Feed aggregator

Tribal Programs: Information on Freedmen Descendants of the Five Tribes

Crude Stocks Rise Most In Two Months As US Oil Production Finally Drops

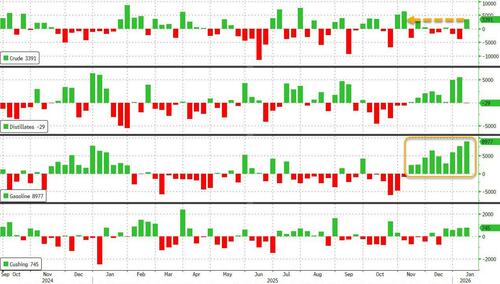

While oil prices keep rising on mounting geopolitical tensions in Iran, the production glut refuses to go away, and as today's DOE report showed, there was a material increase across almost all products, with the exception of Distillates which were flat. Of note, amid expectations for a modest crude draw, we saw a 3.4MM barrel increase, the largest since the start of November.

Here is what the EIA reported in its weekly inventory report

- Crude +3.391MM, Exp.-1.682MM

- Gasoline +8.977MM, Exp. +2.0MM

- Distillates -29K, Exp. -662K

- Cushing +745K

Of note here is that while we saw a sizable build in most products, with Crude rising the most in two months, it was gasoline where the stocking was most notable: the nearly 9 million barrels added were the most since December 29, 2023.

Some more details:

Crude Build

- Nationwide crude stockpiles rose to 422.4 million barrels. The weekly gain of about 3.4 million barrels is the largest build since early November. Stockpiles at Cushing, Oklahoma, continue to climb. The storage hub has seen a rise in inventories for the fourth consecutive week. Stocks now sit at about 23.6 million barrels, the highest since September.

Imports

- The build in crude inventories can be partly explained by an increase in imports. They rose to the highest since November of 2024. Imports from the Middle East edged higher, driven by a 62% increase in the amount of crude arriving from Iraq. Inflows from Brazil, Mexico, Colombia and Ecuador all jumped.

Refinery Runs

- Refinery runs have now risen in 9 of the past 10 weeks countrywide, inching closer to the highest since the pandemic. In the Midwest, refineries are processing the most crude on record on a seasonal basis. West Coast refinery runs are now at the highest level since late-September.

While Cushing draws reversed for a 4th consecutive week, stocks remain not too far from tank bottoms.

Yet there is some hope that US production is finally moderating: while US Crude production hovers near record highs despite the continuing decline in rig count, last week saw a notable drop in total production, dropping by 58K barrels to 13.753 million, the lowest since the end of October.

Despite the sizable build in crude stock, WTI is holding gains as attention remains glued to what happens in Iran next...

On the bright side, the broadly weaker trend on crude oil prices has dragged gas (pump) prices down to their lowest since May 2021...

While it's not exactly 'drill, baby, drill', it's certainly what Trump wanted (the question is, will the lower price push shale producers to cut production... and round and round we go).

Tyler Durden Wed, 01/14/2026 - 11:03Trump Takes Responsibility for Post-Pandemic Inflation

The post Trump Takes Responsibility for Post-Pandemic Inflation appeared first on CEPR.

Are Central Bankers Willing To Truly Upset Markets So Trump Backs Off?

By Michael Every of Rabobank

Officially it’s 2,000, but reportedly as many as 12,000 Iranian protestors could have been killed by their own government over the past few days. While the West has seen none of the mass protests that the last two-plus years have been full of, President Trump told those on Iran’s streets to keep going and that “Help is coming,” adding if the government starts hanging those it’s arrested, matters will be even worse. What might this mean though? It’s unclear. The Wall Street Journal reports that US Gulf Allies, led by Saudi Arabia, have been lobbying the US not to get involved (as the Trump admin labelled three Muslim Brotherhood branches as terrorist organisations).

The intricacies of the Middle East defy the space available here (or on protesters’ placards), but alongside tensions in Yemen/South Yemen and Somalia/Somaliland, a key takeaway is that the Western assumption of a more moderate Saudi-led GCC is perhaps being called into question. Rather, it looks as if there is a Saudi-UAE split, with the former moving closer to Qatar, Turkey, and Pakistan as it loses fear of Iran as a regional hegemon and instead works with those it sees as able to fill that power vacuum who aren’t Israel (see ‘From partners to rivals: What the Saudi-UAE rupture means for Europeans’). That will matter hugely ahead, if so; and for now it’s wait and see on what the US will do in Iran.

That isn’t the only energy story, as two Russian tankers were hit by drones in the Black Sea; that’s as 70% of Kyiv’s power went down as Russia goes all out to try to plunge Ukraine into darkness. Europe is also going to redouble efforts to stop China and India buying Russian oil: how, without sanctions or Trump-style tariffs? (One asks, as the EU is now close to dropping tariffs on Chinese EVs in favor of a minimum price – which effectively means the EV is the same price for the consumer but the tariff flows to China instead of the EU. Realpolitik is hard for some.)

On Greenland and NATO, tensions remain high. Greenland’s PM said the territory chooses Denmark over the US, which Trump rejected; Russia trolled that Greenland might vote to join it, not the US; US senators introduced a bill to prevent the US from invading NATO territory; and France continued to lobby for the EU military aid package for Ukraine to only be spent on EU weapons – which they cannot provide in the volumes required, in the same way that the US underlines that they can’t actually provide adequate forces to cover Greenland.

Meanwhile, help came for embattled Fed Chair Powell. Not the CPI print of 0.3% m-o-m and 2.7% y-o-y headline and 0.2% and 2.6% core, which frankly don’t matter much against the current backdrop. Rather, we saw ‘Central bankers of the world, unite!’ as the BIS, ECB, BoE, RBA, Riksbank, SNB, BCB, BoK, BoC, and the Norges Bank --all institutionally opposed to unionization, "because markets" -- said they “Stand in full solidarity" with Fed Chair Powell, who is facing a possible criminal investigation by the DoJ. (Something that isn't new to one of those central bankers.) “The independence of central banks is a cornerstone of price, financial and economic stability in the interest of the citizens that we serve. It is therefore critical to preserve that independence, with full respect for the rule of law and democratic accountability," was their defiant collective message.

(Of course, this overlooks that their track record on those fronts is questionable, and that for most of global history we didn't have independent central banks and did fine - better than recently, in fact, if you look at post-WW2 growth and inflation.)

But where was the BoJ? That omission speaks volumes about realpolitik and a central bank with a balance sheet amounting to a terrifying % of GDP (as a snap February election looms, JPY falls, and the 5-year JGB yield just hit the highest since 2000: somebody can’t afford to annoy the US right now).

Where was the RBI, as India is close to trade deal with the EU, and German Chancellor just stated he wants to build deep economic and defense relationships with it.

Where was the PBoC, from the world's second largest economy and the largest in PPP terms? That obvious absence speaks volumes about how little the West grasps that its 'liberal world order’ doesn't speak for the world – and, increasingly, all liberals.

Where was this collective outrage when Bank of Poland Governor Glapinksi was being leaned on by his liberal government? Is Poland --which just overtook the UK in GDP per capita, and which will soon have the second most powerful conventional army in Europe at a time when that really matters-- 'just an EM'? Protests are variable, it seems.

On the specifics of the Powell case, the US DoJ stated, “None of this would have happened if they had just responded to our outreach,” which makes the case that the Fed doth protest too much. However, the FT claims Powell sent a letter to US senators with details of his Fed refurbishment project following his testimony, which makes the investigation look political. (At least this isn’t happening in South Korea, where the impeached former president now faces the death penalty for his recent actions.)

