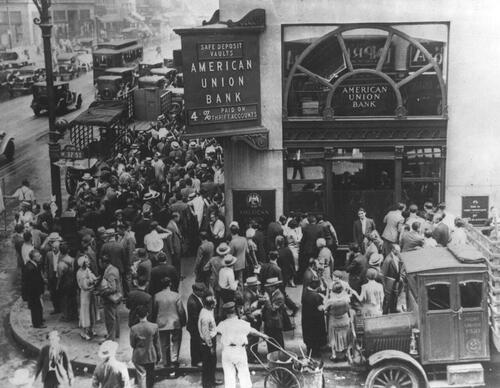

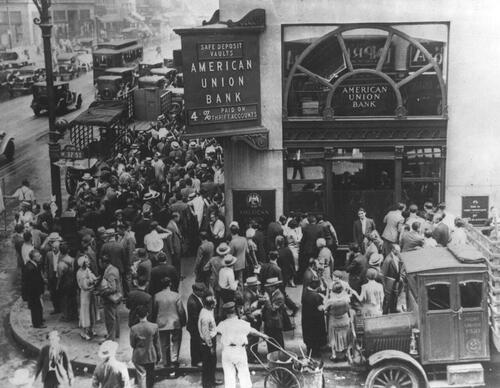

How Long Does US Depositors' Nerve Hold?

Authored by Tuomas Malinen via GnS Economics Newsletter,

I am returning to work slowly and will start with an update to the Bank Run Warning we issued on Friday.

Not a single financial institution sought funding through the SRF today (Wednesday), but this does not lead me to conclude that the risk of a banking crisis in the U.S. has passed. It just did not start right now.

While the borrowing from the Standing Repo Facility of the Fed has eased, for now, it does not indicate that the cash-drought some financial institutions are experiencing will be over.

The banks could have sought funding from other counterparties of the repo, or the beginning of the month could have brought more cash in.

The problem the banks currently face, relating to the government shutdown, is two-fold:

-

Money is accumulating in the U.S. Treasury General Account, and

-

Loan delinquencies are likely to be mounting.

The former implies that money is not moving from the government to the accounts of some 1.4 million government employees. The latter implies that, as government employees are not getting paid, some of them are not paying back their loans (principal and/or interest) either. Both of these diminish cash flow to banks. Like we noted in the warning on Friday:

What makes the situation precarious is the fragility of banks, which we documented in the Black Swan Outlook.

There has been a massive increase in bank lending during the past few quarters.

It is possible (likely) that some banks have been overly optimistic in the credit boom and are suddenly cash-starved because interest payments and loan repayments have ceased (from their excessive lending).

This may start rumors about the survivability of a bank or a group of banks, which could trigger a bank run in the current uncertain environment.

If there’s no shock, we can assume that the banking system keeps on functioning normally, ensured, for example, by the SRF, from which banks can obtain short-term liquidity to cover for deposit withdrawals.

However, banks are always at risk of failing due to the business model we want them to have. That is, we want to deposit our money in the bank and have it provide loans at the lowest possible interest rate for us. We also want instant access to our funds (demand deposits) or, alternatively, a higher yield (interest rate) to compensate for the lack of immediate access, like in savings accounts.

A standard commercial bank is a business that receives deposits and covers them with assets to balance its balance sheet (most U.S. regional banks operate like this). These assets can be in the form of loans to households and businesses, corporate or government bonds, or central bank reserves. Therefore, if all or a very high share of deposits are withdrawn, there simply is no bank anymore. Its business model fails. This directly implies that if we lose trust in a bank, no amount of reserves can save it from failing.

For example, a slew of bad news broke the trust of depositors in the Silicon Valley Bank (SVB) in mid-March 2023, resulting in a cataclysmic run on 87% of its deposit base in just a few days. No amount of reserves (which the bank had plenty of) could have saved SVB from the devastating outflow of deposits impairing its balance sheet. Thus, the bank failed and was taken over by authorities.

