The transcript from this week’s, MiB: Ben Hunt, co-founder Perscient, is below.

You can stream and download our full conversation, including any podcast extras, on Apple Podcasts, Spotify, YouTube, and Bloomberg. All of our earlier podcasts on your favorite pod hosts can be found here.

~~~

Bloomberg Audio Studios, podcasts, radio News. This is Masters in business with Barry Riol on Bloomberg Radio

Barry Ritholtz: On the latest Masters in Business podcast. What a fascinating conversation. I sit down with Ben Hunt, he writes Epsilon Theory, but he is also the president and co-founder of Persuent. What a fascinating analytic story they’ve put together. They essentially take feeds of everything that’s published around the world, whether it’s in English or Chinese or Russian. They create these large language models and use artificial intelligence to identify rising narratives. In other words, they’re looking for the things that will become storylines, but haven’t quite hit that yet. I I found this conversation to be absolutely fascinating, and I think you will also, with no further ado, my conversation with Persuent Ben Hunt. Ben Hunt, welcome to Bloomberg.

Ben Hunt: Thanks for having me.

Barry Ritholtz: This is long. time coming

Ben Hunt: I love the intro. I gotta have you at all my events. It’s fantastic.

Barry Ritholtz: That’s right. I’m available for hire. I can introduce you at, at weddings bar Mitzvahs. Wherever you’re giving a toast, I’ll be happy to tee you up. This is long overdue. I’ve followed your work for so long. I’m fascinated by both what you put out in your blog, Epsilon Theory, thank you, and which is now a blog and a newsletter and, and the work you do at persuent. We’re going to get to that stuff, but before we do, I gotta ask PhD from Harvard. You were a tenured political science professor. Was academia the original career plan?

Ben Hunt: You know, it’s interesting, Barry. So I, academia was always a, I’ll call it a, a way station for me. It ended up being

Barry Ritholtz: A 10 year way station?

Ben Hunt: 10 years plus grad school.

Barry Ritholtz: That’s a little more than a way station. I

Ben Hunt: A little more than a waste station. But I bet this will be familiar for a lot of your listeners. I always had an entrepreneurial bug. You know, I started my first company when I was in grad school, started another one when I was, when I was a professor. And as I know, you know, a lot of your listeners, viewers know, it is, it is a bug. It’s not a feature.

Barry Ritholtz: Yes, for sure.

Ben Hunt: You can’t help yourself. And academia is not the place to be an aca,

Barry Ritholtz: So let me ask you a question about that.

Ben Hunt: An academia for sure. So I know why I’ve started a series of companies. I can’t work for other people. Why, why did you have that bug? What, what motivated you to say, I gotta get this out into the world?

Barry Ritholtz: I love playing games and solving problems. I have a similar issue about working for other people, which fortunately, academia solves that to a large degree. I mean, you, you are working on your own stuff. You follow your own intellectual bliss in a way that I’ve really never rediscovered. The the problem with academia, of course, is, you know, it’s very, very low stakes. That’s why the academic fights are so vicious, because

Ben Hunt: There’s nothing at stake. Right, right. And, and that that is actually true. That’s actually true. And, and so you learn survival techniques and that kind of jungle where nothing is really at stake, at least monetarily, because the, the goal of any sort of academia conference or presentation, like, is to appear smart. Right? It’s not to actually be smart. You’re not actually listening to a presentation to listen to it. What you learn to do is you’re listening to the presentation the whole time. You’re trying to calculate your head. What’s the most devastating question I can ask?

00:04:07 [Speaker Changed] So you’re gonna rock this guy back on his heels with a devastating, a

00:04:11 [Speaker Changed] Devastating question. And boy, that gets old after a while, Barry, I gotta tell you. Yeah. It, it really does. I, I loved the teaching. I loved the, the research. ’cause like I say, nobody tells you what to work on, but the, the church of academia, the, the actual institution of academia, a it’s for the birds, even back when I was doing it. Right. And I think it’s gotten significantly worse.

00:04:40 [Speaker Changed] I can imagine. I can imagine what’s happening with that. So, but the question that this leads me to is, yeah, you’ve had all these jobs within the world of finance. How did your background in academia shape how you view investing? Risk management allocation?

00:04:57 [Speaker Changed] Barry, starting from academia and then getting into our business of investing, I think it was the best thing that could have happened for me for when I got into it, which was kind of later in life, right? Same, same. You know, after I left academia finally to start a software company. And it, after we sold that software company Yeah. A, a a buddy of mine that I think this happens a lot. A buddy of, you know, you have a buddy who’s in the

00:05:29 [Speaker Changed] Business, Hey, you seem to be pretty smart. How would you like to apply this to

00:05:32 [Speaker Changed] This? We’re always, we’re always talking about company X or technology Y why don’t, you know, why don’t you come in? Let’s, let’s give this a try. So that was my path, if you want to call it a path. And what really sold me on it was that markets, it’s the biggest game in the world

00:05:52 [Speaker Changed] For sure.

00:05:54 [Speaker Changed] And like I say, I’m a game player. I love games

00:05:57 [Speaker Changed] And a game theorist. Let’s, let’s, let’s work down that.

00:06:00 [Speaker Changed] Well, I, I don’t like to talk about that because, you know, because the,

00:06:03 [Speaker Changed] The real game theorists get angry.

00:06:05 [Speaker Changed] Yeah. Well, yes. And, and, and I, I understand I am a real one because that was, that was my field for a while. And it’s a real field and it’s a real thing. But it’s been so trivialized when some talking head will come on. Well, let’s look at the game theory of this. Right? And you just want to just, you know, right. Shoot yourself when somebody does this.

00:06:25 [Speaker Changed] So, so the other part of your research, the other part of your academic focus was on narrative theory. And so let’s talk about how did that focus develop? And, and we will talk a little later about what you do today at Persuent with the narrative machine. But what, and

00:06:46 [Speaker Changed] Believe it or not, believe it or not, it all ties together. I,

00:06:48 [Speaker Changed] I doesn’t don’t doubt that for a second. And,

00:06:50 [Speaker Changed] And it’s

00:06:51 [Speaker Changed] What initially led you down that rabbit hole.

00:06:54 [Speaker Changed] When we think about kind of who’s been an influence on you in your, in your life, had a very influential undergrad professor in political science. And then I had a very influential graduate advisor. Again, they don’t call it political science in, up at, up at Harvard. They call it government or something. Right? Something like that. But, but it’s political science. And, and the reason I say they were influential is that they really got me focused on the science side of political science

00:07:30 And that science side. Yes. It’s kind of some of the typical terrible stuff you see in all social sciences, like economics, where, you know, you’ve gotta learn how to deal with structured data. Right. And, and there was, there was a lot to learn. And I, it’s, it’s worth talking about because I see the same mistakes being made over and over again by people in our business who want to try to, well, you know, apply math to data and, and there are some real pitfalls and some, some real intellectual capital I think that you can achieve within academia that you can then bring in and apply to the, the, the investment world. What,

00:08:20 [Speaker Changed] What we’ve certainly seen amongst the quants, a very successful application of math theory to data. The, in fact, some of the best performing hedge funds are quantitatively driven. That’s not where you’re going.

00:08:37 [Speaker Changed] Well, it’s, it’s part of where I’m going. Right? So, so there, there, there’s a transition in all of all of the sciences, honestly, but certainly the, the social sciences where, where, yes, you start with numbers, structured numbers, right. Price over time, you know, things you can calculate and measure as those numbers. But what was clear immediately in politics, and I think has become increasingly clear in the world of investing, is that it’s not just the numbers that you get on your Bloomberg terminal, it’s also the words and the stories and the narratives that are told to us. Politicians have known this forever, right? So the story of politics is the story of people suggesting laws or policies and then having to present it in a way that gets them elected or keeps them in power or whatever that is. So there’s always been a focus, I’ll say more of a focus in political science than in economics with words. Economics is almost seen as a, as a sideline. Right? It, it’s somehow lesser than the numbers. Right. So what, what I was kind of early on was applying the same techniques that we have for understanding, you know, matrices and structured data, but applying it to unstructured data, which, you know, full circle, this is at the heart of all of the generative AI and the, the AI that we have today.

00:10:28 [Speaker Changed] Well, you’re, you’re getting way ahead of me now with generative ai. We’ll circle back to that. Yeah. But, but

00:10:32 [Speaker Changed] It’s all the, the math has not changed. Right. In 35 years since I started working with network math around unstructured data. I mean, we, we didn’t call it natural language processing back then, and we didn’t call it, you know, large language modeling, but that’s exactly what we were doing.

