James Bradshaw of the Globe and Mail

reports Dutch tax court rules Ontario pension plan wrongly claimed $346-million in tax refunds:

A

Dutch tax court ruled this week that Healthcare of Ontario Pension Plan

wrongly claimed nearly €214-million ($346-million) of dividend tax

refunds through a trading strategy designed to take advantage of the

pension fund’s favourable tax status in the Netherlands.

The

court upheld the opinion of a tax inspector who found that in 445

transactions between 2013 and 2018, HOOPP was not the true beneficial

owner of the Dutch shares that paid the dividends and so could not

reclaim tax withheld against them, in a ruling published on Wednesday.

The decision is a setback for HOOPP in a long-running tax dispute, launched in 2019, which also led a Dutch prosecutor to initiate a separate criminal investigation

in October. The tax court’s decision would require HOOPP to repay the

refunded tax as well as about €40-million ($65-million) in interest

charges.

“HOOPP is

disappointed by this tax court ruling and will appeal the decision,”

spokesperson Scott White said in an e-mailed statement. “This initial

ruling on events that occurred between 2013 and 2018 will have no impact

on HOOPP’s ability to pay pensions to our members today or in the

future.”

HOOPP declined to make further comment on the case because it is still before the courts.

The

key issue in the tax dispute – and the more recent criminal inquiry –

is whether HOOPP met the test to be considered the beneficial owners of

shares traded on the Dutch stock exchange. Dutch authorities have

alleged the pension fund used sophisticated contracts with

counterparties to exploit its tax status for financial gain.

Dutch

tax authorities first looked into HOOPP’s trades in response to a news

story about “dividend stripping,” which involves buying shares for a

short period before a dividend is declared and then selling them back to

the original owner, according to court filings.

In

2013, HOOPP’s investment risk committee approved a derivative strategy

that sought to capitalize on the fact that foreign pension funds in

countries including Canada are entitled to have a 15-per-cent tax on

dividend distributions refunded, which other institutions would have to

pay, according to documents reviewed by the court.

HOOPP

found that it could buy “foreign stocks prior to the payment of

dividends,” then sell them to another entity – a bank – shortly after it

received the dividend, according to the risk committee’s documents. In

the meantime, it would hedge the risk of the stock price changing using

an equity swap or call option. HOOPP would then keep “a small percentage

of the dividend – a percentage less than the withholding tax, and the

remaining dividend amount is paid to the other entity."

HOOPP

purchased and sold the shares “over the counter” through brokers, and

argued there was no contractual link between its share purchases and the

price return swaps it entered into with banks, so the transactions were

not “circular,” according to court filings.

But

the tax authorities found that HOOPP correspondence showed the pension

fund was communicating with various banks, agreeing on “price return

swaps” at the time it bought the shares. Those contracts were settled

after the record date when HOOPP became eligible to receive the tax-free

dividends.

“With this

strategy, the interested party wanted to make use of its dividend

withholding tax refund position,” a translation of the court ruling said, in reference to HOOPP.

HOOPP’s

counterparty bank, “which has retained its interest in the shares by

means of the price return swap, is on balance compensated an amount

corresponding to the amount of the net dividend to be distributed, plus

part of the dividend tax withheld from the dividend distribution,” the

tax court said.

I reached out to Scott White at HOOPP to get more information and he sent me the official response they sent to the Globe and Mail:

HOOPP is disappointed by this tax court ruling and

will appeal the decision. As the issue is still before the courts, HOOPP

cannot comment any further on this matter. This initial ruling on

events that occurred between 2013 and 2018 will have no impact on

HOOPP’s

ability to pay pensions to our members today or in the future.

And remember back in October 2025, HOOPP issued this statement on its website:

HOOPP firmly rejects allegations from Dutch authorities

HOOPP has been informed that it will be summoned in

the Netherlands regarding a dispute over dividend withholding tax

refunds on Dutch shares it purchased beginning in 2013 and ending in

2018. HOOPP is surprised and disappointed by this decision and will

vigorously defend itself against these allegations.

HOOPP has been

cooperating with the Dutch Tax Authority in the Netherlands for many

years on this issue. HOOPP is confident that it was the beneficial owner

of the shares and therefore entitled to the tax refunds. This issue is

about a dispute over the interpretation of a discrete Dutch tax

provision, which HOOPP believes should be solely adjudicated by a tax

court.

These allegations will have no impact on HOOPP’s ability to pay pensions to our members today or in the future.

I had discussed this case on my blog here when it first broke out in 2019.

Alright, let me get to into this and share my thoughts.

First, the case is clearly being appealed as HOOPP feels it did not violate Dutch tax laws so I understand why they cannot comment further on this matter.

