Why Young Women Moved Left While Young Men Stayed Sane

Authored by vittorio on X,

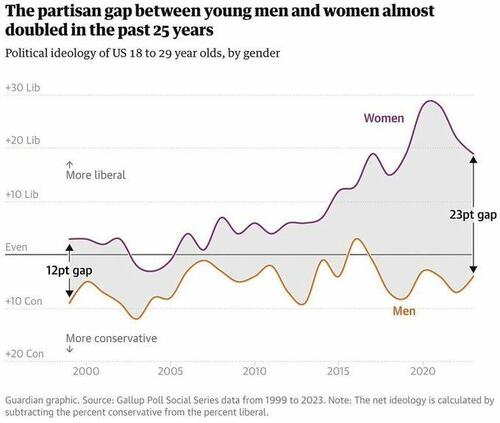

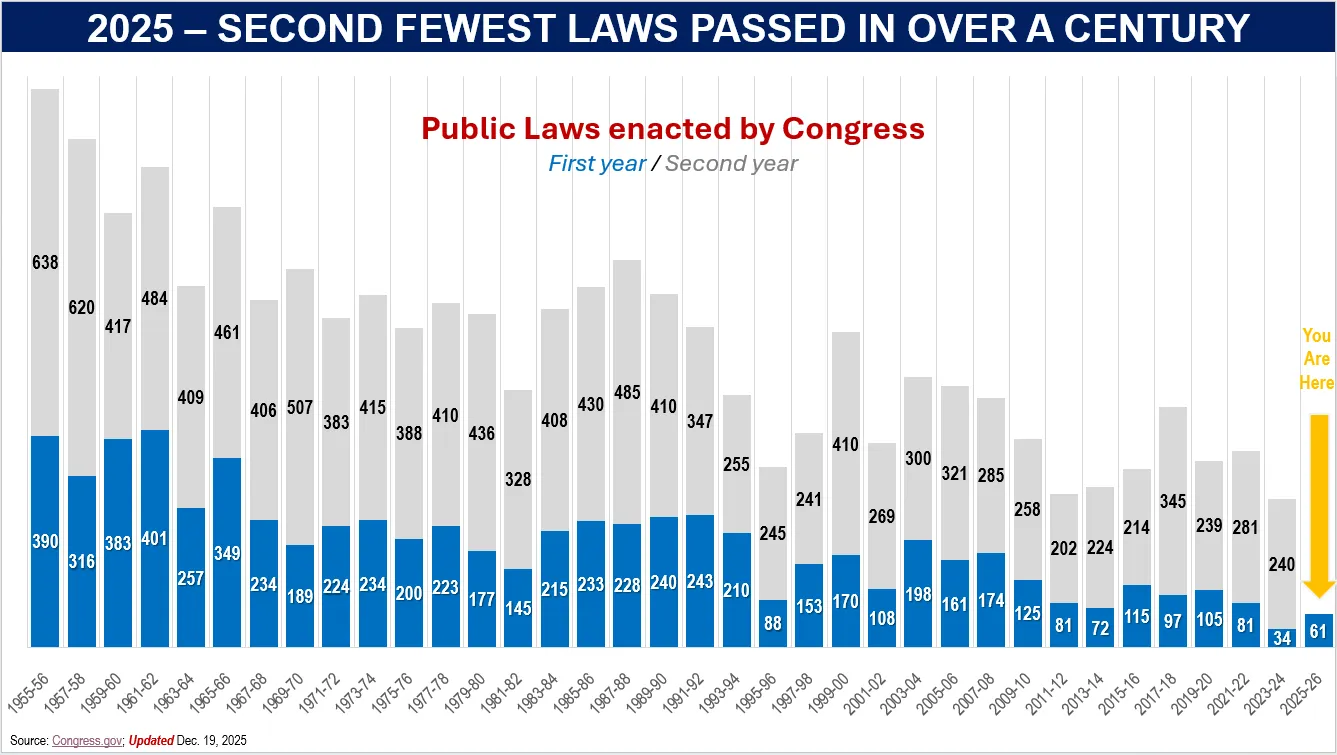

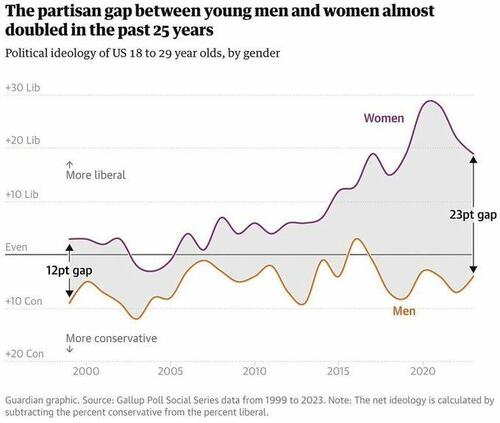

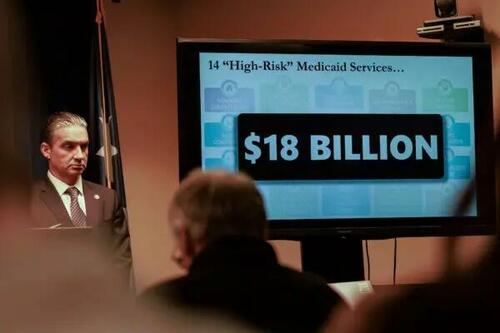

Bill Ackman quote-tweeted a graph showing the partisan gap between young men and women almost doubled in 25 years.

Women moved radically left. Men stayed roughly where they were.

Good question. Most answers I've seen are either tribal ("women are emotional") or surface-level ("social media bad"). Neither traces the actual mechanism.

Let me try.

First, notice what Wanye pointed out:

We've been told for a decade that men are "radicalizing to the right" and that this is dangerous. The actual data shows the opposite. Men barely moved. Women moved 20+ points leftward.

The story we are told is exactly inverted from reality. And when female leftward movement does get discussed, it's framed as progress: "women becoming more educated, more independent, more enlightened."

