs to a common civilization and one we should be very proud of. And only after we recognize that and make that the core of why it is we’re allies in the first place can we then build out all the mechanics of that alliance. And then everything else we do together makes more sense.

QUESTION: The place where that’s being most obviously tested at the moment is Ukraine You see all these numbers from the front where the Ukrainians do seem to be doing better in terms of what’s happening with the Russians. Do you think Ukraine – or do you think Russia is still winning that war, or where you do you – where do you place it militarily?

SECRETARY RUBIO: I think that’s a difficult war to say anyone is winning. The Russians are losing seven to eight thousand soldiers a week – a week.

QUESTION: Yes —

SECRETARY RUBIO: Not wounded – dead. Ukraine has suffered extraordinary damage, including overnight, and again, to its energy infrastructure. And it will take billions of dollars and years and years to rebuild that country. So I don’t think anyone can claim to be winning it. I think that both sides are suffering tremendous damage, and we’d like to see the war come to an end. It’s a senseless war in our view. The President believes that very deeply. He believes the war would have never happened had he been president at the time.

So we’re doing two things. Obviously we continue – look, we don’t provide arms to Russia; we provide arms to Ukraine. We don’t sanction Ukraine; we sanction Russia. But at the same time, we find ourselves in the unique position of serving as probably the only nation on Earth that can bring the two sides to discuss the potential for ending this war on negotiated terms. And it’s an obligation we haven’t – we won’t walk away from because we think it’s a very unique one to have.

It may not come to fruition, unfortunately. I hope it does, and I think there are days when I feel more optimistic about it than others. But we’re going to keep trying because that is – in the end, this war will not be solved militarily. It will be – in the end, it will come to a negotiated settlement. We’d like to see that happen as soon as possible.

QUESTION: Are you worried that if Ukraine loses the war it’s going to be a disaster for the transatlantic relationship? Because the Americans will say the Europeans didn’t provide enough arms, and Europeans will look and remember the meeting in the White House and Zelenskyy and Trump, and they will blame (inaudible).

SECRETARY RUBIO: No, but that – that would ignore reality. Look, Ukraine – first of all, they deserve a lot of credit. They have fought very bravely. They have received an extraordinary amount of support from the United States to the tune of billions of dollars that preexist the war. In fact, Ukraine probably wouldn’t have survived the early days of the war had it not been for American aid that came to them even before the war had started with the Javelin missile that disabled the tank (inaudible).

QUESTION: I wasn’t saying it was fair. I was just saying there’s a – you have to deal with perceptions.

SECRETARY RUBIO: Well, I mean people are saying – no, but I’m not worried about that because I can tell you that I think history will understand it. But I don’t think the war is going to end in a traditional loss in the way people think. I don’t think it’s possible for Russia to even achieve whatever initial objectives they had at the beginning of this war. I think now it’s largely narrowed down to their desire to take 20 percent of Donetsk that they don’t currently possess.

And that’s hard. It’s a hard concession for Ukraine to make for obvious reasons, both from a tactical standpoint and also from a political one. And so that’s kind of where this thing has narrowed, and we’ll continue to search for ways to see if there is a solution to that unique problem that’s acceptable to Ukraine and that Russia will also accept. And it may not work out, but we are going to do everything we can to see if we can find a deal.

Like I said, there are days like last week where you felt we had made some pretty substantial progress. But ultimately, we have to see a final resolution to this to feel that it’s been worth the work, but we’re going to keep trying. And our negotiator, Steve Witkoff – now Jared Kushner’s involved – have dedicated a tremendous amount of time to this, and they’ll have meetings again on Tuesday in regards to this.

QUESTION: What about a country with which you’ve had a long interest: Cuba? You mentioned it obliquely in the speech talking about the Cuban Missile Crisis. How long do you think the regime can last without oil?

SECRETARY RUBIO: Yeah, I think the regime in Cuba is – look, the revolution in Cuba ended a long time ago and – Cuba’s fundamental problem is that it has no economy and its economic model is one that has never been tried and has never worked anywhere else in the world, okay? It just – it doesn’t have a real economic policy. It doesn’t have a real economy.

Now, forget – put aside for a moment the fact that it has no freedom of expression, no democracy, no respect for human rights. The fundamental problem Cuba has it is has no economy, and the people who are in charge of that country, in control of that country, they don’t know how to improve the everyday life of their people without giving up power over sectors that they control. They want to control everything. They don’t want the people of Cuba to control anything.

So they don’t know how to get themselves out of this. And to the extent that they have been offered opportunities to do it, they don’t seem to be able to comprehend it or accept it in any ways. They would much rather be in charge of the country than allow it to prosper.

QUESTION: Is there any kind of off-ramp for the regime? I mean, previous ones – when you negotiated with Venezuela, you said if they agreed with various things it would be possible to continue.

