Feed aggregator

Trump Says Wants To Keep "Hassett Where He Is" Sending Warsh Fed Chair Odds Soaring; Gold Slides

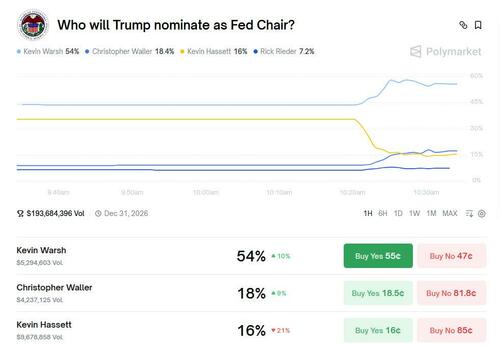

In a strong hint ahead of Trump's decision later this month who the next Fed chair will be, the president appears to have hobbled the chances of one of the Kevins when he said that Kevin Hassett was "fantastic on TV today", and Trump wants to "keep him where he is" since "Fed officials don't talk much" while Hassett is "good at talking."

“I actually want to keep you where you are, if you want to know the truth,” Trump told Hassett during a White House event.

“If I move him, these Fed guys — certainly the one we have now — they don’t talk much. I would lose you. It’s a serious concern to me.”

The news promptly sent Kevin Warsh's Polymarket up to 54% from 34% previously making him the favorite, while Hassett tumbled from a 34% chance to be nominated to a 16% chance, below Chris Waller whose odds also jumped, from 9% to 18%.

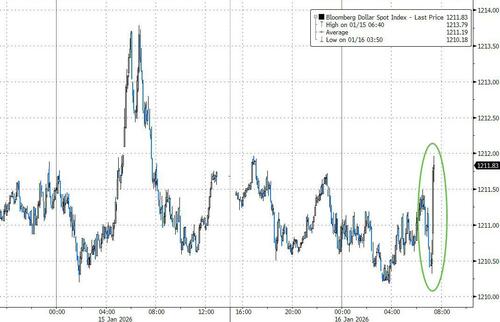

And since Warsh is generally viewed more hawkish than Hassett, we have seen an instant jump in the Dollar index...

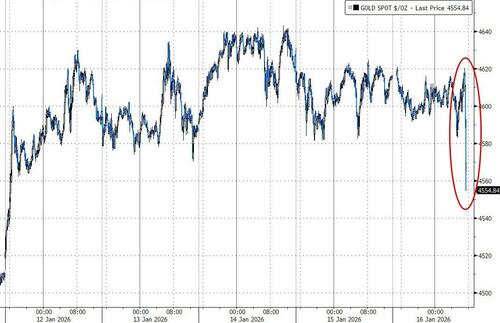

.. and a slide in gold.

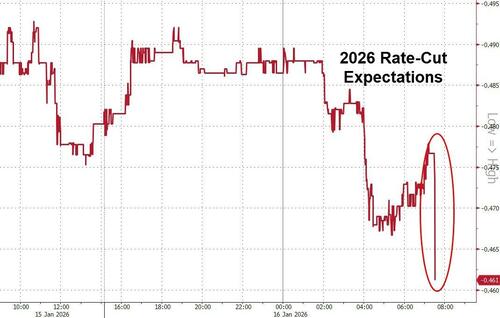

...as rate-cut expectations plunge...

Tyler Durden Fri, 01/16/2026 - 10:51Trump Stuns By Floating Tariffs On Countries That Stand In The Way On Greenland

Days ago as it became clear that Europe and the United States would be locked in a showdown over the future fate of Greenland and its sovereignty, the EU touted that it has some cards to play, as leaders stepped up in defense of Denmark's longtime hold on the resource-rich Arctic territory:

The European Parliament is considering putting on hold the European Union's implementation of the trade deal struck with the United States in protest over threats by U.S. President Donald Trump to seize Greenland.

The European Parliament has been debating legislative proposals to remove many of the EU's import duties on U.S. goods - the bulk of the trade deal with the U.S. - and to continue zero duties for U.S. lobsters, initially agreed with Trump in 2020. It was due to set its position in votes on January 26-27, which the MEPs said should now be postponed.

But the EU might soon regret this threat as diplomacy gives way to leverage, and the US under Trump has plenty of it.

President Trump on Friday went unexpectedly nuclear on the Greenland issue, openly floating tariffs as a pressure tactic against countries that refuse to "go along" with Washington’s ambitions over Greenland.

"I may put a tariff on countries if they don’t go along with Greenland, because we need Greenland for national security," President Trump said at a White House event Friday, according to Bloomberg.

via Reuters

via Reuters

"Trump was speaking about tariff threats serving as leverage to secure most-favored-nation drug pricing before he mentioned Greenland," the report indicates of the context.

While he stopped short of naming specific countries, the message is unmistakable - cooperation comes with benefits and those who stand in America's way will suffer the consequences.

Critics have said the move could fracture NATO and deepen rifts with Europe at a time of already heightened geopolitical tension, while some other sources have speculated of NATO's potential unraveling over this: maybe that's the point?

Tyler Durden Fri, 01/16/2026 - 10:50Six ways the Trump administration tried to erase MLK’s legacy in 2025

More than 60 years ago, Dr. Martin Luther King, Jr. and other leaders of the Civil Rights Movement helped generate the moral impetus and political will for U.S. lawmakers to pass sweeping legislation to combat the oppressive legacies of slavery, Jim Crow laws, and the many expressions of racial discrimination in the United States. Through landmark legislation, the U.S. outlawed racial segregation, prohibited employment and housing discrimination, and dismantled legal barriers to voter registration—challenging a centuries-long denial of basic human and civil rights for people of color.

While acknowledging that these legislative achievements led to “some very wonderful things,” President Trump recently mischaracterized this historic period as one in which white people “were very badly treated” amid “reverse discrimination.” The president’s unfounded remarks explain why this administration has directly attacked more than half a century of progress toward racial and economic justice.

Here are six ways the Trump-Vance administration worked to undermine Dr. King’s legacy and curtail economic justice for people of color in 2025:

- Making it easier for employers to discriminate by undermining the effectiveness of the Equal Employment Opportunity Commission (EEOC) to enforce Title VII of the Civil Rights Act of 1964 for historically marginalized workers, and by gutting the Office of Federal Contract Compliance Programs (OFCCP).

- Hindering equal access to education by dismantling the Department of Education and pushing policies that could limit diversity in higher education, a critical pathway to economic mobility.

- Effectively eliminating the Minority Business Development Agency, the only economic development agency created to help minority-owned businesses overcome social, economic, and legal discrimination.

- Cutting spending on the Supplemental Nutrition Assistance Program (SNAP) amid persistently high rates of poverty for children of color and rising food insecurity.

- Slashing funding for Medicaid and the Children’s Health Insurance Program (CHIP), programs that disproportionately help families and children of color access health care.

- Undermining health equity through massive cuts to the country’s public health infrastructure, setting the stage for the next health crisis.

The emboldened assertion of white supremacy in our political economy demands a renewed commitment to Dr. King’s legacy of racial and economic justice. In a 1966 essay, Dr. King described economic justice and security as rightful aims in the transition from equality to opportunity. Contrary to Trump’s unsubstantiated claims of pervasive discrimination against white people, both equality and opportunity continue to elude people of color at far greater rates as evidenced by disparate and suboptimal outcomes in employment, earnings, wealth, and even health. Moreover, none of those indicators suggest that white people have been disadvantaged by civil rights enforcement. The immortal words of Coretta Scott King capture the true spirit and impact of the civil rights era and expose Trump’s error and hypocrisy: “Freedom and justice cannot be parceled out in pieces to suit political convenience. I don’t believe you can stand for freedom for one group of people and deny it to others.”

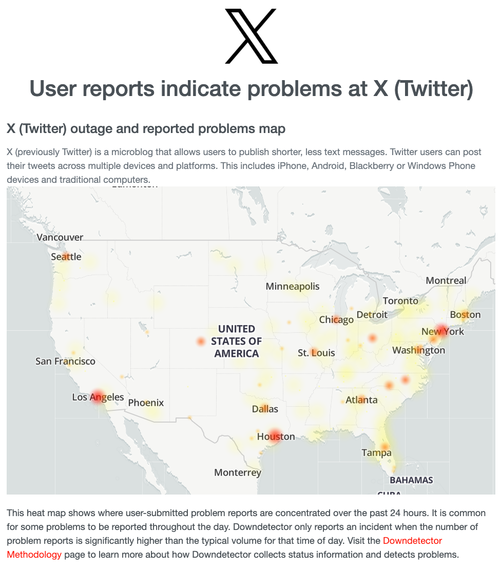

"Connection Timed Out": X Goes Dark

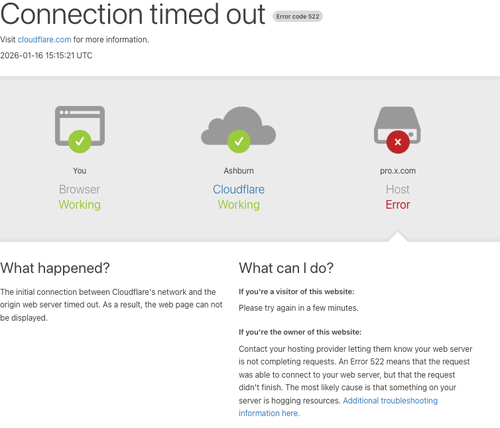

At around 10:10 ET, X went down, displaying a "connection timed out" message, suggesting an issue on the Cloudflare side.

Here's the error message, indicating a host-side failure.

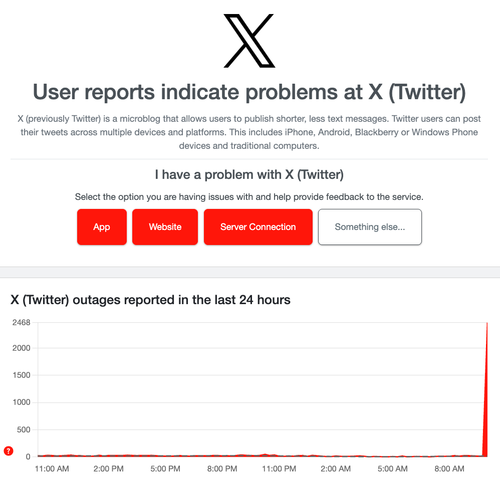

Website tracker Downdetector is currently showing a spike in reported X outages.

The disruption appears to be nationwide.

Developing…

Tyler Durden Fri, 01/16/2026 - 10:24U.S. International Investment Position, 3rd Quarter 2025

"Emergency Intervention": Trump To Cap Residential Electric Bills By Forcing Tech Giants To Pay For Soaring Power Costs

Back in August, when the American population was just waking up to the dire consequences the exponentially growing army of data centers spawned across the country was having on residential electricity bills, we said that the chart of US CPI would soon become the most popular (not in a good way) chart in the financial realm.

In one year, this will be the most popular chart on this site pic.twitter.com/h93gWXMoNL

— zerohedge (@zerohedge) August 11, 2025

One month later we added that it was only a matter of time before Trump, realizing that soaring electricity costs would almost certainly cost Republicans the midterms, would enforce price caps.

100% wrong. Trump is about to put a cap on power price and will crush utilities. https://t.co/WjiZe8MEnM

— zerohedge (@zerohedge) September 29, 2025

Turns out we were right.

And while Trump obviously can not pull a communist rabbit out of his hat, and centrally plan the entire US power grid, what he can do is precisely what he is about to announce.

