Are Central Bankers Willing To Truly Upset Markets So Trump Backs Off?

By Michael Every of Rabobank

Officially it’s 2,000, but reportedly as many as 12,000 Iranian protestors could have been killed by their own government over the past few days. While the West has seen none of the mass protests that the last two-plus years have been full of, President Trump told those on Iran’s streets to keep going and that “Help is coming,” adding if the government starts hanging those it’s arrested, matters will be even worse. What might this mean though? It’s unclear. The Wall Street Journal reports that US Gulf Allies, led by Saudi Arabia, have been lobbying the US not to get involved (as the Trump admin labelled three Muslim Brotherhood branches as terrorist organisations).

The intricacies of the Middle East defy the space available here (or on protesters’ placards), but alongside tensions in Yemen/South Yemen and Somalia/Somaliland, a key takeaway is that the Western assumption of a more moderate Saudi-led GCC is perhaps being called into question. Rather, it looks as if there is a Saudi-UAE split, with the former moving closer to Qatar, Turkey, and Pakistan as it loses fear of Iran as a regional hegemon and instead works with those it sees as able to fill that power vacuum who aren’t Israel (see ‘From partners to rivals: What the Saudi-UAE rupture means for Europeans’). That will matter hugely ahead, if so; and for now it’s wait and see on what the US will do in Iran.

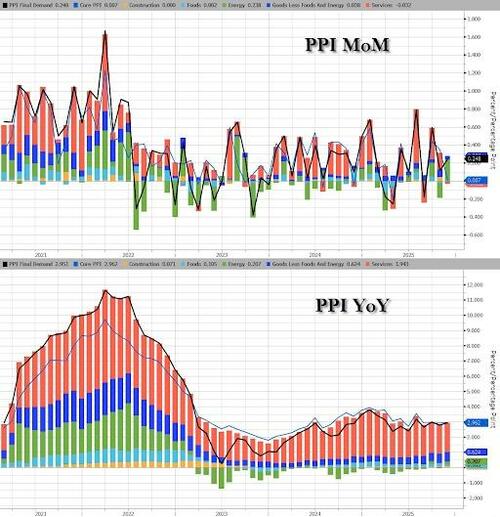

That isn’t the only energy story, as two Russian tankers were hit by drones in the Black Sea; that’s as 70% of Kyiv’s power went down as Russia goes all out to try to plunge Ukraine into darkness. Europe is also going to redouble efforts to stop China and India buying Russian oil: how, without sanctions or Trump-style tariffs? (One asks, as the EU is now close to dropping tariffs on Chinese EVs in favor of a minimum price – which effectively means the EV is the same price for the consumer but the tariff flows to China instead of the EU. Realpolitik is hard for some.)

On Greenland and NATO, tensions remain high. Greenland’s PM said the territory chooses Denmark over the US, which Trump rejected; Russia trolled that Greenland might vote to join it, not the US; US senators introduced a bill to prevent the US from invading NATO territory; and France continued to lobby for the EU military aid package for Ukraine to only be spent on EU weapons – which they cannot provide in the volumes required, in the same way that the US underlines that they can’t actually provide adequate forces to cover Greenland.

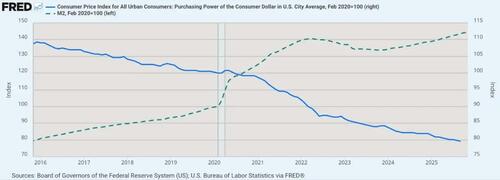

Meanwhile, help came for embattled Fed Chair Powell. Not the CPI print of 0.3% m-o-m and 2.7% y-o-y headline and 0.2% and 2.6% core, which frankly don’t matter much against the current backdrop. Rather, we saw ‘Central bankers of the world, unite!’ as the BIS, ECB, BoE, RBA, Riksbank, SNB, BCB, BoK, BoC, and the Norges Bank --all institutionally opposed to unionization, "because markets" -- said they “Stand in full solidarity" with Fed Chair Powell, who is facing a possible criminal investigation by the DoJ. (Something that isn't new to one of those central bankers.) “The independence of central banks is a cornerstone of price, financial and economic stability in the interest of the citizens that we serve. It is therefore critical to preserve that independence, with full respect for the rule of law and democratic accountability," was their defiant collective message.

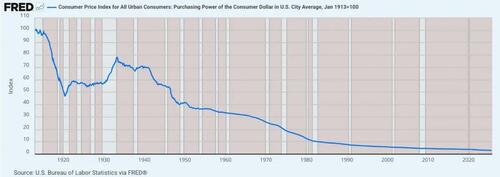

(Of course, this overlooks that their track record on those fronts is questionable, and that for most of global history we didn't have independent central banks and did fine - better than recently, in fact, if you look at post-WW2 growth and inflation.)

