Fast And Furious 47: The Midterm Elections Are Driving Everything

By Peter Tchir of Academy Securities

Fast And Furious 47

The Fast and Furious franchise is on its 10th or 11th movie. The U.S. government is on its 47th President.

In an interesting “mash-up,” we have entered into the arena of Fast and Furious 47.

I don’t think we have ever seen the generation of so many headlines, on so many subjects, so quickly from any world leader, as we’ve seen since the start of this year!

Aside from the “obvious” headlines on Venezuela, which after Friday’s press conference looks more and more like colonization, we have a raft of geopolitical headlines.

- Seizing Russian-flagged crude carriers.

- Threats on Cuba, Iran, and Syria (U.S. strikes against ISIS targets once again on Saturday) to name a few. With the events that occurred in Venezuela, these need to be taken very seriously.

- Some sort of peace negotiations continue with Russia and Ukraine.

- Some sort of plans for rebuilding Gaza (hearing about a ski resort?).

If you missed this week’s Academy Webinar, I highly recommend watching it as Rachel Washburn does an amazing job moderating the conversation with General Ashley (Army), General Bellon (Marine Corps) who was in charge of U.S. Marine Corps Forces South (in South and Central America), Linda Weissgold (Former CIA Deputy Director for Analysis), and myself.

Then on the economic front, we had:

- Venezuela and its oil – there are a lot of potential economic outcomes from the intervention in Venezuela. It remains to be seen how this plays out, and even after the press conference with oil heavyweights on Friday, there seems to be some disagreement on how attractive the prospects of investing in Venezuelan oil are.

- The U.S. invested $2.7 billion in companies involved in uranium enrichment. The ProSec drumbeat continues to create investment opportunities.

- Defense stocks were hit when the President suggested restricting compensation and dividend payouts for companies that are behind their targets for delivery. Then they rose when the President suggested the military budget should be increased from $1 trillion to $1.5 trillion (somehow bonds barely reacted).

- Housing had its own mixed bag of headlines. $200 billion to buy mortgages caused mortgage spreads to tighten. The President also tossed out the idea of restricting home purchases to individuals rather than entities designed to buy up housing.

- Closing out the week was the “announcement” that credit card interest rates should be capped at 10%. On one hand, I’ve never figured out how cutting rates by a few bps here and there moves the needle for people at the lowest income rungs, especially the ones struggling with debt. On the other hand (I can play “economist” periodically), the rates are designed so that the card issuers can provide credit to as many people as possible while compensating for their potential credit losses (capping rates will likely constrain credit issuance to the riskiest borrowers).

I’m sure I missed a bunch of other important and potentially market-moving events.

Midterm Elections are Driving Everything

The President is well aware of the importance of winning the midterm elections. He realized that a President without the House of Representatives and Senate on his side, is not in an enviable position.

Look for him to implement policy after policy after policy attempting to secure victory in the midterm elections for Republicans.

- Success in foreign policy will be a key element. From bombing Iran’s nuclear facilities, to capturing Maduro, look for a lot more to occur on this front.

- Affordability is another key issue. The steps on credit cards, housing, and mortgage rates seem to try to address that. Look for more.

- Drugs and immigration will remain front and center. It seems impossible to envision a path that does not include turning our attention, and likely full might, on the Mexican cartels.

- Transactional. Being transactional is not necessarily bad, and in many cases can be good, and certainly more effective than the policy of admonishing and haranguing, which did seem to be how we treated many developing or emerging nations.

If you had “colonization” on your bingo card for the year, you can stop reading now. You were way more prepared than I was. Maybe it is a stretch to call the intentions with Venezuela a form of “colonization,” but at the moment, it doesn’t seem like too much of a stretch.

Even dialing it back, who really had a successful overnight raid to infiltrate Venezuela, to arrest Maduro, and then bring him (and his wife) to the U.S. to face charges as part of their January 2026 outlook? It is interesting to note that given the clear superiority of our military, in terms of equipment, training, and execution, the admin is keen to use it to our advantage, as demonstrated by the recent and effective actions in Iran and Venezuela.

The point we are trying to make is twofold:

- Expect a LOT more announcements on many more subjects than you thought were possible even in your wildest imagination.

- Let your imagination “run wild” with what could come up as potential policy, because for this admin, “out of the box” is the norm and not trying to get ahead of it could cost you.

Anticipating moves and preparing for them will help you make better investment and corporate decisions.