00:10:53 [Speaker Changed] So what was, what was the moment or the catalyst for you to say, Hey, I’m working in all these other areas, but the narratives continue to pop up over and over again on all sorts of different data sets. And I think in the financial markets, I can use a, a novel approach to identifying narratives and anticipate where the market’s going. What, what led to that sort of in insight,

00:11:25 [Speaker Changed] Not the, not the Great Recession, right? But the aftermath,

00:11:30 [Speaker Changed] Meaning the 2010s following the great financial crisis,

00:11:34 [Speaker Changed] Starting in, in, in 2009, and the recovery that we had out of 2009, and in particular when Win Ben Berke and the Federal Reserve move towards a very explicit effort to use their words to impact markets.

00:11:53 [Speaker Changed] So let’s talk a little bit about that. ’cause I have some really specific memories of the low, of the, the runup afterwards, all the noise Yeah. That was going on. Some of the phrases that have come out of that era, like financial repression and other such things are, are just the tip of the narrative iceberg. So, so walk us through your insight. It’s 2009. Yep. The market bottoms really kind of a v bottom and took off from that. What was that, March 9th, March 7th, something like that. Yep. Oh nine. And there was no turning back. What were you seeing? How were you integrating that into a concept of let’s identify narratives in order to anticipate market moves? Well,

00:12:47 [Speaker Changed] So I was co-founded a, a long short fund inside of a, a larger asset manager going back in oh five and oh 5, 0 6, 0 7. We did well, like everyone else did. Well. And then in oh eight we did great.

00:13:08 [Speaker Changed] Really? In oh eight, we did great. Oh eight, I think I wanna say s and p down 37% something. Yeah. We

00:13:12 [Speaker Changed] Were up 20 something net.

00:13:14 [Speaker Changed] Anything in the green, not in the red is

00:13:16 [Speaker Changed] Smith. Yeah. Amazing. And, and now I’ll tell you, and we can come back to this, like, the real question you should ask is that given what we believed, why wasn’t, why weren’t we up 40%? That, that’s actually, that, that’s actually a question you can ask. But

00:13:33 [Speaker Changed] I I’m, I’m gonna say a 47% relative price swing. I, I, I’ll take,

00:13:39 [Speaker Changed] Had a, had a, had a great year in oh eight and, and

00:13:42 [Speaker Changed] Did that continue in oh nine

00:13:45 [Speaker Changed] Flatlined.

00:13:46 [Speaker Changed] Alright.

00:13:47 [Speaker Changed] From oh nine, so from March of oh nine. So we did well in January 1st quarter, February and the first quarter, right. The rest from, from March of oh nine, our returns flatlined. So we never, we never lost money for our clients in our fund. But

00:14:01 [Speaker Changed] You didn’t catch that recovery. That

00:14:03 [Speaker Changed] V did not catch the recovery. Absolutely did not. And the, the recovery was interesting, right? You’re, you’re right. There was a v but there were, there were starts and stops to it. So the, the big move up from the bottom in late March going into April, it’s like, all right, that actually we caught a little bit of that and that that made sense, right? There was a second leg to the rally. Oh, for sure. April, may. And then in June, in June, June to October was a ferocious rally.

00:14:39 [Speaker Changed] Ferocious is the right word, but,

00:14:40 [Speaker Changed] But June in particular was a classic crap rally.

00:14:45 [Speaker Changed] Right. Meaning it was a low

00:14:46 [Speaker Changed] Quality, right. Low quality stuff. Right. The, the end of March going into April rally, it was Right. This makes sense, right? We bottomed fed the June rally. No, no, it was, we didn’t, we didn’t touch any Oh,

00:15:03 [Speaker Changed] That’s a, that’s fascinating. Go back,

00:15:05 [Speaker Changed] Go back and look at it. Right? I, and, and let me tell

00:15:07 [Speaker Changed] You, oh, I don’t, just so you know. Yeah. I, I have a vivid recollection of chatting with Jim Bianco about this, and we were both bullish, but for completely different reasons. To me, anytime US equity markets are cut in half, I’m a buyer and people say 1929, I’m like, great, you gotta go back a century to find the exception that proves the rule. But Jim was early on in the Tina trade, Hey, the Fed has made everything cash, trash bonds are, they’re forcing you into equities, which is what led my post, which everybody stole the line. This is the most hated bull market in history. Yeah, yeah. And I, I wrote that up. I send that out and I heard everybody borrow that. But I’m curious as to where the June rally took you. Well,

00:15:55 [Speaker Changed] This, and this is where I’m going about the role of forward guidance in Jim Bianco’s point about, because what the Fed did wasn’t just it’s policies around interest rates, you know, they took them to zero. And that’s where we stayed,

00:16:16 [Speaker Changed] Started buying mortgage backs and they did

00:16:19 [Speaker Changed] Qe, balance, balance sheet operations. Right, right.

00:16:22 [Speaker Changed] Quantitative easing,

00:16:23 [Speaker Changed] Actual, you know, actually, and I look, I, I think QE one, I think it saved the world. This

00:16:28 [Speaker Changed] Is what, right. And what was that? A trillion dollars something crazy.

00:16:31 [Speaker Changed] Something. Yeah, something something.

00:16:32 [Speaker Changed] 800 billion, something

00:16:33 [Speaker Changed] Something like 800 billion

00:16:34 [Speaker Changed] Unthinkable number.

00:16:35 [Speaker Changed] So I, I think that, so those were specific actions took, but, but even if you, people often say things when they’re leaving office. So, so Bernanke’s last speech is valedictory address.

00:16:48 [Speaker Changed] Right. More honest than intended.

00:16:51 [Speaker Changed] Much more so, and you see this all the time, right? George Washington leaving office.

00:16:55 [Speaker Changed] I was gonna say, I,

00:16:55 [Speaker Changed] I, I, Eisenhower Yeah.

00:16:57 [Speaker Changed] That’s a big,

00:16:57 [Speaker Changed] I mean, when, when, when, when freaking Eisenhower warns you against the defense industrial complex. You know, you might, you might. I’m just saying. No, I won’t listen.

00:17:06 [Speaker Changed] It’s general like to you. That’s

00:17:08 [Speaker Changed] Right. General, like to me, what Bernanke said when he is leaving his terms of office, he said, look, we had, we had two toolkits. One was traditional stuff, interest rates down to zero. At the time we didn’t know we could have negative interest rates. So, you know, that’s where we were. Right. Second were the balance sheet operations, large scale asset purchases, qe, quantitative easing. It said, you know, QE one was great. Did what we hoped it would do. QE two, eh, operation Twist, QE three, this is Bernanke saying, mind you. Yep. He says, I actually think that might have been a little counterproductive,

00:17:47 [Speaker Changed] Huh?

00:17:49 [Speaker Changed] They said, but we had another toolkit, and that was our communication policy. That was forward guidance, that we started using our words not to communicate to the market what we actually felt. We started using our words and coordinating our words to change the market, to change market behavior. This is what I mean about making a conscious effort to tell a story. And it, it’s not that it was necessarily lying, but they, they were using their words and choosing their words for effect

00:18:28 [Speaker Changed] To shape perception of their underlying

00:18:31 [Speaker Changed] Behavior to market, to, to shape market behavior. And he said, that worked better than we had any hope that it could. And that’s where we are now.

00:18:42 [Speaker Changed] So, so for the youngins listening, I have to point out, and you and I are old enough to remember back in the days where there were no minutes released there, there wasn’t an announcement, forget a press conference. You had to be watching the bond market to figure out what the Fed just did. Like today, there’s, we’re holding the, having this conversation. There was a fed the October meeting, a quarter point rate, cut a conversation about all sorts of stuff. I really didn’t pay a lot of attention to it. Yeah. Lack of clarity, no data, blah, blah, blah.

00:19:20 [Speaker Changed] Worse than that, Greenspan would be intentionally vague and obtuse.

00:19:25 [Speaker Changed] If you understood with you’re saying what I said then, then you misunders you misinterpreted it. Right? Exactly.

00:19:30 [Speaker Changed] Right.

00:19:30 [Speaker Changed] If you think you understand what I’m saying,

00:19:33 [Speaker Changed] You know, who led the committee to make all that change? Janet Yellen, she was vice chair. Yep.

00:19:39 [Speaker Changed] Back, back in, during the financial crisis. Yeah.

00:19:41 [Speaker Changed] So this was, it was a concerted effort. Bernanke Yellen to this is when they also started going, putting all the Fed Governors on a common calendar.

00:19:52 [Speaker Changed] Right?