They'll tell you the graph shows enlightenment and progress.

Wrong.

What the graph shows is capture.

This Isn't Just America

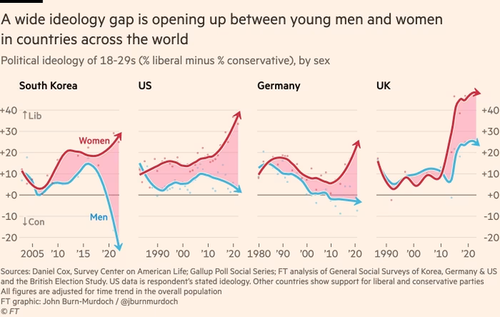

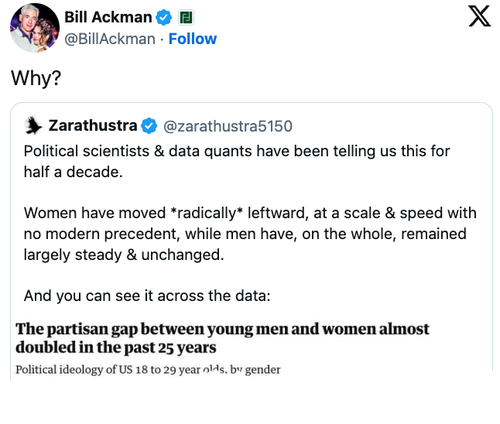

Before getting into the mechanism, something important: this pattern isn't only American. It's global.

The Financial Times documented last year that the gender ideology gap is widening across dozens of countries simultaneously. UK, Germany, Australia, Canada, South Korea, Poland, Brazil, Tunisia. Young women moving left on social issues, young men either stable or drifting right.

This matters because it rules out explanations specific to American politics. It's not Title IX policy. It's not #MeToo. It's not the specific culture war of US campuses. Something bigger is happening, something that rolled out globally at roughly the same time.