Out of the Box on Interest Rates

On Friday, in Jobs, Housing, and Tariffs, we tried to hammer home the need to take the government’s goals on short-term rates, the 10-year Treasury yield, and mortgage yields seriously.

Back in August, we “thought out loud” about some potential steps to Lowering Yields Across the Curve. At this stage, my only regret is that we didn’t think outside the box enough!

My view on rates is:

- We are not pricing in enough cuts quickly enough. 2 cuts by June rather than 1 is at least my “base” case if not my “worst” case. With Fed Funds effective sitting right around 3.65%, I don’t see how we get to the end of the summer (and the heart of the election campaign) with rates higher than 2.875%. This is not an “economist” view based on “economic” data. It is a view that the admin wants it there and fighting that desire seems to be a recipe for disaster.

- Also, there is so much wiggle room around things like the Neutral rate. For all those arguing that 3 cuts wouldn’t make sense, let’s not pretend that setting rates is a science. It is as much guesswork as science.

- 10s will get below 4%. Sooner than later.

- Mortgage yields will grind lower as spreads tighten (and the 10-year Treasury yield moves lower). 3.75% as a target in Q1 seems high, but that is gradually where I think we will come out.

- On Friday we suggested we were finally ready for 2s vs 30s to flatten. It didn’t do much until about 10am when it went from 135 to close at 128. Look for more flattening, which might make 3.75% too high of a target on 10s.

This is not necessarily the monetary policy I would want to enact. A lot can happen in the economic data to change this outlook (certainly true with the Fast and Furious 47 theme). But at the moment, I’m fighting the market, not the admin (which I think includes the Fed, or will include the Fed more than it has historically).

A "Fun" Fast and Furious Story

I was having a conversation a few years ago with an extremely good financial journalist. We were talking about “trades we missed.” You know the sort of thing you had conviction in but took off too early, got stopped out, or just didn’t have the will to push management to put it on. It was a fun and cathartic conversation.

But he had a story that outdid them all.

A journalist had been assigned by some paper/magazine (I want to say Vanity Fair or The NY Times) to explore “Street racing in Los Angeles.” It was outside the usual beat of this journalist but they went ahead and wrote a feature article about street racing in LA.

According to legend, this overworked and underpaid (only modestly successful) journalist was offered an “immense” amount of money (or what seemed like an immense amount of money at the time) to option the movie rights to their work. At the time, presumably the mid-1990s, $50k for an “option” to do movies about street racing in LA seemed like a great deal.

Fast forward to 2001, when Fast and Furious came out and became a surprise hit, that author had some serious regrets. As the franchise grew to a level very few franchises grow to (think James Bond, Star Wars, Friday the 13th), one can only imagine the thoughts going through that person’s mind.

Not sure this has much to do with today’s T-Report (other than that we all miss investments, in part because we don’t believe enough in them), but I did think it makes for an interesting interlude, before the final segment of today’s T-Report.

ProSec Needs You!

The title of this section should probably read You Need ProSec but that doesn’t go as well with the picture that we have included. We already included a “smattering” of ProSec related news in this report. Venezuela, oil, and the uranium investment. The scope of ProSec is broad enough that it encompasses so much more.

We were just discussing how difficult it was to get traction with our theme of National Production for National Security and Resiliency. After a year of trying to get traction with anything from “Refine, Baby, Refine” to National Production for National Security, we settled on ProSec as an easy way to capture our theme. It was back in August that we officially Launched ProSec.

Since August we have used ProSec in the title of 6 T-Reports and incorporated it into countless others. We have lost count of how many times we’ve used it in the media, but finally, Lisa Abramowitz at Bloomberg can keep a straight face when she mentions ProSec. It has been actually used in some reporting on how to invest under this administration. The grammar police say that I should remove “actually” but I think the use of “actually” connotates some level of surprise, which is relevant in this case. While JPM doesn’t officially call the $1.5 trillion earmarked for certain types of investments ProSec, it certainly seems to fit that quite well.

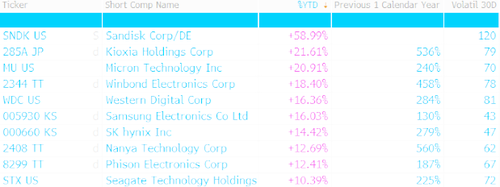

It also doesn’t hurt that two individual stock tickers we mentioned in ProSec 2026 have done extremely well. INTC is up 23% YTD, and BC is up 18% YTD. Pretty healthy increases. Across the board, many of the ProSec sectors and potential stocks (or ETFs) are outperforming the broad market (1.8% on the S&P 500 and 2.8% on the Nasdaq). Our “rotation” theme is also working out well, with the Russell 2000 up almost 6%.