According to Bloomberg, Trump and the governors of several US Northeastern states agreed to push for an emergency wholesale electricity auction that would compel technology companies to effectively fund new power plants, effectively putting a cap for residential power prices at the expense of hyperscalers and data centers. Which, come to think of it, we also proposed back in October.

The data centers and AI giants are making billions as they drain the power grid dry and get indirect consumer subsidies in the form of 100% bill increases. It's time they allocate some of trillions in circle jerk funds to lowering electricity costs for everyone else

— zerohedge (@zerohedge) October 15, 2025

The unprecedented plan, set to be announced Friday morning, seeks to address growing tensions over how the nation can supply electricity to power-hungry data centers, critical to help win the global AI race against China, without simultaneously hiking utility bills for homes and businesses.

The Trump administration and some US governors plan to direct grid operator PJM Interconnection LLC, the largest regional power grid in the US serving 67 million customers primarily in the Northeast, to hold an auction for tech companies to bid on 15-year contracts for new electricity generation capacity.

If the auction proceeds as envisaged, tech giants would pay for power over the duration of the contracts, whether they use the electricity or not, providing secure revenues for years in a market notorious for price volatility and generator bankruptcies.

The auction would deliver contracts supporting the construction of some $15 billion worth of new power plants, said a White House official granted anonymity to detail the approach.

Naturally, since this plan is being introduced under duress, representatives of PJM won’t be in attendance when the plan is laid out Friday according to Bloomberg.

“We don’t have a lot to say on this,” PJM spokesman Jeffrey Shields said by email. “We were not invited to the event they are apparently having tomorrow and we will not be there.”

The push by the administration and the governors — which will come in the form of a non-binding “statement of principles” signed by Trump’s National Energy Dominance Council and the governors of Pennsylvania, Ohio, Virginia and other states — responds to growing concern about power demand far outpacing supply in the region managed by PJM.

PJM is already home to the world’s biggest concentration of data centers, in northern Virginia. It expects peak demand across its system to jump 17% by 2030 from this year’s high. Furthermore, as we noted two months ago, PJM is one of the 8 (out of 13) regional power markets that are already below critical spare capacity levels.

"eight out of the 13 US regional power markets are already at or below critical spare capacity levels." - Goldman https://t.co/YYAGUukfwR pic.twitter.com/eU4XPFAMrp

— zerohedge (@zerohedge) November 23, 2025

Trump has repeatedly described power plants being built alongside data centers, and on Monday, he doubled down on the idea, insisting in a social media post that the big technology companies that construct data centers must “pay their own way.”

“I never want Americans to pay higher Electricity bills because of Data Centers,” Trump wrote in his post, and now he will try to make that a reality.

As we have warned repeatedly in the past year, cost-of-living concerns - especially when it comes to staples like electricity - are already weighing heavily on Republicans’ bid to maintain control of the House and Senate in this November’s congressional elections. While Trump has stressed the plummeting cost of oil and gasoline since he took office last January, electricity prices have climbed due to rising demand, and there’s a building backlash against data centers that are fueling the surge... which - you guessed it - we warned about too.

between exploding electricity bills and lack of jobs for grads, a new luddite revolution is coming - they will be burning down data centers within a year

— zerohedge (@zerohedge) August 25, 2025

The average US retail price for electricity gained 7.4% in September to a record 18.07 cents per kilowatt-hour, the biggest gain since December 2023. Residential prices have jumped even higher, rising by 10.5% between January and August 2025, marking one of the largest increases in more than a decade, according to the National Energy Assistance Directors Association.

Friday’s action is being cast as a one-time emergency intervention into the PJM market, necessary because of the rapid rise in electricity prices in the Mid-Atlantic region. The Trump administration and governors will urge the grid operator to return to market fundamentals after the acute problem is addressed, the White House official said.

The administration’s prescription for PJM is what’s known as a reliability backstop auction — something the grid operator already envisioned in the wake of repeated failed sales. But the administration and governors’ plan would mean holding the emergency auction right away after one clear failure – with unusual terms meant to foster a wave of rapid, new construction and the only bidders being data center owners and operators.

While PJM already holds auctions procuring electricity supplies, those are 12-month periods. In the auction encouraged by Trump and the governors for 15-year contracts, start-up times for the new power plants are likely to be staggered. The White House and governors are urging PJM to hold the special one-time auction by the end of September.

“It sounds like a significant improvement and a logical extension of bring-your-own new generation,” Joe Bowring, president of PJM’ s independent watchdog Monitoring Analytics LLC, said in a telephone interview. Almost as if the Trump admin read something else we wrote...

To prevent skyrocketing electric bills, every state has to follow the Texas example: each data center must have its own "behind the meter" onsite power generation.

— zerohedge (@zerohedge) November 23, 2025

“We believe data centers should pay for the full cost of their power,” Dominion Energy spokesperson Aaron Ruby… https://t.co/0u1owTeAs8 pic.twitter.com/8W421s3rzV

“While a ‘statement of principles’ doesn’t appear to include a legal mandate for PJM to act, pressure from the Trump administration and a bipartisan coalition of PJM states is very likely to motivate a considerable response” from the grid operator, said Timothy Fox, an analyst with the research firm ClearView Energy Partners.

This plan also could fast track the development of natural gas generation and potentially nuclear plants by guaranteeing revenues – and profits – specifically to support data campuses needed to deploy artificial intelligence. The approach could benefit larger tech companies at the expense of smaller firms, as well as companies involved in advanced energy development such as Small and Modular Nuclear Reactors.

Amazon.com Inc., Alphabet Inc.’s Google and Microsoft Corp. are less exposed to electricity price fluctuations since they can pass those costs on to customers, said Gil Luria, analyst at DA Davidson & Co. However, dozens of smaller companies, including Nebius and CoreWeave that offer artificial intelligence infrastructure to cloud-computing companies on multi-year contracts, could be more exposed to big price swings since they are on the hook to absorb higher electricity costs, he said.

“If they have to pay more for electricity, their margins will get squeezed,” Luria said.

Trump's initiative will deliver another benefit: the effort has the potential to help PJM tackle a significant roadblock: improving the accuracy of its forecasts for demand growth. With tech giants paying for the power plants they need, the approach could weed out speculative projects that have skewed demand growth projections, something we discussed earlier.

As Bloomberg notes, the involvement of Democratic governors – including Pennsylvania’s Josh Shapiro and Maryland’s Wes Moore – is seen by the Trump administration as helping to anchor the effort, since state policies have driven recent changes in the power mix, including the retirement of coal and gas plants. The initiative is also seen aiding hyperscalers by ensuring reliable power supply, and it could be a model for other parts of the country, the White House official said.

Governors are committing to implement and assign these costs to the data centers, ensuring the price of these new power plants doesn’t land on the average household, the White House official said.

PJM’s auctions have emerged as a political flashpoint in the national debate about affordability after prices reached record levels in 2024. Although Pennsylvania’s Shapiro struck a deal with PJM to cap prices in future auctions, costs hit new highs in two subsequent sales. In fact, had it not been for an implicit cap in the latest auction, residential prices would have been 60% higher (see "Inside The PJM Auction Report, Something Crazy: Without Price Controls, Electricity Bills Would Explode".)

The most recent auction, in December, also fell 6.6 gigawatts short of supplies, which PJM blamed on the frenzy to build massive data centers. PJM is now being asked to extend the price cap for auctions held through this year, the White House official said.

While the statement of principles being signed Friday isn’t a binding legal document, administration officials have discussed the plan with a host of stakeholders, from PJM executives and state officials, to utilities, power-plant developers, Wall Street and the hyperscalers building these data centers, the official said.

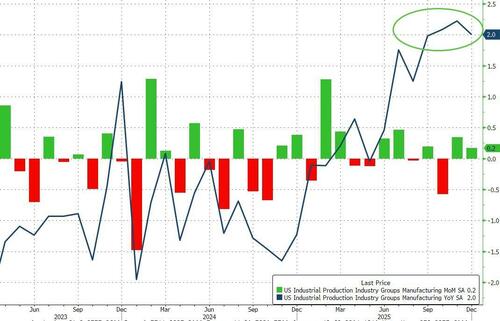

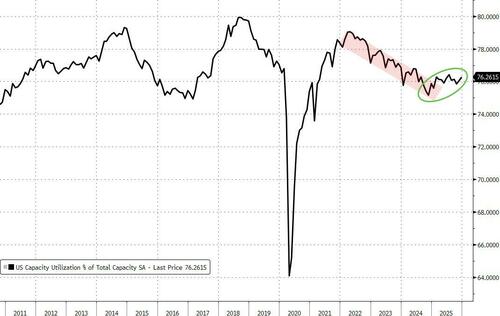

Tyler Durden Fri, 01/16/2026 - 09:25US Industrial Production Surged To End 2025

While 'soft' survey data has been disappointing, hard macro data has been resilient and Industrial Production ended 2025 on a bright note with a 0.4% MoM surge in December (considerably better than the +0.1% MoM expected) complementing November's 0.4% MoM rise. This left industrial production up 2% YoY...

Source: Bloomberg

The index for utilities increased 2.6 percent in December, supported by a rise of 12.0 percent in the index for natural gas...

US Manufacturing output also rose more than expected, +0.2% MoM vs -0.1% MoM exp.

Source: Bloomberg

Capacity Utilization also rebounded in December, seemingly breaking the downtrend...

Source: Bloomberg

This 'positive' macro news seems at odds to the soft survey data that suggests the end of the world.

Finally, rate-cut expectations are lower still following this 'good' news.

Tyler Durden Fri, 01/16/2026 - 09:23Stocks, Bubbles & Market Myths

Each quarter, I prepare a detailed deck and call for Ritholtz Wealth Management clients.1 I start with about 100 ideas and charts, then cut them down to 30 charts and 30 minutes. (Shout out to Chart Kid Matt for his excellent work) Selecting lots of great charts is easy, but curating them into a short, easily consumable deck is the challenge.2

As I do my research in the weeks leading up to the end of the quarter, I have to fight my way through a lot of inaccurate financial data, baseless opinions, and misleading commentary. Much of it is not useful; some is out of context, and lots simply wrong. I fear that too much of what I see, read, and hear will lead its consumers to poor investment outcomes.3

I pulled five charts from the deck to share with you; they counter some of the misinformation out there. I hope you find these useful and thought-provoking.