Now, let's say HOOPP loses the case and is ordered to pay $346 million as well as the $65 million in interest charges to Dutch tax authorities. Will this hamper its ability to pay pensions.

Of course not, HOOPP manages $123 billion as at December 30th 2024 so it can easily pay $411 million and have no liquidity issues whatsoever to pay current and future pensions.

The hit will be felt at the investment level however as it will show up as a loss from a strategy they undertook.

Is this the same thing as the AIMCo vol blowup?

No, the AIMCo vol blowup led to a loss of $2.1 billion which represented a more serious amount relative to total assets at the time and was clearly an investment risk problem.

The only similarity is if HOOPP loses the case, its members will eat the loss.

HOOPP undertook at “dividend stripping” strategy in the Netherlands which involved buying shares for a

short period before a dividend is declared and then selling them back to

the original owner via swaps, according to court filings.

Dutch tax authorities are claiming the strategy was designed to take advantage of HOOPP’s favourable tax status in the Netherlands and that HOOPP used sophisticated contracts with

counterparties to exploit its tax status for financial gain.

HOOPP is disputing this, so this isn't a case involving excessive investment risk, but it is a case that involves legal, operational and reputation risk.

To be frank, I'm surprised HOOPP engaged in this strategy in the Netherlands and that the investment committee and Board approved it because of these risks but Jim Keohane (then CEO), David Long and Jeff Wendling (then co-CIOs) obviously made a persuasive case.

In fact, David Long was the SVP Asset Liability Matching and Derivatives back then and widely recognized as a top derivatives expert along with Jim Keohane so they understood this strategy and all its risks very well.

Importantly, there is no way they didn't due their due diligence and consult legal firms in the Netherlands to make sure it's a) legal and b) discuss the strategy with their counterparts to make sure it's legal.

This is why HOOPP is contesting the court's decision and it's within its rights to do so but obviously they overestimated the legalities of this strategy and underestimated the blowback.

Again, in my opinion, not worth the reputation risk nor do I consider this "real alpha" in nay sense and if I was sitting on that investment committee I would have voted against this strategy even if it was considered legal by outside experts.

What do I mean by real alpha? HOOPP engages in many absolute return strategies internally, mostly arbitrage strategies going long/ short securities and investing in external hedge funds where they cannot replicate alpha internally.

Dividend stripping isn't what I consider alpha, even if you're using swaps to make it look very sophisticated, it's totally bogus in my opinion (again, my opinion).

And that begs the question whether those gains were used to claim "value add over their benchmark" to justify paying bonuses to senior managers.

Those bonuses were paid and if HOOPP loses the case, members will eat the loss and it will not make a material impact on total fund assets but it might make one on investment performance the year that loss is claimed if they lose the case.

It's not Jim Keohane, David Long or Jeff Wendling who are going to pay the price even though the strategy fell under their watch, they're long gone and collected their bonuses.

Again, HOOPP might win the appeal and this might all turn out to be a mute point but I'm sharing with you my insights and the way I see it from the outside, this strategy might have looked like easy money back then, it turned out to be a major headache for the organization, potentially costing it reputation damage.

And I strongly doubt any other Maple 8 engaged in it exactly for the reasons I'm citing above, not worth it, wouldn't be approved by their Board and certainly not considered real alpha.

The vol selling AIMCo was doing others were doing as well, including HOOPP, but they managed risk a lot tighter and didn't lose anywhere near as much.

I've seen plenty of sophisticated strategies blow up at La Caisse and PSP during my time there, a lot of smart people doing stupid things.

It happens, people use the pension fund's balance sheet to gamble and sometimes they win big and sometimes they lose huge.

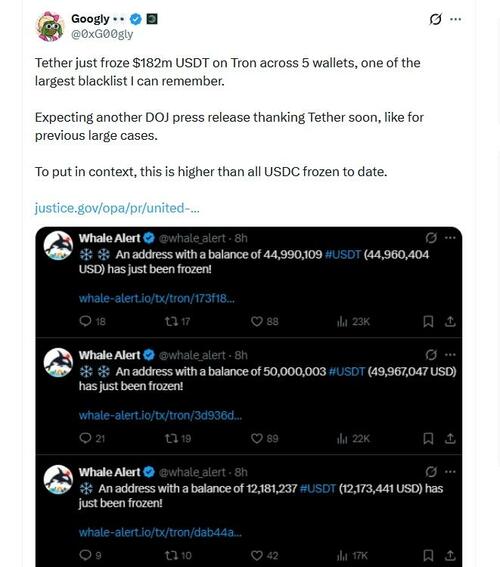

Also worth noting that Morgan Stanley settled its dividend stripping case with Dutch tax authorities last year after a decade-long dispute:

A decade-long court case between US bank Morgan Stanley

and the Dutch tax authorities has been settled, ‘Follow the Money’ has

discovered. Jan van de Streek, Professor of Tax Law, spoke to the news

platform: ‘I'm surprised Morgan Stanley paid everything.’

