Stocks Rise As Tech Meltup Accelerates

Futures are higher, and trading near record territory, led by tech as this year’s great rotation shows no sign of slowing, broadening the base of names driving Wall Street’s push back towards all time highs. As of 8:00am, S&P 500 futures were 0.3% higher with Nasdaq 100 contracts up 0.4% as the latest wave of enthusiasm for technology stocks carried into Friday. Overnight headlines were mostly muted. Pre-market, Mag 7 are mostly higher led by NVDA +1.1%; AI names (AMD +3.2%, AVGO +1.3%, MU +2%) continued their rally yesterday. Bond yields are unchanged. Commodities are mixed: oil added 1.2%, while silver fell -2.0%; ags are mostly higher. US session features industrial production data and three scheduled Fed speakers.

In premarket trading, Mag 7 stocks are mostly higher (Nvidia +0.8%, Tesla +0.6%, Meta +0.09%, Alphabet +0.5%, Microsoft +0.06%, Amazon +0.3%, Apple -0.2%

- JB Hunt Transport Services Inc. (JBHT) falls 4% after the trucking firm reported quarterly revenue that missed estimates, underscoring continued weakness in freight demand.

- Kraft Heinz (KHC) is down 1.1% after Morgan Stanley downgraded the maker of Jell-O and Oscar Mayer hot dogs to underweight.

- Mosaic (MOS) falls 6% after the producer of phosphate and potash crop nutrients said North American fertilizer demand declined well beyond normal seasonal softness in the fourth quarter.

- PNC Financial Services Group Inc. (PNC) rises 3% after reporting a 9% increase in fourth-quarter revenue, beating analysts’ estimates as financing and dealmaking by middle-market customers accelerated.

- Regions Financial (RF) falls 4% after the regional bank reported EPS and total loans for the fourth quarter that came in below the average analyst estimate. The bank also said it sees net interest income declining in the first quarter of 2026.

In corporate news, Trump continues to try to ease the squeeze on Main Street that’s hurting his popularity among voters. A plan is set to be announced on Friday to compel tech firms to effectively fund new plants to power the data centers essential to win the global AI race, without hiking utility bills for homes and businesses. A potential deal that would see China’s BYD supply Ford’s overseas factories with batteries for hybrid vehicles drew immediate political blowback from White House trade adviser Peter Navarro, who questioned its wisdom. OpenAI and Microsoft face a trial over Elon Musk’s claims that Sam Altman’s startup betrayed its founding mission as a public charity when it took billions in funding from the software giant and made plans to operate as a for-profit business.

Yet even after TSMC’s huge beat and capex forecast fueled optimism on Thursday that the AI boom has plenty of room to run, the Russell 2000 continued to outperform the S&P 500. It outpaced its bigger counterpart for a 10th straight session, leaving small caps’ relative performance more than 600 basis points better so far this year.

Despite the bounce, the Nasdaq 100 closed Thursday still in the red for the week, as investors turned toward firms that are benefiting from improving economic growth prospects. The balance between tech leadership and broader market participation is likely to persist in the coming weeks.

“There is scope for some diversification away from concentrated positioning,” said Geoff Yu, senior macro strategist at BNY. “A rising tide can lift all boats as the US economy is still expanding and expectations for market returns remain favorable.”

The first full week of the latest earnings season is boding well for what’s to come, with 89% of the 28 companies that have reported so far beating expectations. With big banks dominating the early days, stock investors will get a clearer view of the broader economy next week when results from names such as Netflix Inc., Johnson & Johnson and 3M Co. are due.

“The results so far show, at least for the banks, that the consumer is okay, deal activity and capital markets are healthy, earnings revisions are still very positive,” said Andrea Gabellone, head of global equities at KBC Global Services. “In the meantime, you have some big tailwinds, like the weak dollar.”

Investors continue to deploy funds into equities and trim cash holdings. According to Bank of America, citing EPFR Global data, US stock funds saw $36.5 billion of inflows in the week ended Jan. 14.

Meanwhile, yield premiums on corporate debt have narrowed to the least since 2007, a Bloomberg index of bonds across currencies and ratings shows, prompting some of the world’s biggest money managers to warn against complacency. The extra yield investors demand to hold junk notes has also dropped to the lowest in nearly two decades. Companies issued roughly $435 billion of bonds in the first half of January, a record for the period, and more than a third above last year’s tally at this point, according to data compiled by Bloomberg.

Five presidents of regional Fed banks, who in recent months found themselves on opposite sides of the policy debate, indicated on Thursday that the central bank is now well-positioned to sit tight and wait for further data before cutting rates again. No change is expected at the Fed’s Jan. 27-28 meeting, after cuts at each of its last three.