When I understood the role the gargantuan increase of easily-withdrawable demand deposits played behind the runs on SVB and Signature Bank, I thought that a nationwide bank run would almost surely follow the failures of SVB and Signature Bank. However, authorities managed to return the trust to the regional banking system better than I thought (by throwing a proverbial kitchen sink at it). It reminded me of how difficult it is to anticipate the timing and length of bank runs, even though I had warned about the fragility of the U.S. banking system just three weeks before the runs started. But, while the runs were halted, the problems remained.

The fact is that the U.S. banking system has been “run-prone” since 2022 (after the gargantuan increase in demand deposits), and the cash-drought created by the government shutdown is making it worse every passing day.

Hence, the likelihood of a negative shock breaking the trust of U.S. depositors in one or more banks currently grows by the day.

I worry.

Tyler Durden

Wed, 11/05/2025 - 15:20

Biden-Appointed D.C. Judge Orders White House To Provide Sign Language Interpreters For Press Briefings

Authored by Aldgra Fredly via The Epoch Times,

A federal judge ruled on Nov. 5 that the White House must provide American Sign Language (ASL) interpretation during press briefings held by President Donald Trump and press secretary Karoline Leavitt.

The decision followed a lawsuit filed in May by the National Association of the Deaf (NAD) and Derrick Ford, a deaf individual, which alleged that the Trump administration “inexplicably stopped” using ASL interpreters since taking office, denying deaf Americans access to real-time White House communications.

In a 26-page order, President-Biden-appointed U.S. District Judge Amir Ali in Washington said the plaintiffs are likely to prevail on their claim that the administration’s actions violated the Rehabilitation Act, a federal law that aims to ensure people with disabilities have access to federal activities.

“White House press briefings engage the American people on important issues affecting their daily lives—in recent months, war, the economy, and healthcare, and, in recent years, a global pandemic,” Ali said in the order. “The exclusion of deaf Americans from that programming, in addition to likely violating the Rehabilitation Act, is clear and present harm that the court cannot meaningfully remedy after the fact.”

The judge said that English captions and transcripts alone are not enough to make briefings accessible to people who use ASL, as many deaf individuals do not communicate in English, according to the ruling.

The White House had argued that requiring the president to share his platform with ASL interpreters at all press briefings would cause a “major incursion on his central prerogatives.”

The judge rejected this argument, noting that ASL interpretation could be implemented without requiring interpreters to be in the same room as the speaker. Ali added that the White House did not clarify what “major incursion” it was referring to.

The plaintiffs also asked the court to mandate ASL interpretation for press briefings and events held by First Lady Melania Trump, Vice President JD Vance, and Second Lady Usha Vance, as well as for all videos posted on the White House’s websites and social media channels. Ali said they had not presented sufficient evidence to justify that request.

Ali ordered the Trump administration to file a status report by Nov. 7 that “apprises the court of their compliance with this order.”

Neither the NAD nor the White House responded to a request for comment by publication time.

The lawsuit marks the NAD’s second suit against the White House over access to ASL interpretation. In 2020, the NAD sued to require ASL interpretation for COVID-19-related press briefings.

That case was resolved when the White House implemented a policy to provide interpreters for all press briefings conducted by the president, vice president, first lady, second gentleman, and press secretary, according to the group.

The White House stopped providing ASL interpretation in January this year and has not included interpreters at any press briefings since, the NAD said in a May 28 statement.

Tyler Durden

Wed, 11/05/2025 - 13:20

US Urges UN To Lift Sanctions On Syrian Leader Ahead Of Washington Visit

Authored by Kimberley Hayek via The Epoch Times,

The United States has put forth a draft resolution within the U.N. Security Council meant to end sanctions on Syrian President Ahmed al-Sharaa, leader of the Islamist militant and political group Hayat Tahrir al-Sham (HTS).

The proposal comes ahead of al-Sharaa’s anticipated meeting with President Donald Trump at the White House, set for next Monday.

The Security Council has regularly approved travel exemptions for al-Sharaa this year, meaning the White House meeting does not hinge on the outcome of the U.S. proposal.