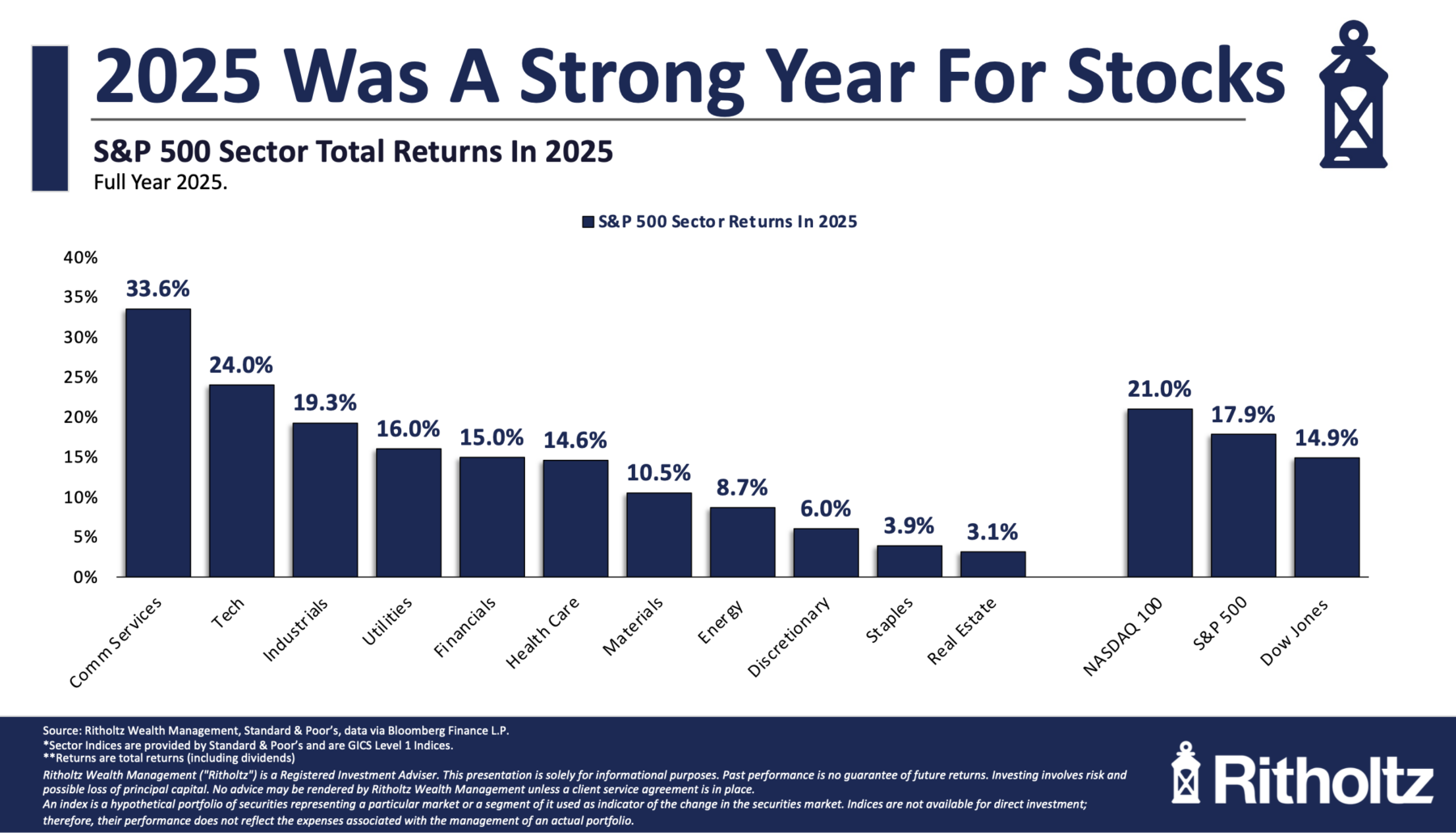

2025 US Equities Up Broadly

U.S stocks had a solid year, with the S&P 500 up 17.9% and the Nasdaq 100 gaining 21.0%. As yyou can see in the chart at top, gains broadened out beyond the Communication and Technology sectors (33.6% and 24%), to the Industrials (+19.3%), Utilities (+16%), Financials (+15%), and Health Care (+14.6%). There were solid gains across most sectors, with Real Estate (3.1%), Staples (3.9%) and Discretionary (6.0%) as the major laggards.

There were only 153 stocks in the S&P 500 that beat the index average; 350 were below 17.9%. That’s narrower than I prefer, but not fatal.

No SPX sector was in the red for 2025.

The bigger news was global: After 15 years of U.S. equity dominance, the rest of the world began to catch up: International stocks rose 33% in 2025. This shift was driven in part by a weakening U.S. dollar, down almost 10%. Global trading partners are repatriating capital due to dissatisfaction with U.S. trade and security policies. While U.S. earnings remain solid, the market is benefiting from diversification as international equities catch up

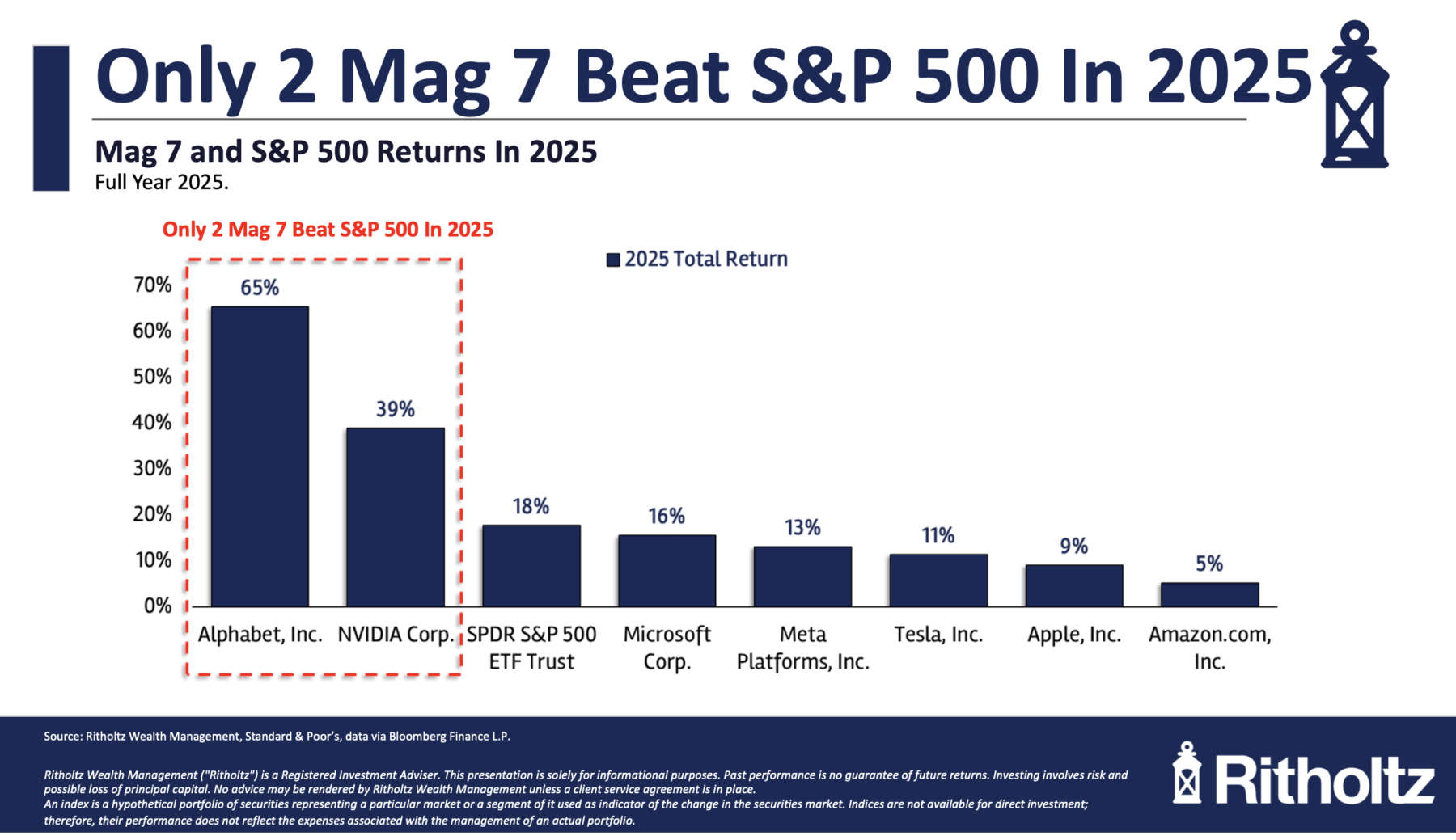

Market Concentration

The most surprising chart in the entire deck is this one: Only 2 of the “Magnificent Seven” outperformed the index. TWO! After hearing for so long from the Concentration Bears that the Mag 7 would be the end of us all, this single datapoint perfectly frames that argument.

Perhaps the Mag 7 dominance is fading; if five of these seven companies underperformed the S&P 500, that means the other 493 companies are catching up in both price appreciation and (eventually) earnings growth.

Valuation

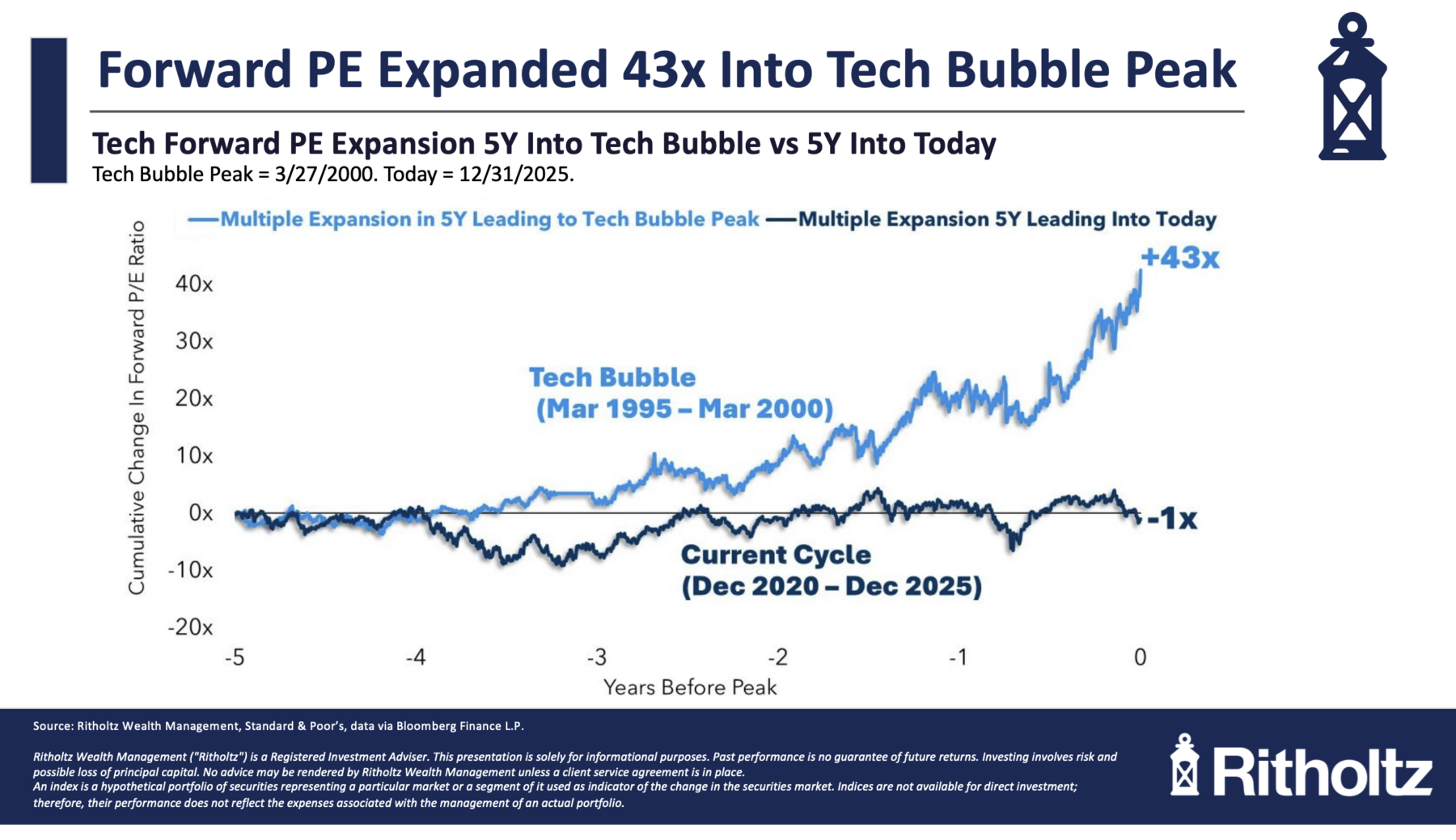

I wonder if the persistent “bubble callers” would be surprised by this chart: Valuations are (mostly) flat: Unlike the dot-com era, which saw P/E multiples expand so dramatically, P/E multiples have remained flat for the past five years. Forward P/E ratios for core AI companies like Meta, Google, Amazon, and Microsoft have also remained stable or declined.