European stocks dip but remain on track for their fifth straight weekly advance, the longest streak of gains since May, as investors remain confident about earnings and artificial intelligence demand. The Stoxx 600 falls 0.1% as health care stocks outperform while miners lag, as news of a Chinese clampdown on high-frequency trading sinks metals. Here are some of the biggest movers on Friday:

- Kloeckner & Co shares surge as much as 30%, to the highest level since June 2022, after Worthington Steel agreed to buy the metals processor for €11 per share in cash.

- Polar Capital shares rise as much as 8% to their highest level since April 2022, following the asset manager’s quarterly update and announcement of a share buyback program.

- Novo Nordisk shares advance as much as 6.7%, snapping two days of declines, as analysts at Berenberg and Bank of America lift their price targets on the stock, while Deutsche Bank calls the Danish drugmaker one of its top picks.

- Elekta shares gain as much as 9.1% after its Evo Linear Accelerator imaging system gained clearance from the US FDA.

- HBX shares rise as much as 8.6%, the most since May, after the Spanish travel technology firm announced a share buy-back program and plans to pay regular dividends.

- Genus shares surge as much as 15%, the most in more than four months, after the animal genetics firm said it now expects FY26 adjusted pretax profit to come in “moderately” above the top end of current views.

- Sunrise Communications shares slide as much as 4.7% after an offering of 4 million shares by holder Baupost Group priced at a 3.38% discount to Thursday’s close.

- Richemont shares fall as much as 3.8% as BofA downgrades to neutral from buy, in a second day of declines for the stock following the luxury goods group’s sales report.

- Boliden shares slip as much as 3.7%, leading miners lower as news of a Chinese clampdown on high-frequency trading cooled sentiment.

Earlier in the session, Asian stocks rose, with Taiwan’s key index jumping to a record, as results from TSMC helped confirm an upbeat outlook for artificial intelligence demand. The MSCI Asia Pacific Index advanced 0.4%, with TSMC the biggest contributor along with other tech firms including Samsung Electronics and Delta Electronics. Taiwan’s Taiex climbed nearly 2% and Korea’s Kospi gained 0.9% to a new high, while Japanese stocks slipped following a recent rally. The regional benchmark has gained about 2.8% this week, which would be its best since September 2025. While TSMC helped reinforce the AI rally, an agreement for the US to lower tariffs on Taiwan provided additional relief amid ongoing geopolitical concerns on multiple fronts. Chinese stocks fell amid fresh signs that authorities are attempting to cool the market rally, with record outflows seen in some of the exchange‑traded funds heavily owned by the so‑called national team. Next week’s highlights include monetary policy decisions in Japan, Malaysia and Indonesia. The World Economic Forum in Davos is among the key events that will be watched by global investors.

In FX,the yen strengthened, trimming its third weekly decline, as Japan’s Finance Minister Satsuki Katayama reiterated her warning that all options including direct currency intervention are available for dealing with the recent weakness. The US dollar slipped against most major currencies with Treasury yields trading in a tight range. The kiwi is leading gains against the greenback, rising 0.4% while the Japanese yen and Norwegian krone are not far behind.

While equities are moving, yields are snoozing. The 10-year Treasury yield is headed for a fifth straight week of minimal change, rivaling its longest stretch of inertia in the past two decades. The bond market is waiting for a clearer steer on the economy and the outcome of the Trump administration’s pressure on Fed chair Jerome Powell to cut interest rates further. On Friday, treasuries edged lower in early US session after plying small ranges since Asia open with European bonds underperforming. Yields are less than 2bp cheaper on the day with curve spreads little changed; 10-year around 4.19% is 2bps higher, outperforming bunds and gilts slightly.The weekly IG volume stands in line with $60b projection after Thursday’s six-name $35b slate headed by Goldman Sachs’ $16b landmark transaction; issuers paid about 1bp in new issue concessions on deals that were 3.5 times covered.

In commodities, oil rebounded after its biggest drop since June, while gold and silver declined. WTI crude futures rise 1.3% to near $60 a barrel. Spot silver falls 4%.

US economic calendar includes January NY Fed services business activity (8:30am), December industrial production (9:15am) and January NAHB housing market index (10am). Scheduled Fed speakers include Collins (10:50am), Bowman (11am) and Jefferson (3:30pm)