Yet in reality everyone is rallying round Powell, not Poland, because if the Fed is part of economic statecraft, not neoliberal global establishment monetary policy, then there isn't a neoliberal global establishment.

Free trade has gone – as Canada’s Carney walks a tightrope on a trip to Beijing to try to diversify away from the US, while Trump stated the USMCA is “irrelevant” during a Ford Motor factory tour. Free movement of people is going.

Free movement of capital is declining. The fiscal rules are being ripped up as fiscal dominance rules. And, as shown back in 2016's 'Thin Ice', if central bank cooperation collapses, it's game over. Realistically, what would the ECB and BoE, etc., do if the Fed was politicised under US neo-mercantilism?

Equally logical is the fact that the Fed is a vital part of any true Gramscian revolution, and would ideally be flipped well before the looming mid-term elections. Did you not notice Trump using an executive order to de facto institute MBS QE last week? Those are the real stakes.

Yet given Powell is gone in a few months anyway, what will this resistance achieve vs Trump that the slew of lawfare didn't in the run-up to the 2024 election? That’s as BlackRock's Rieder emerges as a new Fed Chair tip in the home stretch: is that the gamekeeper turning poacher or vice versa? Do central bankers really think Trump will retreat when called out? Or are they willing to truly upset markets so he backs off?

In short -- and unlike in Iran, where things are hard to call -- this looks like a battle that the establishment probably can't win. Indeed, while a brighter day might be on the horizon for the Iranian people, no help is coming for the liberal world order.

Tyler Durden Wed, 01/14/2026 - 10:30FBI Raids WaPo Reporter's Home In Classified Docs Case

The FBI executed a search warrant on the home of Washington Post reporter Hannah Natanson as part of a probe into "a government contractor accused of illegally retaining classified government materials," the paper announced Wednesday.

Natanson, was at her Virginia home when the agency showed up with a warrant. According to the outlet, "law enforcement was investigating Aurelio Perez-Lugones, a system administrator in Maryland who has a top secret security clearance and has been accused of accessing and taking home classified intelligence reports that were found in his lunchbox and his basement." The journalist's home and devices were search.

According to her X bio, Natanson covers "the Trump administration's reshaping of the government and its effects."

Perez-Lugones is a US citizen who was born in Miami and now resides in Laurel, Maryland according to the FBI's criminal complaint. He has been a government contractor since 2002 and holds top secret security clearance.

According to the complaint, at least one document found in Pererz-Lugones' basement was related to national defense. WaPo reports that Natanson has been part of its most sensitive coverage in the 2nd Trump administration. She told WaPo that the FBI seized a phone and a Garmin watch.

According to AG Pam Bondi: "his past week, at the request of the Department of War, the Department of Justice and FBI executed a search warrant at the home of a Washington Post journalist who was obtaining and reporting classified and illegally leaked information from a Pentagon contractor. "

This past week, at the request of the Department of War, the Department of Justice and FBI executed a search warrant at the home of a Washington Post journalist who was obtaining and reporting classified and illegally leaked information from a Pentagon contractor. The leaker is…

— Attorney General Pamela Bondi (@AGPamBondi) January 14, 2026

Developing...

Tyler Durden Wed, 01/14/2026 - 10:08"Defining Moment": Saks Global Files For Bankruptcy After Botched Neiman Marcus Takeover

Luxury department store conglomerate Saks Global filed for bankruptcy protection late Tuesday night, in one of the largest US retail collapses since the Covid era and, among other things, what appears to be a casualty of the menacing K-shaped economy.

Saks Global has been weighed down by heavy debt following its $2.7 billion, debt-fuelled acquisition of Neiman Marcus and Bergdorf Goodman in 2024. Slowing luxury sales, a K-shaped economy, and dwindling cash levels led Saks to delay payments to suppliers, prompting some vendors to halt shipments or demand cash on delivery, which further pressured sales. The retailer missed a $100 million interest payment in December.

Despite the bankruptcy filing, Saks secured $1.75 billion in financing, including $1.5 billion from senior secured bondholders, and appointed former Neiman Marcus chief Geoffroy van Raemdonck as CEO. The restructuring will wipe out existing equity holders, including newer investors such as Amazon and Salesforce.

"This is a defining moment for Saks Global, and the path ahead presents a meaningful opportunity to strengthen the foundation of our business and position it for the future," said van Raemdonck, adding, "In close partnership with these newly appointed leaders and our colleagues across the organization, we will navigate this process together with a continued focus on serving our customers and luxury brands. I look forward to serving as CEO and continuing to transform the Company so that Saks Global continues to play a central role in shaping the future of luxury retail."

The future of the Saks Global empire will be much clearer in the weeks and months ahead as bankruptcy proceedings begin and new investors enter the picture. It's important to note that van Raemdonck is a luxury retail veteran who has played key leadership roles in Louis Vuitton and Ralph Lauren.

Saks' demise appears to stem from slowing luxury sales and the Neiman Marcus deal, as well as ...

"In a market where luxury brands are moving direct-to-consumer and shoppers expect personalization and speed, that (merger) was always going to fail," said Brittain Ladd, a strategy and supply-chain consultant at Florida-based Chang Robotics, who was quoted by Reuters.

In markets, the Goldman Luxury European Index (GSXELUXG), a sell-side benchmark tracking luxury heavyweights including LVMH, Hermès, Richemont, Burberry, Ferrari, and others, has traded largely sideways since 2022.

Morningstar analyst David Swartz recently noted, "Rich people are still buying ... just not so much at Saks."

Tyler Durden Wed, 01/14/2026 - 09:55How Independent Is The Federal Reserve?

Authored by Jeffrey Tucker via The Epoch Times,

The Department of Justice has opened an investigation into cost overruns in the Federal Reserve’s renovation project, with particular focus on Fed Chairman Jerome Powell and his testimony to Congress in June 2025. The question is whether he perjured himself concerning what he knew and when.

Powell responded with a highly unusual video message to the public. He defended himself and further speculated that this investigation is merely a tactic to interfere with the Fed’s independence.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the president,” he said. “This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions—or whether instead monetary policy will be directed by political pressure or intimidation.”

He speaks to a long-running dispute on the relationship between the Fed and the executive branch. The organizational chart of the federal government puts the central bank clearly under the authority of the president. That said, there is a long-running understanding that its operations would be politically independent and that presidents would not and could not interfere.

The courts have affirmed its independence in passing, but the status of the institution in constitutional law remains murky.

Powell’s certain supposition that this is not really about the renovation project might in fact be incorrect. In July 2025, Rep. Anna Paulina Luna (R-Fla.) referred Powell for criminal investigation over false testimony. Powell had denied to lawmakers that the renovation involved a “VIP dining room, premium marble, water features, and a roof terrace garden.”

But Luna found the plans submitted to the National Capital Planning Commission that clearly had all those features, requiring cost overruns of $600 million. Looking through the plans, the sheer opulence and scale are what stand out. Powell grants that costs have ballooned but blames unexpected discoveries of new needs and, ironically, inflation.

Contrary to Powell’s dismissals, this is actually serious. The subpoena is based on genuine grievances that Powell simply lied to Congress.

Independence is one thing, but spending $600 million without congressional authorization is another matter entirely.

In his statement, Powell said, “I have carried out my duties without political fear or favor, focused solely on our mandate of price stability and maximum employment.”