00:19:53 [Speaker Changed] Follow all the, and assigning the fact, okay, you’re gonna speak this day, you’re gonna speak that day. That’s when all this started. It was an intentional effort. And again, this is something that politicians have known forever, right? Politicians craft the message and use their words. So I, I knew the, the tools to try to understand this, but what I wasn’t prepared for was how, and neither was Bernanke, was how powerful this would become to the point where today it’s not just central bankers using their words as their main policy toolkit, but it’s every CEO it’s every CEO Now, I mean, you go on this network or one of the other networks, and what makes for a good CEO is can you tell the story? Can you tell the narrative of your company to get a multiple, right? Because, because a multiple is a narrative. A multiple is a story.

00:20:52 [Speaker Changed] They’re

00:20:52 [Speaker Changed] All stories. Well look at,

00:20:53 [Speaker Changed] Look at some of the most successful CEOs throughout history. I would throw Jack Welch into that pile. ’cause he was a fabulous, fabulous. Yeah, he was a fabulous, fabulous. ’cause the stories he told were great, right? Up until the point where we found out that he was running a, a, a hedge fund with GE Capital, and they magically always beat by a penny.

00:21:17 [Speaker Changed] So I remember vividly when GE was coming to our shop, what they wanted was a fin a financial multiple, right? So they were making, they, they wanted,

00:21:33 [Speaker Changed] Even though they’re an old world industrial,

00:21:35 [Speaker Changed] Even though they’re an industrial, this, that this was, they wanted to tell a story that they should be seen as and get the multiple of a financial, that’s what GE was all about in those years leading up to the, the, the GFC. So a, my, my poster child for this is, is Mark Benioff Salesforce, because he’s pri you often see this with people who come out of sales like, like Mark did, right? But

00:22:08 [Speaker Changed] The way it’s all about storytelling.

00:22:10 [Speaker Changed] It’s all about storytelling. And

00:22:13 [Speaker Changed] What isn’t that true for go through the great, see, look, Steve Jobs, Reed Hastings, Larry Ellison at Oracle to some degree, Steve Ballmer at Microsoft, who wasn’t a great CEO, but he was a great cheerleader story, and a great storyteller, great

00:22:32 [Speaker Changed] Storyteller. What all of those companies have in common is that they’re great storytellers, and those are trillion dollar companies today. Right. What I would say to you is that you don’t remember or hear about the companies that did not have CEOs who are great storytellers.

00:22:51 [Speaker Changed] Well, Ken Lay was a great storyteller until you found out that it was all nonsense. And you could say the same thing about folks like Bernie Madoff.

00:23:00 [Speaker Changed] There are a lot of stories that get told that are not true. Right? What, and and I think even today, people think of this word narrative. They have a pejorative sense to it. It’s like,

00:23:15 [Speaker Changed] Oh, really? Really? That’s interesting. I didn’t think of it that

00:23:17 [Speaker Changed] Way. Oh, for, for, for, for for sure. That’s just your narrative, man. You know, the Big Lebowski, you know, that’s, that’s the, and it’s not that a story is a lie. It’s that the story is constructed for effect. It’s, it’s not, and it’s presented to you as if this is my true and inner thoughts, but the construction of the, the intentionality behind these stories, phenomenal. Benioff, for example, you know, created the metrics by which he wanted Salesforce to be judged. Not metrics of profitability, but metrics of what he called proforma, net revenue growth, whatever the hell that means. Right? Right. And because if you can construct the story, you can construct it in a way that, yes, I can beat and raise pretty much every quarter. So there was, there were three, I think, big changes that happened to make the role of narrative overwhelming as it is today. Whereas before, it’s always been there. To your point, it’s always been there today, it’s overwhelming. And, and I think it’s, it’s not just the success that first central bankers and then CEOs. I mean, wall Street’s the greatest copying machine. We Wall Street copies what works. Sure. So when you see that something’s working, oh, they’re, they’re getting a multiple by telling the story and going on Kramer, you know, four times a

00:24:50 [Speaker Changed] Year. It’s endless. It’s endless iteration. You’re just constantly tweaking it, doing works. And if it works, do more of it. And if it doesn’t, toss it out. So

00:24:58 [Speaker Changed] It was the, the fact that it works to tell a story and people got good at telling stories. It’s the growth of 24 7. I’m gonna use air quotes here and I’m glad we’re taping this news. Well,

00:25:11 [Speaker Changed] It’s media, social media news right

00:25:13 [Speaker Changed] Now.

00:25:14 [Speaker Changed] News, like news light.

00:25:16 [Speaker Changed] That wasn’t the case.

00:25:18 [Speaker Changed] So I wanna I wanna annotate what you said slightly. Okay. Because I think CEOs have always been storytellers, but they were storytellers to their boards, to their employees, to their shareholders. Correct. They always, the, you’re hitting now on the modern world of 24 7. Media telling a story in a boardroom is very different than sitting in a TV studio and talking about, Hey, here’s why our new chip is gonna catch up to Nvidia. Yep. And it’s the greatest thing ever. Yep. That’s a different skillset. It

00:25:52 [Speaker Changed] It changes the time horizon. It is a very different skillset because you’re not telling the story of, oh, I’m getting another, you know, turn of leverage in our operations, or, you know, our capacity utilization in this factory went up by 5%. Which are the kind of stories you would tell even on earnings call or certainly to a board. Now, this is the story where got a

00:26:16 [Speaker Changed] Gotta gotta

00:26:17 [Speaker Changed] A little bit. You, you’re, you’ve got a segment, you’re going on, Kramer, you got four you minutes and say bye bye bye. You got at most four minutes. Right? Right. How are you gonna tell that story that sings to that audience? Enormous change, change, structural change in our media, both quote unquote news media, but also financial news media. The Wall Street Journal today is a 24 7 news, financial news organization. Right.

00:26:47 [Speaker Changed] What, what isn’t It’s printed New York Times, Bloomberg, the Washington Post. Exactly. They all have websites that get updated around the clock.

00:26:54 [Speaker Changed] And here’s the thing, there’s not enough hard news to fill the time or to fill the space. So what takes the space opinion

00:27:04 [Speaker Changed] Story you were channeling

00:27:05 [Speaker Changed] Story takes the place of

00:27:06 [Speaker Changed] The hard, you were channeling Michael Creon from 25 years ago. Most of what you see in the media is speculation, opinion, and theory, not news. I,

00:27:18 [Speaker Changed] I’ve written so much about Creighton and his

00:27:21 [Speaker Changed] I know. That’s why I threw that back to

00:27:22 [Speaker Changed] You. He says he, he was, he was so far ahead

00:27:25 [Speaker Changed] This quarter century ahead of what, of what took place.

00:27:28 [Speaker Changed] And there’s a third piece though,

00:27:31 [Speaker Changed] Give us the third piece before we go to our next segment. Third

00:27:34 [Speaker Changed] Piece has changed. Everything is our smartphones

00:27:37 [Speaker Changed] That you walking around with. Right? Not only a studio, but a, a a a, a dopamine device that you’re constantly playing.

00:27:46 [Speaker Changed] It’s my dopamine machine, right. And I, we do it to ourselves. It’s not that someone forces us to hear these stories over and over again. We do it to ourselves. I mean, I get a little nervous if I, you know, pat, where’s my phone? Where’s my phone? That’s right. That’s right. I, I get a little nervous. And it’s a, it’s, it is absolutely a neurotransmitter addiction. I think it’s so important to keep that from our kids. That’s a whole nother thing.

00:28:17 [Speaker Changed] There’s a whole depression situation with teenagers today, and it all traces back to the phone and social media.

00:28:22 [Speaker Changed] These are three, I think, real secular changes we’ve had. Markets become this political utility, the success of constructing a story, structural changes in social media, and the devices that we insist on caring with our ourselves all the time,

00:28:46 [Speaker Changed] Huh. Absolutely Fascinating. Coming up, we continue our conversation with Ben Hunt, president and co-founder of Perent, explaining how he’s using AI to identify narratives in real time. I’m Barry Ltz. You’re listening to Masters in Business on Bloomberg Radio. I am Barry Ritholtz. You are listening to Masters in Business on Bloomberg Radio. My special guest this week is Ben Hunt. He is a academic fund manager, risk manager, entrepreneur, tech startup person. He is currently co-founder and president at persent, which applies AI tools to map and measure market narratives in real time. It’s really more than market mar narratives. It’s politics, it’s economics, it’s markets. You cover a whole lot of stuff. A

00:29:51 [Speaker Changed] Hundred percent. So what we’re able to do today, and this is the crazy change in the world back from when I was doing this on microfiche back in

00:30:02 [Speaker Changed] The

00:30:02 [Speaker Changed] 1980s. Yeah, exactly. We get, we have access to everything that’s published publicly in the world. And there are a couple of big data aggregators, Dow Jones, one LexiNexis another, everything that gets published in the world, all these languages, it’s available to you. And it’s, it’s not cheap, but it’s not crazy expensive like it used to be. And it’s always getting cheaper. So we’re able to take everything in the world that gets published, all the newspapers, all the websites, all the transcripts, everything that’s published publicly, we can pull in and then we can process it, process it with really, it’s the same math that I was using 30 years ago. Nobody’s invented cold fusion here,

00:30:55 [Speaker Changed] But the software tools are faster, stronger, better,

00:30:59 [Speaker Changed] And infinite. So the, the, the calculations here are not particularly complicated, but you have to do them at enormous scale.