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.5%

- Russell 2000 mini +0.4%

- Stoxx Europe 600 little changed

- DAX -0.1%

- CAC 40 -0.4%

- 10-year Treasury yield little changed at 4.17%

- VIX -0.3 points at 15.54

- Bloomberg Dollar Index little changed at 1210.82

- euro little changed at $1.1613

- WTI crude +1.1% at $59.82/barrel

Top Overnight News

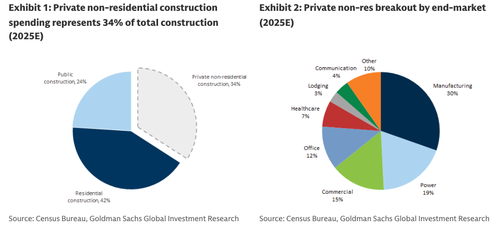

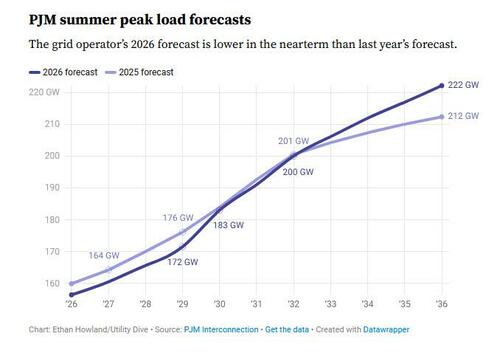

- A plan to address power costs from data centers is set to be announced today. Donald Trump will direct the top US grid operator to hold an emergency power auction, forcing tech giants to fund new power plants, according to a White House official. BBG

- President Trump was advised that a large-scale strike against Iran was unlikely to make the government fall and could spark a wider conflict, U.S. officials said, and for now will monitor how Tehran handles protesters before deciding on the scope of a potential attack. Still, Trump is expected to order the Pentagon to send an aircraft carrier, the USS Abraham Lincoln, from the South China Sea to the Middle East. WSJ

- Bipartisan talks in the Senate about a healthcare deal to extend ACA subsidies are stalling, making an agreement less likely. Politico

- US senators are set to meet members of the Danish parliament in Copenhagen today as Denmark and Greenland step up lobbying in an effort to head off Trump’s push to take control of Greenland. BBG

- Canada and China reached a wide-ranging agreement to lower trade barriers including a reduction in tariffs for Canadian canola and Chinese EVs. Mark Carney hailed his strategic partnership with Xi Jinping, referencing a “new world order.” BBG

- Chinese companies have started discussions about renting computing power at data centers in Southeast Asia and the Middle East to get access to Rubin chips, according to people involved in the talks. That follows companies’ efforts last year to access chips in Nvidia’s Blackwell series. WSJ

- Some Bank of Japan policymakers see scope to raise interest rates sooner than markets expect with April a distinct possibility, as a sliding yen risks adding to already broadening inflationary pressure. RTRS

- The criminal investigation into Federal Reserve Chair Jerome Powell threatens to upend the contest over whom President Trump will choose to succeed him as it enters its final stretch. Trump has made clear he prizes loyalty in his pick, but the Justice Department probe—which Powell said was part of a pressure campaign to get the Fed to lower interest rates—threatens to make that quality a liability. WSJ

- Japanese Finance Minister Katayama said FX intervention is a potential option under the US-Japan agreement and expresses readiness to take decisive action while keeping all options on the table: BBG

Trade/ Tariffs

- Canadian PM Carney said the relationship with China is more predictable than the one Canada has with the US.

- Canadian PM Carney announces that they will allow as many as 49k Chinese EVs into the Canadian market, with a most-favoured-nation tariff of 6.1%. In return, Canada anticipates that by March 1st China will reduce tariffs on Canola seed to a c. 15% combined rate. In addition to a resolution to other trade obstacles.

- A White House Official said the chip announcement on Wednesday was 'phase one' action and there could be other announcements, pending ongoing negotiations with other countries and companies.

Central Banks

- BoJ: abolish the "Amount of Cash Collateral for Lending of ETFs" today, given that the new lending of ETFs has been ceased and the outstanding balance of ETF lending has reached zero.

- BoJ is seen as likely to raise its FY26 economic and inflation forecasts, Reuters reported citing sources; the report adds that some BoJ policymakers see scope to raise interest rates as soon as April due to the inflationary effect of a weaker JPY.

- ECB's Lane said that there is no immediate debate on interest rates if current conditions persist and that that current rates set to establish baseline for years ahead.

- NBP Governor Kotecki, in a Bloomberg interview, said it is becoming increasingly clear that there is room for further rapid interest rate cuts. Assumes that in February, the MPC will resume its activities from last year. The inflation outlook is increasingly optimistic.