But where was the BoJ? That omission speaks volumes about realpolitik and a central bank with a balance sheet amounting to a terrifying % of GDP (as a snap February election looms, JPY falls, and the 5-year JGB yield just hit the highest since 2000: somebody can’t afford to annoy the US right now).

Where was the RBI, as India is close to trade deal with the EU, and German Chancellor just stated he wants to build deep economic and defense relationships with it.

Where was the PBoC, from the world's second largest economy and the largest in PPP terms? That obvious absence speaks volumes about how little the West grasps that its 'liberal world order’ doesn't speak for the world – and, increasingly, all liberals.

Where was this collective outrage when Bank of Poland Governor Glapinksi was being leaned on by his liberal government? Is Poland --which just overtook the UK in GDP per capita, and which will soon have the second most powerful conventional army in Europe at a time when that really matters-- 'just an EM'? Protests are variable, it seems.

On the specifics of the Powell case, the US DoJ stated, “None of this would have happened if they had just responded to our outreach,” which makes the case that the Fed doth protest too much. However, the FT claims Powell sent a letter to US senators with details of his Fed refurbishment project following his testimony, which makes the investigation look political. (At least this isn’t happening in South Korea, where the impeached former president now faces the death penalty for his recent actions.)

Yet in reality everyone is rallying round Powell, not Poland, because if the Fed is part of economic statecraft, not neoliberal global establishment monetary policy, then there isn't a neoliberal global establishment.

Free trade has gone – as Canada’s Carney walks a tightrope on a trip to Beijing to try to diversify away from the US, while Trump stated the USMCA is “irrelevant” during a Ford Motor factory tour. Free movement of people is going.

Free movement of capital is declining. The fiscal rules are being ripped up as fiscal dominance rules. And, as shown back in 2016's 'Thin Ice', if central bank cooperation collapses, it's game over. Realistically, what would the ECB and BoE, etc., do if the Fed was politicised under US neo-mercantilism?

Equally logical is the fact that the Fed is a vital part of any true Gramscian revolution, and would ideally be flipped well before the looming mid-term elections. Did you not notice Trump using an executive order to de facto institute MBS QE last week? Those are the real stakes.

Yet given Powell is gone in a few months anyway, what will this resistance achieve vs Trump that the slew of lawfare didn't in the run-up to the 2024 election? That’s as BlackRock's Rieder emerges as a new Fed Chair tip in the home stretch: is that the gamekeeper turning poacher or vice versa? Do central bankers really think Trump will retreat when called out? Or are they willing to truly upset markets so he backs off?

In short -- and unlike in Iran, where things are hard to call -- this looks like a battle that the establishment probably can't win. Indeed, while a brighter day might be on the horizon for the Iranian people, no help is coming for the liberal world order.

Tyler Durden

Wed, 01/14/2026 - 10:30

Secretary of State Marco Rubio speaks during a press conference as President Donald Trump and Secretary of War Pete Hegseth listen at Mar-a-Lago club in Palm Beach, Fla., on Jan. 3, 2026. Joe Raedle/Getty Images

Secretary of State Marco Rubio speaks during a press conference as President Donald Trump and Secretary of War Pete Hegseth listen at Mar-a-Lago club in Palm Beach, Fla., on Jan. 3, 2026. Joe Raedle/Getty Images Jordanian demonstrators waving green Muslim Brotherhood flags and other banners shout anti-Israel slogans during a mass rally held outside the parliament building in Amman, Jordan, in this file photo. Khalil Mazraawi/AFP via Getty Images

Jordanian demonstrators waving green Muslim Brotherhood flags and other banners shout anti-Israel slogans during a mass rally held outside the parliament building in Amman, Jordan, in this file photo. Khalil Mazraawi/AFP via Getty Images

The Department of Government Efficiency (DOGE) website is displayed on a phone, in this photo illustration. Oleksii Pydsosonnii/The Epoch Times

The Department of Government Efficiency (DOGE) website is displayed on a phone, in this photo illustration. Oleksii Pydsosonnii/The Epoch Times A U.S. soldier assigned to the 1-62 Delta Battery Air Defense Artillery Regiment Patriot at a Patriot launcher at at Al Udeid Air Base, Qatar, on March 4, 2015. Tech. Sgt. James Hodgman/U.S. Air Force via DVIDS

A U.S. soldier assigned to the 1-62 Delta Battery Air Defense Artillery Regiment Patriot at a Patriot launcher at at Al Udeid Air Base, Qatar, on March 4, 2015. Tech. Sgt. James Hodgman/U.S. Air Force via DVIDS

Recent comments