00:31:08 [Speaker Changed] It’s, it’s a ton of volume. So,

00:31:10 [Speaker Changed] I mean, it’s crazy. The, the, just the, the scale of

00:31:15 [Speaker Changed] The numbers. Petabytes, terabytes just crazy.

00:31:17 [Speaker Changed] I mean, yeah. In the last couple of months we’ve processed over 200 billion tokens. Billion,

00:31:25 [Speaker Changed] Right. And a token is how much

00:31:26 [Speaker Changed] A, a token is like a word or a phrase. Okay. And so that’s the kind of the unit that you talk about when you’re putting through, when you’re putting something through a linguistic calculator. So 200, which is, which is what all of the, the

00:31:41 [Speaker Changed] LLMs,

00:31:41 [Speaker Changed] All the LLMs are, they’re linguistic calculators. And so, you know, we’ve processed, you know, several hundred billion tokens. Again, it’s not complex, but it is at scale. And what, what we’re doing with that is we’re reading the world’s news to understand the world’s stories and narratives. And you’re right, it’s, it’s much bigger than, or it’s much more focused that we have much higher resolution than just saying, oh, I’m bullish on financials. I mean, that’s a, that’s a narrative. Sure. Right.

00:32:20 [Speaker Changed] But

00:32:21 [Speaker Changed] There are 20 different variations of that. You’re, you’re bullish on financials. Why?

00:32:27 [Speaker Changed] So wait, let me, let me, you,

00:32:28 [Speaker Changed] And we can track all those, we can track all those stories and how they wax and wane over time. That’s really cool. So

00:32:32 [Speaker Changed] Let, really cool me roll back to, I want you to explain what Perent is. Who are the clients? I don’t mean names, but No, sorry. What type of of clients do you have and, and what do they do with Persian’s output?

00:32:47 [Speaker Changed] So we started Persent in 2018. My partner from, we were at a, a asset manager spun out there to take the, the technology that I’ve been working on for years and, and really been writing about with Epsilon theory. So we started that in 2018 to do the, the basic research into processing enormous amounts of financial news data and to track the stories and how they rise and fall and wax and wane over time. Is that, that was, that was the story. That was the

00:33:25 [Speaker Changed] Goal. So I, I love that description because there are a lot of trades going on where the storyline changes on a regular basis. Probably the Mac daddy of that is crypto first. It’s, Hey, you know, there’s fiat currency, this is outside of the system, it’s defi, then it’s a hedge for deflation, then it’s a hedge for inflation. Now it’s scarcity and,

00:33:51 [Speaker Changed] And digital gold. Right? Digital

00:33:53 [Speaker Changed] Gold.

00:33:53 [Speaker Changed] It’s, it’s, there are no fundamentals, right? With, with, with crypto. And I people will say there are, but there aren’t. Right? It’s, it’s driven by the waxing and waning of stories. And do, do they find purchase? Do they or do they kind of, people get tired of them?

00:34:11 [Speaker Changed] Well, they got tired of the defi story. And then once JP Morgan and BlackRock started creating, like, the Ibit is the fastest ETF to a hundred billion dollars. And so the old story of Defi is gone. And the new story is, oh no, this is an asset class at Wall Street’s embracing. That’s why you have to own it.

00:34:32 [Speaker Changed] That story, that story was, and very, that was a very similar story by the way, or a transition story from physical gold to GLD when that ETF came out. Right. Which was a very similar pattern because once it became a Wall Street, a, a table at the Wall Street Casino, right? Then it takes on a different meaning specifically around gold. Gold changed from being, okay, something that you bury in your backyard or you’re having your vault, you know, along with ammo and seeds for when the, the, the hard times come

00:35:11 [Speaker Changed] Bottled water, right? Bottled meals ready to eat, right, gold and lead. It

00:35:15 [Speaker Changed] Becomes a security. And its meaning changes from that, you know, apocalyptic bottled water. Right? And the meaning of gold today is as an insurance policy, a security against central bank error or government error. That’s the meaning of gold today.

00:35:35 [Speaker Changed] And is that the dominant narrative that you’re identifying as gold rallied over through 4,000? Ab

00:35:41 [Speaker Changed] Ab Absolutely. So, I mean, we’ve really been able to track that one in

00:35:46 [Speaker Changed] Specifically. So, so here’s the really big, here’s the million dollar or trillion dollar question. How do you identify a narrative and say, oh, gold is gonna double from here based on this narrative? Or, or are we not there yet?

00:36:00 [Speaker Changed] No, you, you identify the narratives. ’cause the narrative, the stories don’t ever change, right? So the, the story that leave gold aside for a while, think about you we’re talking about your bullish on company X, Y, Z because there are about, I don’t know, depending on how, again, how finely you want to resolve that. There are only about a dozen stories for why you’re bullish on something, right? They can be management change, top line growth, opportunity consolidation in the industry,

00:36:35 [Speaker Changed] Upcoming catalyst,

00:36:36 [Speaker Changed] Catalyst. So, so every catalyst story, new

00:36:38 [Speaker Changed] Products, new product, FDA’s gonna prove the new mo, new drug, new molecule.

00:36:43 [Speaker Changed] So that story, you just change the name. That’s the same story that’s repeated over and over again about any pharma or, or, or biotech company. The stories, we think that they’re amorphous and variable. The fact is that the, the core of the story, what we call the semantic signature, the meaning of a story, they’re amazingly constant over time. So what we’re looking for is for, and it’s, it could be dormant for a long time, but what you want to know is when that story starts picking up again, when someone starts playing that story, when it appears on Kramer and starts happening in the financial press, that’s the stuff we can pick up with real precision. So it’s both the stories that are starting to fade,

00:37:41 [Speaker Changed] But,

00:37:42 [Speaker Changed] But the, I think the really interesting stories are the stories that have been dormant for a long time and they start picking up again,

00:37:48 [Speaker Changed] You, you are reminding me of Campbell’s hero’s journey, that there’s only so many

00:37:54 [Speaker Changed] My hero, right? There are only so many stories Right. In the, in, in the world. And that, that’s a now I like to talk about in Hollywood, famously there are only like five scripts.

00:38:08 [Speaker Changed] That’s right. Right?

00:38:10 [Speaker Changed] Tolstoy is supposedly Tolstoy. He said there were only two stories that a man goes on a journey or a stranger comes to town. Those are the only two stories in the world. And

00:38:20 [Speaker Changed] Not quite, but he’s, he’s

00:38:21 [Speaker Changed] Not quite but you on, he’s pretty close. You’re on the right track.

00:38:23 [Speaker Changed] Right? Right. The

00:38:24 [Speaker Changed] The point is, there’s a finite number of stories, right? You can drill down. So you can get a couple of dozen about any sector you want to talk about or like, but it’s, it’s a finite number. And so what we do, and what I think is really interesting is to track that finite number of stories. And you’re right, it’s not just around markets. We track several thousand of these stories today.

00:38:50 [Speaker Changed] How so? Let’s, let’s delve into that. Yeah. So, so how do you, you have this massive database you’re sucking in every news feed. Yep. Everything magazine, newspaper, everything. Anything that you could quantify and, and run into a linguistics model. What’s the process for analyzing this? How to use artificial intelligence to, to go through this, and how do you make sense out of that heap of how do you find signal amidst all that noise?

00:39:23 [Speaker Changed] The crucial thing is you can’t just ask AI an open-ended question. Say, what are the narratives in Right? This comp for this company or for this sector? Don’t do that. Right? And this is a mistake that people make all the time. They ask open-ended questions of chat, GPT or or or whoever. The problem is chat, GPT will give you an answer.

00:39:45 [Speaker Changed] Just not a good one.

00:39:47 [Speaker Changed] Not a good one. It’ll hallucinate a lot. Yeah. Right. It’ll go out, it’ll find its own data. The, the secret to to using AI successfully is to take this magic genie because it’s a magic genie and you stuff it into that bottle, right? You do not let it out. You constrain it dramatically. You don’t let it go out and find data. You give it the data crucial thing. You don’t allow it to think. You tell it how to think. So the, the most important step that we do is we don’t ask ai what are the narratives that you look at? We tell it this is human direction. You have to have human control.

00:40:31 [Speaker Changed] So I’m hearing dataset is controlled by you as well as the thinking prompts. The seman.