A more detailed look at global markets courtesy of Newqsuawk

Top Asian News

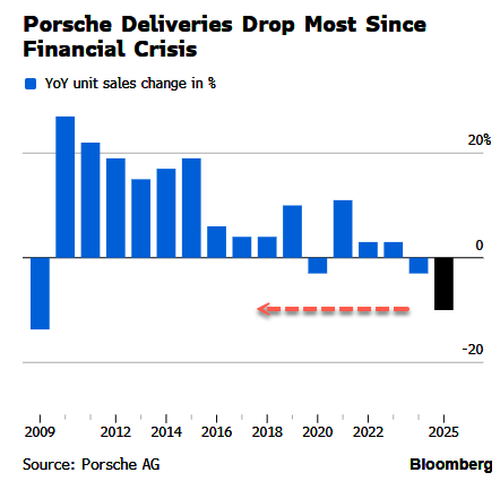

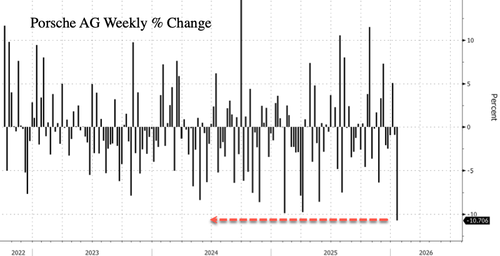

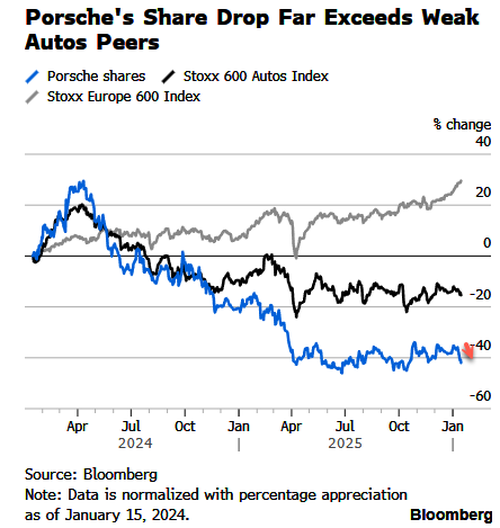

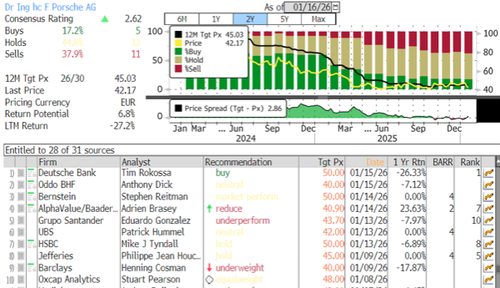

European equities (STOXX 600 -0.1%) are trading mostly softer, contrary to APAC which traded mostly in the green. Not much on a macro newsflow to explain broader weakened sentiment seen in European. European sectors are trading mostly in the red. At the bottom of the pile are Basic Resources (1.5%), Automobiles & Parts (-1.4%) and Consumer Product & Services (-1.3%). Sentiment around the Basic Resources sector has been pinned down by lower metal prices with copper especially pressured by China’s crack down on high-frequency trading. On the upside, Utilities (+0.3%), Health Care (+0.3%) and Energy (+0.2%) are the slight outperformers.

Top European News

- The ONS has drawn up contingency plans to delay the launch of its new labour market survey by 6 months, Bloomberg reported citing people familiar with the matter. Another scenario under consideration is to launch the survey in May 2027. ONS plans to decide in the summer whether to stick to the November roll-out date.

FX

- DXY is flat/incrementally lower this morning and currently within a narrow 99.26-99.40 range, which is towards the upper end of Thursday’s bands. Overnight, a White House Official suggested that the latest chip announcement was “phase one” and more could be put out following negotiations. That aside, not really much US specific newsflow, but focus will turn to a few Fed speakers and Industrial Production later.

- G10s are mixed, with the Kiwi and JPY topping the pile whilst the Loonie is mildly pressured. The JPY was boosted overnight after a Reuters report suggested that the BoJ could hike as soon as April, with some members fearing a weak currency could lead to a resurgence in inflation. In the midst of all this, Finance Minister Katayama has continued to provide some jawboning, which also helped the JPY. USD/JPY currently trades at the lower end of a 157.97-158.70 range vs Monday’s open of 158.07.

- Politics remains the main theme for Japan, as attention now turns to the 22nd of January, when PM Takaichi is expected to dissolve the Diet. UBS believes that the LDP will be able to secure a half majority, improving the party's position. Interestingly, Nippon TV ran the numbers following the CDP-Komeito tie-up and calculated that LDP "would retain only 60 of the 132 single‑member districts it won in 2024". Though this is only a mathematical calculation, and does not account for Takaichi's high approval rating of more than 70%.

- Japanese Finance Minister said the statement between Japan and the US can be viewed as saying intervention to counter FX moves out of line with fundamentals is permitted. Not sure when JPY-carry trades peak out as Japan-US interest rate differentials are set to narrow further.

Fixed Income

- A contained start for fixed income benchmarks, though the bias is increasingly bearish.

- Newsflow has been light. USTs in a very thin sub-five tick range just above the 112-00 mark into an afternoon once again dictated by, on paper at least, data and Fed speak.

- Bunds under increasing pressure into the morning, pressure that has emerged without a clear or overt fundamental driver. Down to a 128.26 base with downside of 17 ticks at most. No reaction to unrevised inflation from Germany and Italy, while the European docket ahead is light today before picking up next week with several key ECB speakers at the Davos WEF, including President Lagarde.

