92% Of Employed Americans Have Cut Back On Spending As The Standard Of Living In The US Crumbles

Authored by Michael Snyder via The Economic Collapse blog,

The headline of this article is not a misprint. The reason why “affordability” has become the number one issue for U.S. voters is because most of the population is being absolutely crushed by the rising cost of living.

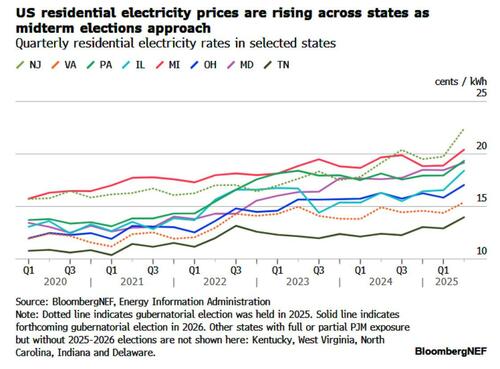

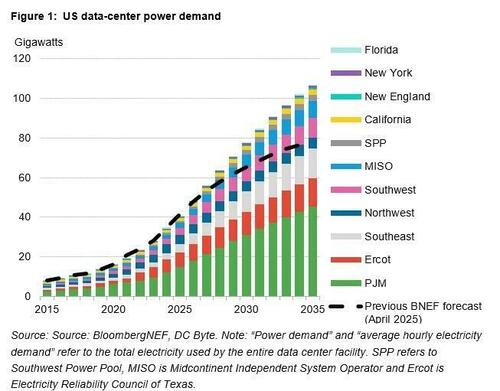

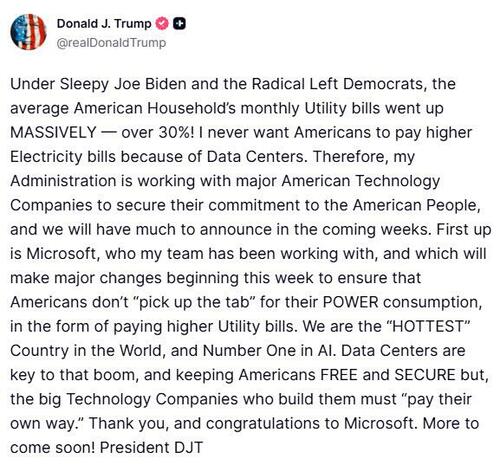

Just look at how much you are paying for electricity compared to five years ago. And just look at how much you are paying for food compared to five years ago. Housing costs have risen to absurd heights, property taxes have become absolutely insane in many areas of the country, and health insurance premiums have more than doubled for millions of Americans. It isn’t just a coincidence that so many people are bitterly complaining about the cost of living these days. The truth is that most of the country is experiencing very real pain.

Of course it isn’t an accident that this has happened. Our politicians have borrowed and spent 28 trillion dollars that we did not have since Barack Obama first entered the White House in January 2009, and I warned that all of this money would create rampant inflation.

On top of that, the Federal Reserve has pumped trillions of dollars that were created out of thin air into the financial system since 2008. That has helped the stock market hit record highs, but it has been one of the factors that has made the cost of living unbearable for the rest of us.

The very foolish decisions that our leaders have been making have had dramatic consequences.

Our standard of living is crumbling right in front of our eyes, and now a brand new report is telling us that 92 percent of employed Americans have been forced to cut back on spending…

For millions of Americans, staying financially afloat now means difficult trade-offs. As the price of everyday necessities continues to rise faster than wages, new data shows workers are cutting back wherever they can – often at the expense of savings, overall financial security and even essential needs.

That is the picture emerging from Resume Now’s 2026 Cost-of-Living Crunch Report, a national survey of 1,011 employed Americans, which has found that only 17 percent of Americans feel financially secure enough to cover essentials and save money. Nearly two-thirds of respondents cited everyday essentials as their biggest financial burden. What’s more, a remarkable 92 percent said they have cut back on spending, including on items many would previously have considered non-negotiable.

Please notice that only “employed Americans” were asked about the cost of living.

More than 100 million U.S. adults are not working at all.

For those that do not regularly follow my work, yes that is an accurate number. The vast majority of U.S. adults that are not working are considered to be “not in the labor force” by the federal government.

Another survey that was conducted at the end of December found that 70 percent of Americans consider the cost of living where they live to be “not very affordable” or “not affordable at all”…

American consumers aren’t feeling great about the economy or their own financial situation, with the phrase “affordability crisis” dominating headlines and political campaigns over the last few months.

The majority — 70% — of Americans surveyed in a Marist poll of over 1,400 adults taken in December, say that the cost of living in their area is not very affordable, or not affordable at all, for the average family.

This is the result of decades of incredibly bad economic policy.