00:40:39 [Speaker Changed] Yes. And it’s more than prompt, right? So the, it it, it includes prompt. But the, the phrase that’s used in this world is called not prompt engineering, but context engineering.

00:40:53 [Speaker Changed] Okay. That makes sense.

00:40:54 [Speaker Changed] So you want to, you want to control everything around the ai because you want to limit it to being that linguistic calculator. You want it to be your operating system. That’s really the way, the thing. And, and if you do that, then it will give you the same answer twice for the same inputs and the same question. That’s the crucial thing. So it’s

00:41:18 [Speaker Changed] Consistent

00:41:18 [Speaker Changed] For this to be true for, for it to be consistent, for it to be real signal. So this is a human directed process. You can’t ask AI an open-ended question. You have to control all the inputs. You have to control the output, meaning you judge it, you run it back through a different AI system to say, how’d they do? Did they go off the rails here? But the most important thing is you have to give it the scaffolding. You have to give it the, the skeleton. You have to tell it. These are the thoughts you are allowed to think about. You know what, and those are the, those are the, the signatures.

00:41:53 [Speaker Changed] I, I’ve kind of learned, I have to avoid asking questions that have a, a, a human emotional subtext. Like, tell me what was most surprising about this? Doesn’t know what a surprise is. Tell me what was most interesting about this. It does, it’s not able to do that. You really have to treat it like it’s a dumb machine.

00:42:18 [Speaker Changed] Well, that’s right. This is why, I mean, you treat it, you, you need to treat it as an operating system. You need to constrain every bit about it, particularly in how you allow it to think because it wants to please you so badly, right? It does. So if you ask it, what’s interesting, it will look back at its history of communication with you, and it’ll think, what will Barry find interesting? And it will give that answer to you. And if it can’t find it easily, it’ll make it up. It’ll make up an answer that you will find interesting.

00:42:48 [Speaker Changed] I, I find when I, I, I try and prompt, Hey, tell me about Ben Hunt’s background and gimme the timeline of his career that it’s good at. Hey, what was Ben Hunt really good at? It has, has got no idea.

00:43:04 [Speaker Changed] So what, what you’re able to do, if you’re able to, again, put the genie in the bottle, tell it how to think about a problem, is you’re able to identify, and this does go back to the work from 35 years ago, the type of stories we tell that we humans tell the, the about stocks or politics. We tell two types of stories. We tell descriptive stories. Oh, the, you know, the fed cut rates by 25 basis points today. A descriptive story. But, and we can also tell the description of the, you know,

00:43:45 [Speaker Changed] It’s the because clause, because we’re seeing slowing increasing layoffs and slowing consumer terms.

00:43:53 [Speaker Changed] And, and that’s high resolution and dec and, and very descriptive, right? The, the Powell was surprisingly hawkish today. And he was, that’s a description. There’s another type of story we tell Barry. And that’s prescriptive,

00:44:13 [Speaker Changed] Meaning,

00:44:13 [Speaker Changed] Meaning the Fed should be hawkish. The Fed should cut by 25 basis points. Those are the stories that are indicative of an effort being made to move public opinion in a certain direction.

00:44:33 That’s like the forward guidance that the Fed still does, right? Using their words for effect. They’re using words to nudge you and how you should think about the world, how to think about the world. So the crucial thing when we’re doing these, when we’re asking the AI to here’s, here’s all the text in the world, here are the stories that we want you to identify. We can also boil that down into identify the stories that are trying to tell the reader how they should think or how policy should go that we find has a lot of predictive capability to it.

00:45:18 [Speaker Changed] So you are in the business of analyzing the world’s narratives every day. How is that even possible? It seems like that is an impossible

00:45:29 [Speaker Changed] Test. That’s seem crazy.

00:45:30 [Speaker Changed] Crazy, right?

00:45:31 [Speaker Changed] And, and, and it used to be, it used to be crazy. I, I mean, Barry, I I really do remember my, in the academic days, I would literally hire grad students and give them a cup of dimes. So they go down to the microfiche machine.

00:45:46 [Speaker Changed] I remember those machines in the library. You

00:45:47 [Speaker Changed] Remember those

00:45:48 [Speaker Changed] Machines? Yes.

00:45:48 [Speaker Changed] Yes. You remember those machines? I would code, hand code the, or hand record the coded data. I would type it into remote access for a digital equipment mini frame. And the next day, you know, something would churn out for me. Right? Today it’s, I say we are, we’re processing hundreds of billions of tokens. We get millions of documents overnight like that.

00:46:16 [Speaker Changed] Is there there

00:46:17 [Speaker Changed] Any, is there infinite computing resources available to us? I,

00:46:20 [Speaker Changed] Is there anything you can’t access that you wish you had access to any data source?

00:46:28 [Speaker Changed] So one of the things that’s happened on Wall Street is that the banks and the sell side have become very jealous of their publications because they tend to think in their wrong that they’re good at it. Right? They’re that they’re good at analysis. I personally don’t think they are. Well,

00:46:49 [Speaker Changed] Let, let’s just say some are better than others. Some

00:46:52 [Speaker Changed] Are better than others, but, but none of ’em are really, if if they were, if there was, I’ll call it kind of significant alpha there, they wouldn’t be a bank.

00:47:04 [Speaker Changed] They’d be a hedge fund.

00:47:05 [Speaker Changed] Yeah. They wouldn’t be a ba on the, on the sell side. Now, so I’m interested in reading the sell side research, not because I think there’s some nugget of truth in there, but because I wanna see what they’re all talking about,

00:47:17 [Speaker Changed] Right? It’s reflective of, if not a consensus. Yeah. Certainly a a popular set of ideas.

00:47:24 [Speaker Changed] And, and this is a crucial thing to talk about what we do. I I don’t know what the truth is, right? I have

00:47:31 [Speaker Changed] No idea. Does it matter?

00:47:32 [Speaker Changed] And I don’t think it matters. I I want to provide this information to people who do have a view on the truth. Let’s say you’re a, you’re a value investor, right? You’re running a fund, you’ve got your views, you’ve done a, your homework, you’ve done your research,

00:47:47 [Speaker Changed] You’ve got a good back test. Yeah.

00:47:49 [Speaker Changed] You, yeah, yeah. You’ve got, so I’d say I’ve got, here are the companies where I think I’ve identified something special, something that’s valuable that the market does not recognize. And so I wanna buy it, and then I’m just gonna wait. I gotta wait until one day the market realizes the market comes to their senses and says, oh, wow, that should trade at a higher multiple or a higher price. Because that special thing that you saw, that source of value, the rest of the world comes to see that. Well, what I can think I can show you is when the rest of the world starts to wake up to whatever it is you’re looking for.

00:48:31 [Speaker Changed] So you’re catching the early lift off the bottom. That’s the

00:48:35 [Speaker Changed] Goal. I see. When the, when, when a value investment only works, when the market recognizes it. And we are tracking when something like that gets discovered by the market.

00:48:46 [Speaker Changed] So before Nvidia is 5 trillion, when it, when it starts ramping up to 500 billion, hey, something’s going on here.

00:48:57 [Speaker Changed] What I have found in my experience as an investor is that you make the most money on a trade during what I call the discovery phase of a trade. When the rest of the world wakes up to something that you had noticed and identified before, that’s when the money is made. Once it gets out there,

00:49:19 [Speaker Changed] Then it’s reflect then the, the market be ev is eventually efficient.

00:49:23 [Speaker Changed] It’s a different, it is a different risk and reward profile. Let me, let me put it that way. Fair. You, you, you get, you get a lot more ups and downs post that discovery phase than you do when you’re enjoying the discovery phase. It’s a lot harder. Once you have the, now you may say, oh, but there’s gonna be this other catalyst. And then say, well,

00:49:45 [Speaker Changed] But that, that discovery phase is, I’m gonna quote Doug, Cass, that’s the, there’s a phrase he uses it, it’s like a, a contrarian perspective. A variant perspective where a perspective, you have some insight that is not widely held. Right. And the market being mostly kind of sorta of eventually efficient if there’s a truth or at least a good story in your variant perspective, all

00:50:15 [Speaker Changed] It is a story, right? All it takes is a story. It’s

00:50:17 [Speaker Changed] Gotta be a good story though. Yeah.

00:50:19 [Speaker Changed] It’s gotta be a, well, I’ll call it, it’s gotta be a compelling story, right? Right. And that’s, that’s why you are looking for a CEO who can tell that compelling story. You’re looking for the ability to tell a compelling story, because that is what gives you a multiple. So let me multiple is story.

00:50:37 [Speaker Changed] So let me ask you a few more questions on, on Perent before we go into a few other areas. Sure. So first, you, you’ve been doing this for seven years. What are you doing today? That was unimaginable 4, 5, 6, 7 years ago.