Debt

Bubbles are typically driven by excessive leveraging, but current debt growth remains a fraction of what was seen in 1999–2000. Debt was essentially flat for five years, with only a 9% increase in 2025. Compare this to the last few years of triple-digit debt growth in the 1990s: +111%, +152%, and +187%!

Earnings

If you could only see one data point to guess how markets have performed, it would be earnings.

Earnings grew at a robust pace. Unlike the dotcom era, the AI “boom” is supported by tangible business results rather than pure speculation. For example, despite predictions that AI would kill its core business, Google successfully integrated AI into search and saw its stock rise 65% in 2025.

See also:

The Concentration Bears Have Steered You Wrong

Josh Brown

Downtown, Dec 13, 2025

The Probability of Loss in the Stock Market

Ben Carlson

A Wealth of Common Sense, January 9, 2026

Previously:

10 Datapoints for Thanksgiving (November 26, 2025)

Rational Exuberance? (November 24, 2025)

A Short History of Bubbles (October 24, 2025)

The Probability Machine (August 28, 2025)

All Time Highs Are Bullish (June 26, 2025)

__________

1. If Compliance gives me the OK, I’ll release the full deck and call in the near future.

2. “I have made this longer than usual because I have not had time to make it shorter.” – Blaise Pascal, “Lettres Provinciales,” 1657.

3. I even wrote a book about the impact of all of this bad information!

The post Stocks, Bubbles & Market Myths appeared first on The Big Picture.

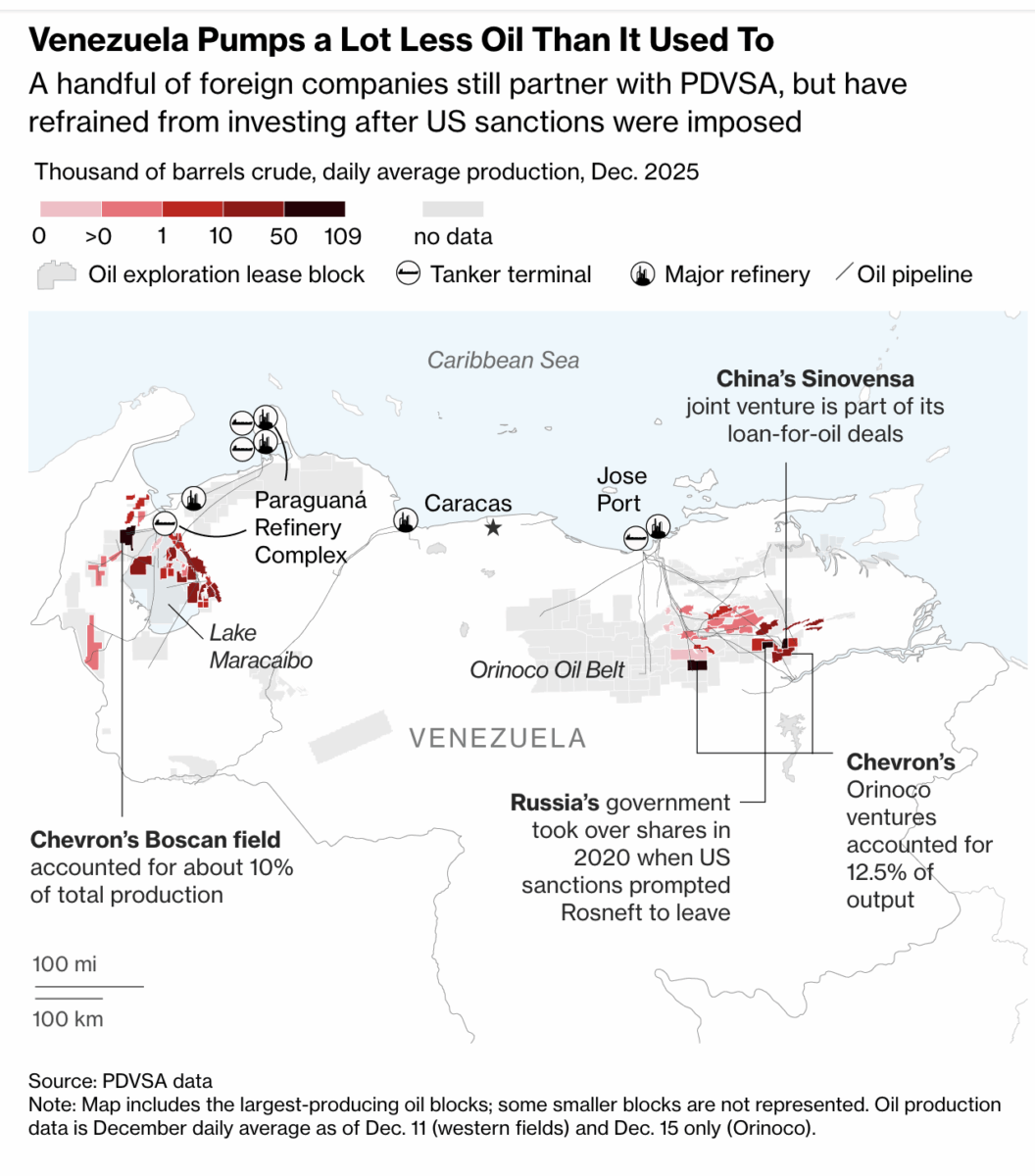

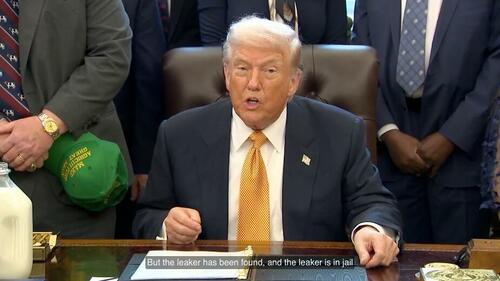

Trump Says 'Venezuela Leaker' Jailed As Polymarket Accounts Go Quiet

Authored by Helen Partz via CoinTelegraph.com,

US President Donald Trump said the “leaker on Venezuela” has been jailed, a remark that has renewed scrutiny of prediction markets following a series of well-timed bets earlier this month.

“The leaker on Venezuela has been found and is in jail right now,” Trump said in the Oval Office on Wednesday, according to a video posted by The Wall Street Journal.

Although Trump did not mention prediction markets, blockchain analysts such as Lookonchain have speculated that the leaker may be linked to a cluster of Polymarket accounts that placed concentrated bets on Venezuela outcomes just hours before the news became public.

“We noticed that two of the three wallets that previously profited from betting on Venezuelan President Maduro being out of office have been inactive for 11 days,” Lookonchain wrote in an X post on Thursday.

Some accounts are still active with bets on IranAddressing the inactive wallets, Lookonchain highlighted the 0xa72DB1 Polymarket account, which turned a $5,800 stake into $75,000 by betting on Maduro being out of office by Jan. 31, 2026.

Lookonchain also noted the 0x31a56e account, which placed a series of bets on Venezuelan events before disappearing from Polymarket around Jan. 8.

Source: WSJ

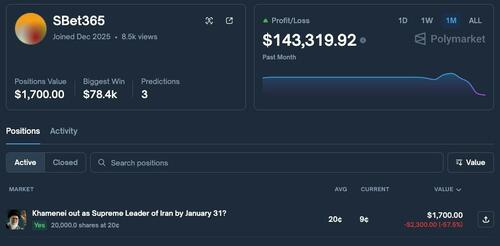

The remaining wallet, SBet365, placed another bet two days ago, predicting that Iran’s Supreme Leader Ayatollah Ali Khamenei would be ousted by Jan. 31, Lookonchain noted.

SBet365 was also among accounts that gained significant profits from betting on Venezuela on Polymarket, making abour $140,000 from wagers tied to Maduro’s ouster.

“There could be some others [leakers], and we will let you know about that,” Trump said, referring to the jailed Venezuelan leaker.

Source: Polymarket

The events come amid ongoing scrutiny of prediction markets, with US lawmakers pushing a bill to combat insider trading on political wagers.

Sean Patrick Maloney, president and CEO at Coalition for Prediction Markets, a national industry alliance formed in late 2025, said coalition members already ban insider trading by enforcing strict Know Your Customer policies.

“It’s critical to draw a bright line between offshore, unregulated prediction platforms and federally regulated US ones,” Maloney told Cointelegraph, adding:

“Consistent with current law, offshore, unregistered platforms should not be able to operate in the US or serve US customers without the same safeguards and registrations, keeping this activity governed responsibly under US oversight.”

Tyler Durden Fri, 01/16/2026 - 08:45Stocks Rise As Tech Meltup Accelerates

Futures are higher, and trading near record territory, led by tech as this year’s great rotation shows no sign of slowing, broadening the base of names driving Wall Street’s push back towards all time highs. As of 8:00am, S&P 500 futures were 0.3% higher with Nasdaq 100 contracts up 0.4% as the latest wave of enthusiasm for technology stocks carried into Friday. Overnight headlines were mostly muted. Pre-market, Mag 7 are mostly higher led by NVDA +1.1%; AI names (AMD +3.2%, AVGO +1.3%, MU +2%) continued their rally yesterday. Bond yields are unchanged. Commodities are mixed: oil added 1.2%, while silver fell -2.0%; ags are mostly higher. US session features industrial production data and three scheduled Fed speakers.

In premarket trading, Mag 7 stocks are mostly higher (Nvidia +0.8%, Tesla +0.6%, Meta +0.09%, Alphabet +0.5%, Microsoft +0.06%, Amazon +0.3%, Apple -0.2%

- JB Hunt Transport Services Inc. (JBHT) falls 4% after the trucking firm reported quarterly revenue that missed estimates, underscoring continued weakness in freight demand.

- Kraft Heinz (KHC) is down 1.1% after Morgan Stanley downgraded the maker of Jell-O and Oscar Mayer hot dogs to underweight.

- Mosaic (MOS) falls 6% after the producer of phosphate and potash crop nutrients said North American fertilizer demand declined well beyond normal seasonal softness in the fourth quarter.

- PNC Financial Services Group Inc. (PNC) rises 3% after reporting a 9% increase in fourth-quarter revenue, beating analysts’ estimates as financing and dealmaking by middle-market customers accelerated.

- Regions Financial (RF) falls 4% after the regional bank reported EPS and total loans for the fourth quarter that came in below the average analyst estimate. The bank also said it sees net interest income declining in the first quarter of 2026.

In corporate news, Trump continues to try to ease the squeeze on Main Street that’s hurting his popularity among voters. A plan is set to be announced on Friday to compel tech firms to effectively fund new plants to power the data centers essential to win the global AI race, without hiking utility bills for homes and businesses. A potential deal that would see China’s BYD supply Ford’s overseas factories with batteries for hybrid vehicles drew immediate political blowback from White House trade adviser Peter Navarro, who questioned its wisdom. OpenAI and Microsoft face a trial over Elon Musk’s claims that Sam Altman’s startup betrayed its founding mission as a public charity when it took billions in funding from the software giant and made plans to operate as a for-profit business.

Yet even after TSMC’s huge beat and capex forecast fueled optimism on Thursday that the AI boom has plenty of room to run, the Russell 2000 continued to outperform the S&P 500. It outpaced its bigger counterpart for a 10th straight session, leaving small caps’ relative performance more than 600 basis points better so far this year.