The purchasing power of our money has been steadily declining, and now 65 percent of employed Americans are struggling to even afford everyday essentials…

Sixty-five percent of the survey respondents said that affording everyday essentials was a top contributor to their financial strain.

Jared Kessler, founder of Forex Broker, said the concentration of stress around essentials is a key indicator that the problem runs deeper than any short-term financial shocks. “It is clear, based on this data, that we are experiencing a real cost-of-living crisis as opposed to an immediate inflationary response to the COVID-19 pandemic,” he told Newsweek.

Read that last sentence again, because it is so true.

We are in the midst of a nightmarish cost of living crisis that never seems to end.

At this stage, 60 percent of employed Americans “could only cover three months or less of expenses if they were to lose their job”…

Sixty percent of respondents said they could only cover three months or less of expenses if they were to lose their job, leaving little room for error in the event of layoffs, illness or other events that could impact their financial standing. For many, even routine expenses are being trimmed.

Most of the country is living right on the edge.

Nobody can deny this.

And consumer sentiment rapidly moved in the wrong direction in 2025…

Between January and November last year, consumer sentiment among the lowest and middle terciles of American household income fell 29.8% and 27.6%, respectively, while the country’s highest third of earners suffered a steeper 32.1% decline.

Our politicians in Washington shouldn’t have been borrowing and spending so much money all these years.

But they did.

And we should have never allowed ourselves to go 38.4 trillion dollars in debt.

But we did.

Many of us ranted about the bad decisions that were being made for years.

But most of the population didn’t listen.

Sadly, as I pointed out in a previous article, we have now reached a point where “affordability” has become the number one issue for U.S. voters…

A University of Michigan poll published in December shows that high prices remain a pain point for consumers. About 46% blame high prices for poor personal finances — among the highest shares since the series started in the late 1970s.

Consumers’ views of their current financial situation in December “collapsed” into negative territory for the first time since July 2022, the month after pandemic-era inflation had peaked, according to a poll published Tuesday by the Conference Board.

Overall, 65% of U.S. households say the cost of living has gotten worse or much worse in the past year, according to a recent Politico poll.

Previous generations handed us the keys to the greatest economic machine that the world had never seen.

And we went out and wrecked it.

50 years ago, the U.S. economy was so dominant that it would have taken stupidity on an epic scale to cause it to fail.

But somehow we managed to do it.

Even though our standard of living is in the process of collapsing all around us, most Americans are still working hard and are “effectively trying to muscle through this”…

“What we’re seeing is there is still inflation pressure across the system, particularly in the retail environment, and consumers, through our research tell us that they are effectively trying to muscle through this,” Will Auchincloss, Americas retail sector leader at EY-Parthenon, says. “They’re trying to buy what they’ve always bought or want to buy, but in the face of higher prices.”

Most of us want to continue to live the way we did before, but we simply do not have enough money to do it.

So U.S. households are piling up tremendous amounts of debt.

In fact, U.S. household debt recently hit an all-time record high of 18.59 trillion dollars…

Americans’ household debt levels – including mortgages, car loans, credit cards and student loans – are now at a new record high, according to data released Wednesday by the Federal Reserve Bank of New York.

Total household debt reached $18.59 trillion from July through September of this year, up by $197 billion from the previous quarter.

Of course the federal government is an even bigger offender.

The U.S. government is now 38.4 trillion dollars in debt, and it is being projected that number will be well above 40 trillion dollars before the end of this year.

For more than a decade I warned about what would happen if we kept going down this road, and now it has happened.

We are literally committing societal suicide.

The next time you feel like screaming while you are paying your bills, you might want to remember who got us into this mess in the first place.

* * *

Michael’s new book entitled “10 Prophetic Events That Are Coming Next” is available in paperback and for the Kindle on Amazon.com, and you can subscribe to his Substack newsletter at michaeltsnyder.substack.com.

Tyler Durden Tue, 01/13/2026 - 17:15

Source: Wana News agency

Source: Wana News agency

Microsoft president Brad Smith says Chinese AI companies are undercutting US rivals because of state subsidies

Microsoft president Brad Smith says Chinese AI companies are undercutting US rivals because of state subsidies

U.S. Secretary of Homeland Security Kristi Noem testifies before the House Committee on Homeland Security in the Cannon House Office Building in Washington on Dec. 11, 2025. Anna Moneymaker/Getty Images

U.S. Secretary of Homeland Security Kristi Noem testifies before the House Committee on Homeland Security in the Cannon House Office Building in Washington on Dec. 11, 2025. Anna Moneymaker/Getty Images U.S. President Donald Trump speaks inside the Oval Office at the White House in Washington, D.C., November 12, 2025. REUTERS/Kevin Lamarque

U.S. President Donald Trump speaks inside the Oval Office at the White House in Washington, D.C., November 12, 2025. REUTERS/Kevin Lamarque

Recent comments