Continuing to build out a portfolio of ProSec linked names should continue to work well.

- A mix of “National Champions” with smaller, very domestic-focused companies should do well. Also, companies integral to the build-out phase, will do very well.

- Processors, refiners, and finished goods manufacturers will likely outperform those further down the supply chain. Yes, the entire chain will do well, but expect benefits to accrue disproportionately to companies that reduce our dependency on China the most. While less dependency on everyone is part of the admin’s goal, those that can address China the best will do the best.

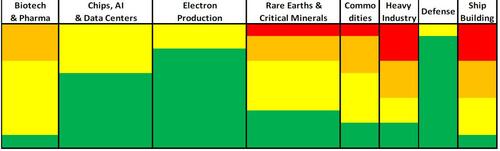

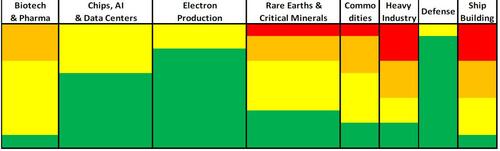

- While the following chart is almost embarrassingly bad, even by T-Report charting skills, I think it is a great way to filter companies in (or out of) the ProSec narrative.

You Need ProSec

Whether you are part of forming government policy (at any level of government, domestic or international), are an investor, or directing the future of your company, thinking about Production for Security and Resiliency is likely to become a large part of your analysis going forward. Might as well start embracing it now, if you haven’t already.

Holy Corporate Bond Market!

The corporate bond calendar started the year at a record setting pace. I’m not sure how people in the bond market had time to breathe this week – between the headlines and the onslaught of new issues!

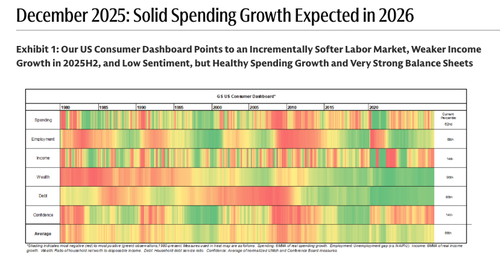

Not only was the supply absorbed easily (deals were oversubscribed, came with little or no concession, and still traded tighter) but also spreads in the secondary market tightened (based on the CDX IG CDS Index and the Bloomberg Corporate Bond Option Adjusted Spread).

Look for credit to continue to be stable and maybe grind a bit tighter.

Still waiting to see how the year evolves for the funding needs of data centers, AI, and energy generation. I suspect for companies that explain their plans, and communicate that they will be cautious on spending if the results don’t warrant spending, the markets will be very receptive.

Those markets will likely include public credit in your own name, private credit (on a project finance basis), and possibly even some larger deals that fall squarely into the “traditional” realm of structured products.

Bottom Line

Two biggest threats to risk markets:

- China decides to respond to more aggressive U.S. actions across the globe by constraining shipments of rare earths and critical minerals. That is their primarily leverage. If they do use that leverage, it will come at the expense of their ability to legally procure U.S. AI and chip technology. I’m watching for any sign that China starts to “slow play” their approval of export licenses and/or the slowing of any contracted shipments.

- Our own politics become so divisive that things cannot get done. Seems like a low risk, but we have seen some movement across party lines in some votes this past week. Keep an eye on that as a risk to the current path, which has been benefitting ProSec.

The “surprise” that could propel risk markets much higher:

- The bond market drifts towards our outlook on rates.

Part of me wishes the current pace of headlines cannot continue, but:

- I do think the current pace of headlines will continue as Fast and Furious 47 is a real thing.

- I probably must admit that I enjoy the pace of headlines and the excitement and opportunities they bring to the markets.

Good luck and thanks again for all your help in 2025 and everything you have done to help us get 2026 going in the right direction for Academy!

Tyler Durden

Sun, 01/11/2026 - 14:00

The U.S. embassy in Caracas on Jan. 9, 2026. Federico Parra/AFP via Getty Images

The U.S. embassy in Caracas on Jan. 9, 2026. Federico Parra/AFP via Getty Images

Greene visited “The View” in November amid the spat with Trump. Lou Rocco/ABC

Greene visited “The View” in November amid the spat with Trump. Lou Rocco/ABC

Recent comments