One Fell Swoop: Lawsuit Eyes Death Blow To Racial Preferences

Authored by RealClear Investigations' Benjamin Weingarten,

Opponents of affirmative action hoped that the Supreme Court had delivered a death blow to the controversial policy in 2023 when Chief Justice John Roberts declared for the court’s majority that “Eliminating racial discrimination means eliminating all of it.”

But as sweeping as that pronouncement was, it came in a ruling in the landmark SFFA v. Harvard case, solely barring the use of racial preferences in college admissions. The practices that the court deemed illegal on campus have persisted elsewhere, including in programs across the federal government.

A lawsuit now wending its way through the courts, Revier v. Loeffler, aims to change that. Building on the SFFA ruling, the suit’s plaintiffs are taking aim at regulations that they allege direct agencies to unconstitutionally dole out tens of billions of dollars in awards on the basis of race – most prominently through no-bid or limited competition contracts reserved for so-called “Small Disadvantaged Businesses” and facilitated by the Small Business Administration. The case could have wide implications, as the SBA’s definition of disadvantage has been widely adopted by many other federal agencies.

The lawsuit’s thrust parallels a slew of related executive orders, policies, and probes the Trump administration has advanced to purge diversity, equity, and inclusion (DEI) from the public and private sectors. A future president with different priorities, however, could reverse them. Consequently, absent legislation from a razor-thin Republican congressional majority, opponents of racial preferences believe the courts may offer the best opportunity to end such practices.

Defenders of affirmative action, however, note that it is rooted in laws passed by Congress that reflected the belief that racial discrimination is a powerful source of disadvantage. And they believe that righting past wrongs through its implementation has redounded to Americans’ collective benefit. Massachusetts Sen. Ed Markey, the ranking Democrat on the Senate Small Business Committee, and Sen. Mazie K. Hirono of Hawaii sent a letter to the SBA defending minority companies, which they say “play a role in strengthening the industrial base by diversifying the supply chain.”

Biden Amped Up Racial Preference

The Revier case could be a game-changer in part because of the size, scope, and influence of federal contracting.

The U.S. government is the world’s largest buyer of goods and services. Historically, on a bipartisan basis, it has sought to use its buying power to benefit small businesses, for whom the feds earmark roughly one-quarter of all contract dollars. The SBA reported that in fiscal year 2024, federal authorities had inked $630 billion in small business eligible prime contracts.

Following the civil rights acts of the 1960s, the federal government sought to promote the development of minority-owned small businesses, with the Nixon administration initiating the policy to steer a subset of contracts to such enterprises.

The Biden administration significantly increased the value of federal government contracts extended to such businesses to “advance equity and build wealth in underserved communities,” more than doubling the statutorily-driven 5% contracting goal threshold that had been set by Congress. In 2024, the SBA awarded some $78 billion – or 12% of all contract dollars – to so-called “Small Disadvantaged Businesses,” often under no-bid or limited-competition arrangements.

Such contracts cover work in areas ranging from construction to professional services and information technology and are awarded across two dozen agencies, including the Departments of Defense, Health and Human Services, and Agriculture.

SBA sets forth who qualifies as “socially and economically disadvantaged” through regulations, instituted nearly 30 years ago, that have since spread government-wide. While white-owned businesses theoretically qualify for the program, the regulations created a “rebuttable presumption” that – irrespective of one’s individual circumstances – treated blacks, Hispanics, Native Americans, and Asians by default as “socially disadvantaged.”

Under its “Minority Small Business and Capital Ownership Development Program,” sometimes referred to as 8(a), SBA has historically rendered small firms owned and controlled at least 51% by those identifying as minorities, and who meet certain economic criteria, eligible for its minority business development program – giving them preferential entrée to more than $40 billion in annual awards over non-minorities.

Analyses show that in recent years, no individually owned firms led by a Caucasian have participated in the program.

Fraud Allegations

The program also has long been subject to allegations of fraud and abuse, reflected in a series of past Government Accountability Office and SBA Office of Inspector General studies and reports. Some of the initiative’s 4,300 participants have engaged in misconduct ranging from offering kickbacks to reportedly arranging “pass-through” work where purported minority-led companies effectively serve as fronts – winning business only to outsource the work to non-minority subcontractors.