Here we have another problem. We have just lived through the second worst inflationary bout in a century of monetary policy. The great inflation of 2021–2024 reduced the overall purchasing power of the dollar by 25 percent to 30 percent for a broad index of goods and services. Some particulars show far higher price increases. You can probably think of examples in which the posted price has doubled since 2019.

In other words, this is not the most opportune time for Powell to cite the Fed’s dedication to price stability.

What’s more, the inflation that shocked the country was a direct consequence of Powell’s decision in March 2020 to flatline interest rates to make possible vast funding that would flow as part of the COVID-19 pandemic response. He had spent the two previous years gradually increasing rates as a means of patching up the Fed’s broken balance sheet.

The problem he had sought to solve with higher rates traced all the way back to 2008 under the leadership of Ben Bernanke. The Fed adopted a zero interest rate policy to bail out financial institutions following the collapse of the market for mortgage-backed securities. Part of the scheme involved paying banks for deposits at a higher rate than the market would bear, thus forestalling inflationary pressure.

The downside of such a policy involved grave distortions in industrial production structures plus a Fed holding on to useless debt assets. Powell had been determined to reverse this error and at least get the Fed on a sound financial footing.

All was going well until the first week of March. Someone, somehow, got to him and persuaded him to completely reverse course. The result was a default back to zero interest rates for the next two years, with disastrous results.

The rate of money creation during this period broke all records. Unlike the quantitative easing of 2005, the new money was sent directly to Americans’ bank accounts and became hot money on the street. This fueled inflation never before experienced by anyone younger than 45. Far from being transitory, it was devastating, wiping out the whole value of the stimulus payments.

There can be no question that the Fed was responsible.

As the inflation roared, Powell stepped in with the fastest rate increases on record. This policy likely contributed to the taming of the inflationary beast. And yet just as we were approaching the national election of 2024, he reversed policy yet again, in a manner that could easily be interpreted as a boon to then-Vice President Kamala Harris’s presidential campaign and the Democrats.

Looked at in total, these are not the actions of an independent Fed but rather one that changes policy based on political pressure. Powell denies it, but the evidence is rather clear.

This was perhaps not the best time for the Fed to renovate its headquarters with luxury accommodations and $600 million in cost overruns. Even leaving aside the sheer power of the central bank to manipulate political outcomes, it surely needs some oversight from the people’s elected representatives. For the central bank to claim that it is an institution dedicated entirely to economic science and the public interest is a real stretch.

The Constitution includes no mention of an independent central bank. Its mentions of money include only a provision that only gold and silver can be coined as money by states, an implicit rebuke of unsound money. This is why the institution of a national bank has invited so much controversy over the years.

On July 10, 1832, President Andrew Jackson issued a veto of the chartering of the Second National Bank. It is one of the most famous presidential vetoes in U.S. history. It was also a genius move, bolstering his standing and guaranteeing his reelection. The United States was thereby protected against a central bank until one emerged in secret in 1913.

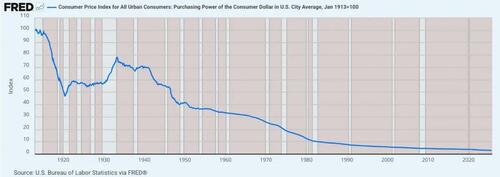

The truth is that central banking has never been popular in U.S. history. This is for good reason. Inflation is a genuine trauma. Since the Fed’s creation, the value of the dollar has been on a long downward slide, and is now worth about 3 cents from 1913. This is not a record about which any chairman of the Fed should feel pride.

Tyler Durden Wed, 01/14/2026 - 09:40Trump To Speak At Globalist WEF Forum

Authored by Steve Watson via Modernity.news,

President Trump is set to crash the World Economic Forum in Davos, bringing his America First agenda straight into the heart of the globalist elite’s annual gathering. As the multilateralism devotees scramble to maintain their facade of openness Trump’s presence signals a direct challenge to their open borders and free trade obsessions that have long undermined U.S. sovereignty.

All eyes will be on the President as he heads to the Swiss ski resort for the confab, where the theme this year is ironically dubbed “A Spirit of Dialogue.”

“We’re pleased to welcome back President Trump,” said Borge Brende, the forum’s chief executive, during an online press conference. He noted this marks six years since Trump’s previous in-person appearance during his first term.

BREAKING: Donald Trump will lead the "largest and most senior" US delegation to Davos ever, say officials at the World Economic Forum.

— Sky News (@SkyNews) January 13, 2026

The organisation's annual meeting will start on 19 January in the Swiss town.https://t.co/5MpePzQTlm

? Sky 501 and YouTube pic.twitter.com/nSxwteEmLO

Trump will arrive with the largest U.S. delegation ever, including key figures like Secretary of State Marco Rubio and Treasury Secretary Scott Bessent, as well as Steve Witkoff, his special envoy for the Middle East and Ukraine.

“The interest is to come together at the beginning of the year to try to connect the dots, decipher, and also see areas where we can collaborate,” Brende claimed, adding “Dialogue is not a luxury. Dialogue is really a necessity.”

Yet, Trump’s track record of protectionist tariffs and disdain for traditional alliances casts a long shadow over any hopes for cozy collaboration. Brende noted that the summit unfolds against “the most complex geopolitical backdrop since 1945.”

Economist Karen Harris at Bain & Co., remarked “2025 will ultimately be seen as the year in which neoliberal globalisation ended and … the post-globalisation era began.”

She described it as one where “the US prioritises national security, its own security, and uses the economy as a tool to achieve some of those goals.”

Attendees include China’s Vice Premier He Lifeng, EU Commission chief Ursula von der Leyen, and Ukraine’s President Volodymyr Zelensky, setting up potential flashpoints on issues from Ukraine and Venezuela to Gaza, Greenland, and Iran.

Trump’s video address to Davos last year, just after his second inauguration, laid bare his stance: he warned nations to shift manufacturing to the U.S. or face tariffs, rejecting decades of unchecked global trade.

? ?? BREAKING: President Trump is set to attend the World Economic Forum’s annual meeting in Davos, Switzerland NEXT WEEK, where he is expected to deliver the keynote address to the globalists.

— JJ?? (@jesseyjay94) January 9, 2026

In his virtual address last year at Davos 2025, President Trump fiercely rejected… pic.twitter.com/8nEx8YUT5h

This rejection extends to multilateral institutions, as Philippe Dauba-Pantanacce, head of geopolitical analysis at Standard Chartered, observed: it “is precisely a broad rejection of multilateral institutions, on the view that international cooperation is inconsistent with ‘winning’ a global competition that is seen as a zero-sum game.”

“With his tariffs, trade ‘is a subject where Trump has made a lot of noise’,” said Pascal Lamy, former head of the World Trade Organization, adding “But unlike what has been the case with geopolitics, whether it’s Ukraine, China, Iran or Venezuela, the impact on the global economy has been limited so far.”

Among the 850 CEOs attending are Nvidia’s Jensen Huang and Microsoft’s Satya Nadella, underscoring the forum’s blend of business and politics.

Trump’s Davos appearance follows his decisive action just days ago, where he pulled the U.S. out of 66 international organizations, including climate bodies like the Intergovernmental Panel on Climate Change and UN-linked groups on gender equality and human settlements.

Secretary of State Marco Rubio slammed these as “redundant in their scope, mismanaged, unnecessary, wasteful, poorly run, captured by the interests of actors advancing their own agendas contrary to our own, or a threat to our nation’s sovereignty, freedoms, and general prosperity.”

