Watch: US Vows To Unleash Full Arsenal Of Tools Against UK PM Starmer's War On Free Speech

Authored by Steve Watson via Modernity.news,

As Keir Starmer’s Labour regime tightens the noose on online freedom, the United States has issued a blistering warning: nothing is off the table to defend free speech in Britain.

With government appointed regulator Ofcom now formally investigating Elon Musk’s X over Grok-generated images, American officials are rallying against what they call authoritarian tactics straight out of a tyrant’s playbook.

Sarah B Rogers, US Under-Secretary of State for Public Diplomacy, has assured the British people that the Trump administration will counter any assault on X with the same tools used to pierce internet blackouts in oppressive states. This clash exposes Labour’s selective outrage—obsessed with AI bikinis while turning a blind eye to genuine dangers like grooming gangs.

The escalation builds on threats from Starmer’s government floating a total ban on X over Grok’s image generation capabilities, under the tyrannical Online Safety Act. Critics have slammed the move as a thinly veiled bid to silence dissent on the one platform where globalist narratives get shredded daily.

They are moving rapidly to ban X in the UK with a flimsy ridiculous excuse that you can make fake images of people in bikinis on Grok (which you can do on any AI platform). pic.twitter.com/ls1o1oF5dV

— m o d e r n i t y (@ModernityNews) January 9, 2026

While anything meaningful takes years to progress through government in the UK, within days of sounding an intention to crackdown, they have made it illegal to create what they claim are ‘sexualised’ AI images.

? BREAKING: Technology Secretary Liz Kendall says creating ”non-consensual intimate images”, including with Grok, will be made illegal this week pic.twitter.com/6vgA4HC3AP

— Politics UK (@PolitlcsUK) January 12, 2026

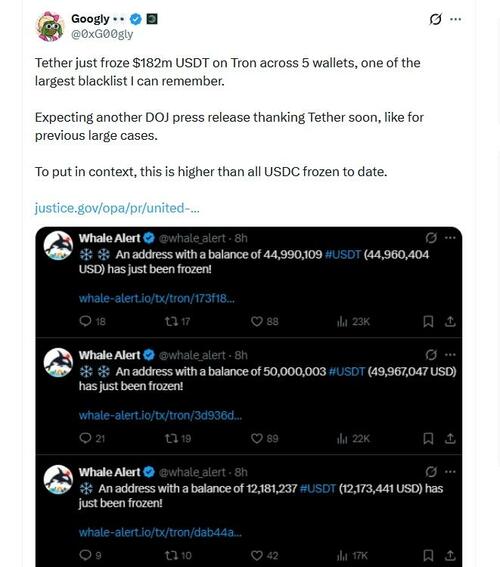

Now, the crackdown has advanced. Ofcom announced its probe into X, claiming concerns over “Grok AI chatbot account on X being used to create and share undressed images of people – which may amount to intimate image abuse or pornography – and sexualised images of children that may amount to child sexual abuse material.”

The regulator’s X post detailing the investigation drew sharp irony for disabling replies, blocking public pushback.

Here you have the government-approved regulatory and competition authority announcing they're 'investigating' X to find out if it is complying with duties to "protect people in the UK." Yet it has closed the replies on the post, preventing people in the UK from responding. https://t.co/2LT7696unt

— m o d e r n i t y (@ModernityNews) January 12, 2026

In a GB News interview, Rogers dismissed Labour’s actions as politically driven, emphasizing America’s commitment to free expression amid Britain’s slide toward censorship.

She stated that the government’s ban threats were politically motivated—and that “given the pro-censorship inclinations of the British state in recent memory, I can’t say that we’ll be shocked” if it followed through.

'I’m willing to be a bit uncomfortable if that’s what it takes to be free.'

— GB News (@GBNEWS) January 13, 2026

US Under Secretary of State Sarah B. Rogers warns against overreaching censorship laws, as Labour looks to ban X.

'Free societies don’t ban platforms like X. Russia, Iran, and Venezuela do.' pic.twitter.com/pXA8spbvVP

Rogers outlined US capabilities: “America has a full range of tools that we can use” to open up internet access in “authoritarian, closed societies where the Government bans it.”