- OATs lag in Europe, down by 20 ticks at worst to a 121.01 base. Action that has lifted the OAT-Bund 10yr yield spread above 68bps, though the above Bund pressure is stemming the downside. Slight underperformance that is likely a function of the French Government electing to suspend the National Assembly budget debate last night, meaning that the deliberations of the budget and likely conclusion of it will not occur today. As such, the pencilled-in date of a Monday vote on the revenue draft is off the table.

- Gilts opened on the backfoot, with losses of six ticks and have since extended to a 92.27 low, -21 ticks at most. Pressure that is a function of catch-up to the bearish action that was seen in the latter part of Thursday's US session, the morning's bearish bias, and reports that the ONS might be delaying the new labour data by six months.

Commodities

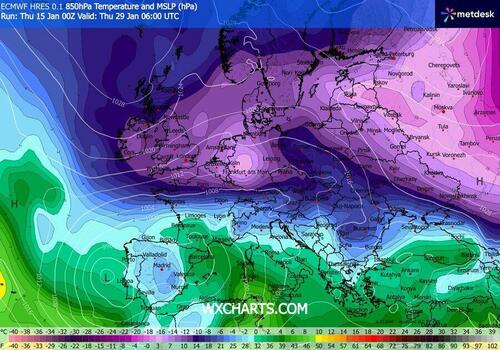

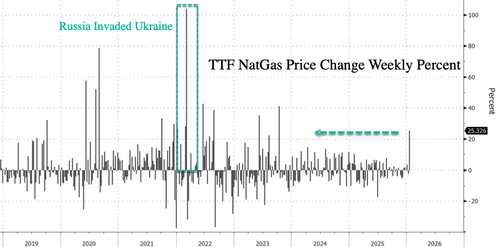

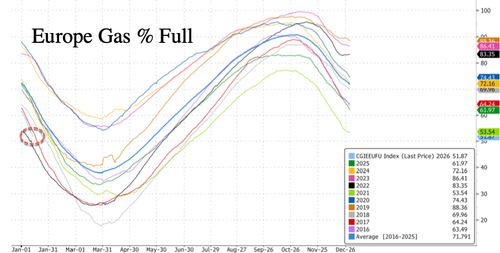

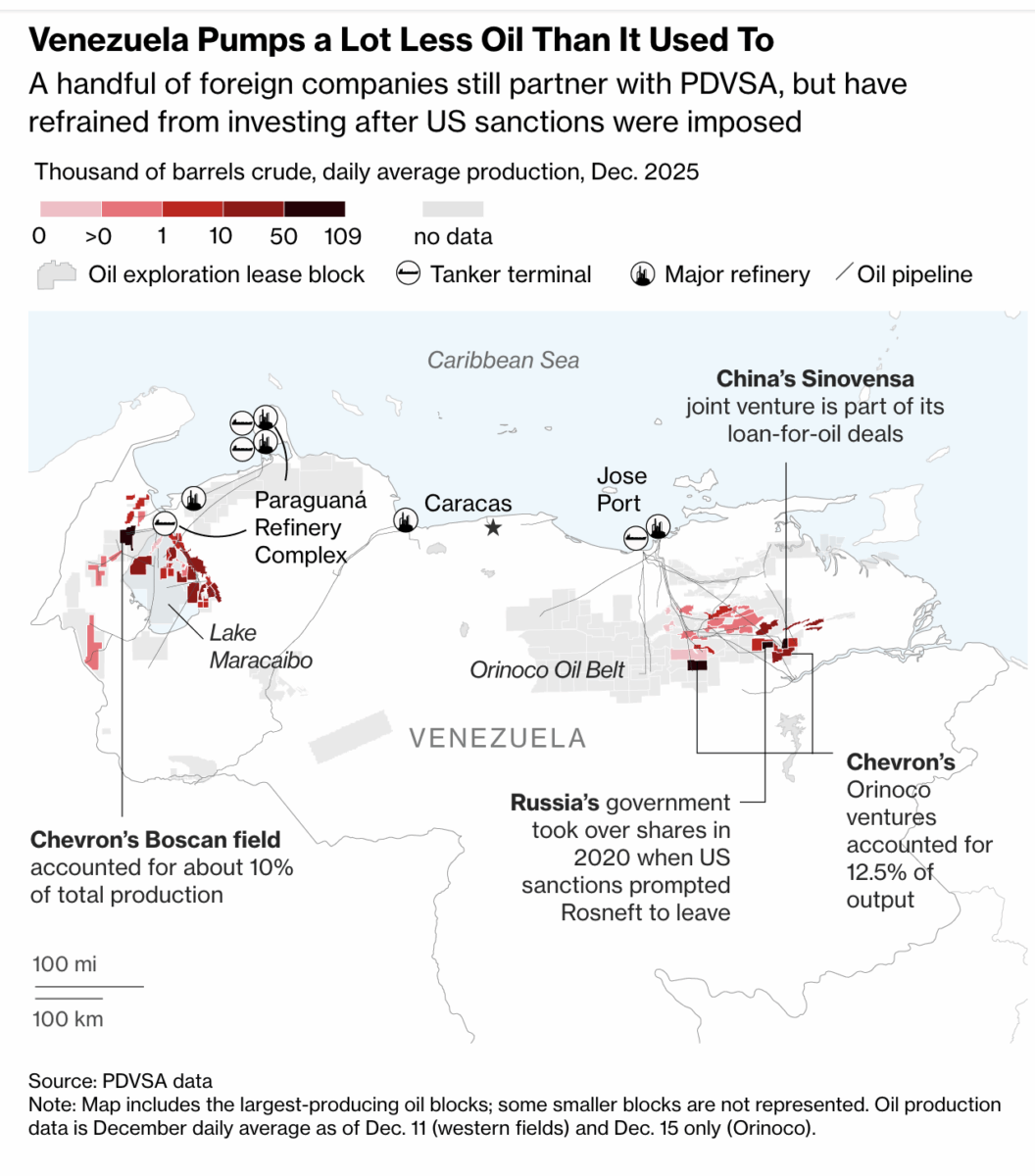

- Crude benchmarks are firmer this morning, and while they are set to end the week in the green with upside of c. USD 0.80/bbl for WTI and USD 1.0/bbl for Brent, they are towards the lower-end of the week's c. USD 4.00/bbl parameters. Continuing with energy but away from crude, gas benchmarks remain alight and at highs. Drivers remain the same as discussed in recent sessions, including: Iran supply, European cold spell, Asian demand, and expectations for a cold spell in APAC next week. Dutch TTF briefly surmounted the EUR 35/MWh mark this morning

- Spot gold is under modest pressure. Hovering around the USD 4.6k/oz handle despite a contained USD, but hit as the risk tone stateside is constructive and geopolitics, as discussed, hasn't escalated. Further pressure is also potentially stemming from the firmer global yield environment.