Rubio further critiqued their evolution into “a sprawling architecture of global governance, often dominated by progressive ideology and detached from national interests.” Trump’s move saves billions in taxpayer dollars, rejecting the inertia of funding entities that push DEI mandates, climate orthodoxy, and sovereignty-eroding policies.

At Davos, expect Trump to double down on this America First reset, exposing the forum’s multilateral mantra as a cover for globalist control that prioritizes unelected bureaucrats over national priorities.

Trump’s presence in Davos isn’t about playing nice—it’s a reminder that the era of subsidizing globalist schemes at America’s expense is over. By showing up with his powerhouse team, he’s forcing the elite to confront the reality of a U.S. that puts its own people first, free from the entanglements that have drained resources for too long.

First time Trump spoke at Davos, he told them to their face he rejects their totalitarian ‘climate change’ agenda “to dominate, transform and control every aspect of our lives.”

— ??Ø?Ø?? (@KAGdrogo) January 11, 2026

He’s going again to tell the WEF

their dream of a global government is OVER. pic.twitter.com/JQP82qg43X

Your support is crucial in helping us defeat mass censorship. Please consider donating via Locals or check out our unique merch. Follow us on X @ModernityNews.

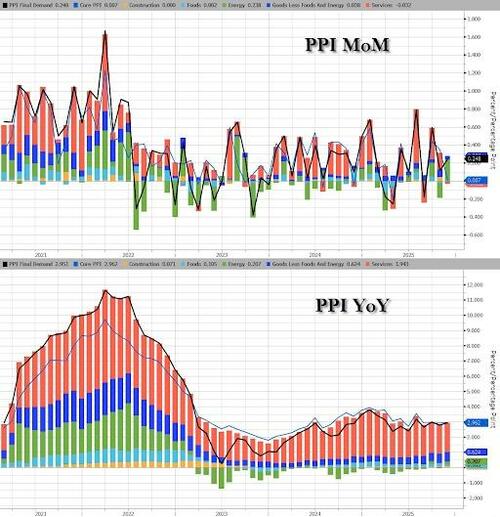

Tyler Durden Wed, 01/14/2026 - 09:05US Producer Prices Come In Hot On Heels Of Mysterious Energy Cost Surge

US wholesale inflation picked up slightly in November from a month earlier on a jump in energy costs, even as prices for services were unchanged.

The producer price index rose 0.2% after climbing 0.1% in the prior month, according to much-heralded BLS.

Source: Bloomberg

PPI Final demand goods:

-

The index for final demand goods advanced 0.9 percent in November, the largest rise since moving up 0.9 percent in February 2024. Over 80 percent of the November increase can be traced to prices for final demand energy, which jumped 4.6 percent.

-

The index for final demand goods less foods and energy advanced 0.2 percent, while prices for final demand foods were unchanged.

-

Product detail:

-

More than half of the November rise in the index for final demand goods is attributable to prices for gasoline, which moved up 10.5 percent.

-

The indexes for electric power, diesel fuel, fresh fruits and melons, jet fuel, and light motor trucks also increased. (Most new-model-year passenger cars and light motor trucks were introduced into the PPI in October and November.

-

In contrast, prices for residual fuels declined 8.6 percent. The indexes for beef and veal and for basic organic chemicals also decreased. (See table 2.)

PPI Final demand services:

-

Prices for final demand services were unchanged in November following a 0.3 percent increase in October.

-

In November, the indexes for final demand services less trade, transportation, and warehousing and for final demand transportation and warehousing services both advanced 0.3 percent.

-

Conversely, margins for final demand trade services fell 0.8 percent.

-

Product detail:

-

Within final demand services in November, prices for bundled wired telecommunications access services rose 4.6 percent.

-

The indexes for machinery and vehicle wholesaling, portfolio management, outpatient care (partial), and game software publishing also moved up.

-

In contrast, margins for health, beauty, and optical goods retailing decreased 4.3 percent.

-

The indexes for automobile retailing (partial), chemicals and allied products wholesaling, guestroom rental, and food and alcohol retailing also declined.

Excluding food and energy, the PPI was unchanged from the prior month and climbed 3% from November 2024.

Source: Bloomberg

Economists and investors closely track the PPI because several of its components feed into the Federal Reserve’s preferred inflation gauge, the personal consumption expenditures price index.

Among those categories, portfolio management fees advanced 1.4% while costs of airline passenger services fell 2.6%. The costs of physican care and hospital inpatient care rose slightly, while hospital outpatient care saw a bigger increase.

However, we are not quite sure where the prices surge seen in PPI data is coming from, as oil prices were still plummeting when this data was 'created'...

Source: Bloomberg

Still, the lack of a PhD on our side means we are surely too dumb to comprehend this divergence.

Tyler Durden Wed, 01/14/2026 - 08:53US Retail Sales Shrug Off 'K-Shaped' Economy With Upside Surprise In November

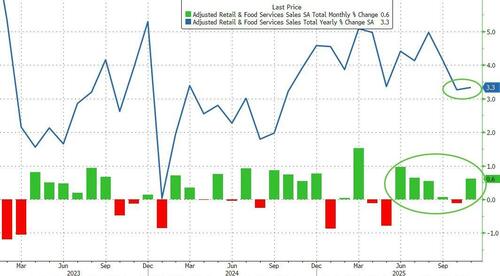

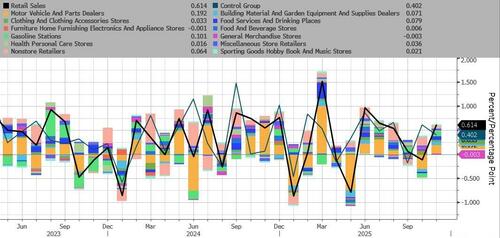

Having noted yesterday that holiday retail spending (December) was up significantly (via the NRF), today we get the official (US Census Bureau) look at Retail Sales from November... so don't get too excited.

But, amid the growing specter of the 'k-shaped' economy, expectations were for a sizable 0.5% MoM jump in retail sales (after October's 0.0% nothingburger)... but the headline print beat expectations with a 0.6% MoM surge... leaving sales up 3.3% YoY...

Source: Bloomberg

That was the strongest MoM jump in retail sales since July.

Additionally, Ex-Autos, and Ex-Autos and Gas also both beat expectations.

Ten out of 13 categories posted increases, including sporting goods and hobby stores as well as building materials retailers and clothing outlets. Motor vehicle sales bounced back after the expiration of federal tax incentives on electric cars restrained sales in the prior month. Higher receipts at gasoline stations also contributed to the overall gain.

General Merchandise stores saw sales decline in November (along with Furniture), while Motor Vehicles and Gas Station sales surged the most...

Real retail sales (a rough approximation against CPI) remained positive on a YoY basis...

Source: Bloomberg

Finally, things look even better for the broad economy as the Retail Sales Control Group (which excludes food services, auto dealers, building materials stores and gasoline stations) - which feeds into the GDP calc - jumped 0.4%% MoM - in line with expectations...

Source: Bloomberg

That MoM jump leaves sales up a strong 5.1% YoY and while the 'k-shaped' economy continues to weigh on market sentiment, it is not evident in the aggregate data and supports solid Q4 GDP growth.

"The consumer ended 2025 on a strong note might get stronger when tax refunds start hitting in the new year," said David Russell, Global Head of Market Strategy at TradeStation.