She added, “We are facilitating uncensored internet in Iran right now,” nodding to Starlink’s role in bypassing regime controls.

‘If the British government cared about women’s safety, it would’ve acted differently on grooming gangs.’@UnderSecPD Sarah B. Rogers tells @BeverleyTurner that Labour’s crackdown on X is about ‘curating the public square’ and suppressing political dissent. pic.twitter.com/hPHUhdPFK1

— GB News (@GBNEWS) January 13, 2026

Directly addressing Starmer’s stance, Rogers fired back: “With respect to a potential ban of X, Keir Starmer has said that nothing is off the table. I would say from America’s perspective, nothing is off the table when it comes to free speech.”

She continued, “Let’s wait and see what Ofcom does and we’ll see what America does in response. This is an issue dear to us, and I think we would certainly want to respond.”

'Keir Starmer has said that nothing is off the table. And I would say from America's perspective that likewise, nothing is off the table when it comes to free speech.'@UnderSecPD Sarah B. Rogers reacts to Labour’s threats to ban X. pic.twitter.com/7vfrpZ1glI

— GB News (@GBNEWS) January 13, 2026

Praising Trump and Vance as “huge champions” of free speech, Rogers recalled Trump’s own ban from pre-Musk Twitter: “Our leadership understands this because President Trump was himself a target of censorship. President Trump was banned by Twitter – the old regime before Elon bought it.”

Invoking Alexei Navalny’s comparison of Trump’s ban to Putin’s tactics, she stressed: “You have to take that comparison seriously. That’s why our President cares about this issue – because people couldn’t deal with his popularity, they couldn’t deal with his success, and they tried to just shut him up so no one could hear him.”

'Americans will feel disappointed. But frankly… I can't say that we'll be shocked.'@UnderSecPD Sarah B. Rogers says a UK ban on X would upset the White House, but warns Britain has a recent history of censorship that makes it sadly predictable. pic.twitter.com/7RWDx1hp58

— GB News (@GBNEWS) January 13, 2026

Rogers also mocked Labour’s “ensure women and girls are safe online” rhetoric, highlighting hypocrisy: in the “real world” one of the party’s council leaders called grooming gang victims “white trash.” Rogers asserted that if the government “cared about women’s safety, it would have acted differently on grooming gangs.”

This US intervention aligns with Trump’s track record of challenging UK overreach, from suspending tech deals to offering asylum for “thought criminals.” Starmer’s plummeting approval—now at 11 percent—fuels his desperation to control narratives, especially on X where his deceptions get community-noted relentlessly.

Labour’s push mirrors EU efforts to muzzle X under similar pretexts, but the selective targeting reeks of fear: Grok isn’t the only AI capable of such outputs, yet X’s embrace of unfiltered truth makes it enemy number one.

'Don’t pick a fight with someone who buys ink by the barrel, and Elon Musk is the digital version of that!'

— GB News (@GBNEWS) January 12, 2026

Toby Young warns the Labour government that going after X and Grok over AI-generated images could backfire, risk a US trade deal, and harm Britain’s AI sector. pic.twitter.com/Z8aIp2E1t5

As Ofcom’s probe unfolds, the Trump team’s assurances signal a potential transatlantic showdown. Britain’s globalist elite can’t suppress voices forever—America’s stand reminds them that freedom fighters have powerful allies ready to act.

Your support is crucial in helping us defeat mass censorship. Please consider donating via Locals or check out our unique merch. Follow us on X @ModernityNews.

Tyler Durden Wed, 01/14/2026 - 06:30

Illustration via The Telegraph

Illustration via The Telegraph Illustration via The Telegraph

Illustration via The Telegraph Illustration via The Telegraph

Illustration via The Telegraph Illustration via The Telegraph

Illustration via The Telegraph

via AP

via AP

Artur Plawgo/Getty Images

Artur Plawgo/Getty Images

Egyptian special forces soldiers, via AFP

Egyptian special forces soldiers, via AFP

Getty Images

Getty Images

An instructor teaches a Spanish lesson at Franklin High School in Los Angeles on May 25, 2017. Robyn Beck/AFP via Getty Images

An instructor teaches a Spanish lesson at Franklin High School in Los Angeles on May 25, 2017. Robyn Beck/AFP via Getty Images

Recent comments