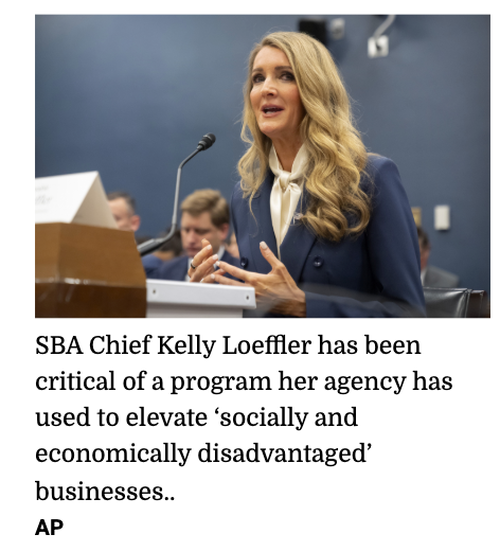

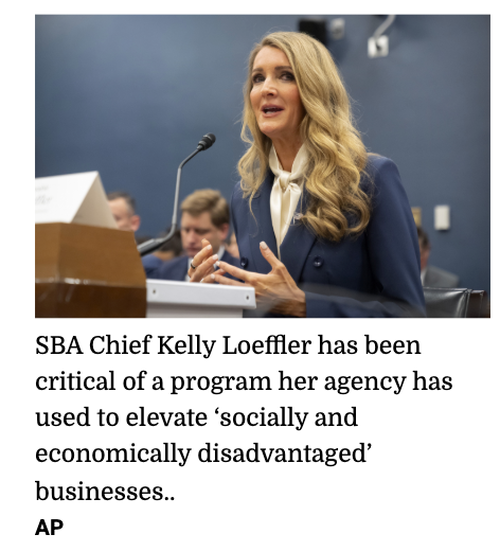

In June, after four individuals pled guilty to a $550 million bribery and fraud scheme enabled by a USAID contracting officer and involving multiple participants in the SBA program – one of whom would receive an additional $800 million in federal contracts even after being flagged by USAID as lacking “honesty or integrity” – SBA Administrator Kelly Loeffler ordered an audit of the program, focusing on high-dollar and limited-competition contracts.

Months later, in October, investigative journalist James O’Keefe released an undercover interview video indicating that one contractor, ATI Government Solutions, used its minority status pursuant to the program to win upwards of $100 million in contracts – only to outsource 80% of its work to subcontractors, including major corporations like Accenture. Shortly thereafter, the SBA would suspend ATI and its three executives.

In December, the administration intensified its scrutiny of the program, issuing letters to all participants demanding a slew of financial records dating back years under threat of losing their program eligibility, and/or facing investigative and remedial action.

“There is mounting evidence that the 8(a) Program designed for ‘socially and economically disadvantaged’ businesses went from being a targeted program to a pass-through vehicle for rampant abuse and fraud – especially during the Biden Administration, which aggressively prioritized DEI over merit in federal contracting,” SBA Administrator Kelly Loeffler said in a press release.

Days later, Senate Small Business Committee Chairwoman Joni Ernst announced during a hearing the launch of her own investigation of the SBA initiative, stating that “Unfortunately, the SBA’s 8(a) program has been a magnet for fraudsters since its inception.”

During that hearing, Ed Markey acknowledged that “Like any federal program, there have been rare cases of bad actors taking advantage of these resources. And they should be held accountable.”

“But,” he added, “these rare instances do not warrant an all-out assault on a program that has created good-paying jobs, provided pathways to success for small businesses, and created economic growth for our country.”

The Massachusetts Democrat also asserted that politics was at play – even while injecting a note of partisanship himself. The Senate, Markey said, was subjecting “the little guys, the minority small business owner, the black and brown small businesses,” to harsh oversight, in contrast with the administration’s dealings with foreign governments and large corporations, who allegedly participate in “President Trump’s pay-to-play system.”

Systemic Discrimination

The entities currently suing the SBA do not allege discrimination in the 8(a) program, but rather in other government programs that have adopted its regulations.

The two plaintiffs – Revier Technology, a small Louisiana-based software company, and Young America’s Foundation (YAF), a national conservative student organization – asked a Louisiana court in November to vacate the SBA’s 8(a) regulation, which they claim has harmed them in their efforts to access other government initiatives reliant upon it.

Revier, which says it is developing AI-based technology for use in construction, claims it was denied investment capital under a Treasury Department small business credit program, since its funding is limited to businesses owned and controlled by socially and economically disadvantaged individuals as defined by SBA regulation, and Revier’s owner, Matthew Schultheis, is white. “The…investment program I applied to was designed to help small entrepreneurs like me,” Schultheis told RealClearInvestigations. “When my application was rejected solely because of my race, I had to take action.”

Likewise, several students affiliated with Young America’s Foundation (YAF) claim discrimination under a Department of Homeland Security cybersecurity fellowship that requires applicants to be socially disadvantaged to be eligible to participate in the program, as defined by SBA regulation. That regulation’s definition of social disadvantage likewise flows through preferential contracting programs at NASA, research grants administered by the EPA, and elsewhere in the federal government, according to the Revier suit.

The Revier and YAF plaintiffs each claim they could “not benefit from a presumption of social disadvantage,” and therefore “could not apply on equal footing” in seeking to participate in relevant federal programs, violating their constitutional rights under the Fourteenth Amendment’s Equal Protection Clause and the Fifth Amendment’s Due Process rights to equal treatment.