"Today’s retail sales report is consistent with accelerating GDP in Q4, which could push rate cuts further into the future. Whatever happens with Jerome Powell, the era of his relevance seems to be winding down. Further easing with be the concern of his successor."

The figures may have gotten an extra boost from federal workers, who recouped lost wages from the government shutdown.

Tyler Durden Wed, 01/14/2026 - 08:39U.S. International Transactions, 3rd Quarter 2025

Bank of America Slides Despite Top, Bottom Line Beat As Underwriting, FICC Miss

After some rather soggy earnings from JPM yesterday, in which the largest US bank disappointed with declining underwriting fees, and spooked markets with a jump in loan loss reserves on its Apple credit card deal as well as downbeat commentary from Jamie Dimon on what a credit card cap would mean for the bank, moments ago Bank of America reported Q4 results which at first glance were stronger, and sent its stock higher premarket, but as analysts read between the lines and noticed the weak parts of the report (underwriting fees, FICC miss), BofA stock has since sunk 2% in the premarket.

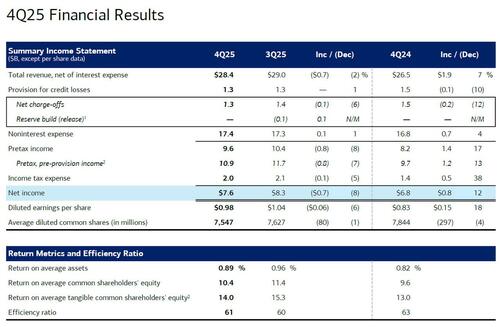

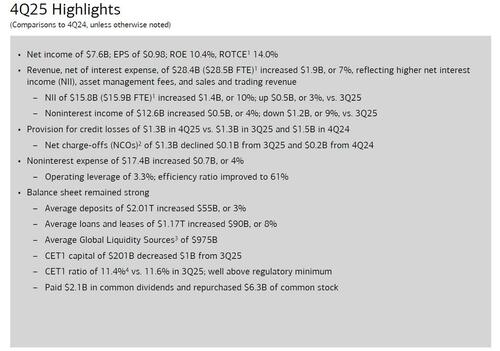

Here are the highlights: BofA Q4 net interest income beat expectations; $15.75 bn versus $15.48 bn expected by Bloomberg consensus. In the Q4 earnings report, total revenue (net of interest expense) for Q4 was $28.4 bn, slightly lower than Q3's $29 bn but above Bloomberg expectations of $27.76 bn, similar to JPMorgan's strong markets beat, as BofA traders reaped the benefits of a volatile Q4 for markets. Revenue from equity trading rose 23% to $2.02 billion in the final three months of the year, beating estimates of $1.9 billion. That helped give Bank of America earnings of 98 cents a share, just barely topping analysts’ estimates of 96 cents. Net income for the fourth quarter was $7.6bn, up 12% YoY, but down 8% from the $8.3bn in Q3. That was the good news. The bad news was an unexpected miss in the bank's all important, high-margin FICC group, coupled with a miss across both debt and equity underwriting.

Here is a snapshot of what BofA reported in Q4:

- EPS $0.98, up 18% YoY from $0.83, beating estimates of $0.96

- Revenue net of interest expense $28.37 billion, up 7% YoY from $26.5 billion, beating estimate $27.78 billion; reflecting higher net interest income (NII), asset management fees, and sales and trading revenue

- Net interest income $15.75 billion, beating estimate $15.48 billion

- Net interest income FTE $15.92 billion, +9.7% y/y, analysts had expected a 7.8% increase for NII

- Trading revenue excluding DVA $4.53 billion, beating estimate $4.33 billion

- FICC trading revenue excluding DVA $2.52 billion, missing estimate $2.62 billion

- Equities trading revenue excluding DVA $2.02 billion, beating estimate $1.89 billion

- Investment banking revenue $1.67 billion, beating estimate $1.66 billion

- Advisory fees $590 million, beating estimate $495.3 million

- Debt underwriting rev. $810 million, missing estimate $864 million

- Equity underwriting rev. $297 million, missing estimate $301 million

- Wealth & investment management total revenue $6.62 billion, beating estimate $6.45 billion

- Net interest income $15.75 billion, beating estimate $15.48 billion

Here are the highlights visually:

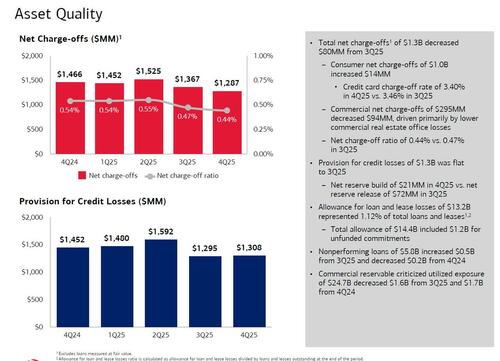

BofA's provision for credit losses of $1.3B in 4Q25 vs. $1.3B in 3Q25 and $1.5B in 4Q24, and below estimates of $1.48BN

- Net charge-offs (NCOs) of $1.29B declined $0.1B from 3Q25 and $0.2B from 4Q24 and below estimates of $1.44BN

“With consumers and businesses proving resilient, as well as the regulatory environment and tax and trade policies coming into sharper focus, we expect further economic growth in the year ahead,” CEO Brian Moynihan said in the press release. “While any number of risks continue, we are bullish on the US economy in 2026.”

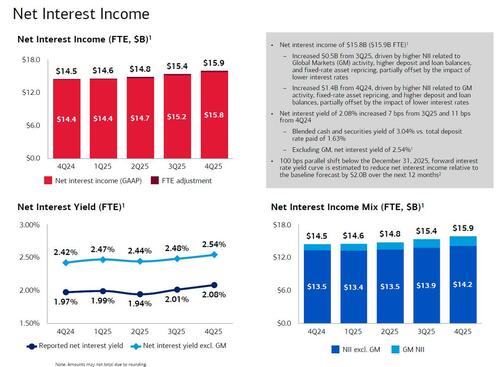

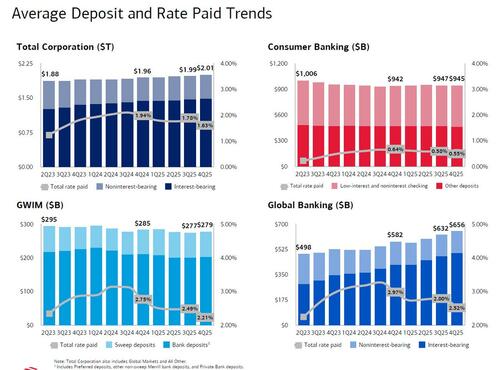

The bank's all important net interest income rose $0.5BN from Q3 to $15.9BN, "driven by higher NII related to Global Markets (GM) activity, higher deposit and loan balances, and fixed-rate asset repricing, partially offset by the impact of lower interest rates." The Net Interest yield of 2.08% rose 7bps sequentially, beating estimates of 2.04%, and was the highest in years. Blended cash and securities yield of 3.04% vs. total deposit rate paid of 1.63%.