The draft resolution, seen by Reuters on Tuesday, also advocates for the repeal of sanctions against Syria’s Interior Minister Anas Khattab.

The U.N. sanctions include a travel ban, asset freeze, and arms embargo.

It is unclear when a vote on the draft could be held. At least nine of the 15 council constituents need to vote in favor of the proposal for it to be enacted. However, Russia, China, the United States, France, and the UK each hold a veto.

Washington has for many months urged the Security Council to cease the sanctions on the regime in Syria.

President Bashar al-Assad was deposed in December 2024 after HTS-led militants effectively won a 13-year civil war in the country.

The country has languished since May 2014 on the U.N. Security Council’s sanctions list aimed at al-Qaeda and ISIS affiliates.

White House press secretary Karoline Leavitt announced al-Sharaa’s visit to the White House at a press briefing on Tuesday.

“When the president was in the Middle East, he made the historic decision to lift sanctions on Syria to give them a real chance at peace, and I think the administration, we’ve seen good progress on that front under their new leadership,” Leavitt said.

In July this year, Trump rescinded unilateral U.S. sanctions on Syria via executive order, saying it was “a chance at greatness” for the Syrian people, but he kept sanctions on Assad and other leaders.

The Trump administration also revoked the foreign terrorist organization designation for HTS.

U.N. monitors said there are no active al-Qaeda-HTS ties in a July report.

Trump last met with al-Sharaa in mid-May in Saudi Arabia’s capital, Riyadh, where the U.S. president urged the Syrian leader to join the Abraham Accords. According to the White House, Trump also asked al-Sharaa to “tell all foreign terrorists to leave Syria, deport Palestinian terrorists, help the U.S. prevent the resurgence of ISIS, and assume responsibility for ISIS detention centers in Northeast Syria.”

On Sept. 22, al-Sharaa addressed the U.N. General Assembly—the first time a Syrian president had done so since 1967—where he called for full sanctions relief and highlighted his country’s reconstruction needs.

[ZH: Of course, as we detailed here, this new 'friendship' has an ulterior motive...]

Tyler Durden

Wed, 11/05/2025 - 12:40

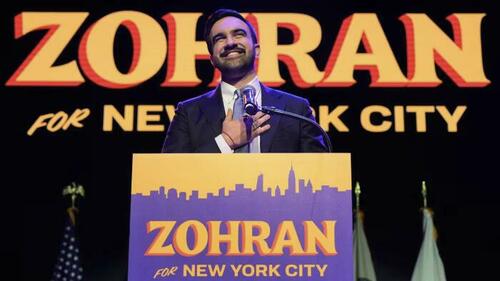

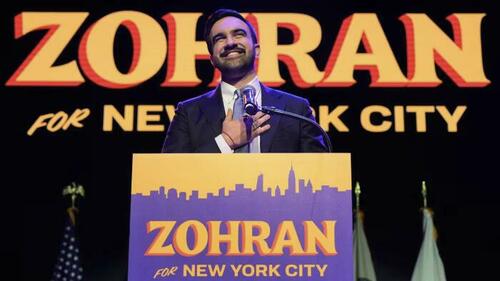

"Contrary To Human Nature": VDH Reminds Us That Mamdani-Style Socialism Always Ends In Disaster

Victor Davis Hanson is warning that Democrats' move towards socialism and their embrace of figures such as Zohran Mamdani is not going to end well.

Mamdani, a socialist who's promised to redistribute wealth, and insists that "taxation isn't theft, capitalism is" - is pushing politics that VDH says are 'contrary to human nature.'

"Historically, socialists always come in after capitalists have made prosperity, and then they offer and improve prosperity," he told Fox News' Laura Ingraham. "And it’s contrary to human nature. People like initiative. They like pride in their property. Some people like to work a lot and get compensated."

According to Hanson, when the state is in control of human innovation and productivity, it it 'has to be repressive.'