South Korea is the extreme case. Young Korean men are now overwhelmingly conservative. Young Korean women are overwhelmingly progressive. The gap there is even wider than the US. Contributing factors include mandatory military service for men (18 months of your life the state takes, while women are exempt) and brutal economic competition. But the timing of divergence still tracks with smartphone adoption.

Whatever is causing this, it's not American. The machine is global.

The Substrate

Start with the biological hardware.

Women evolved in environments where social exclusion carried enormous survival costs. You can't hunt pregnant. You can't fight nursing. Survival required the tribe's acceptance: their protection, their food sharing, their tolerance of your temporary vulnerability. Millions of years of this and you get hardware that treats social rejection as a serious threat.

Men faced different pressures. Hunting parties gone for days. Exploration. Combat. You had to tolerate being alone, disliked, outside the group for extended periods. Men who could handle temporary exclusion without falling apart had more options. More risk-taking, more independence, more ability to leave bad situations.

(Male status still mattered enormously for reproduction, low-status men had it rough. But men could recover from temporary exclusion in ways that were harder for pregnant or nursing women.)

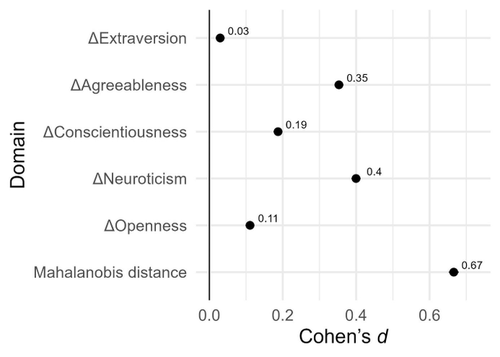

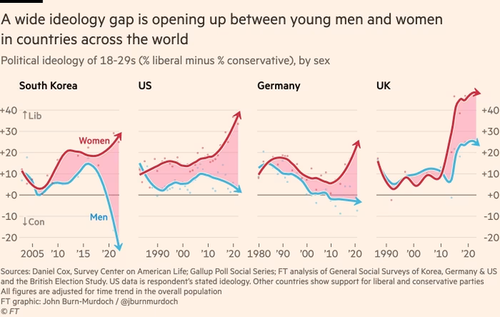

This shows up in personality research. David Schmitt's work across 55 cultures found the same pattern everywhere: women average higher agreeableness, higher neuroticism (sensitivity to negative stimuli, including social rejection cues). Men average higher tolerance for disagreement and social conflict. The differences aren't huge, but they're consistent across every culture studied.

Not better or worse. Different selection pressures, different adaptations.

But it means the same environment affects them differently. Consensus pressure hits harder for one group than the other.

The Machine

Now look at what we built.

Social media is a consensus engine. You can see what everyone believes in real time. Disagreement is visible, measurable, and punishable at scale. The tribe used to be 150 people. Now it's everyone you've ever met, plus a world of strangers watching.