SECRETARY RUBIO: Sure. I mean, there is. I mean, look, I think you have to —

QUESTION: What could – what could the Cuban regime do to —

SECRETARY RUBIO: Well, I’m not going to tell you or announce this in an interview here because obviously these things require space and time to do in the right way. But I will say this, that that is that it is important for the people of Cuba to have more freedom, not just political freedom but economic freedom. The people of Cuba – and that’s what this regime has not been willing to give them because they’re afraid that if the people of Cuba can provide for themselves, they lose control over them, they lose power over them.

So I think there has to be that opening and it has to happen, and I think now Cuba is faced with such a dire situation. Remember this is a regime that has survived almost entirely on subsidies – first from the Soviet Union, then from Hugo Chavez, and how for the first time it has no subsidies coming in from anyone, and the model has been laid bare.

And it’s not just – look, multiple countries have gone in and helped, but the problem is that you lose money in Cuba. They never pay their bills. They never end up paying. It never ends up working out. There were European countries that went to Cuba and made what they thought were investments in certain sectors, only to have them – the contracts canceled and get themselves kicked out because the Cuban regime has no fundamental understanding of what business and industry looks like, and the people are suffering as a result of it.

So I think certainly their willingness to begin to make openings in this regard is one potential way forward. I would also say – and this has not been really talked about a lot, but the United States has been providing humanitarian assistance directly to the Cuban people via the Catholic Church. We did it after the hurricane. We actually just recently announced an increase in the amount we’re willing to give. And that’s something we’re willing to continue to explore, but obviously that’s not a long-term solution to the problems on the island.

QUESTION: One last thing: Iran. You’ve just sent a carrier – a second carrier – there. Is that – and President Trump has talked about a month to give people time. Are you running out of patience there?

SECRETARY RUBIO: Well, I’d say twofold. Number one is I think it’s pretty clear that Iran will never be allowed to have a nuclear weapon, that that poses a threat not just to the United States, to Europe, to world security, and to the region. There’s no doubt about it.

The second is we obviously want to have forces in the region because Iran has shown the willingness and the capability to lash and strike out at the United States presence in the region. We have bases because of our alliances in the region, and Iran has shown in the past that they are willing to attack us and/or threaten our bases. So we have to have sufficient firepower in the region to ensure that they don’t make a mistake and come after us and trigger something larger.

Beyond that, the President has said that his preference is to reach a deal with Iran. That’s very hard to do, but he’s going to try. And that’s what we’re trying to do right now, and Steve Witkoff and Jared have some meetings lined up fairly soon. We’ll see if we can make any progress.

The President would always prefer to end problems with a deal. He would always prefer that, so we’re going to give it a chance here again and see if it works.

QUESTION: Secretary Marco Rubio, thank you very much for talking to Bloomberg.

SECRETARY RUBIO: Thank you. Thank you.

Tyler Durden

Sun, 02/15/2026 - 12:50

CPB officers reportedly fired an AeroVironment LOCUST laser counter-drone weapon on loan from the US Army (AeroVironment photo)

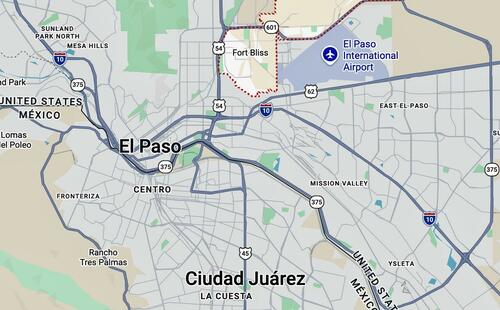

CPB officers reportedly fired an AeroVironment LOCUST laser counter-drone weapon on loan from the US Army (AeroVironment photo) The laser weapon was fired a balloon approaching Fort Bliss, which is immediately adjacent to El Paso International Airport

The laser weapon was fired a balloon approaching Fort Bliss, which is immediately adjacent to El Paso International Airport Getty Images

Getty Images

Iran's former crown prince and now self-styled key opposition figure Reza Pahlavi, via AFP.

Iran's former crown prince and now self-styled key opposition figure Reza Pahlavi, via AFP.

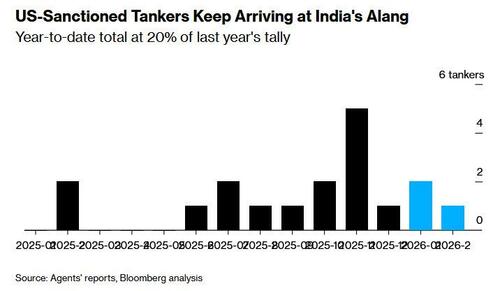

The Woodchip Suezmax ship. Source: MarineTraffic

The Woodchip Suezmax ship. Source: MarineTraffic The Woodchip was seen sailing slowly in mid January from the Gulf of Oman eastwards, before arriving at India’s Alang late last week.Source: Bloomberg

The Woodchip was seen sailing slowly in mid January from the Gulf of Oman eastwards, before arriving at India’s Alang late last week.Source: Bloomberg

Recent comments