- Base peers were softer overnight, hit by China cracking down on high-frequency trading via the removal of servers from some data centres. Action that pushed 3M LME Copper below the USD 13k/t handle early doors and since to a USD 12.77k/t trough, lower by over USD 300/t on the session.

- Heavy rainfall in northeast Australia has triggered floods that are hampering mine operations, with some coal miners declaring force majeure on portions of their shipments or potential delays to customers.

US Event Calendar

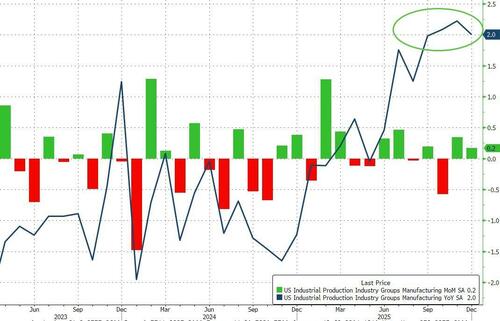

- 9:15 am: United States Dec Industrial Production MoM, est. 0.1%, prior 0.2%

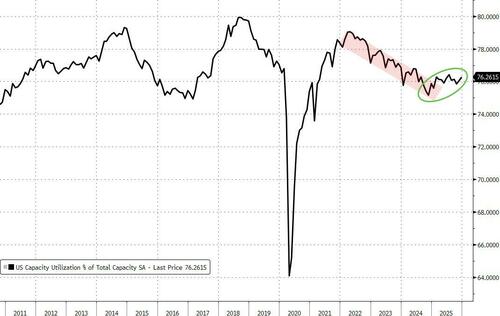

- 9:15 am: United States Dec Capacity Utilization, est. 76%, prior 76%

- 10:50 am: United States Fed’s Collins Delivers Welcoming Remarks

- 11:00 am: United States Fed’s Bowman Speaks on Economy and Monetary Policy

- 3:30 pm: United States Fed’s Jefferson Soppeaks on Economy, Monetary Policy

DB's Jim Reid concludes the overnight wrap

Welcome to the end of another big market week. I had a knee scan yesterday and I made the mistake of uploading the images (which I don't understand) into AI last night. The scan was supposed to see how far the arthritis on the lateral side (outside) had spread and how far I might be towards partial knee replacement. Its swollen and I'm limping a fair bit at the moment. However AI said the scans showed the complete opposite. It says I have a medial (inside) meniscus tear and "massive" bone bruising. AI said my knee was at high risk of a stress fracture and I should see a consultant immediately and stop all activity! This was a bit of a fright. I'm seeing my consultant on Tuesday. Will AI be correct? There are few good outcomes here but I will be impressed if AI has accurately picked up a completely different issue to what my consultant and I thought before the scan. Update to follow next week!