Despite the bounce, the Nasdaq 100 closed Thursday still in the red for the week, as investors turned toward firms that are benefiting from improving economic growth prospects. The balance between tech leadership and broader market participation is likely to persist in the coming weeks.

“There is scope for some diversification away from concentrated positioning,” said Geoff Yu, senior macro strategist at BNY. “A rising tide can lift all boats as the US economy is still expanding and expectations for market returns remain favorable.”

The first full week of the latest earnings season is boding well for what’s to come, with 89% of the 28 companies that have reported so far beating expectations. With big banks dominating the early days, stock investors will get a clearer view of the broader economy next week when results from names such as Netflix Inc., Johnson & Johnson and 3M Co. are due.

“The results so far show, at least for the banks, that the consumer is okay, deal activity and capital markets are healthy, earnings revisions are still very positive,” said Andrea Gabellone, head of global equities at KBC Global Services. “In the meantime, you have some big tailwinds, like the weak dollar.”

Investors continue to deploy funds into equities and trim cash holdings. According to Bank of America, citing EPFR Global data, US stock funds saw $36.5 billion of inflows in the week ended Jan. 14.

Meanwhile, yield premiums on corporate debt have narrowed to the least since 2007, a Bloomberg index of bonds across currencies and ratings shows, prompting some of the world’s biggest money managers to warn against complacency. The extra yield investors demand to hold junk notes has also dropped to the lowest in nearly two decades. Companies issued roughly $435 billion of bonds in the first half of January, a record for the period, and more than a third above last year’s tally at this point, according to data compiled by Bloomberg.

Five presidents of regional Fed banks, who in recent months found themselves on opposite sides of the policy debate, indicated on Thursday that the central bank is now well-positioned to sit tight and wait for further data before cutting rates again. No change is expected at the Fed’s Jan. 27-28 meeting, after cuts at each of its last three.

European stocks dip but remain on track for their fifth straight weekly advance, the longest streak of gains since May, as investors remain confident about earnings and artificial intelligence demand. The Stoxx 600 falls 0.1% as health care stocks outperform while miners lag, as news of a Chinese clampdown on high-frequency trading sinks metals. Here are some of the biggest movers on Friday:

- Kloeckner & Co shares surge as much as 30%, to the highest level since June 2022, after Worthington Steel agreed to buy the metals processor for €11 per share in cash.

- Polar Capital shares rise as much as 8% to their highest level since April 2022, following the asset manager’s quarterly update and announcement of a share buyback program.

- Novo Nordisk shares advance as much as 6.7%, snapping two days of declines, as analysts at Berenberg and Bank of America lift their price targets on the stock, while Deutsche Bank calls the Danish drugmaker one of its top picks.

- Elekta shares gain as much as 9.1% after its Evo Linear Accelerator imaging system gained clearance from the US FDA.

- HBX shares rise as much as 8.6%, the most since May, after the Spanish travel technology firm announced a share buy-back program and plans to pay regular dividends.

- Genus shares surge as much as 15%, the most in more than four months, after the animal genetics firm said it now expects FY26 adjusted pretax profit to come in “moderately” above the top end of current views.

- Sunrise Communications shares slide as much as 4.7% after an offering of 4 million shares by holder Baupost Group priced at a 3.38% discount to Thursday’s close.

- Richemont shares fall as much as 3.8% as BofA downgrades to neutral from buy, in a second day of declines for the stock following the luxury goods group’s sales report.

- Boliden shares slip as much as 3.7%, leading miners lower as news of a Chinese clampdown on high-frequency trading cooled sentiment.

Earlier in the session, Asian stocks rose, with Taiwan’s key index jumping to a record, as results from TSMC helped confirm an upbeat outlook for artificial intelligence demand. The MSCI Asia Pacific Index advanced 0.4%, with TSMC the biggest contributor along with other tech firms including Samsung Electronics and Delta Electronics. Taiwan’s Taiex climbed nearly 2% and Korea’s Kospi gained 0.9% to a new high, while Japanese stocks slipped following a recent rally. The regional benchmark has gained about 2.8% this week, which would be its best since September 2025. While TSMC helped reinforce the AI rally, an agreement for the US to lower tariffs on Taiwan provided additional relief amid ongoing geopolitical concerns on multiple fronts. Chinese stocks fell amid fresh signs that authorities are attempting to cool the market rally, with record outflows seen in some of the exchange‑traded funds heavily owned by the so‑called national team. Next week’s highlights include monetary policy decisions in Japan, Malaysia and Indonesia. The World Economic Forum in Davos is among the key events that will be watched by global investors.

In FX,the yen strengthened, trimming its third weekly decline, as Japan’s Finance Minister Satsuki Katayama reiterated her warning that all options including direct currency intervention are available for dealing with the recent weakness. The US dollar slipped against most major currencies with Treasury yields trading in a tight range. The kiwi is leading gains against the greenback, rising 0.4% while the Japanese yen and Norwegian krone are not far behind.

While equities are moving, yields are snoozing. The 10-year Treasury yield is headed for a fifth straight week of minimal change, rivaling its longest stretch of inertia in the past two decades. The bond market is waiting for a clearer steer on the economy and the outcome of the Trump administration’s pressure on Fed chair Jerome Powell to cut interest rates further. On Friday, treasuries edged lower in early US session after plying small ranges since Asia open with European bonds underperforming. Yields are less than 2bp cheaper on the day with curve spreads little changed; 10-year around 4.19% is 2bps higher, outperforming bunds and gilts slightly.The weekly IG volume stands in line with $60b projection after Thursday’s six-name $35b slate headed by Goldman Sachs’ $16b landmark transaction; issuers paid about 1bp in new issue concessions on deals that were 3.5 times covered.

In commodities, oil rebounded after its biggest drop since June, while gold and silver declined. WTI crude futures rise 1.3% to near $60 a barrel. Spot silver falls 4%.

US economic calendar includes January NY Fed services business activity (8:30am), December industrial production (9:15am) and January NAHB housing market index (10am). Scheduled Fed speakers include Collins (10:50am), Bowman (11am) and Jefferson (3:30pm)

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.5%

- Russell 2000 mini +0.4%

- Stoxx Europe 600 little changed

- DAX -0.1%

- CAC 40 -0.4%

- 10-year Treasury yield little changed at 4.17%

- VIX -0.3 points at 15.54

- Bloomberg Dollar Index little changed at 1210.82

- euro little changed at $1.1613

- WTI crude +1.1% at $59.82/barrel

Top Overnight News

- A plan to address power costs from data centers is set to be announced today. Donald Trump will direct the top US grid operator to hold an emergency power auction, forcing tech giants to fund new power plants, according to a White House official. BBG

- President Trump was advised that a large-scale strike against Iran was unlikely to make the government fall and could spark a wider conflict, U.S. officials said, and for now will monitor how Tehran handles protesters before deciding on the scope of a potential attack. Still, Trump is expected to order the Pentagon to send an aircraft carrier, the USS Abraham Lincoln, from the South China Sea to the Middle East. WSJ

- Bipartisan talks in the Senate about a healthcare deal to extend ACA subsidies are stalling, making an agreement less likely. Politico

- US senators are set to meet members of the Danish parliament in Copenhagen today as Denmark and Greenland step up lobbying in an effort to head off Trump’s push to take control of Greenland. BBG

- Canada and China reached a wide-ranging agreement to lower trade barriers including a reduction in tariffs for Canadian canola and Chinese EVs. Mark Carney hailed his strategic partnership with Xi Jinping, referencing a “new world order.” BBG

- Chinese companies have started discussions about renting computing power at data centers in Southeast Asia and the Middle East to get access to Rubin chips, according to people involved in the talks. That follows companies’ efforts last year to access chips in Nvidia’s Blackwell series. WSJ

- Some Bank of Japan policymakers see scope to raise interest rates sooner than markets expect with April a distinct possibility, as a sliding yen risks adding to already broadening inflationary pressure. RTRS

- The criminal investigation into Federal Reserve Chair Jerome Powell threatens to upend the contest over whom President Trump will choose to succeed him as it enters its final stretch. Trump has made clear he prizes loyalty in his pick, but the Justice Department probe—which Powell said was part of a pressure campaign to get the Fed to lower interest rates—threatens to make that quality a liability. WSJ

- Japanese Finance Minister Katayama said FX intervention is a potential option under the US-Japan agreement and expresses readiness to take decisive action while keeping all options on the table: BBG

Trade/ Tariffs

- Canadian PM Carney said the relationship with China is more predictable than the one Canada has with the US.

- Canadian PM Carney announces that they will allow as many as 49k Chinese EVs into the Canadian market, with a most-favoured-nation tariff of 6.1%. In return, Canada anticipates that by March 1st China will reduce tariffs on Canola seed to a c. 15% combined rate. In addition to a resolution to other trade obstacles.

- A White House Official said the chip announcement on Wednesday was 'phase one' action and there could be other announcements, pending ongoing negotiations with other countries and companies.

Central Banks

- BoJ: abolish the "Amount of Cash Collateral for Lending of ETFs" today, given that the new lending of ETFs has been ceased and the outstanding balance of ETF lending has reached zero.

- BoJ is seen as likely to raise its FY26 economic and inflation forecasts, Reuters reported citing sources; the report adds that some BoJ policymakers see scope to raise interest rates as soon as April due to the inflationary effect of a weaker JPY.

- ECB's Lane said that there is no immediate debate on interest rates if current conditions persist and that that current rates set to establish baseline for years ahead.

- NBP Governor Kotecki, in a Bloomberg interview, said it is becoming increasingly clear that there is room for further rapid interest rate cuts. Assumes that in February, the MPC will resume its activities from last year. The inflation outlook is increasingly optimistic.

A more detailed look at global markets courtesy of Newqsuawk

Top Asian News

European equities (STOXX 600 -0.1%) are trading mostly softer, contrary to APAC which traded mostly in the green. Not much on a macro newsflow to explain broader weakened sentiment seen in European. European sectors are trading mostly in the red. At the bottom of the pile are Basic Resources (1.5%), Automobiles & Parts (-1.4%) and Consumer Product & Services (-1.3%). Sentiment around the Basic Resources sector has been pinned down by lower metal prices with copper especially pressured by China’s crack down on high-frequency trading. On the upside, Utilities (+0.3%), Health Care (+0.3%) and Energy (+0.2%) are the slight outperformers.

Top European News

- The ONS has drawn up contingency plans to delay the launch of its new labour market survey by 6 months, Bloomberg reported citing people familiar with the matter. Another scenario under consideration is to launch the survey in May 2027. ONS plans to decide in the summer whether to stick to the November roll-out date.

FX

- DXY is flat/incrementally lower this morning and currently within a narrow 99.26-99.40 range, which is towards the upper end of Thursday’s bands. Overnight, a White House Official suggested that the latest chip announcement was “phase one” and more could be put out following negotiations. That aside, not really much US specific newsflow, but focus will turn to a few Fed speakers and Industrial Production later.

- G10s are mixed, with the Kiwi and JPY topping the pile whilst the Loonie is mildly pressured. The JPY was boosted overnight after a Reuters report suggested that the BoJ could hike as soon as April, with some members fearing a weak currency could lead to a resurgence in inflation. In the midst of all this, Finance Minister Katayama has continued to provide some jawboning, which also helped the JPY. USD/JPY currently trades at the lower end of a 157.97-158.70 range vs Monday’s open of 158.07.