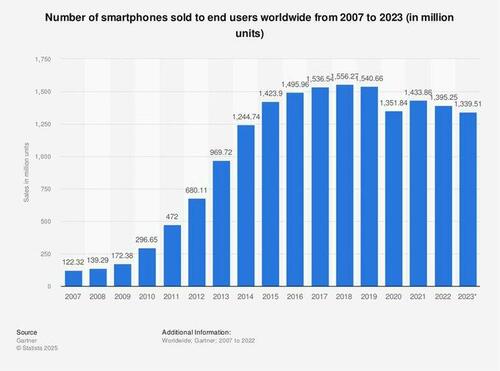

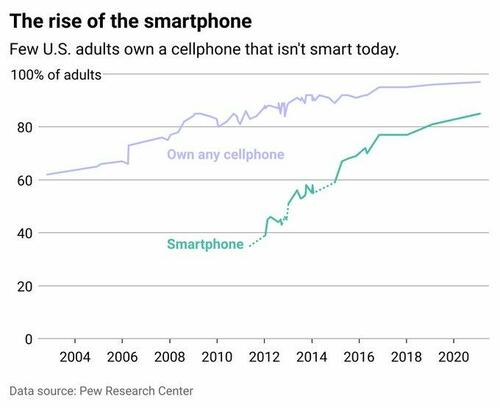

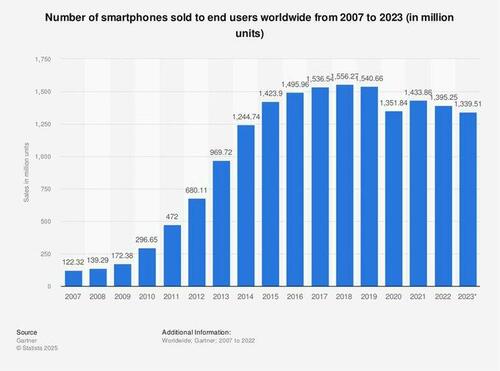

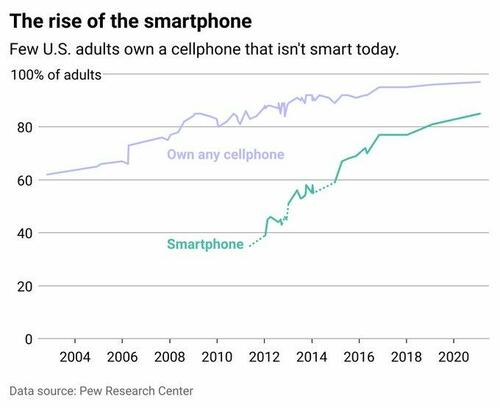

And look at the timeline. Facebook launched in 2004 but was college-only until 2006. The iPhone was launched in June 2007. Instagram in 2010. Suddenly, social media was in your pocket and in your face, all day, every day.

Look at the graph again. Women were roughly stable through the early 2000s. The acceleration starts around 2007-2008.

The curve steepens through the 2010s as smartphones became universal and platforms became more sophisticated.

Women are by nature more liberal, but the radicalization coincides with the rise in smartphone adoption.

The machine turned on and the capture began.

The mental health collapse among teenage girls tracks almost perfectly with smartphone adoption, with stronger effects for girls than boys. The same vulnerability that made social exclusion more costly in ancestral environments made the new consensus engines more capturing.

This machine wasn't designed to capture women specifically. It was designed to capture attention. But it captures people more susceptible to consensus pressure more effectively. Women are more susceptible on average. So it captured them more.

Add a feedback loop: women complain more than men. Scroll any platform and it looks like women are suffering more. Institutions respond to this because visible distress creates liability, PR risk and regulatory pressure. In addition, women are weaker and inevitably seen as the victim in most scenarios. The institutional response is to make environments "safer". Which means removing conflict. Which means censoring disagreement. Which means the consensus strengthens.

The counterarguments get removed or deplatformed and the loop closes.

The Institutions

Universities flipped to 60% female while simultaneously becoming progressive monoculture. The institution young women trust most, during the years their worldview forms, feeds them a single ideology with no serious opposition.

FIRE's campus speech surveys show the pattern clearly: students self-censor, report fear of expressing views, cluster toward acceptable opinions. This isn't unique to women, but women are more embedded in higher education than men now, and the fields they dominate (humanities, social sciences, education, HR) are the most ideologically uniform.

Four years surrounded by peers who all believe the same thing. Professors who all believe the same thing. Reading lists pointing one direction. Disagreement is not even rare, it's socially punished. You learn to pattern-match the acceptable opinions and perform them.

Then they graduate into female-dominated fields: HR, media, education, healthcare, non-profits, where the monoculture continues. From 18 to 35, many women never encounter sustained disagreement from people they respect. The feedback loop never breaks.