Markets put in a stronger performance than my knee yesterday, as ebbing fears about a US military intervention in Iran saw the geopolitical risk premium taken out of various assets. For instance, Brent crude oil (-2.18%) saw its biggest decline since June, closing at $63.76/bbl. Meanwhile, gold (-0.23%) and silver (-0.80%) also retreated slightly from their record highs on Wednesday and continue to dip a little in Asia. Moreover, just as fears eased about the geopolitical situation, a strong batch of US data meant investors grew increasingly confident in the 2026 outlook, offering further support to risk assets. So the S&P 500 (+0.26%) and Europe’s STOXX 600 (+0.49%) moved higher, with the latter hitting a fresh record high. And as investors priced in fewer rate cuts, the 10yr Treasury yield (+3.8bps) also picked back up to 4.17%.

The latest headlines on Iran were the main drivers of market sentiment yesterday, as expectations rose that the US would not intervene for the time being. For instance, Trump posted a reference to a Fox News article that an Iranian protester wouldn’t be sentenced to death, saying “This is good news. Hopefully, it will continue!” So that helped oil prices to come down yesterday, with Brent crude and WTI both posting their first daily decline after a run of 5 consecutive increases. Some lingering uncertainty remains, with Fox News reporting that the US military was preparing a range of options towards Iran.

On top of the Iran developments, risk assets got a further boost from the latest US data, which added to the sense the expansion has further to run. Notably, the weekly initial jobless claims fell to just 198k in the week ending January 10 (vs. 215k expected), which meant that the 4-week moving average (205k) fell to its lowest in nearly 2 years. Even though there is likely to be a holiday season distortion partly impacting these numbers, it still added to optimism on the US economy. This was cemented by a couple of Fed surveys too, which painted an optimistic picture on both growth and inflation. First, there was the New York Fed’s Empire State manufacturing survey, which rose to 7.7 in January (vs. +1.0 expected), with the prices paid component at a 10-month low. And second, the Philadelphia Fed’s manufacturing business outlook survey rose to 12.6 (vs. -1.4 expected), with the prices paid component at a 7-month low.

This strong backdrop for growth meant that investors dialled back the prospect of Fed rate cuts in the months ahead. Indeed, the amount of cuts priced by the December meeting fell -6.3bps on the day to just 48bps, which is the fewest cuts priced so far this year. So that pushed Treasury yields up across the curve, particularly at the front end, with the 2yr yield (+5.4bps) rising to 3.57%, whilst the 10yr yield (+3.8bps) moved up to 4.17%. That also followed some hawkish-leaning comments from Fed officials, with Chicago Fed President Goolsbee saying that “The most important thing facing us is we’ve got to get inflation back to 2%”. Atlanta Fed President Bostic said “We need to make sure that we stay in a restrictive stance, because inflation is still too high”. Kansas City Fed President Schmid suggested that monetary policy should remain “modestly restrictive” and San Francisco Fed President Daly posted that “policy is in a good place”. Remember that today is the last chance we’ll get to hear from Fed officials before the next meeting, as their blackout periods start tomorrow.