00:50:54 [Speaker Changed] I, I tell you something that was unimaginable really two years ago. That’s amazing. And that is the ai. So what we were doing in our early days, we were basically doing small language models. We were making the language models essentially by hand. And, you know, we did our first models and our first versions of this, and we licensed it to some big banks. And here’s the problem, Barry. We, we had constructed a net and it was a pretty good net. I mean, when we would dip it into a data stream, we’d catch a fish meaning a signal. And the signal, oh, that, that signal works. You know, good, good. Hit on the, the signal that we put up. The problem was we were missing too many damn fish, right? Our, our net was too small. And we’d say, oh, we got this one. And then we’d look back at whatever it was.

00:51:46 We were designing the model. So we say, well, how did we miss all these other fish? And the answer was the small language model we were constructing. It’s incredibly complex if you are building these models without the probabilistic approach that modern LLMs allow you to take, right? So this is the whole notion of embedding. So that there are a million ways to say I’m bullish about the management change at company X, Y, Z. There are a million ways you can say that. And if you’re in the business as we were of kind of handcrafting, let’s write down all the ways you can say that. Oh, really? You miss a lot. Yeah. You’ve made a small net and what you’re trying to, to, to,

00:52:33 [Speaker Changed] And a and a small data set, and it’s

00:52:35 [Speaker Changed] A pretty small data set. So we, we rebuilt all of our software, again, using AI as an operating system context, engineering control, how you dole out the text data, how you test it, how you allow it to think. And we thought, all right, you know what? We’re building a bigger net. I bet we see five, maybe even six x improvement in our signal

00:53:05 [Speaker Changed] Catching. And what did you end up with over

00:53:06 [Speaker Changed] A hundred x?

00:53:07 [Speaker Changed] That’s unbelievable.

00:53:08 [Speaker Changed] Over a hundred x, it’s over. And now it’s, we’ve had a multiple of that. Again, it’s, it’s, it is hard to describe in, in the, in the, the expansion of the net is in so many different directions. Everything we were doing before was just English language,

00:53:23 [Speaker Changed] Right? So now you’re global and how many languages are you pulling into the,

00:53:29 [Speaker Changed] Anything, anything that an AI has been trained on, we read it and we can say we can,

00:53:35 [Speaker Changed] Is that 40 languages? Is that like how many languages? Well, there

00:53:38 [Speaker Changed] Are only a, you know, there are about a dozen languages that are useful in markets. So

00:53:43 [Speaker Changed] It’ll be Japanese, Chinese, a variety of European languages. So

00:53:47 [Speaker Changed] We can, we can

00:53:48 [Speaker Changed] Tell Indian,

00:53:49 [Speaker Changed] Here’s the, here’s a story here. The story about Chinese domestic markets. There’s a western story, western narrative,

00:53:57 [Speaker Changed] And there’s a domestic Chinese story. And the domestic

00:53:59 [Speaker Changed] Chinese story,

00:54:00 [Speaker Changed] Which is very different.

00:54:01 [Speaker Changed] Often it’s very different. So we were able, for example, picking up, we were able to pick up way before it, it, it got picked up in Western press. The demand for luxury goods in China went off a cliff.

00:54:19 [Speaker Changed] Cliff, yeah.

00:54:21 [Speaker Changed] In last November.

00:54:23 [Speaker Changed] Listen, you can’t go from a double digit GDP to like, low to mid single digits and not have it affect, especially in a country like that. Well,

00:54:31 [Speaker Changed] And, and, but, but it’s interesting, right? Because, because they’ve had, you know, ups and downs on business cycle before, but this is the first time where you saw consumer behavior that really was kind of similar to what you might find in a Western consumer behavior point being you didn’t hear that from LVMH or the Macau gaming guys until February. And we were picking that up in, in, in November from the domestic Chinese media.

00:54:58 [Speaker Changed] So, so that raises a, a really interesting question. You know, at the end of the day, clients want to be able to make money on your research. How are people putting this to work? How, how does what you are building help your clients generate alpha?

00:55:15 [Speaker Changed] What we think we’ve discovered is an entirely new source of data. And what we’re confident is that we’ve built the systems that are very different from what you see with this sort of analytics that are out there from anyone else. Right? So this is not sentiment, right? We’re not tracking or using mean words or nice words. By

00:55:37 [Speaker Changed] The way, that was a big thing, I dunno, was that 10 years ago we’re s we’re scanning Twitter to identify investor sentiment. Oh

00:55:44 [Speaker Changed] My god. I mean I, but I was just looking today and not to pick on Bloomberg, but you know, it was their live coverage of the Fed statement, right? Were at those meeting, they were analyzing the sentences and the fed statement for hawkish and dovish sentiment,

00:56:02 [Speaker Changed] How it changed from the last meeting. And,

00:56:05 [Speaker Changed] And

00:56:05 [Speaker Changed] So, so so you’re saying there’s not a whole lot of signal there.

00:56:08 [Speaker Changed] Hmm. I wanna be careful with what I say, right? Which is that there are a number of, I’ll call ’em high frequency stat arb guys, where if it’s important for you to note the difference in word choice on a millisecond level, I think there, I think you can get something outta that. I do. And so there are firms that can do that very well. That’s not our game, right? This is not the, what we’re trying to, to identify is not just sentiment, not just word choice. This is not Google trends and how many times did they mention AI in the earnings report, right? There’s, we’re able to track the actual stories that drive behavior.

00:56:54 [Speaker Changed] So that, that’s the next question. And, and I’m gonna give Dave not a credit for asking this. Does every narrative turn into a decision? How do you know when something is merely noisy versus where there’s a, a significant tradable signal?

00:57:14 [Speaker Changed] I don’t. Right. So this is, my goal is not to, oh, you know, do the trades. My goal is Mr. Hedge fund guy, Mr. Asset, allocator, you’ve got a, you know China, right? You know your companies, you know your commodities. Here is data that I think you’ll find useful. The efficacy of it though is up to you. I don’t know what you would, what, what you wanna do with it. I want to sell the picks and shovels honestly for this vast new data set that we all know is important. But we haven’t been able to measure it in a very predictive way before.

00:57:59 [Speaker Changed] So let’s talk about a few things related to that. Can I say one more

00:58:02 [Speaker Changed] Thing? Sure. And it’s not just about using this for investment. So we have a product for financial advisors, right? Which is your clients coming in, you’ve got a portfolio. You need to be able to say, what, what is, what is my client? What, what are they worried about? What are they nervous about? What are they hopeful for? What are the stories they’re reading?

00:58:26 [Speaker Changed] And you are pulling this out of the flow of media and

00:58:29 [Speaker Changed] We can tell you exactly for of, for the portfolio you’ve got for that client, here’s what they’re gonna be asking about, worried about. And here are the answers you can give them to show this is when has happened before, when this story has come up. Stay the course, it’s gonna be fine. This is the sort of stuff we can do for financial advisors. Huh.

00:58:46 [Speaker Changed] That’s really interesting. I would, I would love to see some of that. It’s not just

00:58:49 [Speaker Changed] In markets. Barry, I gotta tell you, the

00:58:53 [Speaker Changed] Policy makers, corporate executives, bankers,

00:58:56 [Speaker Changed] Policy. So we did a, you know, we did before in the run up to the Russian invasion of Ukraine and we published this on Epsilon Theory. And this is my old academic work, right? The book Getting to War before a country starts a war, they mobilize public opinion, right? And so we were looking at domestic Russian media looking at and saying, friends, this isn’t gonna li be a limited thing.

00:59:22 [Speaker Changed] This is happening.

00:59:23 [Speaker Changed] This is happening. It’s gonna be a full scale invasion. Because that was the messaging in domestic Russian media to the Russian people.

00:59:31 [Speaker Changed] Wow.

00:59:32 [Speaker Changed] So brands, right? So you are, you know, we’re working with some, some it sounds, but pro sports teams, you want to tell a story to

00:59:44 [Speaker Changed] Your fan

00:59:45 [Speaker Changed] Base, build a stadium,

00:59:46 [Speaker Changed] Sell some tickets to sell some

00:59:47 [Speaker Changed] Stadium. Yeah. Sell tickets, build a stadium, gimme some examples of people who have told good stories and how did that work for them? How can we do the same thing? So let’s,

00:59:56 [Speaker Changed] Let’s just start looking

00:59:57 [Speaker Changed] At storytelling.