“The federal government’s pervasive use of race as a proxy for determining who is ‘socially disadvantaged’ – and therefore who receives contracts, grants, loans, investment capital, opportunities, and other benefits – is unconstitutional, and it must be stopped,” the plaintiffs wrote in their complaint.

YAF is represented by the Wisconsin Institute for Law & Liberty. The conservative/libertarian-oriented public interest law firm, which has served plaintiffs in a number of related cases, has identified at least 60 racially discriminatory programs across the federal government.

Caleb Kruckenberg, litigation director at the Center for Individual Rights, which is co-counsel in the Revier case, told RCI that SBA’s challenged 8(a) regulation “remains on the books and has been incorporated in at least 20 other federal programs administered by multiple federal agencies."

His colleague, Michael A. Petrino, said that if the plaintiffs were to prevail, minimally “all programs that incorporate the SBA regulation and its racial presumption could no longer administer those other programs using any portions of the regulation that are vacated.”

The Trump administration’s unwillingness to defend racial preferences in analogous cases – including challenges to the use of racial and sexual preferences in Department of Agriculture programs – suggests it may not defend the SBA’s regulations. Although the plaintiffs could achieve a limited victory if the administration rescinds the regulation or revises it to remove the alleged unconstitutional content, Petrino told RCI, “A judicial ruling that requires such revocation would prevent a future administration from reviving the same or similar rule.”

Courts Start Chipping Away

In the meantime, the judicial branch is already scrutinizing the SBA’s longstanding regulations mandating racial preferences.

In July 2023, a Tennessee U.S. federal district court judge enjoined SBA “from using the rebuttable presumption of social disadvantage in administering” the 8(a) program, finding that that presumption fails to pass the “strict scrutiny” standard required when setting out racial classifications. It “does not further a compelling governmental interest and is not narrowly tailored to achieve such interest,” the court ruled.

In March 2024, a Texas district court found that a race-based presumption of social disadvantage for applicants in a program run by the Commerce Department’s Minority Business Development Agency was unconstitutional.

Likewise, in October 2024, a Kentucky judge issued a preliminary injunction prohibiting the Department of Transportation “from mandating the use of race- and gender-based rebuttable presumptions” for department contracts impacted by certain “Disadvantaged Business Enterprise” goals when pursued by the plaintiffs who brought the case.

In response to that case, the Trump Justice Department stated that it would no longer defend the SBA-like rebuttable presumptions incorporated into the department’s Disadvantaged Business Enterprise program, finding it to be unconstitutional.

The Revier plaintiffs are seeking a more ambitious end in the elimination of that rule at SBA, and everywhere else it is incorporated.

Citing such litigation, Petrino told RCI that “any time would have been a good time to bring this case, but the Supreme Court’s rulings in recent years on both racial preferences and administrative law challenges make it easier.”

The Supreme Court declined to take up a challenge to the 8(a) program’s constitutionality back in 2017 on Fifth Amendment grounds. That case, however, challenged the relevant provisions of the Small Business Act authorizing the program. The statute defines socially disadvantaged individuals as those “subjected to racial or ethnic prejudice or cultural bias because of their identity as a member of a group without regard to their individual qualities.” And the statute includes a congressional finding that blacks, Hispanics, Native Americans, and other groups are “socially disadvantaged.” But, unlike the regulations that the Revier plaintiffs are challenging, the law contains no explicit rebuttable presumption of social disadvantage if an individual is a member of such a group.

Resistance Ahead

Any challenge to racial preferences in government programs – particularly at a Supreme Court that has already handed progressives defeats on racial matters – is likely to be met by significant resistance.

Democrats on the House and Senate Small Business Committees have continued defending it and related efforts.

Rep. Nydia M. Velázquez criticized the SBA following its announcement that it would be initiating an audit of the 8(a) program in June, and delivery of a warning letter to federal contracting officers in July calling on them to report potential program misconduct.

“The SBA’s decision to target the use of a key small business contracting program and pressure federal agencies is deeply disappointing,” Velázquez, the ranking Democrat on the House Small Business Committee, said in an August statement. “This move strays from the agency’s core mission. Instead of helping small businesses compete in the federal marketplace, SBA is stripping away the very tools that enable them to succeed.”

In addition to its political defenders and the businesses and individuals who are the direct beneficiaries of tens of billions of dollars in government awards annually, a constellation of trade associations, NGOs, law firms, and researchers support and/or rely on the continuation of the regime. Challengers have taken the Trump administration to court over a variety of anti-DEI executive actions – to mixed effect.

Regarding racial preferences in government programs more broadly, a witness selected by congressional Democrats in a relevant June 2025 House Oversight Committee subcommittee hearing captured the position of program proponents.