- Politics remains the main theme for Japan, as attention now turns to the 22nd of January, when PM Takaichi is expected to dissolve the Diet. UBS believes that the LDP will be able to secure a half majority, improving the party's position. Interestingly, Nippon TV ran the numbers following the CDP-Komeito tie-up and calculated that LDP "would retain only 60 of the 132 single‑member districts it won in 2024". Though this is only a mathematical calculation, and does not account for Takaichi's high approval rating of more than 70%.

- Japanese Finance Minister said the statement between Japan and the US can be viewed as saying intervention to counter FX moves out of line with fundamentals is permitted. Not sure when JPY-carry trades peak out as Japan-US interest rate differentials are set to narrow further.

Fixed Income

- A contained start for fixed income benchmarks, though the bias is increasingly bearish.

- Newsflow has been light. USTs in a very thin sub-five tick range just above the 112-00 mark into an afternoon once again dictated by, on paper at least, data and Fed speak.

- Bunds under increasing pressure into the morning, pressure that has emerged without a clear or overt fundamental driver. Down to a 128.26 base with downside of 17 ticks at most. No reaction to unrevised inflation from Germany and Italy, while the European docket ahead is light today before picking up next week with several key ECB speakers at the Davos WEF, including President Lagarde.

- OATs lag in Europe, down by 20 ticks at worst to a 121.01 base. Action that has lifted the OAT-Bund 10yr yield spread above 68bps, though the above Bund pressure is stemming the downside. Slight underperformance that is likely a function of the French Government electing to suspend the National Assembly budget debate last night, meaning that the deliberations of the budget and likely conclusion of it will not occur today. As such, the pencilled-in date of a Monday vote on the revenue draft is off the table.

- Gilts opened on the backfoot, with losses of six ticks and have since extended to a 92.27 low, -21 ticks at most. Pressure that is a function of catch-up to the bearish action that was seen in the latter part of Thursday's US session, the morning's bearish bias, and reports that the ONS might be delaying the new labour data by six months.

Commodities

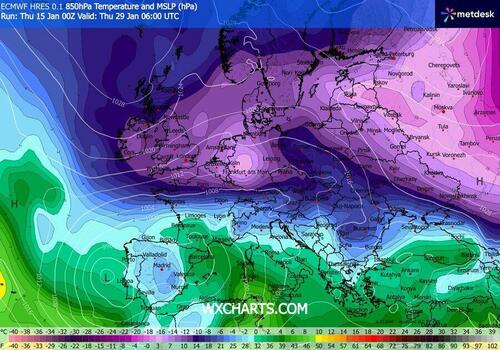

- Crude benchmarks are firmer this morning, and while they are set to end the week in the green with upside of c. USD 0.80/bbl for WTI and USD 1.0/bbl for Brent, they are towards the lower-end of the week's c. USD 4.00/bbl parameters. Continuing with energy but away from crude, gas benchmarks remain alight and at highs. Drivers remain the same as discussed in recent sessions, including: Iran supply, European cold spell, Asian demand, and expectations for a cold spell in APAC next week. Dutch TTF briefly surmounted the EUR 35/MWh mark this morning

- Spot gold is under modest pressure. Hovering around the USD 4.6k/oz handle despite a contained USD, but hit as the risk tone stateside is constructive and geopolitics, as discussed, hasn't escalated. Further pressure is also potentially stemming from the firmer global yield environment.

- Base peers were softer overnight, hit by China cracking down on high-frequency trading via the removal of servers from some data centres. Action that pushed 3M LME Copper below the USD 13k/t handle early doors and since to a USD 12.77k/t trough, lower by over USD 300/t on the session.

- Heavy rainfall in northeast Australia has triggered floods that are hampering mine operations, with some coal miners declaring force majeure on portions of their shipments or potential delays to customers.

US Event Calendar

- 9:15 am: United States Dec Industrial Production MoM, est. 0.1%, prior 0.2%

- 9:15 am: United States Dec Capacity Utilization, est. 76%, prior 76%

- 10:50 am: United States Fed’s Collins Delivers Welcoming Remarks

- 11:00 am: United States Fed’s Bowman Speaks on Economy and Monetary Policy

- 3:30 pm: United States Fed’s Jefferson Soppeaks on Economy, Monetary Policy

DB's Jim Reid concludes the overnight wrap

Welcome to the end of another big market week. I had a knee scan yesterday and I made the mistake of uploading the images (which I don't understand) into AI last night. The scan was supposed to see how far the arthritis on the lateral side (outside) had spread and how far I might be towards partial knee replacement. Its swollen and I'm limping a fair bit at the moment. However AI said the scans showed the complete opposite. It says I have a medial (inside) meniscus tear and "massive" bone bruising. AI said my knee was at high risk of a stress fracture and I should see a consultant immediately and stop all activity! This was a bit of a fright. I'm seeing my consultant on Tuesday. Will AI be correct? There are few good outcomes here but I will be impressed if AI has accurately picked up a completely different issue to what my consultant and I thought before the scan. Update to follow next week!

Markets put in a stronger performance than my knee yesterday, as ebbing fears about a US military intervention in Iran saw the geopolitical risk premium taken out of various assets. For instance, Brent crude oil (-2.18%) saw its biggest decline since June, closing at $63.76/bbl. Meanwhile, gold (-0.23%) and silver (-0.80%) also retreated slightly from their record highs on Wednesday and continue to dip a little in Asia. Moreover, just as fears eased about the geopolitical situation, a strong batch of US data meant investors grew increasingly confident in the 2026 outlook, offering further support to risk assets. So the S&P 500 (+0.26%) and Europe’s STOXX 600 (+0.49%) moved higher, with the latter hitting a fresh record high. And as investors priced in fewer rate cuts, the 10yr Treasury yield (+3.8bps) also picked back up to 4.17%.

The latest headlines on Iran were the main drivers of market sentiment yesterday, as expectations rose that the US would not intervene for the time being. For instance, Trump posted a reference to a Fox News article that an Iranian protester wouldn’t be sentenced to death, saying “This is good news. Hopefully, it will continue!” So that helped oil prices to come down yesterday, with Brent crude and WTI both posting their first daily decline after a run of 5 consecutive increases. Some lingering uncertainty remains, with Fox News reporting that the US military was preparing a range of options towards Iran.

On top of the Iran developments, risk assets got a further boost from the latest US data, which added to the sense the expansion has further to run. Notably, the weekly initial jobless claims fell to just 198k in the week ending January 10 (vs. 215k expected), which meant that the 4-week moving average (205k) fell to its lowest in nearly 2 years. Even though there is likely to be a holiday season distortion partly impacting these numbers, it still added to optimism on the US economy. This was cemented by a couple of Fed surveys too, which painted an optimistic picture on both growth and inflation. First, there was the New York Fed’s Empire State manufacturing survey, which rose to 7.7 in January (vs. +1.0 expected), with the prices paid component at a 10-month low. And second, the Philadelphia Fed’s manufacturing business outlook survey rose to 12.6 (vs. -1.4 expected), with the prices paid component at a 7-month low.

This strong backdrop for growth meant that investors dialled back the prospect of Fed rate cuts in the months ahead. Indeed, the amount of cuts priced by the December meeting fell -6.3bps on the day to just 48bps, which is the fewest cuts priced so far this year. So that pushed Treasury yields up across the curve, particularly at the front end, with the 2yr yield (+5.4bps) rising to 3.57%, whilst the 10yr yield (+3.8bps) moved up to 4.17%. That also followed some hawkish-leaning comments from Fed officials, with Chicago Fed President Goolsbee saying that “The most important thing facing us is we’ve got to get inflation back to 2%”. Atlanta Fed President Bostic said “We need to make sure that we stay in a restrictive stance, because inflation is still too high”. Kansas City Fed President Schmid suggested that monetary policy should remain “modestly restrictive” and San Francisco Fed President Daly posted that “policy is in a good place”. Remember that today is the last chance we’ll get to hear from Fed officials before the next meeting, as their blackout periods start tomorrow.

With geopolitical risk subsiding and US data surprising on the upside, that meant it was another solid day for equities, though the S&P 500 (+0.26%) did decline late in the session, closing half a percent below its intra-day highs. Semiconductor stocks led the gains after TSMC’s strong earnings release, with the Philadelphia Semiconductor index up +1.76% and Nvidia rising +2.13%, though the broader Mag-7 (+0.18%) had a more neutral day. It was also a good day for bank stocks, with the KBW Bank index (+1.67%) recovering after four consecutive declines, aided by strong earnings from Morgan Stanley (+5.78%) and Goldman Sachs (+4.63%). And it was another strong day for small-cap stocks, with the Russell 2000 (+0.86%) up to a fresh record, meaning the index is already up +7.76% in 2026 so far. This marked the tenth consecutive session that the Russell 2000 outperformed the S&P 500, the longest such run since 1990.

Over in Europe, markets also put in a decent performance, with the STOXX 600 (+0.49%) and the FTSE 100 (+0.54%) reaching fresh record highs. Meanwhile, strong data also helped to push up sovereign bond yields, particularly for UK gilts after the November GDP print surprised on the upside. It showed that GDP grew by +0.3% in November (vs. +0.1% expected), which is the strongest monthly print since June. Separately in Germany, we also found out that the economy grew by +0.2% for the full year in 2025, in line with expectations, recovering after two consecutive contractions in 2023-24. So yields on 10yr UK gilts moved up +4.8bps, whilst those on 10yr bunds (+0.5bps) and OATs (+0.1bps) saw marginal increases.

Asian equity markets are a little mixed this morning. Tech is performing, still benefitting from robust earnings from chipmaking leader TSMC the day before. However, this positive sentiment is being tempered by dips in other sectors. The KOSPI (+0.59%) and the S&P/ASX 200 (+0.48%) are increasing but with the Hang Seng (-0.27%) lower. The Nikkei (-0.11%) is pausing for breath after a great week and mainland China is flat. S&P 500 (+0.28%) and NASDAQ 100 (+0.38%) futures are regaining some of the late losses last night.

In FX markets, the Japanese Yen (+0.25%) is appreciating, currently trading at 158.23 against the US Dollar. This strengthening follows remarks from Japanese Finance Minister Satsuki Katayama, who indicated a willingness to consider all available options, including coordinated intervention with the US, to address excessive foreign exchange volatility. Yields on 10-year Japanese Government Bonds have risen by +2.0bps, reaching 2.18% as we go to print.

The next main data point in Asia is China's fourth-quarter GDP data on Monday. This will tell us whether the Chinese economy met the government's annual growth target of 5%.

Looking at the day ahead, data releases include US industrial production and capacity utilization for December, along with the NAHB’s housing market index for January. Otherwise from central banks, we’ll hear from the Fed’s Jefferson, Bowman and Collins, along with the ECB’s Escriva.

Tyler Durden Fri, 01/16/2026 - 08:33EU NatGas Spikes Most In Two Years As "Perfect Storm" Unfolds

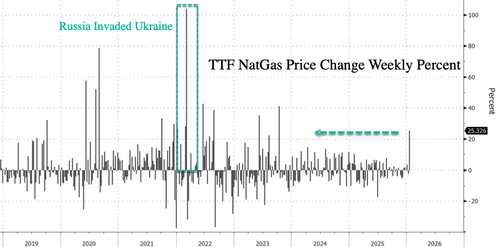

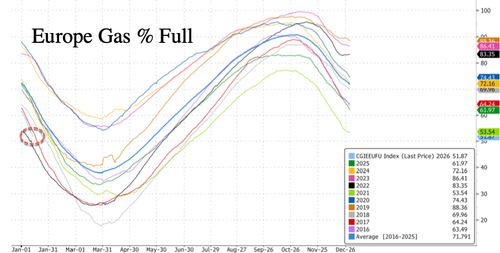

Dutch TTF natural gas futures, Europe's benchmark gas contract, are up 25% on the week and on track for their largest weekly gain since October 2023. The abrupt reversal in sentiment reflects tightening storage levels, short covering, and a burst of unusually cold weather sweeping across the continent.