00:59:58 [Speaker Changed] If Jeff Bezos was a subscriber to this back when he was trying to build a tax funded HQ on the Hudson, had he had your data and you were crunching all the New York City news stories about this, might you have been able to give him advice that he

01:00:19 [Speaker Changed] Suffered? A percent

01:00:20 [Speaker Changed] Suffered such a backlash. Because you

01:00:22 [Speaker Changed] Know what we have today? We have polls. Right? Right. Because,

01:00:24 [Speaker Changed] Which are terrible,

01:00:26 [Speaker Changed] Terrible, terrible. Right. Which are mostly terrible now, you know, and, and I love the poly market stuff and other things where you try to get as many people as possible to put money on something. Right?

01:00:34 [Speaker Changed] So, you know, when you ask a person a question, you’re asking them, Hey, what do you think you think? And what do you think you’re gonna do in the future when we know people are terrible at both of those things?

01:00:45 [Speaker Changed] Terrible at both of those things.

01:00:45 [Speaker Changed] But if you put a little money on it, alright, maybe they might be a little more circumspect that,

01:00:50 [Speaker Changed] That, that helped. That helps a ton. So, so in places where you can have a make a bet, I think that improves the kind of information you can get. It still lends itself to a lot of manipulation. Sure. And a lot of,

01:01:02 [Speaker Changed] They’re not issues around it, poly markets and cashie and all those things. It’s not the bond market. It’s not a hundred and something trillion dollars. It’s a couple of bucks on each of these. And sometimes that’s right, a million dollars moves a half a million dollars can move a market.

01:01:17 [Speaker Changed] But for a lot of things, let’s say you’re polling for a political candidate, right? You can’t ask them to put money down on something. Right? Right. You, but, but you really wanna know the, these, these policies that my candidate is thinking about taking on, is that popular? Does it resonate? Is it a compelling story? We can absolutely see if that is true by looking at local media, local social media, all of that. So it’s, it’s pretty wild there. I mean, once you start looking at how important stories are and once you’ve got a tool where you can actually measure them and visualize them, it’s like, it’s like, I feel like it was like when they invented whoever was Lovin Hook or whoever invented the microscope when you’re actually to see something that we all know is there,

01:02:05 [Speaker Changed] Well now we do back then. Right? Like remember germ theory took what a century to catch on it.

01:02:10 [Speaker Changed] It took a century. Yeah. And it takes, it takes seeing it, right? It takes the instrument to actually measure it before you actually believe in it. And so I, I, I feel like that’s kind of where we are right now. It’s these early days. But to actually see and measure the storytelling at this level of resolution, this magnification is pretty freaking cool.

01:02:29 [Speaker Changed] So, so we’re having this conversation with market at all time highs, and you’ve written about the ravine. Yep. Tell us a little bit about what is the ravine, how does, does your data identify that? Tell us what this means.

01:02:46 [Speaker Changed] Well there’s, there’s, there’s clearly been a change in policy regime out of, of Washington and

01:02:53 [Speaker Changed] New administration, and a radically different,

01:02:56 [Speaker Changed] Radically different

01:02:57 [Speaker Changed] Approach, even from the first Trump presidency,

01:02:59 [Speaker Changed] Even from the, the, the first presidency. And so what we’re able to, to measure, really measure is how does that, I’ll say play, but also what comes, narratives never happen in a vacuum. There’s always a counter story. For every bull story, there’s a bear story. And they, they, they, you can almost kind of see the battlefield of ideas, the battlefield of stories and how it emerges. So my strong sense, Barry, is that we are going towards politically in this country towards trench warfare, greater and greater, I’ll call it narrative violence. And it, if you look historically how that plays out in countries, it doesn’t, it doesn’t play out well.

01:03:56 [Speaker Changed] Civil war, domestic political violence, things like that.

01:04:01 [Speaker Changed] Sadly. Yes. Exactly like that. Exactly like that. So there’s that element. And so that’s a, that’s a sad one, you know, or a, a very troubling one and trying to, well, how do we navigate that? But even when in, in markets, and I alluded to this earlier, how capital markets have become a political utility and the, the role of markets in our society, you can really see how that changes in the stories we tell ourselves about the role of markets, what it’s there for. And I

01:04:38 [Speaker Changed] End of day options and speculation, what else is it supposed to be there for?

01:04:43 [Speaker Changed] But that, but that’s kind of what I’m getting at, Gary, right? You, you can see an enormous change in the meaning of markets. And it connects with a, yes, they’ll call it the speculation layer, but it also connects with financial nihilism, yolo, it, it, it leads to a very, I think, less attractive future for how we think about money and the role of markets and the role of capitalism

01:05:20 [Speaker Changed] Coming up. We continue our conversation with Ben Hunts, president and co-founder of persuent, discussing how money managers use their output to generate alpha. I’m Barry Ritholtz, you, you’re listening to Masters in Business on Bloomberg Radio. I am Barry Ritholtz. You are listening to Masters in Business on Bloomberg Radio. My extra special guest today is Ben Hunt. He is president and co-founder of Persuent, a data analytics narrative, storytelling, large language model, using artificial intelligence to find some signal amongst the noise firm. Their clients range everything from large money managers to hedge funds to academics and corporate America. So you write Epsilon Theory and some of it is for subscribers. Some of it is public. A lot of

01:06:35 [Speaker Changed] It’s public. Yeah.

01:06:36 [Speaker Changed] One of the things you wrote is absolutely my favorite item from the first few months of the Trump presidency because I like to talk in probabilities. ’cause I don’t know what’s gonna happen. Yep. But here’s the best case scenario. Here’s the worst case. Here’s all the middle scenarios. You wrote a piece, the end of Pax Americana that I thought was the most cogent, imaginative, well thought out. Hey, here’s the worst case scenario, and we are becoming dangerously flirting with this possible outcome. And I use that as all right, so here’s what I think is high probability. Yep. Here’s the best case. But if you really want to think about how this can go off the rails, check out what Ben wrote. And so tell us a little bit about how did Perent inform the end of Pax Americana? Because I, I get the sense that domestically that wasn’t really where a lot, what, how a lot of people were thinking. But I got the sense from overseas that was a much more common thought. Tell, tell us a little bit about both the piece and, and how the data informed it.

01:07:55 [Speaker Changed] I’ll start with the, I’ll call it the, the international dimension. I wanna come back to the domestic dimension because I, I think we’ve got some really interesting data recently to, to, to share. It goes back to this, yeah. Again, I, I cringe what I was talking about, but, but, but it is, it is game theory, right? And all game theory is, is strategic interaction. It’s that the, the United States, yes. Is the most powerful player on the world stage, but every country has some degrees of freedom and some autonomy in their, in the policies that they, that, that they implement this. There is not a dominant strategy, meaning an outcome. An equilibrium outcome. Again, I hate using these words, but I’ll use them anyway. All an equilibrium means is, it’s a balancing point where both parties, let’s call ’em the United States and a European country, where do they end up? Where they all say, okay, I can live with this, where I can live with this and the America first set of policies, and it’s all these set of policies. What you end up with is less potential economic growth, trade, all all of these things,

01:09:12 [Speaker Changed] All the things that we enjoyed post World War ii, that realignment, that imbued to our benefits so greatly,

01:09:20 [Speaker Changed] Enormously to our, to our, to our, to our advantage. Our advantage, yeah. Enormously to our advantage. It, it goes by the name of a soft power and you know, the dollar system, the bread, Bretton wood system, all of this

01:09:30 [Speaker Changed] Reserve currency on and off

01:09:32 [Speaker Changed] The reserve currency to finance our deficit. All of this is enormously to our advantage. And yes, there are free riders on that system. Yes, there are cost to that, particularly on defense and some other, some other areas. Tariffs are in other area where there’s absolutely free riders on that. So there’s improvement that can be made in that system, for sure. Right. But this is not, this is a different system. This is a different set of rules of the road. And it leads to a different strategic interaction between, between countries. So that’s what the note was about. And it’s, it’s, I’m not trying to predict, I’m just, I’m just trying to observe that. And which is a great line actually by George Soros, which is, you know, I’m, I’m not predicting, I’m observing, which I love that as a line I’m not. And our technology is not there to try to predict the future is trying to tell you what is true in the present today.

01:10:30 [Speaker Changed] I, I’m amazed how many people think they can forecast the future when they have no idea what’s happening. Right. I

01:10:36 [Speaker Changed] Wanna, I want to now cast what I want do. That’s exactly, yeah. Not, not forecast. I want to now cast. And that gets the, I wanted to talk about kind of domestic. So we started tracking the different narratives around immigration policy early last year and what you saw in some of the kind of simp

01:10:59 [Speaker Changed] This is during the run up to the election.

01:11:01 [Speaker Changed] Yes, exactly. And what you saw, and really going back, ’cause we can take, we take this stuff back for a decade or more. And what you absolutely saw up to last October, there’s a, there was an event from last October, not the election, but an event from last October. You see a steady increase in, regardless of your political affiliation. You know what immigration isn’t working for us isn’t as, as Americans saw a steady increase starting with the, they’re eating the, the cats.