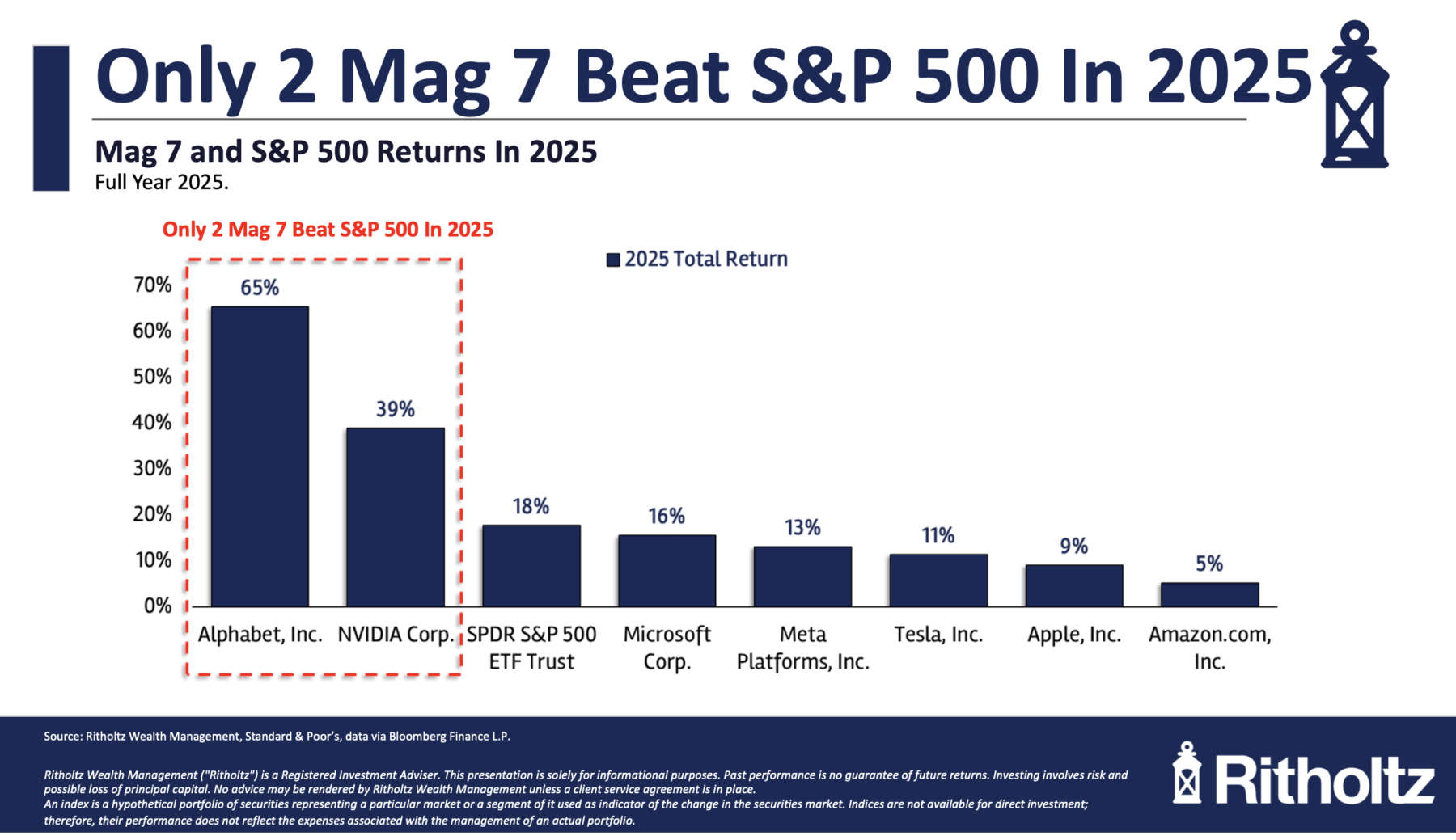

With geopolitical risk subsiding and US data surprising on the upside, that meant it was another solid day for equities, though the S&P 500 (+0.26%) did decline late in the session, closing half a percent below its intra-day highs. Semiconductor stocks led the gains after TSMC’s strong earnings release, with the Philadelphia Semiconductor index up +1.76% and Nvidia rising +2.13%, though the broader Mag-7 (+0.18%) had a more neutral day. It was also a good day for bank stocks, with the KBW Bank index (+1.67%) recovering after four consecutive declines, aided by strong earnings from Morgan Stanley (+5.78%) and Goldman Sachs (+4.63%). And it was another strong day for small-cap stocks, with the Russell 2000 (+0.86%) up to a fresh record, meaning the index is already up +7.76% in 2026 so far. This marked the tenth consecutive session that the Russell 2000 outperformed the S&P 500, the longest such run since 1990.

Over in Europe, markets also put in a decent performance, with the STOXX 600 (+0.49%) and the FTSE 100 (+0.54%) reaching fresh record highs. Meanwhile, strong data also helped to push up sovereign bond yields, particularly for UK gilts after the November GDP print surprised on the upside. It showed that GDP grew by +0.3% in November (vs. +0.1% expected), which is the strongest monthly print since June. Separately in Germany, we also found out that the economy grew by +0.2% for the full year in 2025, in line with expectations, recovering after two consecutive contractions in 2023-24. So yields on 10yr UK gilts moved up +4.8bps, whilst those on 10yr bunds (+0.5bps) and OATs (+0.1bps) saw marginal increases.

Asian equity markets are a little mixed this morning. Tech is performing, still benefitting from robust earnings from chipmaking leader TSMC the day before. However, this positive sentiment is being tempered by dips in other sectors. The KOSPI (+0.59%) and the S&P/ASX 200 (+0.48%) are increasing but with the Hang Seng (-0.27%) lower. The Nikkei (-0.11%) is pausing for breath after a great week and mainland China is flat. S&P 500 (+0.28%) and NASDAQ 100 (+0.38%) futures are regaining some of the late losses last night.

In FX markets, the Japanese Yen (+0.25%) is appreciating, currently trading at 158.23 against the US Dollar. This strengthening follows remarks from Japanese Finance Minister Satsuki Katayama, who indicated a willingness to consider all available options, including coordinated intervention with the US, to address excessive foreign exchange volatility. Yields on 10-year Japanese Government Bonds have risen by +2.0bps, reaching 2.18% as we go to print.

The next main data point in Asia is China's fourth-quarter GDP data on Monday. This will tell us whether the Chinese economy met the government's annual growth target of 5%.

Looking at the day ahead, data releases include US industrial production and capacity utilization for December, along with the NAHB’s housing market index for January. Otherwise from central banks, we’ll hear from the Fed’s Jefferson, Bowman and Collins, along with the ECB’s Escriva.

Tyler Durden

Fri, 01/16/2026 - 08:33

Source: UN Dispatch

Source: UN Dispatch

AFP/Getty Images

AFP/Getty Images

Source: United24

Source: United24

Recent comments