"Sentiment has completely turned ... you could almost call it a perfect storm," Global Risk Management analyst Arne Lohmann Rasmussen wrote in a note.

TTF futures are set for the largest weekly gain (25%) since the week of October 13, 2023.

TTF futures have rocketed higher this week from lows, now trading at nearly 36 euros per megawatt-hour.

Lohmann Rasmussen noted that sizable NatGas withdrawals have also brought stockpiling risks into focus ahead of next summer. According to Bloomberg data, inventories across the continent currently stand at around 52%, well below the 10-year average of 71% for this time of year.

Bloomberg noted, "The rally highlights a deeper structural shift. Europe has lost much of the flexibility it once relied on to absorb supply shocks, leaving storage as one of its few remaining buffers as it procures liquefied natural gas from across the globe."

The good news is that Europe has secured ample LNG supply this winter and Norwegian pipeline flows remain steady, but the lack of a meaningful buffer when temperatures plunge and heating demand surges highlights just how fragile Europe's energy system has become.

Tyler Durden Fri, 01/16/2026 - 08:20Porsche Sales Plunge Most In 16 Years

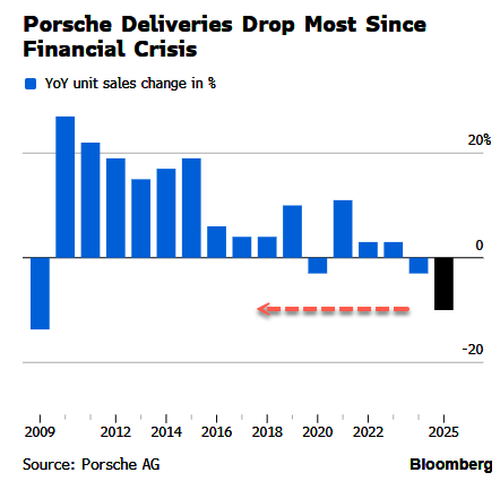

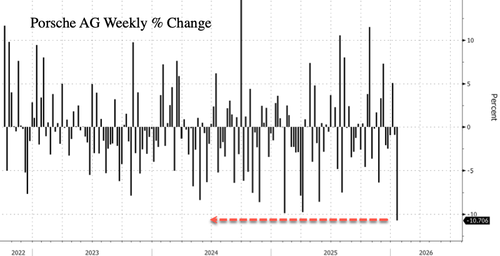

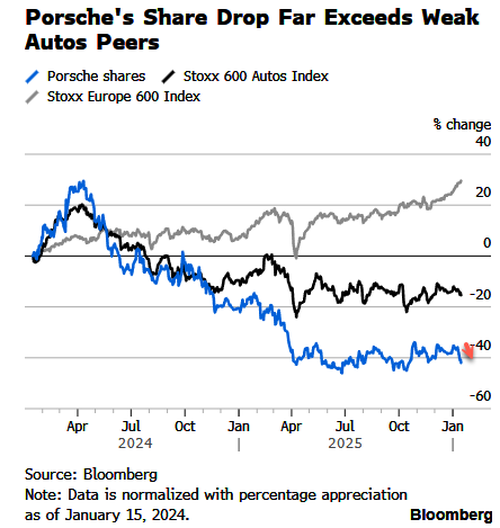

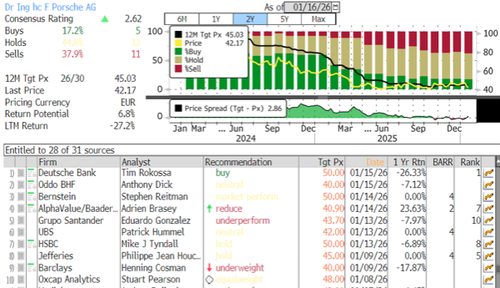

Porsche AG shares in Germany are headed for their steepest weekly decline since trading began in late 2022, after the 911 maker reported that vehicle sales in the 2025 selling year fell to their lowest level in 16 years.

The 911 maker announced earlier that it delivered 279,449 vehicles to customers worldwide in 2025, down 10% from 310,718 in 2024. This marked the largest annual drop in deliveries since the 2009 financial crisis roiled global markets and crushed consumer sentiment.

"After several record years, our deliveries in 2025 were below the previous year's level. This development is in line with our expectations and is due to supply gaps for the 718 and Macan combustion-engined models, the continuing weaker demand for exclusive products in China, and our value-oriented supply management," Matthias Becker, Member of the Executive Board for Sales and Marketing at Porsche, wrote in a statement.

Porsche's troubles are not dissimilar to those of other European auto brands, where sliding sales, profit warnings, intensifying competition from Chinese brands, and weak electric-vehicle demand have created significant uncertainty that is likely to linger well into the second half of the year.

The stock is slightly lower in European trading. On the week, shares are down the most on record (-10%), with trading data going back to their 2022 initial public offering.

Compared with peers...

Bloomberg cited a conversation earlier this week between Oddo BHF analyst Anthony Dick and Porsche CFO Jochen Breckner at the German Investment Seminar in New York. Breckner told the analyst he was "even more conservative" than before. In reducing his estimates, Dick said Porsche is in an ongoing "major restructuring," noting that profitability has been under pressure since its IPO. He added that this year and next are likely to be transition years for the company

According to Bloomberg data, analysts remain mostly pessimistic on Porsche, with just five buy ratings, 13 neutral ratings, and 11 sell ratings.

The broader EU auto industry is struggling.

Bernstein analysts, led by Stephen Reitman, called Porsche their "wild card," noting that a shift to a full-time CEO with experience at Ferrari and McLaren Automotive provides "room for optimism" and greater urgency in improving performance.

Overall, Porsche appears to be in prolonged transition over the next one to two years, while the broader EU auto industry remains stuck in a rut, weighed down by weak demand, margin pressure, and an uncertain path forward.

Tyler Durden Fri, 01/16/2026 - 07:45UK Govt Threatens To Return Lucy Connolly To Jail For Sharing Joke Post On X

Authored by Steve Watson via Modernity.news,

Lucy Connolly, the 42-year-old UK woman previously sentenced to two years in prison for a post on X is back under the microscope of Britain’s speech enforcers, with the government threatening to put her back behind bars for merely reposting a satirical jab at Prime Minister Keir Starmer.

The latest drama stems from Connolly reposting a comment that read: “Could Trump could come and take Starmer like they did in Venezuela.”

Probation officials deemed it “not of good behaviour,” with Connolly noting: “Apparently… somebody called probation and said they were very offended by this post and it’s inciting violence.”

Lucy Connolly – who has already spent ten months locked up for a singular post on X – is facing a recall to prison because she retweeted a joke about Donald Trump arresting Keir Starmer.

— Dan Wootton (@danwootton) January 14, 2026

Officials told her it was inciting violence.

THERE IS NO FREE SPEECH IN THE UK!@LucyTCWife pic.twitter.com/W3LtW5czA3

The fact that some random person called in the thought crime to the authorities is arguably equally as disturbing as the resulting threat to send Connolly back to prison. It highlights how there are hordes of bootlicking citizens eager to act as the thought police and to tattle to the State.

Connolly has also been cautioned over remarks about British-Egyptian extremist Alaa Abd el-Fattah, who has a history of posting extremist threats against British people, yet was welcomed into the country recently by Kier Starmer after being released from prison by Egyptian authorities.

Connolly first hit the headlines after the horrific Southport attacks, where three young girls were murdered by a second-generation Rwandan migrant. In the heated aftermath, she tweeted: “Mass deportation now, set fire to all the f***ing hotels full of the bastards for all I care.”

Judge Melbourne Inman KC labeled it “grossly offensive” and handed her the maximum 31-month sentence under the Public Order Act, despite no prior offences or direct threats. She served 380 days before release on licence in August, under conditions typically reserved for serious offenders.

Her case drew fire from proponents of free speech, who blasted it as proof of Britain’s “two-tier justice system.” Before his tragic murder, Charlie Kirk noted such words “would not be any prison time in America,” underscoring how the UK has slid toward a “totalitarian country.”

Connolly insists she hasn’t posted anything offensive or inciting since her release, even suggesting authorities provide a list of “things she was allowed to say” to avoid these traps.

Connolly has also had to deal with her 13-year-old daughter, Edie, being barred from a new school after the headteacher rescinded a trial placement upon discovering her mother’s conviction. The educator claimed “racism doesn’t go down well” and that Edie’s presence would cause a “ruckus.”

Connolly called it “outrageous discrimination,” asking: “In what world is this ok?” and adding, “My daughter is being punished for my views. She’s innocent, and now she’s the one suffering.”

The Maduro quip that landed Connolly in hot water—suggesting Trump should swoop in and haul Starmer away like Venezuelan tyrant Nicolás Maduro—was no isolated gag. Thousands of frustrated Brits have cracked similar jokes across X and beyond, venting rage at a regime seen as trampling freedoms while bungling borders and the economy.

Posts like “Trump is gonna Maduro your ass next!” and “We really need Trump to repeat the Maduro operation with Starmer” rack up likes in the hundreds or thousands for mocking the PM’s fate. If resharing such satire warrants prison time, what’s next—a mass roundup of every citizen daring to poke fun at the powers that be?

This reeks of selective tyranny, cherry-picking targets to stifle dissent while ignoring the real threats fueling public fury.

Connolly’s ordeal is just one thread in Britain’s expanding speech gulag. Last year alone, police arrested nearly 10,000 people for “grossly offensive” social media posts under draconian laws like the Communications Act—averaging 30 busts a day.

Forces raid homes over sarcastic emails, old tweets, or WhatsApp chats, diverting resources from real crimes like burglaries and knife attacks. We’ve even seen early releases for violent offenders to make room for thought criminals.

Take the case of Luke Yarwood, jailed 18 months for two anti-immigration tweets viewed just 33 times. The judge called them “odious in the extreme,” despite no real-world impact or followers acting on them. Such minimal-reach rants get hammered harder than child abusers in some courts, exposing priorities skewed against ordinary Brits raging against open borders.

Starmer’s regime has recently gone as far as suggesting a complete ban on X, citing its Grok AI for generating fake images as a convenient excuse for what is clearly an effort to target the platform where unfiltered truth is allowed to reach the masses.

Now the government is turning its attention once again to Online Safety Act’s Section 121, empowering Ofcom to force platforms like WhatsApp to scan private messages via client-side tech—shattering end-to-end encryption.

Officially for child exploitation and terrorism, it flags everyday views on mass migration as radicalization risks: researching immigration stats, defending British rights, or protesting cultural shifts.

Schools are even using games labeling such concerns as paths to extremism.

The use of the “Maduro joke” shared by Connolly to crackdown on free speech echoes globally. In Spain, ex-senator Carles Mulet has denounced bullfighter Fran Rivera and right wing activist Vito Quiles for jokingly urging Trump to “continue” after Venezuela by intervening in Spain and eyeing Prime Minister Pedro Sánchez.

Ridiculously, the pair are now facing 5-10 years in prison, with authorities citing treason and provocation, among a litany of other offences.

This global assault on free expression demands fierce pushback. When mere reposts or quips land ordinary people in the crosshairs and families bear the brunt, it’s evident: the real danger isn’t online words, but regimes worldwide desperate to silence opposition to their rejected agendas.