Men took different paths. Trades. Engineering. Finance. Military. Fields where results matter more than consensus. Fields where disagreement is tolerated or even rewarded. The monoculture didn't capture them because they weren't in the institutions being captured. (mostly because they were kicked out of them, but that's a different piece)

The Economics

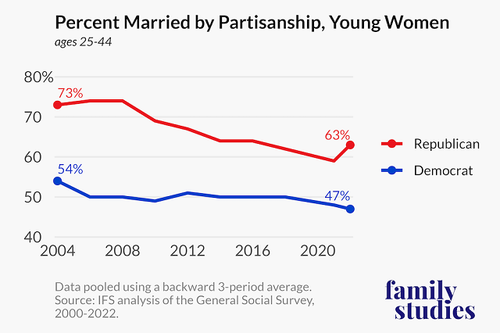

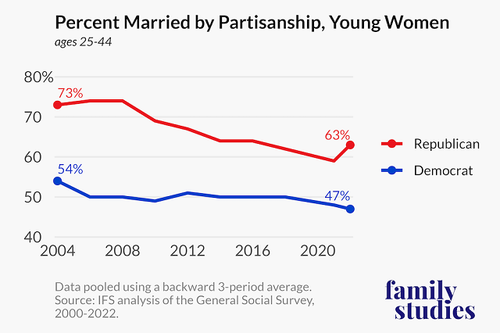

Marriage collapsed. This probably matters more than people think.

Single women vote more left than married women. This is consistent across decades of exit polls. Part of this is likely economic: single women interact with government more as provider of services, married women interact with government more as taker of taxes. The incentives point different directions.

The marriage gap in voting is one of the most consistent predictors. And marriage rates have collapsed precisely during the period of divergence.

Men saw marriage collapse differently. Family courts. Child support. Alimony. The rational response was skepticism of expanding state power.

Same phenomenon, different positions in it, different political responses.

The Algorithms

Algorithms optimize for engagement. Engagement means emotional response. Time on platform. Clicks. Shares. Comments.

Women respond more strongly to emotional content on average, they are more empathetic, they can be more easily manipulated with sad stories. That higher neuroticism again, higher sensitivity to negative stimuli. The machine learned this. It fed them content calibrated to their response patterns. Fear. Outrage. Moral panic. Stories about danger and injustice and threat and wars and "victims".

Men got different feeds because they responded to different triggers. The algorithm doesn't really have a gender agenda. It has an engagement agenda. But engagement looks different by demographic, so the feeds diverged.

Women ended up in information environments optimized for emotional activation. Men found alternatives: podcasts, forums, cars, wars, manosphere etc.

The Ideology

Feminism told women their instincts and biology were oppression and wrong. Wanting children was brainwashing. Wanting a provider husband was internalized misogyny. Their natural desires were false consciousness installed by patriarchy.

Many believed it. Built lives around it. Career first. Independence. Freedom from traditional constraints.

Now they're 35, unmarried, measuring declining fertility against career achievements. And here's the trap: the sunk cost of admitting the ideology failed is enormous. You'd have to admit you wasted your fertile years on a lie. That the women who ignored the ideology and married young were right. That your mother was right.

I think this is why you see so little defection. Not because the ideology is true, but because the psychological cost of leaving is higher than the cost of staying. Easier to double down. Easier to believe the problem is that society hasn't changed enough yet.

The Other Capture

I should be honest about something: men weren't immune to capture. They were captured differently.

Women got ideological conformity. Men got withdrawal. Porn. Video games. Gambling apps. Outrage content. The male capture wasn't "believe this or face social death." It was "here's an endless supply of dopamine so you never have to build anything real."

Different machines, different failure modes. Women got compliance. Men got passivity.

The male line on that graph staying flat through 2020 isn't necessarily health. It might just be a different kind of sickness, men checking out instead of being pulled in. Or it may be that everyone and everything moved more left and women moved lefter.