01:11:37 [Speaker Changed] They’re eating the cats, they’re eating their dogs. They’re

01:11:40 [Speaker Changed] Eating the dogs. When you saw one, the, the Columbus mo when you, that, that moment,

01:11:45 [Speaker Changed] One of the most, that’s where things, the real moments in debate history.

01:11:49 [Speaker Changed] And we see very clearly in our media data, and this is, this is not mainstream media. This is everything that we’re pulling up. We’ve seen an, a really significant decline in the volume and density of, oh my God, immigration is a problem. We need mass deportations. On the contrary, we’ve seen an enormous increase, again, regardless of political affiliation, including Republicans. No, immigration is a good thing for this country. Huh? This is the stories of America that are pro-immigrant and immigration. Now, you would not believe that if you were looking at the policies that the White House has implemented during these first, you know, 10 months of the administration.

01:12:38 [Speaker Changed] So, wait, when did you first notice that? Regardless of policy, we think immigration is a net benefit to America. When did that first start showing up?

01:12:49 [Speaker Changed] It started changing right? In October because it, following

01:12:52 [Speaker Changed] The dogs,

01:12:53 [Speaker Changed] Cats, it was too far. It was, it was like, this is just silly stupid. This is silly and stupid. And it’s been a steady increase. You know? And you wouldn’t, you wouldn’t believe that if you were I immersed in Twitter stuff. But, but,

01:13:06 [Speaker Changed] So this

01:13:07 [Speaker Changed] Is, our country is actually quite pro-immigrant. I know that sounds cr

01:13:13 [Speaker Changed] But we are a nation of immigrants here. Here’s another data point that’s kind of mind blowing. We were talking about a different data point in, in the entirety of the US history, 2025 looks like the first year where the US population will decrease. Yeah, yeah, yeah. So it’s a decrease in legal immigrants. Not, not only illegal immigrants, but legal immigrants. Add that with the deportations and just people staying away.

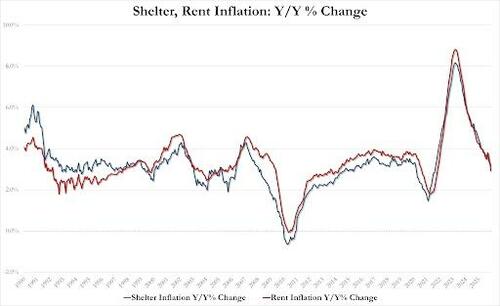

01:13:41 [Speaker Changed] Well, this, this gets back to the, the, the economic picture and from other, so what, what you’ve had is a clear, and again, we, we, we see this in our data from other countries. There’s a clear effort to repatriate assets and funds away from the us. There’s been a clear effort outside the us You see this with central banks, but also with

01:14:03 [Speaker Changed] Cor hence gold. The big and gold. Gold. Correct.

01:14:07 [Speaker Changed] Treasuries used to be a safe haven asset. Right?

01:14:11 [Speaker Changed] No

01:14:11 [Speaker Changed] More. That’s, that’s, it’s, it’s,

01:14:13 [Speaker Changed] Do you understand how significant that charge is? That you’re making, you’re basic, enormous, basically accusing the president, well, of submarining one of the single greatest assets America halts. Well,

01:14:26 [Speaker Changed] That it’s a, it is built up to such a, an extent, right? That the way I think of this is an iceberg that is melting, but it is melting. What we do not see, we do not see capital flight.

01:14:40 [Speaker Changed] Right? We, we saw it for like a week in April, and then that was quickly

01:14:44 [Speaker Changed] Reversed. That was it. So there’s, there, there is, there’s no capital flight there, there are no,

01:14:47 [Speaker Changed] But there was some fear US

01:14:48 [Speaker Changed] Investors that leaving the country that there were fears, and we can track it. If that starts to happen, we’ll see it immediately. That’s not happening. Repatriation continues to happen.

01:15:00 [Speaker Changed] Slowly measured, balanced,

01:15:01 [Speaker Changed] Melting iceberg. Right? Because there are limits to, if you’re a Bermuda reinsurer, I mean, you’re kind of, you’re, you’re stuck with treasuries, right? Right. I mean that, that

01:15:11 [Speaker Changed] You’re, you could buy some gold to offset it, but you can’t sell a hundred billion dollars worth of treasuries. No, you

01:15:16 [Speaker Changed] Can’t. You can’t. So it’s a melting iceberg. But we can clearly see that the dog is not barking yet and maybe never will is capital flight. What we see in politically domestically is that actually, and this was validated by a Gallup poll they’ve been doing 20 years, which also showed what we had saw, started seeing a lot earlier where immigration as a thing is actually pretty darn popular in the United States.

01:15:47 [Speaker Changed] Yeah. But so are, so is restricting assault rifles and we can’t get any change on that. I that’s 75, 80% or the actual

01:15:57 [Speaker Changed] Large. I, I gotta tell you, I gotta tell you that depends very much in how that question is asked.

01:16:01 [Speaker Changed] Well, that’s true for all polling. Well,

01:16:04 [Speaker Changed] This is the benefit of what I’m trying. So, so when, when we’re doing these seman, we call the semantic signatures, it has nothing to do with how you’re phrasing the question. We’re not doing polling. We’re seeing what people are actually the meaning of what they’re talking about in, in media.

01:16:20 [Speaker Changed] So how does that play out if people are legitimately saying no immigration is a good thing for America. Is there an impact on population and the economy? Is there an impact on markets? Is there an impact on policy and politics?

01:16:35 [Speaker Changed] I think there’s an impact on the election, the midterms next year.

01:16:40 [Speaker Changed] So we’re talking, we’re talking literally 12 months from now.

01:16:45 [Speaker Changed] Yeah. ’cause that’s how this, the stuff gets ca on the political front narratives and opinions. They get cashed out in elections. Right. Mark are different. You, you cash stuff out every day. The right, the market’s

01:16:59 [Speaker Changed] Open every day. The feedback loop is so rapid with markets.

01:17:02 [Speaker Changed] Ex Exactly. Politics is a different story. So Right. It gets cashed out in the elections.

01:17:08 [Speaker Changed] If you were to ask me before this conversation, what’s the most significant impact on the midterm elections? There was just a Gallup poll yesterday, GOP questions on the economy. They were plus 14% two years ago. They’re minus 4% this year. Yeah, I,

01:17:26 [Speaker Changed] I saw that.

01:17:27 [Speaker Changed] And, and that’s an amazing swing. And I’m, I’m saying to myself, you know, listen, the out of power party usually picks up, you know, 10, 15 seats. Yeah. You have the redistricting question, which may blunt that. But if, if the most important question during the election was on the economy, and that’s an 18% swing, this is looking like a pretty substantial shift. What I’m hearing from you is, hey, this isn’t just about the economy.

01:17:55 [Speaker Changed] It’s not,

01:17:56 [Speaker Changed] It’s not what, so it’s the economy, it’s immigration. What else? What else are you seeing? That’s interesting. That’s

01:18:01 [Speaker Changed] It. That’s, that’s pretty. Now there are other aspects though, where the, the stories, it, this is, this is people talking about immigration as a thing. Now, whether, now whether that gets translated into a political party position. ’cause I gotta tell you, the Democratic party I is enormous enough. But there, there are no, there are no narratives that are being put forward by the Democrats that are powerful. Or, or, or, or popular. So I

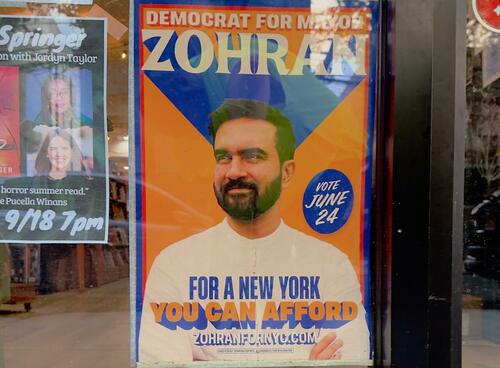

01:18:31 [Speaker Changed] I I don’t, other than the mayoral contest in New York. Yeah,

01:18:34 [Speaker Changed] Yeah.

01:18:35 [Speaker Changed] Right. That what I, that’s this

01:18:36 [Speaker Changed] One. What I’m saying is that the, is that the many of the policies that are being presented by this administration are unpopular, not just with the Democrats, but with Republicans. And increasingly so immigration being one of them. I think economy being another one,

01:18:58 [Speaker Changed] Tariffs aren’t really popular amongst, but people perceive that as a tax increase or, or a pressure on small business