"It gives you that freedom of opportunity. And then the society at large benefits, Laura, from all these millions of agendas and ideas that improve, that people are free to innovate and to take experiments and risk. But when the state monopolizes all of that, it’s contrary to human nature, and then it has to be repressive," Hanson said. "So all of these social experiments, even if they’re democratic, they end up repressive. At the worst form, it’s no accident that the greatest mass murderers in history were Mao [Zedong] and [Joseph] Stalin, 30 million, 60 million, and they were radical communists, and even people like Hitler, National Socialist Party."

And of course, whoever is running a communist regime is living a life of privilege.

"Talented people who can help the economy, who are successful or demonized, they flee. People who want things for nothing come in. There’s open borders," Hanson continued. "They destroy personal liberty, and they stamp out any dissent or criticism. And there’s always an elite, the billionaire Castro brothers, Chavez and Maduro. They always are never subject to their consequences, their ideology. Here in California, we are becoming socialist."

Tyler Durden

Wed, 11/05/2025 - 12:20

Plugging One Goal With The Other

By Elwin de Groot, Head of Macro Strategy at Rabobank

Markets were in a risk-off mood yesterday, led by a sell-off in tech shares and growing investor concerns about valuations and policy risks. The US made the books with the longest government shutdown in its history. The S&P lost 1.2%, the Eurostoxx 50 index fell 0.4%. The risk-off tone resulted in lower yields across the board, albeit modestly (1-3 bp in US/Europe). Remarkably, Bitcoin plunged and gold prices dipped as well, an unusual move suggesting broader repositioning rather than just a classic safe-haven bid.

Talks between EU environment ministers yesterday confirmed that the bloc remains committed to its headline goal of cutting greenhouse gas emissions by 90% by the 2040, but with greater flexibility built in. This flexibility introduces a higher risk that targets may not be fully met, or not within the set timeframe. Ministers agreed to include so-called brake clauses, which would allow targets to be adjusted if natural carbon sinks underperform, and to permit offsetting, meaning that part of the reductions could come from foreign carbon credits. They also discussed enabling emissions to be traded between domestic sectors such as industry and agriculture.

This shift in tone is not surprising and reflects the recalibration of priorities between economic and environmental goals advocated in the 2024 Draghi report on competitiveness. That report did not call for abandoning climate objectives, but it urged integrating decarbonization with competitiveness through a “Clean Industrial Deal” and a major investment push. The EU intends to present a unified view next week at the COP30, but many details remain unresolved and attention may already be shifting toward another critical issue: raw material supply security.

On that front, tensions between China and the Netherlands –and by extension the EU– remain unresolved. The US announced on Saturday that China would allow Dutch chipmaker Nexperia BV to resume shipments from its Chinese facilities, easing fears of disruptions to auto production. However, China escalated pressure yesterday. Beijing criticized the Dutch government’s “unilateral” actions and urged it to stop interfering in Nexperia’s internal affairs and find a constructive solution.

The broader economic impact on European or even global industry is still hard to gauge at this stage. Nexperia chips are widely used, especially in automotive applications. Since Nexperia halted wafer exports to China, supply disruptions could also affect production of consumer goods there. Automotive experts note that substitutes exist, but switching would take weeks at minimum – raising the risk of temporary production halts given low inventories in Europe. Some companies, such as Robert Bosch GmbH in Germany and Honda in the US, have already announced production reductions, while others, including Volkswagen AG, have warned they may have to follow suit.

There is little precedent for assessing the impact. The post-COVID chip shortage, which partly caused a 40% decline in motor vehicle production between November 2020 and August 2021, offers some perspective. That shortage stemmed from a perfect storm of factors: surging demand for consumer electronics during lockdowns, automakers cancelling chip orders early and then scrambling as demand rebounded, factory shutdowns, and staffing shortages at semiconductor fabs, natural disasters such as droughts in Taiwan and fires in Japan, and later raw material shortages linked to the Russia–Ukraine war.

If so, it probably requires more financial resources from governments as well, which are in short supply, as the IMF warned yesterday. The institution argues for “a rethink of the role of government […] in some countries” and notes that “if reforms and medium-term consolidation are insufficient, then more radical fiscal measures could include reassessing the scope of public services and other government functions, potentially affecting the social contract.”