The Line Is Moving Now

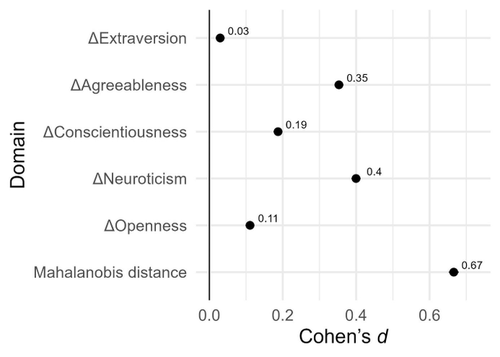

Here's the update: the male line isn't flat anymore.

Post-2024 data shows young men shifting right. Recent surveys all show the same thing. Young men are now actively moving more conservatively.

My read: women got captured first because they were more susceptible to consensus pressure. The capture was fast (2007-2020). Men resisted longer because they were less susceptible and less embedded in captured institutions. But as the gap became visible and culturally salient, as "men are the problem" became explicit mainstream messaging, as men started being excluded from society because of lies, as masculinity, or the very thing that makes men men became toxic, men had to start counter-aligning.

The passivity is converting into opposition. The withdrawal is becoming active rejection.

This doesn't mean men are now "correct" or "free". It might just mean they're being captured by a different machine, one optimized for male grievance instead of female consensus. Andrew Tate didn't emerge from nowhere. Neither did the manosphere. Those are capture systems too, just targeting different psychological vulnerabilities.

The graph is now two lines diverging in opposite directions. Two different machines pulling two different demographics toward two different failure modes.

Some people will say this is just education: women go to college more, college makes you liberal, simple as that. There's something to this. But it doesn't explain why the gap widened so sharply post-2007, or why it's happening in countries with very different education systems.

Some will say it's economic: young men are struggling, resentment makes you conservative. Also partially true. But male economic struggles predate the recent rightward shift, and the female leftward move happened during a period of rising female economic success.

Some will point to cultural figures: Tate for men, Taylor Swift for women. But these are symptoms, not causes. They filled niches the machines created. They didn't create the machines.

The multi-causal model fits better: biological substrate (differential sensitivity to consensus) + technological trigger (smartphones, algorithmic feeds) + institutional amplification (captured universities, female-dominated fields) + economic incentives (marriage collapse, state dependency) + ideological lock-in (sunk costs, social punishment for defection).

No single cause. A system of interlocking causes that happened to affect one gender faster and harder than the other.

So What

If this model is right, some predictions follow.

The gap should be smaller in countries with later smartphone adoption or lower social media penetration. (This seems true: the divergence is less extreme in parts of Eastern Europe and much of Africa, though South Korea is a major exception due to other factors.)

The gap should narrow among women who have children, since parenthood breaks the institutional feedback loop and introduces competing priorities. (Exit polls consistently show this: mothers vote more conservative than childless women.)

The gap should continue widening until the machines are disrupted or the generations age out of them.

Here's the part I don't know how to solve: these systems are self-reinforcing. The institutions aren't going to reform themselves. The algorithms aren't going to stop optimizing. The ideology isn't going to admit failure. The male counter-capture isn't going to produce healthy outcomes either.

Some women will escape.

The ones who have children often do since reality is a powerful solvent for ideology. The ones who build lives outside institutional capture sometimes do.

Some men will stop withdrawing or stop rage-scrolling.

The ones who find something worth building. The ones who get tired of the simulation.

But the systems will keep running on everyone else.

The Question

Bill asked why.

The answer isn't "women are emotional" and it isn't "social media bad." The answer is that we built global-scale consensus engines and deployed them on a species with sexually dimorphic psychology. The machines captured the half more susceptible to consensus pressure. Then they started capturing the other half through different mechanisms.

We're watching the results in real time. Two failure modes. One graph. Both lines are moving away from each other and away from anything healthy.

I don't know how this ends. I don't think anyone does. I don't think it will.

Both machines are still running.

Tyler Durden

Sat, 01/17/2026 - 22:10

via Associated Press

via Associated Press

Recent comments