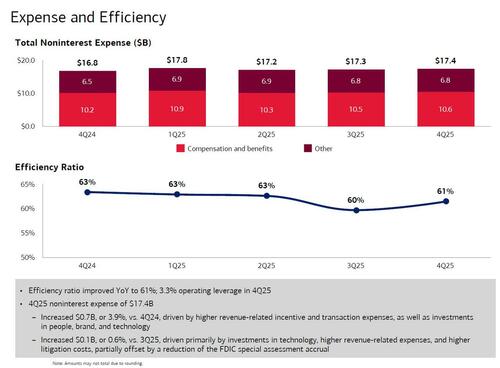

BofA's Q3 efficiency ratio was 61.5% down from 63.4% y/y as noninterest expenses rose to $17.44 billion, but was below estimates of $17.47 billion. Compensation expenses $10.60 billion, estimate $10.55 billion

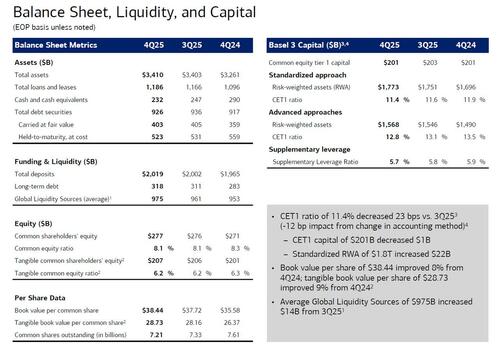

Taking a closer look at the bank's balance sheet, we find ample liquidity:

- Average Global Liquidity Sources of $975B

- CET1 capital of $201B decreased $1B from 3Q25

- CET1 ratio of 11.4%4 vs. 11.6% in 3Q25; well above regulatory minimum

- Efficiency ratio 61.5% vs. 63.4% y/y

- Paid $2.1B in common dividends and repurchased $6.3B of common stock

- Basel III common equity Tier 1 ratio fully phased-in, advanced approach 12.8%, estimate 13%

- Standardized CET1 ratio 11.4%, estimate 11.5%

Total deposits of $2.02TN increased $55B, or 3%, below estimates of $2.03TN

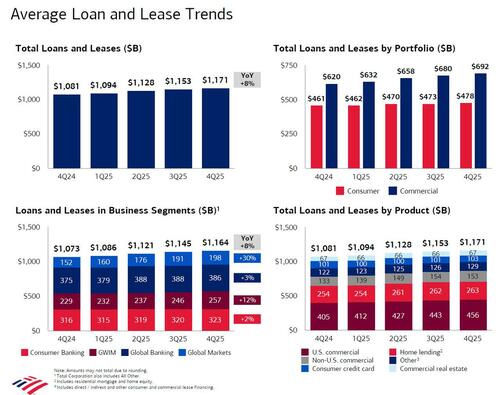

Total loans and leases of $1.19T increased $90B, or 8%, above estimates of $1.18TN

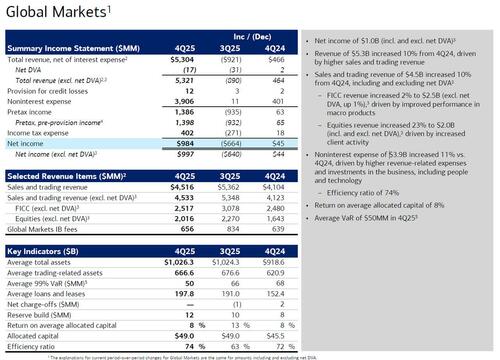

Turning to the all important Markets/Banking division, we find that just like JPM, markets revenue was ok, with Equities beating/FICC missedm while investment banking also saw underwriting weakness. Here are the details:

- Total Markets Revenue of $5.3B increased 10% YoY, driven by higher sales and trading revenue

- Trading revenue excluding DVA $4.53 billion, beating estimate $4.33 billion

- FICC trading revenue excluding DVA $2.52 billion, missing estimate $2.62 billion, and was "driven by improved performance in macro products"

- Equities trading revenue excluding DVA $2.02 billion, beating estimate $1.89 billion, and was "driven by increased client activity"

- Noninterest expense of $3.9B increased 11% vs. 4Q24, driven by higher revenue-related expenses and investments in the business, including people and technology

But while Markets was ok, the same weakness JPM observed in Investment Banking was also palpable at BofA, where advisory fees came in strong, but were offset by very poor debt and equity underwriting environment.

- Investment banking revenue $1.67 billion, beating estimate $1.66 billion

- Advisory fees $590 million, beating estimate $495.3 million

- Debt underwriting rev. $810 million, missing estimate $864 million

- Equity underwriting rev. $297 million, missing estimate $301 million

- Noninterest expense of $3.1B increased 6% vs. 4Q, driven by investments in the business, including people and technology

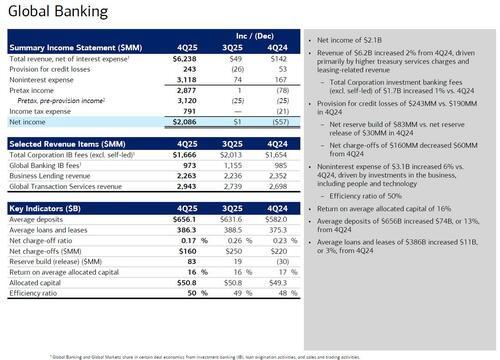

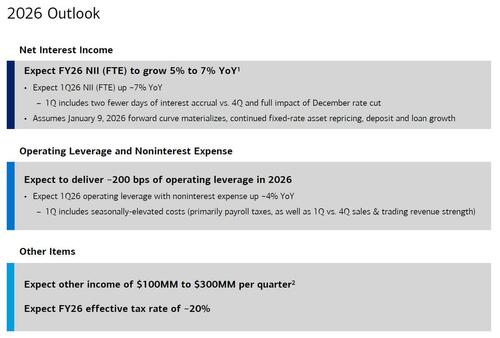

Looking ahead, the bank's 2026 outlook was solid, just like JPM, with the bank expecting NII to grow 5-7%, a solid increase but a slowdown from the 10% YoY increase in Q4. The bank also expects to deliver 200bps of operating leverage in 2026, although costs will be elevated in Q1.

Bank of America’s results offer a further look at how the biggest US banks fared during the first year of Trump’s return to office. On Tuesday, JPMorgan reported earnings that beat analysts’ estimates, with trading activity boosting results, despite an unexpected decline in investment-banking fees, similar to BofA. The market was not impressed and the stock tumbled 4%, its worst post-earnings reaction since Q1 2024.

That said, execs expect deals to pick up in 2026, with a strong pipeline and corporate clients who pushed off activity coming back to the market.

Shares of Charlotte, North Carolina-based Bank of America, slumped 1% in premarket trading as algos realized read the fine print below the superficial beat. BofA had gained 19% in the 12 months through Tuesday, more than the 12% increase in the S&P 500 Financials Index.

BofA's full investor presentation can be found here: pdf link.

Tyler Durden Wed, 01/14/2026 - 08:26Coast Guard: Actions Needed to Ensure Complete and Timely Reports to Congress Regarding Sexual Assault and Sexual Harassment

DOGE Cancels Or 'Descopes' Contracts Worth $1.5 Billion Over A 5-Day Period

The demise of DOGE has been greatly exaggerated.

The Department of Government Efficiency (DOGE) website is displayed on a phone, in this photo illustration. Oleksii Pydsosonnii/The Epoch Times

The Department of Government Efficiency (DOGE) website is displayed on a phone, in this photo illustration. Oleksii Pydsosonnii/The Epoch Times

Over the weekend, the Department of Government Efficiency announced that agencies have terminated and descoped '42 wasteful contracts with a ceiling value of $1.5B and savings of $269M, including a $1.2M Millennium Challenge Corp. DEI professional services contract for a “DCO Gender and Social Inclusion Director Full Time”."