Tyler Durden

Wed, 11/05/2025 - 12:00

Peter Schiff: Printing Money Is Not the Cure for Cononavirus

In his most recent podcast, Peter Schiff talked about coronavirus and the impact that it is having on the markets.

Earlier this month, Peter said he thought the virus was just an excuse for stock market woes. At the time he believed the market was poised to fall anyway. But as it turns out, coronavirus has actually helped the US stock market because it has led central banks to pump even more liquidity into the world financial system.

All this means more liquidity — central banks easing. In fact, that is exactly what has already happened, except the new easing is taking place, for now, outside the United States, particularly in China.”

Although the new money is primarily being created in China, it is flowing into dollars — the dollar index is up — and into US stocks. Last week, US stock markets once again made all-time record highs.

In fact, I think but for the coronavirus, the US stock market would still be selling off. But because of the central bank stimulus that has been the result of fears over the coronavirus, that actually benefitted not only the US dollar, but the US stock market.”

In the midst of all this, Peter raises a really good question.

The primary economic concern is that coronavirus will slow down output and ultimately stunt economic growth. Practically speaking, the world would produce less stuff. If the virus continues to spread, there would be fewer goods and services produced in a market that is hunkered down.

Why would the Federal Reserve respond, or why would any central bank respond to that by printing money? How does printing more money solve that problem? It doesn’t. In fact, it actually exacerbates it. But you know, everybody looks at central bankers as if they’ve got the solution to every problem. They don’t. They don’t have the magic wand. They just have a printing press. And all that creates is inflation.”

Sometimes the illusion inflation creates can look like a magic wand. Printing money can paper over problems. But none of this is going to fundamentally fix the economy.

In fact, if central bankers were really going to do the right thing, the appropriate response would be to drain liquidity from the markets, not supply even more.”

Peter explained how the Fed was originally intended to create an “elastic” money supply that would expand or contract along with economic output. Today, the money supply only goes in one direction — that’s up.

The economy is strong, print money. The economy is weak, print even more money.”

Of course, the asset that’s doing the best right now is gold. The yellow metal pushed above $1,600 yesterday. Gold is up 5.5% on the year in dollar terms and has set record highs in other currencies.

Because gold is rising even in an environment where the dollar is strengthening against other fiat currencies, that shows you that there is an underlying weakness in the dollar that is right now not being reflected in the Forex markets, but is being reflected in the gold markets. Because after all, why are people buying gold more aggressively than they’re buying dollars or more aggressively than they’re buying US Treasuries? Because they know that things are not as good for the dollar or the US economy as everybody likes to believe. So, more people are seeking out refuge in a better safe-haven and that is gold.”

Peter also talked about the debate between Trump and Obama over who gets credit for the booming economy – which of course, is not booming.

We are living in crazy times. I have a hard time believing that most of the general public is not awake, but in reality, they are.

We've never seen anything like this; I mean not even under Obama during the worst part of the Great Recession."

Now the Fed is desperately trying to keep interest rates from rising. The problem is that it's a much bigger debt bubble this time around , and the Fed is going to have to blow a lot more air into it to keep it inflated.

The difference is this time it's not going to work."

It looks like the Fed did another $104.15 billion of Not Q.E. in a single day. The Fed claims it's only temporary. But that is precisely what Bernanke claimed when the Fed started QE1. Milton Freedman once said, "Nothing is so permanent as a temporary government program." The same applies to Q.E., or whatever the Fed wants to pretend it's doing. Except this is not QE4, according to Powell. Right. Pumping so much money out, and they are accusing China of currency manipulation ? Wow! Seriously! Amazing!

Dump the U.S. dollar while you still have a chance.

Welcome to The Atlantis Report.

And it is even worse than that, In addition to the $104.15 billion of "Not Q.E." this past Thursday; the FED added another $56.65 billion in liquidity to financial markets the next day on Friday.

That's $160.8 billion in two days!!!! in just 48 hours.