“Congress has never placed a ceiling on the debt it endlessly accumulates to African Americans, indigenous peoples, and other communities of colors,” University of Southern California Professor Shaun Harper told the panel, “These diverse citizens persistently appear at the bottom of just about every health indicator and statistical metric of thriving…Government and private sector investments into DEI efforts have never been anywhere close to covering the enormous sum of this unpaid, continuously accruing debt.”

“The real cost of racial inequities far surpasses spending on DEI programs, positions, and professional learning experiences,” Harper concluded.

By contrast, Judge Glock of the right-leaning Manhattan Institute wrote in a spring 2023 City Journal piece that “Instead of righting historical wrongs,” government minority contracting efforts have “enriched a small subset of already-wealthy businesses, bred corruption and fraud, deepened racial divisions, and cost taxpayers countless billions of dollars – while doing nothing to help the truly disadvantaged.”

Such “unconstitutional” programs, Glock said in testimony delivered opposite Harper, “should be removed from all levels of government as quickly as possible.”

* * *

This article was originally published by RealClearInvestigations and made available via RealClearWire.

Tyler Durden

Thu, 01/08/2026 - 12:45

The section of a Boeing 737 Max where a door plug fell while Alaska Airlines Flight 1282 was in flight on Jan. 7, 2024. NTSB via AP

The section of a Boeing 737 Max where a door plug fell while Alaska Airlines Flight 1282 was in flight on Jan. 7, 2024. NTSB via AP (Left) Fulton County District Attorney Fani Willis at the Atlanta Police headquarters in Atlanta on May 3, 2023. (Right) Former President Donald Trump prepares to deliver remarks in Las Vegas on July 8, 2023. Megan Varner; Mario Tama/Getty Images

(Left) Fulton County District Attorney Fani Willis at the Atlanta Police headquarters in Atlanta on May 3, 2023. (Right) Former President Donald Trump prepares to deliver remarks in Las Vegas on July 8, 2023. Megan Varner; Mario Tama/Getty Images Shoppers on Black Friday at a mall in Bethesda, Md., on Nov. 28, 2025. Madalina Kilroy/The Epoch Times

Shoppers on Black Friday at a mall in Bethesda, Md., on Nov. 28, 2025. Madalina Kilroy/The Epoch Times Shoppers on Black Friday at a mall in Bethesda, Md., on Nov. 28, 2025. Madalina Kilroy/The Epoch Times

Shoppers on Black Friday at a mall in Bethesda, Md., on Nov. 28, 2025. Madalina Kilroy/The Epoch Times Trump has "gone to bat for Tulsi" in appointing her and keeping her as DNI, but it seems some considered her a 'risk' in terms of being let in on the covert Venezuelan Maduro kidnap raid. via NBC

Trump has "gone to bat for Tulsi" in appointing her and keeping her as DNI, but it seems some considered her a 'risk' in terms of being let in on the covert Venezuelan Maduro kidnap raid. via NBC

Packages containing unknown seeds from China. Texas Department of Agriculture

Packages containing unknown seeds from China. Texas Department of Agriculture  eh...

eh... Members of the Lebanese army secure the area near the site of an Israeli strike, after Israeli military said that it struck a militant from the Hezbollah terrorist group, in Beirut's southern suburbs of Lebanon on Nov. 23, 2025. Mohamed Azakir/Reuters

Members of the Lebanese army secure the area near the site of an Israeli strike, after Israeli military said that it struck a militant from the Hezbollah terrorist group, in Beirut's southern suburbs of Lebanon on Nov. 23, 2025. Mohamed Azakir/Reuters

Food and Drug Administration Commissioner Marty Makary in Washington on July 29, 2025. Saul Loeb/AFP via Getty Images

Food and Drug Administration Commissioner Marty Makary in Washington on July 29, 2025. Saul Loeb/AFP via Getty Images

Sen. Rand Paul, R-KY, speaks to reporters alongside Sen. Tim Kaine, D-VA, during a pen and pad meeting with reporters at the U.S. Capitol on January 07, 2026 in Washington, DC.

Sen. Rand Paul, R-KY, speaks to reporters alongside Sen. Tim Kaine, D-VA, during a pen and pad meeting with reporters at the U.S. Capitol on January 07, 2026 in Washington, DC.  “Guys are quitting and walking away, and that eventually leads to land that doesn’t get picked up … Cropland with no crop,” says Alex Harrell.(Photo courtesy of Harrell Farms)

“Guys are quitting and walking away, and that eventually leads to land that doesn’t get picked up … Cropland with no crop,” says Alex Harrell.(Photo courtesy of Harrell Farms) “In some ways, I think the worst part is still to come, but people don’t realize that yet.” (Photo by Chris Bennett)

“In some ways, I think the worst part is still to come, but people don’t realize that yet.” (Photo by Chris Bennett)

Recent comments