Your support is crucial in helping us defeat mass censorship. Please consider donating via Locals or check out our unique merch. Follow us on X @ModernityNews.

Tyler Durden Fri, 01/16/2026 - 07:20Financial Audit: Securities and Exchange Commission's FY 2025 Financial Statements

UN Chief's Last Annual Speech Warns Global Cooperation 'On Deathwatch'

UN Secretary-General Antonio Guterres will step down as head of the UN in 2026, and on Thursday he issued a stark warning to world leaders upon the occasion of this last annual priorities speech.

He said that international cooperation is being pushed "onto deathwatch" by widening geopolitical rifts and increased and unpredictable violations of international law and sharp cuts to humanitarian aid. While not naming names, the United States under President Trump was probably high on the UN official's mind, and certainly the audience was thinking it in the wake of the Venezuela operation as well as threatened US strikes on Iran.

Source: UN Dispatch

Source: UN Dispatch

"At a time when we need international cooperation the most, we seem to be the least inclined to use it and invest in it," he said, decrying some governments are actively working to weaken the system, increasingly creating "self-defeating geopolitical divides".

"The context is chaos," Guterres told delegates. "We are a world brimming with conflict, impunity, inequality and unpredictability."

Another big and dramatic line, as he discussed hot conflicts from Ukraine to Gaza to Yemen to Sudan - came in the following:

"That is the paradox of our era: at a time when we need international cooperation the most, we seem to be the least inclined to use it and invest in it," he said, adding: "Some seek to put international cooperation on deathwatch. I can assure you: we will not give up."

"Peace is more than the absence of war," he additionally said, blaming that poverty, lack of development, inequality and weak institutions end up creating conditions for further violence. "Sustainable peace requires sustainable development."

"As we meet today, millions are trapped in cycles of violence, hunger and displacement," he additionally described, calling on more robust global action.

Meanwhile over in Moscow, President Putin expressed agreement, the same day in a speech not related to the United Nations describing that the global situation is on the brink:

“The situation on the international stage is increasingly deteriorating - I don’t think anyone would argue with that - long-standing conflicts are intensifying, and new serious flashpoints are emerging,” Putin said with a smile.

In a speech to new ambassadors who had presented their credentials in the Kremlin, his first public remarks on foreign policy issues this year, Putin did not mention the United States or Trump explicitly.

“We hear a monologue from those who, by the right of might, consider it permissible to dictate their will, lecture others, and issue orders,” Putin said. “Russia is sincerely committed to the ideals of a multipolar world.”

Russian President Vladimir Putin has delivered a stark warning about the state of global security, saying the world is becoming more unstable as old conflicts flare up and new flashpoints emerge. https://t.co/R0yHuPdpQf

— Rajeev Ahmed (@twittingrajeev) January 15, 2026

"We hope that recognition of this need will come sooner or later. Until then, Russia will continue to consistently pursue its goals," Putin stated.

More junior Russian officials have over the past days pointed out that it's absurdly hypocritical for the West to lecture Moscow, when Washington is going unprovoked into countries like Venezuela to remove leaders - and threatening new war against Iran.

Tyler Durden Fri, 01/16/2026 - 06:5510 Friday AM Reads

My end-of-week morning train WFH reads:

• 10 Breakthrough Technologies: Here are the advances that we think will drive progress or incite the most change—for better or worse—in the years ahead. (MIT Technology Review)

• $25 Billion. That’s What Trump Cost Detroit. It is pretty difficult to futureproof your company against stupid. This is exactly what the American automobile industry is facing as a result of President Trump’s gratuitous war against electric vehicles, which is forcing manufacturers to return to an increasingly outdated past. (New York Times) see also EVs grew more in ’25 than ’24, despite constant lies saying otherwise. In 2025, the world sold 20.7 million EVs – 3.6 million more EVs than it did in the previous year, according to a new report by Rho Motion. That’s a larger increase than last year’s 3.5 million increase, which was also higher than the previous year, showing that EVs keep growing despite unprecedented attacks against them by governments, media and even by automakers themselves. (Electrek)

• The YouTube Vibecession: By the numbers, everything is going great for creators. So why are so many of them scared it’s all about to fall apart? (New York Magazine)

• Steak Is Expensive, and Now It Rules the Food Pyramid: New dietary guidelines raise affordability concerns, but some US officials say customers have choices. (Businessweek free)

• The Oligarchs Pushing for Conquest in Greenland: Trump’s fixation on filching the island territory from Denmark may seem like the demented ravings of a mad king. But to a cohort of plutocrat weirdos, it makes perfect sense. (New Republic)

• Inside the Mad Dash to Save Saks, America’s Last Luxury Retailer: Putting Saks Fifth Avenue and Neiman Marcus together was supposed to create a luxury powerhouse. Just over a year later, unpaid debts triggered its bankruptcy. (Wall Street Journal)

• The secret to being happy in 2026? It’s far, far simpler than you think … Stop stressing about self‑improvement or waiting until you’re on top of everything. This year give yourself permission to prioritise pleasure. (The Guardian)

• Trump Has No Plan for Venezuela: How the Trump administration’s contempt toward planning all but ensures a mess in Venezuela. Plus: Donald Trump’s predatory worldview and Rudyard Kipling’s “Recessional.” (The Atlantic)

• Life Under a Clicktatorship: What happens to government when everything is content? (Can We Still Govern?) see also What We Choose to Nazi: The Department of Labor is posting Heroic Realism propaganda. What, exactly, are they telling us? (The Bulwark)

• The untameable Victor Osimhen: The volcanic temperament and irresistible brilliance of the footballing star converge as the Super Eagles close in on continental glory. (Africa Is A Country)

Be sure to check out our Masters in Business interview this weekend with Nobel laureate Richard Thaler and his University of Chicago Booth School colleague Alex Imas on the update and reissue of his classic book The Winner’s Curse.

Exxon CEO Calls Venezuela ‘Uninvestable’

Source: Bloomberg

Sign up for our reads-only mailing list here.

The post 10 Friday AM Reads appeared first on The Big Picture.

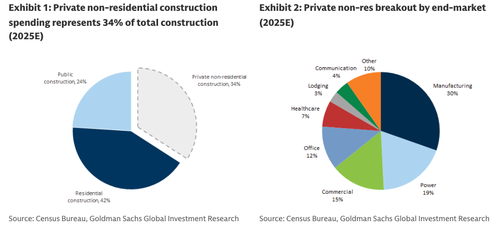

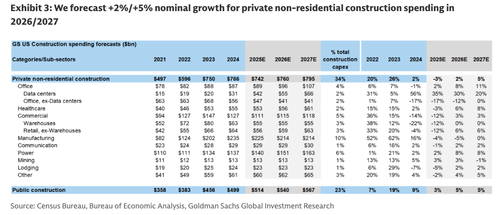

Data Centers, Power Infrastructure, Healthcare Set To Lead Next Phase Of Construction Boom

Eric Gaus, chief economist at Dodge Construction Network, joined Goldman Sachs analysts to discuss the overall state of U.S. building construction, assessing which project types are likely to dominate and the underlying strength of the trend.

"We come away from our discussion with a continued outlook for private non-residential construction spending to return to growth in 2026 vs 2025, with strength led by data centers, power infrastructure, and healthcare," Goldman analysts led by Adam Bubes wrote in a note on Tuesday.

For those unfamiliar with Dodge Construction, the index is a leading indicator of U.S. construction activity, measuring the dollar value of new, nonresidential building projects entering the planning phase. Analysts track the index because it provides early signals for industrials, materials, engineering firms, and REITs, and often anticipates broader turns in the business cycle.

Bubes forecasted nominal growth of 2% in 2026 and 5% in 2027 in private nonresidential construction spending, with data centers, power infrastructure, and healthcare leading the way.

About 2.5 months ago, the Dodge Momentum Index showed a sharp increase in data center buildouts expected for 2026. In May of last year, we pointed to UBS analyst Steven Fisher, who forecasted the Trump-era construction boom in AI data centers wouldn't filter into the real economy until early 2026.

"More slowing before reacceleration in 2026," Fisher told clients at the time, adding, "We expect stimulus and structural forces to drive the rebound, while cyclical factors remain weak."

ZeroHedge Pro Subs can read the full Goldman note in the usual place, where key takeaways from the Dodge Construction roundtable offer more insight into building trends nationwide this year.

Tyler Durden Fri, 01/16/2026 - 05:45Data Centers, Power Infrastructure, Healthcare Set To Lead Next Phase Of Construction Boom

Eric Gaus, chief economist at Dodge Construction Network, joined Goldman Sachs analysts to discuss the overall state of U.S. building construction, assessing which project types are likely to dominate and the underlying strength of the trend.

"We come away from our discussion with a continued outlook for private non-residential construction spending to return to growth in 2026 vs 2025, with strength led by data centers, power infrastructure, and healthcare," Goldman analysts led by Adam Bubes wrote in a note on Tuesday.

For those unfamiliar with Dodge Construction, the index is a leading indicator of U.S. construction activity, measuring the dollar value of new, nonresidential building projects entering the planning phase. Analysts track the index because it provides early signals for industrials, materials, engineering firms, and REITs, and often anticipates broader turns in the business cycle.

Bubes forecasted nominal growth of 2% in 2026 and 5% in 2027 in private nonresidential construction spending, with data centers, power infrastructure, and healthcare leading the way.

About 2.5 months ago, the Dodge Momentum Index showed a sharp increase in data center buildouts expected for 2026. In May of last year, we pointed to UBS analyst Steven Fisher, who forecasted the Trump-era construction boom in AI data centers wouldn't filter into the real economy until early 2026.

"More slowing before reacceleration in 2026," Fisher told clients at the time, adding, "We expect stimulus and structural forces to drive the rebound, while cyclical factors remain weak."

ZeroHedge Pro Subs can read the full Goldman note in the usual place, where key takeaways from the Dodge Construction roundtable offer more insight into building trends nationwide this year.

Tyler Durden Fri, 01/16/2026 - 05:45China Leads Global Coal Power Additions Despite Renewables Push

By Charles Kennedy of OilPrice.com

China continues to nearly single-handedly prop up global coal consumption and new coal-fired power generation, despite being also the world’s leading investor in renewables and battery storage.

China is set to commission as many as 85 coal-fired power generating units this year, out of a total global of 104 coal projects slated for start-up in 2026, according to data by non-profit Global Energy Monitor (GEM) cited by the Financial Times.

Of all the 63 gigawatts (GW) of coal-fired power generation expected to begin commercial operations globally this year, 55 GW will be in China, the GEM data showed.

Last year, China accounted for a massive 78% of all global coal power capacity that began operating. The world’s top coal consumer and importer also makes up a whopping 86% of the total global capacity under construction and expected to be commissioned this year, according to the data analyzed by GEM.

Apart from China, other Asian economies such as India, Indonesia, and Vietnam continue to add coal-fired capacity.

GEM data shows India has 24 GW of coal power capacity under construction. India is investing huge sums in renewables and hit its renewable installation target earlier than planned, but it continues to bet on coal.

Coal-fired power generation and capacity installations in India continue to rise and coal remains a key pillar of India’s electricity mix with about 60% share of total power output. Despite booming renewable capacity additions, India continues to rely on coal to meet most of its power demand as authorities also look to avoid blackouts in cases of severe heat waves.

Globally, China is the leader – by far – in renewable energy investments and capacity installations, but it is also a leader in coal-fired power and continues to be the key driver of record-high global coal demand.

So, any meaningful reduction of global coal-related energy emissions depends on how China approaches its energy security and affordability dilemma in the coming years.

Tyler Durden Fri, 01/16/2026 - 05:00

Recent comments