That is more than 2 TIMES the highest amount the FED has ever injected on a monthly basis under a Q.E. program (which was $80 billion per month)

Since this isn't QE....it will be really scary on what they are going to call Q.E. Will it twice, three times, four times, five times what this injection per month

! It is going to be explosive since it takes about 60 to 90 days for prices to react to this, January should see significant inflation as prices soak up the excess liquidity. The question is, where will the inflation occur first

. The spike in the repo rate might have a technical explanation: a misjudgment was made in the Fed's money market operations. Even so, two conclusions can be drawn: managing the money markets is becoming harder, and from now on, banks will be studying each other's creditworthiness to a greater degree than before.

Those people, who struggle with the minutiae of money markets, and that includes most professionals, should focus on the causes and not the symptoms. Financial markets have recovered from each downturn since 1980 because interest rates have been cut to new lows. Post-2008, they were cut to near zero or below zero in all major economies. In response to a new financial crisis, they cannot go any lower. Central banks will look for new ways to replicate or broaden Q.E. (At some point, governments will simply see repression as an easier option).

Then there is the problem of 'risk-free' assets becoming risky assets. Financial markets assume that the probability of major governments such as the U.S. or U.K. defaulting is zero. These governments are entering the next downturn with debt roughly twice the levels proportionate to GDP that was seen in 2008.

The belief that the policy worked was completely predicated on the fact that it was temporary and that it was reversible, that the Fed was going to be able to normalize interest rates and shrink its balance sheet back down to pre-crisis levels. Well, when the balance sheet is five-trillion, six-trillion, seven-trillion when we're back at zero, when we're back in a recession, nobody is going to believe it is temporary. Nobody is going to believe that the Fed has this under control, that they can reverse this policy. And the dollar is going to crash. And when the dollar crashes, it's going to take the bond market with it, and we're going to have stagflation. We're going to have a deep recession with rising interest rates, and this whole thing is going to come imploding down.

everything is temporary with the fed including remaining off the gold standard temporary in the Fed's eyes could mean at least 50 years

This liquidity problem is a signal that trading desks are loaded up on inventory and can't get rid of it. Repo is done out of a need for cash. If you own all of your securities (i.e., a long-only, no leverage mutual fund) you have no need to "repo" your securities - you're earning interest every night so why would you want to 'repo' your securities where you are paying interest for that overnight loan (securities lending is another animal). So, it is those that 'lever-up' and need the cash for settlement purposes on securities they've bought with borrowed money that needs to utilize the repo desk.

With this in mind, as we continue to see this need to obtain cash (again, needed to settle other securities purchases), it shows these firms don't have the capital to add more inventory to, what appears to be, a bloated inventory. Now comes the fun part: the Treasury is about to auction 3's, 10's, and 30-year bonds. If I am correct (again, I could be wrong), the Fed realizes securities firms don't have the shelf space to take down a good portion of these auctions. If there isn't enough retail/institutional demand, it will lead to not only a crappy sale but major concerns to the street that there is now no backstop, at all, to any sell-off. At which point, everyone will want to be the first one through the door and sell immediately, but to whom?

If there isn't enough liquidity in the repo market to finance their positions, the firms would be unable to increase their inventory. We all saw repo shut down on the 2008 crisis. Wall St runs on money. . OVERNIGHT money. They lever up to inventory securities for trading. If they can't get overnight money, they can't purchase securities. And if they can't unload what they have, it means the buy-side isn't taking on more either.

Accounts settle overnight. This includes things like payrolls and bill pay settlements.

If a bank doesn't have enough cash to payout what its customers need to pay out, it borrows. At least one and probably more than one banks are insolvent. That's what's going on.

First, it can't be one or two banks that are short. They'd simply call around until they found someone to lend. But they did that, and even at markedly elevated rates, still, NO ONE would lend them the money. That tells me that it's not a problem of a couple of borrowers, it's a problem of no lenders. And that means that there's no bank in the world left with any real liquidity. They are ALL maxed out.