For more than a decade, US bank Morgan

Stanley has been embroiled in a lawsuit with the Dutch tax authorities

over dividend stripping. Investigative journalism platform Follow the Money recently discovered

that the case has been settled. The bank must pay the tax authorities a

sum of almost 200 million euros. ‘I am surprised that Morgan Stanley

has paid everything, both the claimed tax and interest,’ says Van de

Streek. ‘I am curious what the bank got back in return for that

settlement.’

According to the professor, rising interest rates

may have played a role: ‘That tax rate was 7.5% in 2024. Suppose the

bank still lost the case, that interest rate could have reached enormous

proportions.' The settlement does not relieve the US bank of all

litigation in the Netherlands. A criminal case is still pending with the

Public Prosecution Service. According to Van de Streek, there is a

chance that the prosecution will drop the case: ‘The fact that Morgan

Stanley has resolved the case fiscally is positive. The prosecution will

undoubtedly take that into account when considering whether or not to

pursue the criminal case.'

In November of last year, Bloomberg reported that Morgan Stanley was fined €101 million (US$117 million) by the Dutch public prosecutor over dividend tax evasion and deliberately filing incorrect tax returns:

The

fines for carrying out Cum-Cum trades were imposed on two Morgan

Stanley companies in London and Amsterdam, according to a statement by

the Dutch public prosecution service on Thursday. Cum-Cum trades allowed

foreign owners of stocks to avoid withholding tax by lending the securities during dividend season to an exempt entity such as a local bank.

Morgan Stanley “through a specially designed structure, ensured that

parties who were not entitled to a dividend tax offset or refund could

still wrongly benefit from a portion of the offset dividend tax,” the

prosecutor said. The fine is in addition to the tax due that Morgan Stanley paid to Dutch authorities at the end of 2024.

Under Dutch law, domestic dividend recipients

are entitled to the right to offset dividend tax if they are the

ultimate beneficiaries of those dividends. The prosecution service said

that Morgan Stanley established a Dutch company that acquired shares

between 2007 and 2012, but held them only briefly around dividend dates,

receiving a total of €830 million during these short-term holding

periods.

The

firm offset the dividend tax withheld on these shares, totalling €124

million, in five corporate income tax returns between 2009 and 2013, it

said.

The

bank is “pleased to have resolved this historical matter, which related

to corporate tax returns filed in the Netherlands over 12 years ago,” a

Morgan Stanley spokesperson said. The bank had previously rejected the

allegations.

It's not exactly the same case or structure which is why Morgan Stanley settled its case but it didn't look good.

Anyway, I hope HOOPP wins this case but I must admit, from the outside, it doesn't look good.

Keep in mind, unlike other Maple 8 funds, HOOPP is a private trust and doesn't have to disclose anywhere near as much as its peers, it discloses a lot and is very transparent but I doubt we will get a detailed assessment of what happened here if the Dutch court of appeals doesn't overturn the verdict.

Lastly, and most importantly, HOOPP is doing great, it's delivering alpha and beta and didn't really need to engage in this strategy and it has more than enough assets to pay current and future pensions no matter what happens in this case.

It's new CEO Annesley Wallace has a clear strategy and a vision and she had nothing to do with this strategy even if she inherits any potential fallout.

Below, in this episode, the Compliance Officers Playbook podcast unpacks the major enforcement action taken against Morgan Stanley after Dutch authorities uncovered its role in coordinated tax evasion schemes. Following extensive audits and criminal investigations, regulators issued a €101 million fine—the maximum possible—after determining that the firm used complex trading and derivative strategies to exploit dividend withholding tax rules.

Again, this was illegal which was why Morgan Stanley settled its case, not the same as the HOOPP case. Just sharing this to show you why these strategies are not worth the operational and reputation risks.

Illustration via The Telegraph

Illustration via The Telegraph Illustration via The Telegraph

Illustration via The Telegraph Illustration via The Telegraph

Illustration via The Telegraph Illustration via The Telegraph

Illustration via The Telegraph

via AP

via AP

Artur Plawgo/Getty Images

Artur Plawgo/Getty Images

Egyptian special forces soldiers, via AFP

Egyptian special forces soldiers, via AFP

Getty Images

Getty Images

An instructor teaches a Spanish lesson at Franklin High School in Los Angeles on May 25, 2017. Robyn Beck/AFP via Getty Images

An instructor teaches a Spanish lesson at Franklin High School in Los Angeles on May 25, 2017. Robyn Beck/AFP via Getty Images

Recent comments