Contracts Update!

— Department of Government Efficiency (@DOGE) January 10, 2026

Over the last 5 days, agencies terminated and descoped 42 wasteful contracts with a ceiling value of $1.5B and savings of $269M, including a $1.2M Millennium Challenge Corp. DEI professional services contract for a “DCO Gender and Social Inclusion Director… pic.twitter.com/RDnmCxSaKq

The post came roughly a week after DOGE announced that over a three-day period, federal agencies had similarly terminated and descoped 55 "wasteful" contracts with a ceiling value of $1.6 billion, resulting in $542 million in savings. Included in those was a $47 million State Department contract for "Africa/Djibouti, Somalia armored personnel carriers and Somalia National Army crew."

Contracts Update!

— Department of Government Efficiency (@DOGE) January 3, 2026

Over the last 3 days, agencies terminated and descoped 55 wasteful contracts with a ceiling value of $1.6B and savings of $542M, including a $47M State Dept. program support contract for “Africa / Djibouti, Somalia armored personnel carriers and Somalia… pic.twitter.com/JgF8YR6ht4

As the Epoch Times notes further, as of Jan. 1, DOGE had saved approximately $215 billion through contract, grant, and lease cancellations, according to the department. Among an estimated 161 million individual federal taxpayers, DOGE has saved $1,335.40 per taxpayer.

Based on data displayed on its leadership board, the U.S. agencies that accounted for most of the savings are the Department of Health and Human Services, the General Services Administration, the Social Security Administration, the Office of Personnel Management, and the Small Business Administration.

Regarding contracts, the top amounts terminated are $12.5 billion and more than $5.7 billion from the Department of Defense (DOD), nearly $4 billion from the Department of the Air Force, and $3.75 billion again from the DOD, now known as the Department of War.

As for grants, the highest value amounts canceled are $4 billion and $2.6 billion from the now-defunct United States Agency for International Development (USAID). USAID was dismantled by the Trump Administration on July 1, 2025.

Fraud Alleged in StatesDOGE’s latest announcement comes in the wake of large-scale government benefit fraud discovered in Minnesota, resulting in the waste of billions of taxpayer dollars, according to a Jan. 9 statement from the Department of the Treasury.

“Under Democratic Governor Tim Walz, welfare fraud has spiraled out of control,” said Treasury Secretary Scott Bessent. “Billions of dollars intended for feeding hungry children, housing disabled seniors, and providing services for children in need were diverted to benefit Somali fraud rings.”

Complex fraud rings in Minnesota have allegedly stolen billions of dollars from taxpayer-funded state programs, with criminals using the money to purchase residential and commercial real estate, luxury goods, vehicles, planes, international flights, and other luxury expenses, the statement said.

On Jan. 6, President Donald Trump also announced a fraud investigation targeting California.

Also, after the incidents in Minnesota, Texas Gov. Greg Abbott has directed state agencies to investigate social services for potential fraud.

Tyler Durden Wed, 01/14/2026 - 07:45Coast Guard: Opportunities Exist to Strengthen Reform Efforts to Address Sexual Misconduct

Combating Fraud: Approaches to Evaluate Effectiveness and Demonstrate Integrity

US Military Opens New Air Defense Coordination Cell In Qatar

Authored by Ryan Morgan via The Epoch Times (emphasis ours),

The U.S. Central Command (CENTCOM), on Jan. 13, announced the launch of a new air defense coordination cell in Qatar.

A U.S. soldier assigned to the 1-62 Delta Battery Air Defense Artillery Regiment Patriot at a Patriot launcher at at Al Udeid Air Base, Qatar, on March 4, 2015. Tech. Sgt. James Hodgman/U.S. Air Force via DVIDS

A U.S. soldier assigned to the 1-62 Delta Battery Air Defense Artillery Regiment Patriot at a Patriot launcher at at Al Udeid Air Base, Qatar, on March 4, 2015. Tech. Sgt. James Hodgman/U.S. Air Force via DVIDS

CENTCOM, the U.S. military command that oversees operations in the Middle East, said the new unit is located at the Al Udeid Air Base and will be operated by personnel from the United States and other regional partners.

Called the Middle Eastern Air Defense—Combined Defense Operations Cell, the center is situated within the existing Combined Air Operations Center at Al Udeid Air Base.

Over the past 20 years, representatives from 17 nations have helped to coordinate air operations from the Combined Air Operations Center.

“This is a significant step forward in strengthening regional defense cooperation,” Adm. Brad Cooper, the commander of CENTCOM, said in a statement on Tuesday.

“This cell will improve how regional forces coordinate and share air and missile defense responsibilities across the Middle East.”

CENTCOM and its regional partners have contended with long-range missile and drone attacks in recent years.

In April 2024, Iran launched a wave of one-way attack drones and missiles at Israel in response to an apparent Israeli strike on an Iranian diplomatic compound in Syria.

U.S. forces helped blunt that Iranian barrage, with CENTCOM reporting it intercepted 80 drones and six ballistic missiles.

American forces in the region again helped intercept Iranian ballistic missiles bound for Israel in October 2024.

As Israel and Iran came to blows in June 2025, U.S. forces again helped intercept Iranian attacks targeting Israel.

After U.S. forces struck Iran on June 22, Al Udeid Air Base came under direct retaliatory attack from Iran, and U.S. and Qatari air defense forces arrayed around the base defended against multiple missiles.

Lt. Gen Derek France, who leads the U.S. Air Force’s CENTCOM component, said the new air defense cell at Al Udeid Air Base “creates a consistent venue to share expertise and collectively create new solutions together with our regional partners.”

Qatar has been a key regional partner of the United States for years.

In addition to providing one of the largest bases for U.S. forces in the region at Al Udeid, Qatar has also played an intermediary role in negotiations for a cease-fire in the Israel–Hamas conflict in Gaza.

President Donald Trump has taken steps to expand the U.S.–Qatari partnership.

In September, Trump signed an executive order stating it is the policy of the United States “to guarantee the security and territorial integrity of the State of Qatar against external attack.”

In October, the Pentagon announced it had approved the creation of a new facility at Mountain Home Air Force Base in Idaho that will be dedicated to training members of the Qatar Armed Forces.

Tyler Durden Wed, 01/14/2026 - 07:20"Rude Awakening" For Travelers: Cancun Drowns In Seaweed

Cancun's busiest travel period is underway (late Dec.-March), and travelers expecting crystal-clear Caribbean waters have been shocked over the past week as seaweed piled up to shin-high levels in some of the prime hotel and resort areas.

"Travelers who booked a January 2026 trip to the Riviera Maya expecting guaranteed crystal-clear water were hit with a rude awakening this week," local outlet Cancun Sun said.

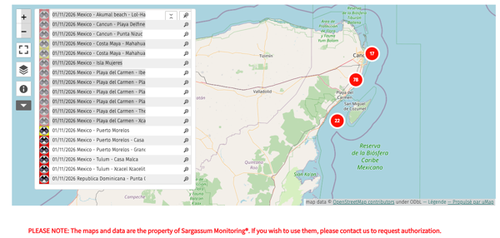

In recent weeks, an "atypical surge" of sargassum seaweed hit the coast and covered some of the resort town's most popular beaches...

Cancun Sun reported, citing a University of South Florida study that tracks blooms and warns that the "sargassum-free season" is disappearing.

Sargassum Monitoring Mapping Network

Report continues:

Here is what we know, and why 2026 is acting so differently.