But as bad as that is, and that alone could be catastrophic, what it really signals is even worse. The lending rates are just the flip side of the coin of the value of the assets lent against. If the rates go up, the value goes down. And with rates spiking to 10%, how far does the value fall? Enormously! And if banks had to actually mark down the value of the assets to reflect 10% interest rates, then my god, every bank in the world is insolvent overnight. Everyone's capital ratios are in the toilet, and they'd have to liquidate. We're talking about the simultaneous insolvency of every bank on the planet. Bank runs. No money in ATMs, Branches closed. Safe deposit boxes confiscated. The whole nine yards, It's actually here. The scenario has tended to guide toward for years and years is actually happening RIGHT NOW! And people are still trying to say it's under control. Every bank in the world is currently insolvent. The only thing keeping it going is printing billions of dollars every day. Financial Armageddon isn't some far off future risk. It's here. Prepare accordingly.

This fiat system has reached the end of the line, and it's not correct that fiat currencies fail by design. The problem is corruption and manipulation. It is corruption and cheating that erodes trust and faith until the entire system becomes a gigantic fraud. Banks and governments everywhere ARE the problem and simply have to be removed. They have lost all trust and respect, and all they have left is war and mayhem. As long as we continue to have a majority of braindead asleep imbeciles following orders from these psychopaths, nothing will change.

Fiat currency is not just thievery. Fiat currency is SLAVERY.

Ultimately the most harmful effect of using debt of undefined value as money (i.e., fiat currencies) is the de facto legalization of a caste system based on voluntary slavery.

The bankers have a charter, or the legal *right*, to create money out of nothing.

You, you don't. Therefore you and the bankers do not have the same standing before the law. The law of the land says that you will go to jail if you do the same thing (creating money out of thin air) that the banker does in full legality.

You and the banker are not equal before the law. ALL the countries of the world; Islamic or secular, Jewish or Arab, democracy or dictatorship; all of them place the bankers ABOVE you.

And all of you accept that only whining about fiat money going down in exchange value over time (price inflation which is not the same as monetary inflation). Actually, price inflation itself is mainly due to the greed and stupidity of the bankers who could keep fiat money's exchange value reasonably stable, only if they wanted to.

Witness the crash of silver and gold prices which the bankers of the world; Russian, American, Chinese, Jewish, Indian, Arab, all of them collaborated to engineer through the suppression and stagnation of precious metals' prices to levels around the metals' production costs, or what it costs to dig gold and silver out of the ground.

The bankers of the world could also collaborate to keep nominal prices steady (as they do in the case of the suppression of precious metals prices). After all, the ability to create fiat money and force its usage is a far more excellent source of power and wealth than that which is afforded simply by stealing it through inflation. The bankers' greed and stupidity blind them to this fact. They want it all, and they want it now.

In conclusion,

The bankers can create money out of nothing and buy your goods and services with this worthless fiat money, effectively for free. You, you can't.

You, you have to lead miserable existences for the most of you and WORK in order to obtain that effectively nonexistent, worthless credit money (whose purchasing/exchange value is not even DEFINED thus rendering all contracts based on the null and void!) that the banker effortlessly creates out of thin air with a few strokes of the computer keyboard, and which he doesn't even bother to print on paper anymore, electing to keep it in its pure quantum uncertain form instead, as electrons whizzing about inside computer chips which will become mute and turn silent refusing to tell you how many fiat dollars or euros there are in which account, in the absence of electricity. No electricity, no fiat, nor crypto money.

It would appear that trust is deteriorating as it did when Lehman blew up .

Something really big happened that set off this chain reaction in the repo markets. Whatever that something is, we aren't be informed. They're trying to cover it up, paper it over with conjured cash injections, play it cool in front of the cameras while sweating profusely under the 5 thousands dollar suits. I'm guessing that the final high-speed plunge into global economic collapse has begun. All we see here is the ripples and whitewater churning the surface, but beneath the surface, there is an enormous beast thrashing desperately in its death throws. Now is probably the time to start tying up loose ends with the long-running prep projects, just saying. In other words, prepare accordingly, and

Get your money out of the banks. I don't care if you don't believe me about Bitcoin. Get your money out of the banks. Don't keep any more money in a bank than you need to pay your bills and can afford to lose.

The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more

The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more

Recent comments