The "Winter Die-Off" Failed. Usually, sargassum is a seasonal problem. The massive "seed population" of algae floating in the Atlantic typically blooms in the spring and dies off when the water cools in November and December.

That didn’t happen this year.

According to USF data, the bloom remained historically strong through late 2025. Instead of withering away in the cooler temperatures, the biomass survived and continued to grow.

The result? The "season" didn't end; it just paused. And now, that massive surplus of seaweed is arriving on our shores months ahead of schedule. As we detailed in our 2026 Sargassum Outlook, early arrivals like this are often a warning sign of a "major" year to come.

With algorithms routing consumers to top resort destinations, you might want to think twice about Cancun at the moment. But not all is lost. There is still Coco Bongo.

Tyler Durden Wed, 01/14/2026 - 06:55Watch: US Vows To Unleash Full Arsenal Of Tools Against UK PM Starmer's War On Free Speech

Authored by Steve Watson via Modernity.news,

As Keir Starmer’s Labour regime tightens the noose on online freedom, the United States has issued a blistering warning: nothing is off the table to defend free speech in Britain.

With government appointed regulator Ofcom now formally investigating Elon Musk’s X over Grok-generated images, American officials are rallying against what they call authoritarian tactics straight out of a tyrant’s playbook.

Sarah B Rogers, US Under-Secretary of State for Public Diplomacy, has assured the British people that the Trump administration will counter any assault on X with the same tools used to pierce internet blackouts in oppressive states. This clash exposes Labour’s selective outrage—obsessed with AI bikinis while turning a blind eye to genuine dangers like grooming gangs.

The escalation builds on threats from Starmer’s government floating a total ban on X over Grok’s image generation capabilities, under the tyrannical Online Safety Act. Critics have slammed the move as a thinly veiled bid to silence dissent on the one platform where globalist narratives get shredded daily.

They are moving rapidly to ban X in the UK with a flimsy ridiculous excuse that you can make fake images of people in bikinis on Grok (which you can do on any AI platform). pic.twitter.com/ls1o1oF5dV

— m o d e r n i t y (@ModernityNews) January 9, 2026

While anything meaningful takes years to progress through government in the UK, within days of sounding an intention to crackdown, they have made it illegal to create what they claim are ‘sexualised’ AI images.

? BREAKING: Technology Secretary Liz Kendall says creating ”non-consensual intimate images”, including with Grok, will be made illegal this week pic.twitter.com/6vgA4HC3AP

— Politics UK (@PolitlcsUK) January 12, 2026

Now, the crackdown has advanced. Ofcom announced its probe into X, claiming concerns over “Grok AI chatbot account on X being used to create and share undressed images of people – which may amount to intimate image abuse or pornography – and sexualised images of children that may amount to child sexual abuse material.”

The regulator’s X post detailing the investigation drew sharp irony for disabling replies, blocking public pushback.

Here you have the government-approved regulatory and competition authority announcing they're 'investigating' X to find out if it is complying with duties to "protect people in the UK." Yet it has closed the replies on the post, preventing people in the UK from responding. https://t.co/2LT7696unt

— m o d e r n i t y (@ModernityNews) January 12, 2026

In a GB News interview, Rogers dismissed Labour’s actions as politically driven, emphasizing America’s commitment to free expression amid Britain’s slide toward censorship.

She stated that the government’s ban threats were politically motivated—and that “given the pro-censorship inclinations of the British state in recent memory, I can’t say that we’ll be shocked” if it followed through.

'I’m willing to be a bit uncomfortable if that’s what it takes to be free.'

— GB News (@GBNEWS) January 13, 2026

US Under Secretary of State Sarah B. Rogers warns against overreaching censorship laws, as Labour looks to ban X.

'Free societies don’t ban platforms like X. Russia, Iran, and Venezuela do.' pic.twitter.com/pXA8spbvVP

Rogers outlined US capabilities: “America has a full range of tools that we can use” to open up internet access in “authoritarian, closed societies where the Government bans it.”

She added, “We are facilitating uncensored internet in Iran right now,” nodding to Starlink’s role in bypassing regime controls.

‘If the British government cared about women’s safety, it would’ve acted differently on grooming gangs.’@UnderSecPD Sarah B. Rogers tells @BeverleyTurner that Labour’s crackdown on X is about ‘curating the public square’ and suppressing political dissent. pic.twitter.com/hPHUhdPFK1

— GB News (@GBNEWS) January 13, 2026

Directly addressing Starmer’s stance, Rogers fired back: “With respect to a potential ban of X, Keir Starmer has said that nothing is off the table. I would say from America’s perspective, nothing is off the table when it comes to free speech.”

She continued, “Let’s wait and see what Ofcom does and we’ll see what America does in response. This is an issue dear to us, and I think we would certainly want to respond.”

'Keir Starmer has said that nothing is off the table. And I would say from America's perspective that likewise, nothing is off the table when it comes to free speech.'@UnderSecPD Sarah B. Rogers reacts to Labour’s threats to ban X. pic.twitter.com/7vfrpZ1glI

— GB News (@GBNEWS) January 13, 2026

Praising Trump and Vance as “huge champions” of free speech, Rogers recalled Trump’s own ban from pre-Musk Twitter: “Our leadership understands this because President Trump was himself a target of censorship. President Trump was banned by Twitter – the old regime before Elon bought it.”

Invoking Alexei Navalny’s comparison of Trump’s ban to Putin’s tactics, she stressed: “You have to take that comparison seriously. That’s why our President cares about this issue – because people couldn’t deal with his popularity, they couldn’t deal with his success, and they tried to just shut him up so no one could hear him.”

'Americans will feel disappointed. But frankly… I can't say that we'll be shocked.'@UnderSecPD Sarah B. Rogers says a UK ban on X would upset the White House, but warns Britain has a recent history of censorship that makes it sadly predictable. pic.twitter.com/7RWDx1hp58

— GB News (@GBNEWS) January 13, 2026

Rogers also mocked Labour’s “ensure women and girls are safe online” rhetoric, highlighting hypocrisy: in the “real world” one of the party’s council leaders called grooming gang victims “white trash.” Rogers asserted that if the government “cared about women’s safety, it would have acted differently on grooming gangs.”

This US intervention aligns with Trump’s track record of challenging UK overreach, from suspending tech deals to offering asylum for “thought criminals.” Starmer’s plummeting approval—now at 11 percent—fuels his desperation to control narratives, especially on X where his deceptions get community-noted relentlessly.

Labour’s push mirrors EU efforts to muzzle X under similar pretexts, but the selective targeting reeks of fear: Grok isn’t the only AI capable of such outputs, yet X’s embrace of unfiltered truth makes it enemy number one.

'Don’t pick a fight with someone who buys ink by the barrel, and Elon Musk is the digital version of that!'

— GB News (@GBNEWS) January 12, 2026

Toby Young warns the Labour government that going after X and Grok over AI-generated images could backfire, risk a US trade deal, and harm Britain’s AI sector. pic.twitter.com/Z8aIp2E1t5

As Ofcom’s probe unfolds, the Trump team’s assurances signal a potential transatlantic showdown. Britain’s globalist elite can’t suppress voices forever—America’s stand reminds them that freedom fighters have powerful allies ready to act.

Your support is crucial in helping us defeat mass censorship. Please consider donating via Locals or check out our unique merch. Follow us on X @ModernityNews.

Tyler Durden Wed, 01/14/2026 - 06:30

Recent comments